Get Tax Credits for Inclusive Hiring Practices

You recognize the value a diverse workforce brings to your business and community. But did you know you can also get federal tax credit for hiring individuals who have historically faced significant barriers to employment? By leveraging the WOTC, you can transform your hiring practices into opportunities for growth and tax savings.

Realize Potential Savings While Empowering Employees

The WOTC not only supports those facing employment challenges, including veterans, it also offers your business a chance to optimize tax benefits. With MGO’s guidance, you can navigate the complexities of the WOTC to take advantage of potential tax credits — ranging from $1,200 to $9,600 per qualified employee.

Groups eligible for this credit include those often discriminated against during hiring or experiencing substantial hiring barriers.

- Individuals with past felony convictions

- Veterans

- IV-A recipients

- Designated Community Residents (DCRs)

- Vocational rehabilitation referrals

- Qualified summer youth employees

- Qualified Supplemental Nutrition Assistance Program (SNAP) benefits recipients

- Qualified Supplemental Security Income (SSI) recipients

- Long-term family assistance recipients

- Qualified long-term unemployment recipients

Claiming the WOTC for Your Business

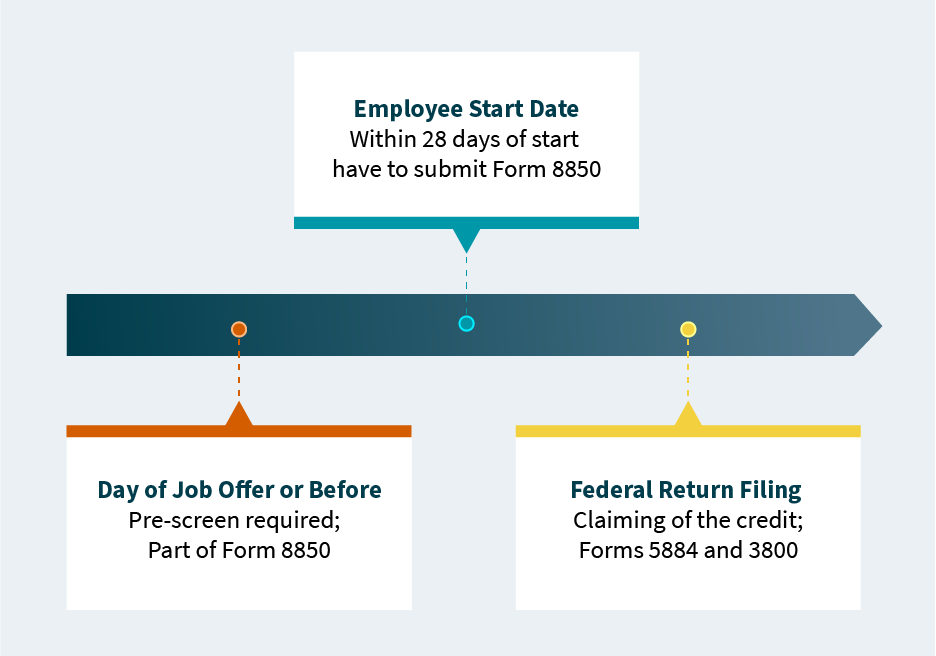

This tax credit opportunity requires documentation and submission forms earlier than other credits and incentives. If you are interested in taking advantage of this credit, it is imperative for you to act fast to avoid missing essential deadlines.

Connect with MGO to Get More from Your Tax Credits and Incentives

MGO provides solutions to both meet your current tax compliance needs and prepare your business for future growth. With extensive knowledge of tax credits and incentives, we will tailor a strategy that aligns with your goals to help enhance your credit opportunity.

Reach out now to discover how MGO can integrate the WOTC or other credits and incentives into a comprehensive tax strategy for your business.

Tax Leaders Ready to Serve You

As you grow, you face complex risks and opportunities. Benefit from hands-on guidance focused on delivering top-to-bottom value for you and your organization.