Executive Summary:

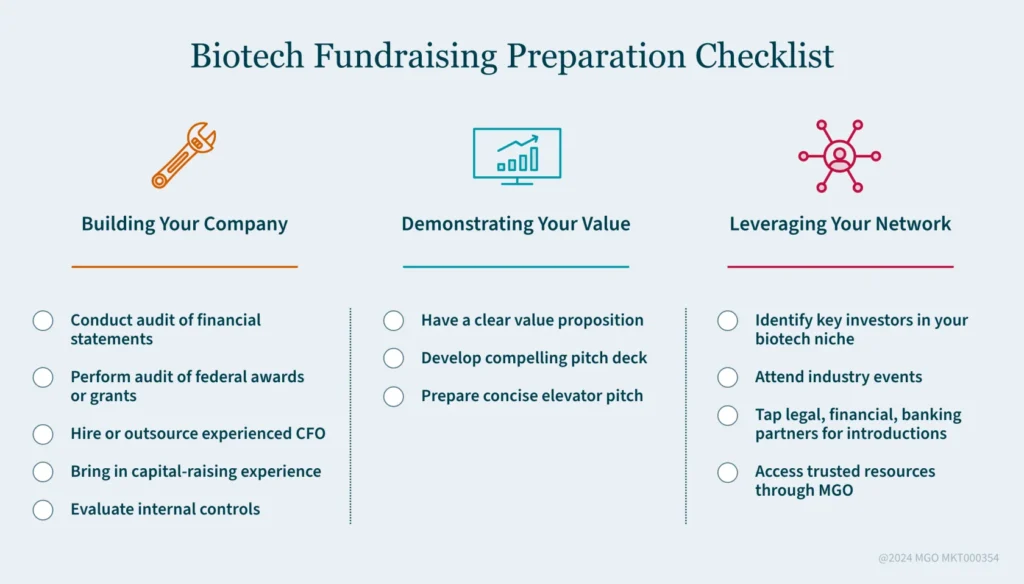

- Build investor trust through financial transparency, strong leadership, and solid internal controls to overcome the “first-time fundraising roadblock” in biotech.

- Showcase your product’s potential with a compelling pitch and clear value proposition, backed by data and a talented research team.

- Leverage your professional network and industry connections to get noticed by the right investors in the biotech space.

~

The biotech landscape is currently divided into the “haves” and “have-nots” when it comes to fundraising. Those who have successfully brought products to market or secured previous funding rounds have a substantial advantage. They possess the track record, relationships, and trust investors crave.

But what if you don’t have that? If your biotech company is preparing to raise capital for the first time, not to worry — you can still stand out and secure funding. Here are five key strategies to help you get around the first-time fundraising roadblock and gain the attention of investors.

1. Build Trust with Financial Transparency

Investors need to trust your company is financially sound. Without a track record, demonstrating your fiscal responsibility is essential. Start by having a quality audit of your financial statements, conducted by a reputable auditor with experience in the biotech space. Accurate, clear financial reporting builds investor confidence, showing you are serious about managing capital effectively.

If you have already raised seed funding or received a grant, highlight how you have used those resources responsibly. A grant audit, for example, can showcase you have maximized the value of previous funds—something investors will look for as they evaluate your business.

2. Strengthen Your Leadership and Team

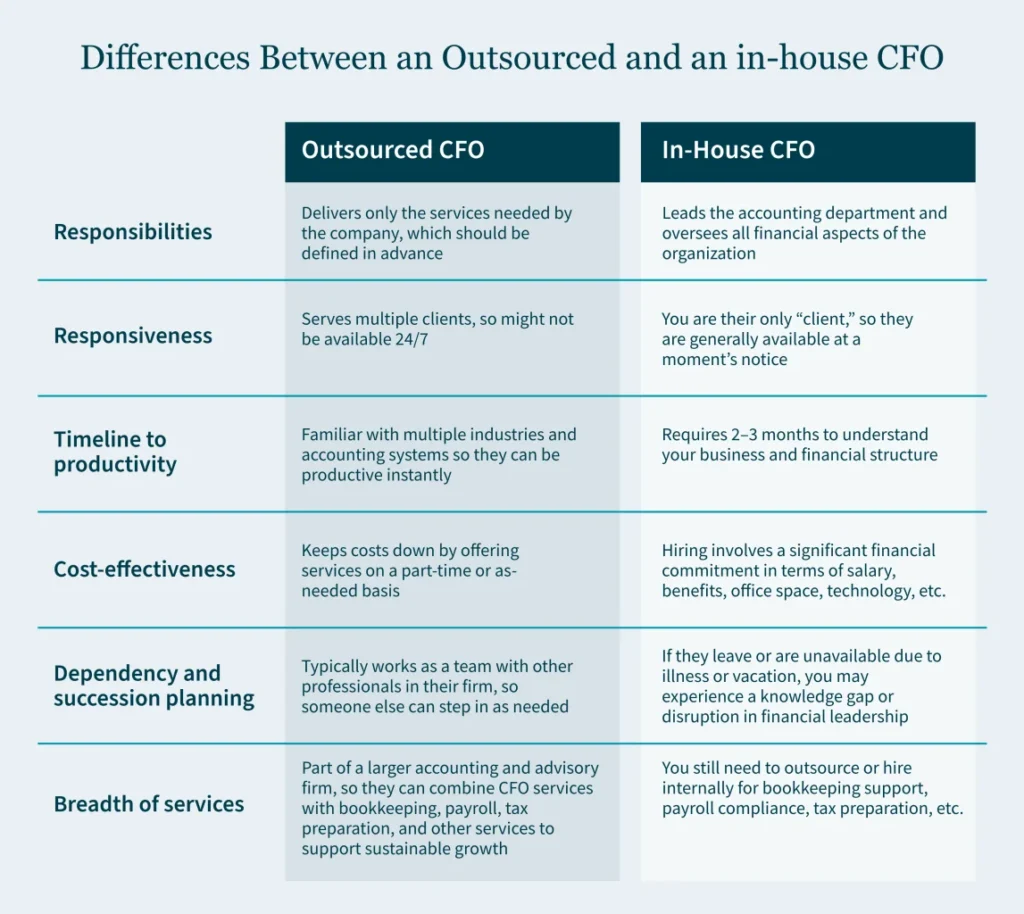

Investors are not just funding an idea; they are funding the people behind it. If you lack in-house knowledge or experience, consider hiring or partnering with experienced professionals. A strong chief financial officer (CFO) — even an outsourced one — can make a significant difference. Outsourced accounting support allows you to tap into the knowledge of seasoned professionals without the full-time cost. A skilled CFO will strengthen your financial reporting and operations, further enhancing trust with investors.

Additionally, if you don’t have an executive with capital-raising experience, bring in someone who does. Investors are more likely to bet on a team with a proven track record in biotech, especially when that person has a Rolodex of contacts and a history of success. Just remember: there is no silver bullet. Even bringing in a seasoned executive won’t move the needle if the fundamentals aren’t in place. Investors will see through any attempts to paper over weaknesses.

3. Demonstrate Your Product’s Potential

At the core of any capital raise is the product you are developing. Investors want to know your biotech solution has potential. Your value proposition should be clear, well-researched, and backed by data. Whether you are creating a novel drug or pioneering a new treatment technology, demonstrate the market need, potential impact, and your path to commercialization. A strong, well-articulated product concept, supported by a talented research team, will help you stand out.

This is where you must focus on having a polished pitch deck and elevator pitch. If you do secure a meeting with potential investors, being prepared with a compelling and concise presentation can make or break the deal. Your pitch should clearly communicate your company’s vision, market potential, and how their investment will drive growth.

4. Establish Strong Internal Controls

Investors not only want to see financial transparency and a strong product, they also want to know your business is structured for long-term success. Demonstrating you have solid internal controls — related to compliance with regulations like the Sarbanes-Oxley Act (SOX) — shows you are prepared to scale responsibly.

An internal controls evaluation can identify areas for improvement and help strengthen your company’s operational documentation, efficiency, and security. This is a crucial step in building investor trust and positioning yourself as a mature, trustworthy business.

5. Leverage Your External Network

Building your company is just one part of the equation. The next step is expanding your personal network so you are speaking to the right investors. Start by identifying the key players in your biotech niche. Look at competitors and peers who have successfully raised capital and find out who their investors were. This will help you target the right people and increase your chances of getting noticed.

Once you have a list of potential investors, begin outreach. Attend industry events, schedule informal meetings, and use every opportunity to introduce yourself and your business. This is where your external network can become an invaluable resource. Don’t hesitate to tap into your legal, financial, and banking partners for introductions to investors. These professionals often have established relationships with investors and can open doors you would not be able to access on your own. If you don’t have all these partners in place, one can often connect you with the others. For example, at MGO, we can refer you to trusted legal and banking partners to help you get the full support you need.

Breaking Down Barriers to Secure First-Time Funding

Raising capital for the first time is undoubtedly challenging, but it’s far from impossible. By focusing on building a strong company, demonstrating your value, and strategically expanding your network, you can bridge the gap between the “haves” and “have-nots” of biotech fundraising — securing that essential first round of funding.

How MGO Can Help

Navigating your first capital raise can be daunting, but you don’t have to go it alone. We’re here to help you build the strong foundation you need to attract investors and take your groundbreaking ideas to the next level.

Our experienced biotech practice offers a range of services tailored to meet your specific needs, including:

- Audit and assurance services to validate your financial statements

- Outsourced CFO services to strengthen your financial operations

- Internal control evaluations to enhance your operational efficiency

- Strategic advisory services to help you navigate the fundraising landscape

Don’t let being a first-time fundraiser hold you back. Reach out to our team today to learn how we can support your journey from promising startup to funded success story.