Key Takeaways:

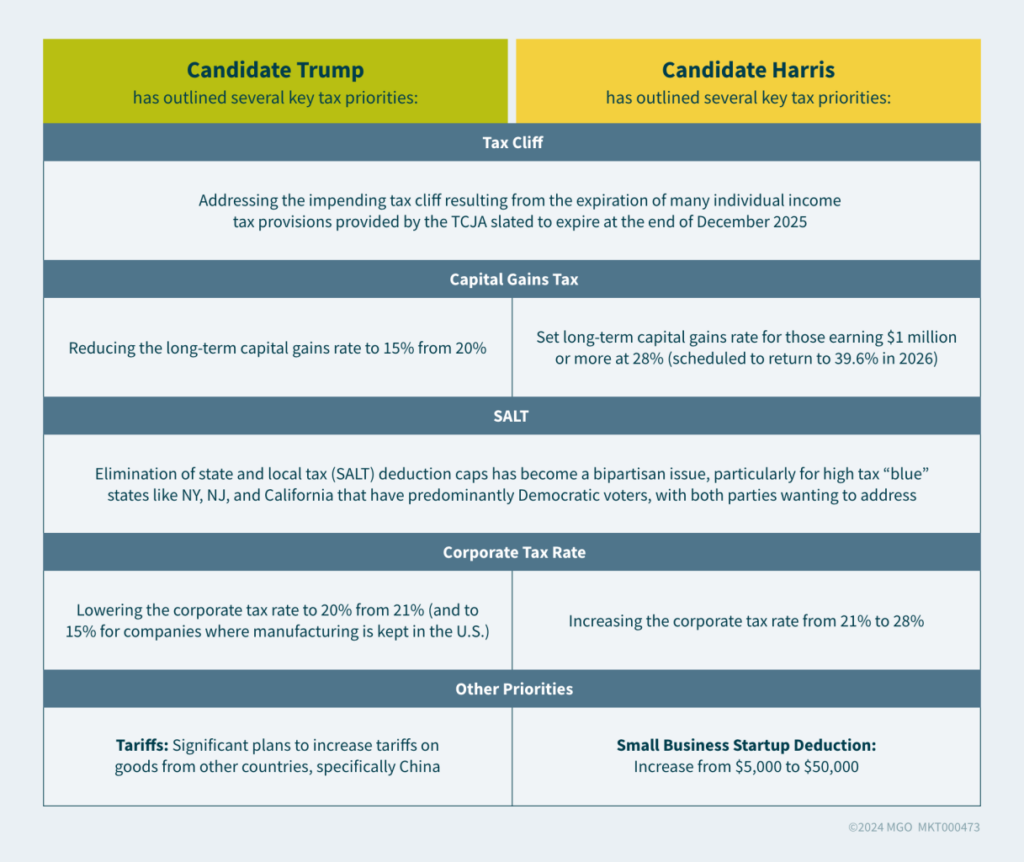

- The upcoming election cycle has introduced uncertainty in U.S. tax policy, so corporate boards should be ready for potential changes — namely the expiration of the 2017 TCJA provisions.

- Boards should stay flexible in their tax planning. Divergent tax policies from both parties mean the election outcome could yield drastic differences in tax rates, capital gains treatment, and deductions.

- Boards should regularly review tax strategies for alignment with corporate goals and regulatory standards, maintaining oversight of the corporate tax posture.

- Stakeholders expect companies to be transparent and socially responsible in tax. Boards should prioritize this.

~

The upcoming U.S. election cycle gives rise to ambiguity in business tax planning. Companies must prepare for a shifting tax landscape while considering differing priorities of Republicans and Democrats regarding U.S. tax policies, such as the approaching expiration of some components of the 2017 Tax Cuts and Jobs Act (TCJA). This environment emphasizes the importance of the board’s oversight role and its understanding of a company’s total tax strategy, emerging compliance complexities, the impact of potential election results and associated tax planning scenarios, and the need for a broad perspective on total tax posture and associated social responsibility of the company.

The TCJA

The TCJA brought significant changes to the U.S. tax code, but many of its provisions are set to expire in 2025. Notably, the corporate tax rate will remain at 21%, but other aspects of the act will sunset, potentially leading to increased tax liabilities for businesses and individuals. Future tax policies will be shaped by the House of Representatives, the Senate, and the White House, and a resulting mix of political power within these bodies will necessitate compromises to pass proposed legislation.

Political Corporate Tax Priority Outlines

Boards should have a clear understanding of their company’s current tax strategy, which takes into consideration the total tax liability – the composite total of all taxes owed by a taxpayer for the year. Next, consideration of the impact of and response to various tax scenarios and business operations, while ensuring compliance with existing tax law and regulations, should inform oversight of the company’s tax strategy.

Regular reviews of the company’s current tax strategy is a fundamental component of the board’s oversight responsibility. Key questions for management and tax advisors include:

- What is the company’s current tax strategy? Do they support the company’s corporate strategy?

- Is the tax department evaluating how potential tax scenarios may impact the company?

- Is management developing alternative action plans in response?

Tax Considerations and Questions the Board Should be Asking: Big Picture

Election-related risk factors, such as potential tax code changes, are top of mind in boardrooms. Directors know changes may be coming, and proactive management will facilitate a timely response. An effective tax strategy can positively impact the company’s bottom line, help to mitigate risks, and drive growth. Boards play a pivotal role in overseeing these efforts, ensuring management remains vigilant in weighing tax impacts in making informed and responsible strategic decisions. Read on for key tax considerations for boards and the questions they should be asking of management.

Total Tax Posture

Understanding the company’s total tax posture is essential. This includes not only corporate income tax liability but also other tax responsibilities such as payroll, real estate, sales, and value-added taxes (VAT). For example, a company with large net operating losses (NOLs) may not pay corporate income taxes but may still have other tax obligations to consider.

- Has risk oversight responsibility for total tax posture been allocated to the full board or a committee of the board? If so, has the company disclosed this at the board or appropriate committee level?

- Who is responsible for managing and reporting total tax posture? Does the company have adequate resources to fulfill this responsibility?

- What KPIs are being used to track the company’s total tax posture?

- How do company KPIs compare to those of competitors?

Global Tax Compliance

Global tax compliance is a complex undertaking, involving issues such as the U.S. global intangible low-taxed income (GILTI) and the base erosion and anti-abuse tax (BEAT). Global tax compliance requires a deep understanding and active monitoring of current and evolving international tax laws and regulations in multiple jurisdictions. Boards need to be proactive in overseeing how management is addressing these complexities to ensure compliance and avoid potential legal and financial risks.

- Who is responsible for and how is the company monitoring global tax compliance?

- Does the company have adequate resources dedicated to tax compliance?

- Have there been instances of noncompliance? How were they resolved?

- How does the company monitor evolving domestic and international regulations and legislation impacting compliance?

Tax Transparency and Social Responsibility

Tax transparency and social responsibility are increasingly important in today’s business environment. Companies should strive to be transparent about their tax practices within financial reporting and demonstrate their contributions to society through tax postures. Boards should consider how stakeholders, including investors and the community, see the company’s contribution to social responsibility through taxes. This includes evaluating the company’s tax practices and their alignment within the context of broader social goals.

- Who is responsible for drafting and monitoring all tax disclosure?

- Is the company conducting any stakeholder engagement around tax transparency and social responsibility?

- How is the company using information obtained from stakeholders to adjust its tax planning strategy?

- How do the company’s tax contributions align with competitors and stakeholder expectations?

Engineering Value Chain Efficiencies

Proactive tax structuring and value-chain planning are crucial for optimizing tax efficiency. Boards need to consider how much engineering for tax efficiency is acceptable and what might be perceived negatively by the tax authorities or the public. While manipulating the value chain for tax mitigation is generally acceptable, significant legal structuring and non-arm’s-length transactions, such as the use of shell companies or intercompany transfers, may raise speculation and scrutiny.

- What options are available for value chain efficiencies?

- Does the company have policies regarding tax structuring and value-chain planning?

- Were any structuring and planning policies considered and rejected? If so, why did we decide not to adopt them?

Conclusion

As the expiration of the 2017 TCJA approaches and pending November 2024 U.S. election results clarify which political priorities may evolve into legislation, companies must stay informed and prepare for potential changes in tax policy. By understanding their current tax strategy, planning for various domestic and international taxation scenarios, and emphasizing tax transparency and social responsibility, businesses can better navigate the complexities of the tax landscape and ensure compliance. Boards have the responsibility to play a critical oversight role in guiding these efforts and ensuring that the company management remains proactive and responsible in formulating its tax practices and executing its tax strategy.

How MGO Can Help

Our tax team is here to help your board navigate today’s complex tax landscape with tailored strategies that directly address shifting policies and compliance challenges as they arise. From strategic planning and global compliance support to enhancing overall tax transparency and optimizing value chain efficiencies, we provide proactive solutions that align with your company’s goals — as well as your shareholders’.

Be prepared for whatever changes come your way, all while maintaining robust tax oversight and committing to social responsibility and long-term success. Reach out to our team today.

Written by Amy Rojik, Todd Simmens and Matt Becker. Copyright © 2024 BDO USA, P.C. All rights reserved. www.bdo.com