This article was created in collaboration with HUG, a global community for artists and art lovers.

Executive Summary:

- Implementing basic accounting practices and understanding tax implications can help individuals working independently in creative fields gain clarity, meet obligations, and maximize income.

- Separating business and personal finances, tracking income and expenses, and budgeting for estimated taxes can help creators be proactive in their financial planning.

- Creators earning income across state lines or internationally need to be aware of varying taxation requirements in different jurisdictions.

~

Today’s artists need to view themselves as both businesses and creatives. Whether you are a painter, digital artist, photographer, website designer, YouTuber, Instagrammer, or any type of artist, creator, or influencer, understanding and managing your financial obligations is a crucial aspect of sustaining a thriving career.

Here are 10 tips to help you meet your tax reporting responsibilities and get the most from your hard-earned income:

1. Separate Your Finances

To make your accounting more efficient and streamline the tax-filing process, it is a smart idea to separate your business and personal finances. Designate a dedicated business account to track income and expenses related to your artistic endeavors. This separation not only simplifies tax reporting but also enhances financial clarity, making it easier to assess the overall health of your creative enterprise.

Tip: Establish a separate account for business transactions, or multiple business accounts to allocate money for categories such as expenses, taxes, and savings.

2. Record All Transactions

Sometimes it can be challenging to determine what constitutes income. That’s why it’s important to track everything. Gifts received by sponsors are often taxable, especially if they are products in exchange for services (e.g., promotion of product). “Donations” from various fundraising activities like Kickstarter are also considered revenue. On the other hand, crypto and non-fungible tokens (NFTs) are considered property. Selling them usually generates a capital gain or loss.

Tip: Log all payments and gifts received, even if you are unsure, so your tax preparer can report appropriately.

3. Track Your Expenses

Creators and artists can benefit from various tax deductions tailored to their industry. Deductible expenses may include art supplies, equipment, software subscriptions, professional development, and even a portion of your home used as a dedicated workspace. While expenses should not be excessive, any “ordinary and necessary” expenses of your craft can be deducted.

Tip: Save receipts and track expenses in real-time using a spreadsheet, app, or software for easy recording and reporting.

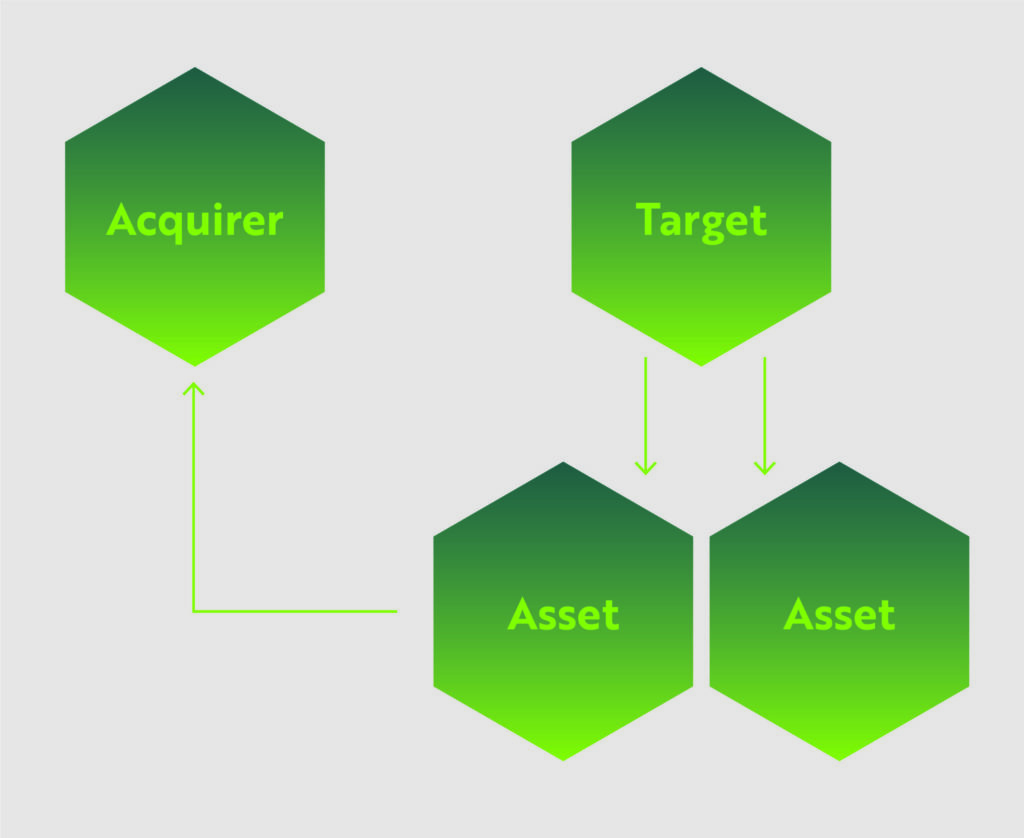

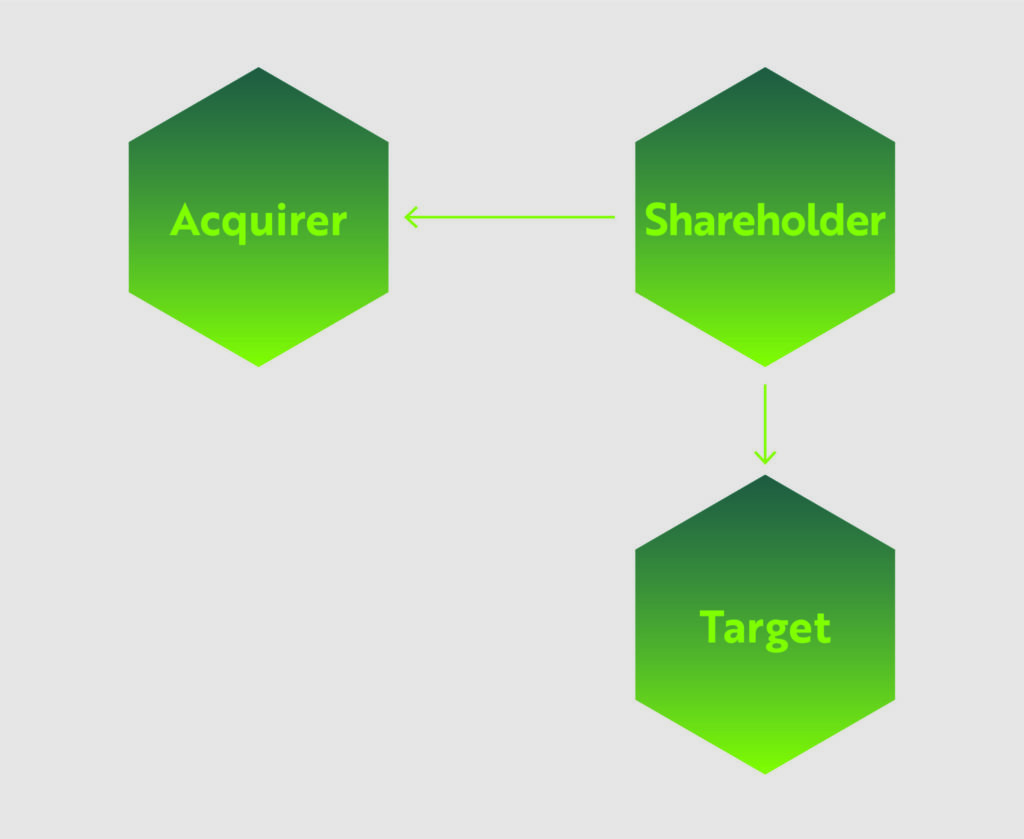

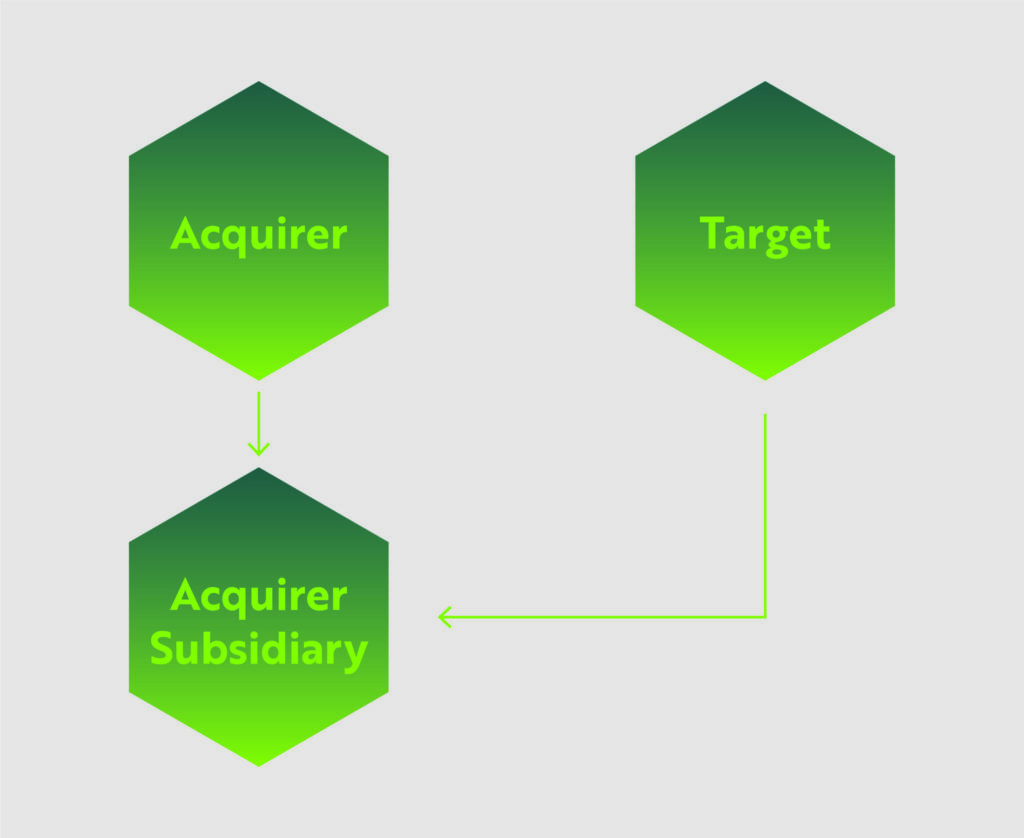

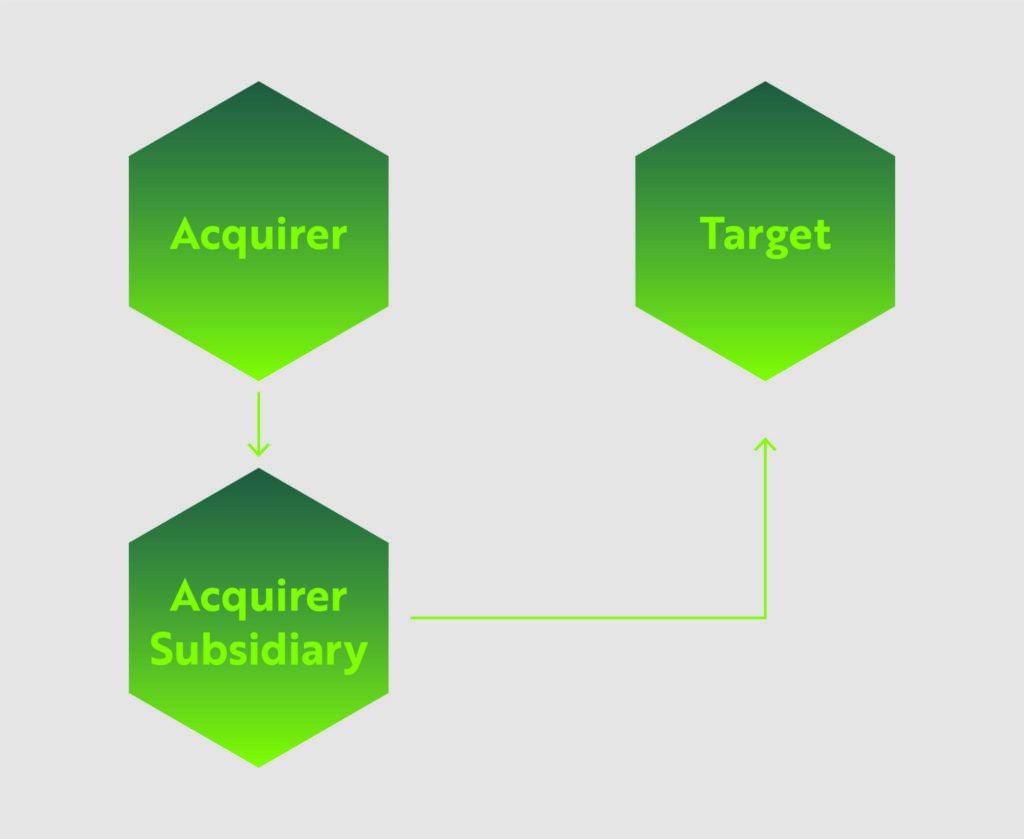

4. Consider Forming an Entity

Creators who run their own business are often independent contractors. Consider setting up an entity for the business — which can help protect your personal assets from your business assets and offer tax savings. S Corporations and LLCs are common for smaller businesses. For larger businesses where investors are coming in, C Corporation may make sense.

Tip: Do some research or talk to a tax professional to find out if setting up an entity makes business and financial sense for you.

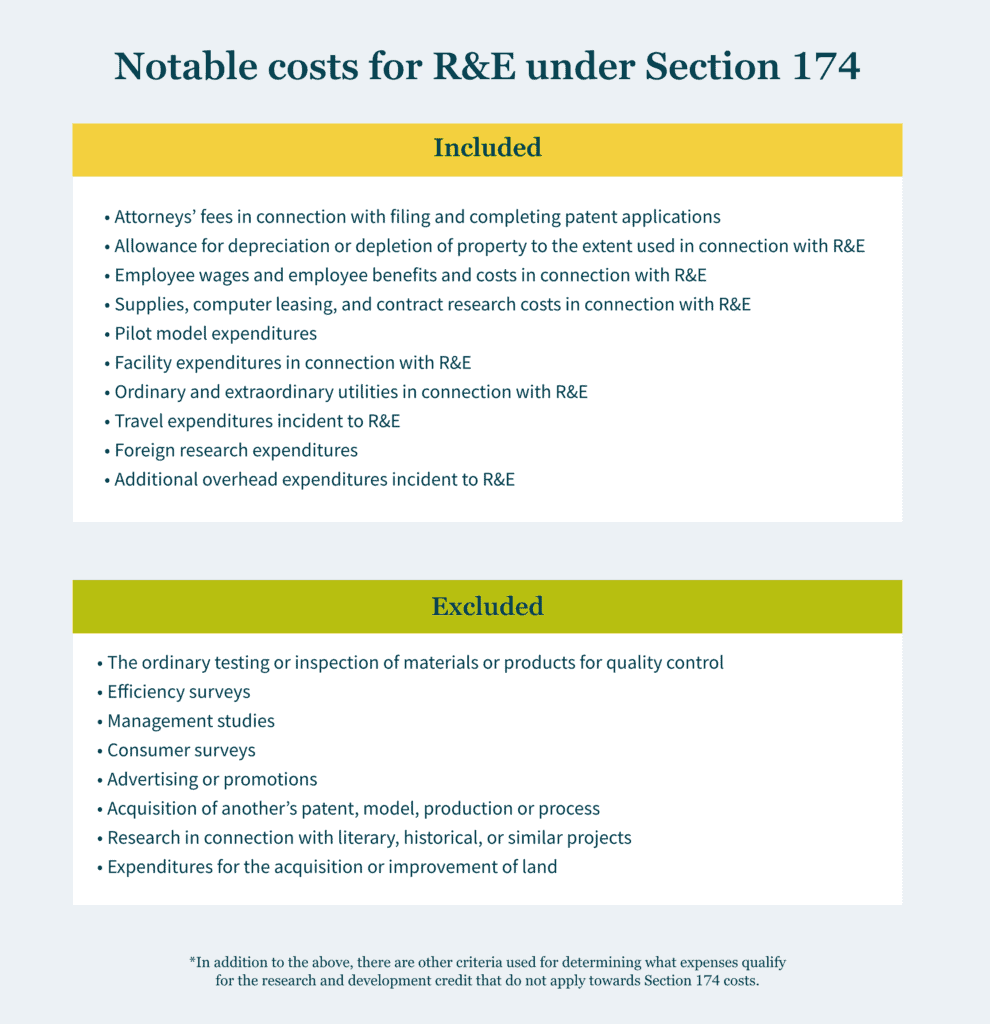

5. Explore Credits You May Be Eligible For

Artists also may be eligible for various tax credits that can help offset their tax liability. Research and Development (R&D) credits can be applicable to certain creative processes, rewarding innovation in your artistic pursuits. For instance, software development is considered to be R&D for income tax purposes.

Tip: Consult a tax professional about ways to maximize credits and minimize your tax liability.

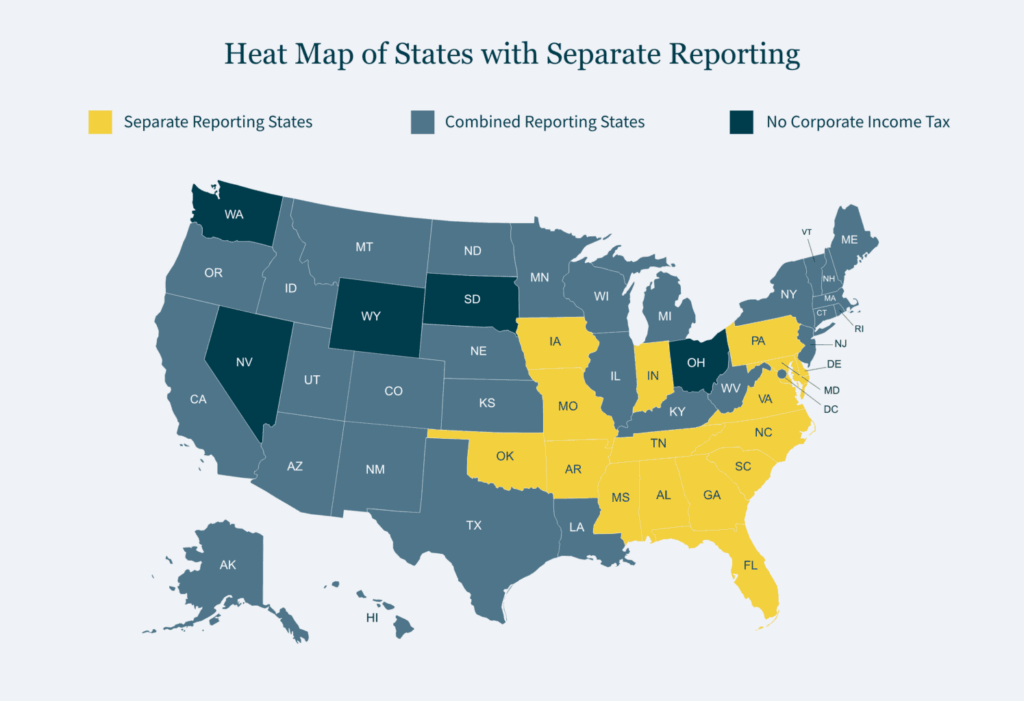

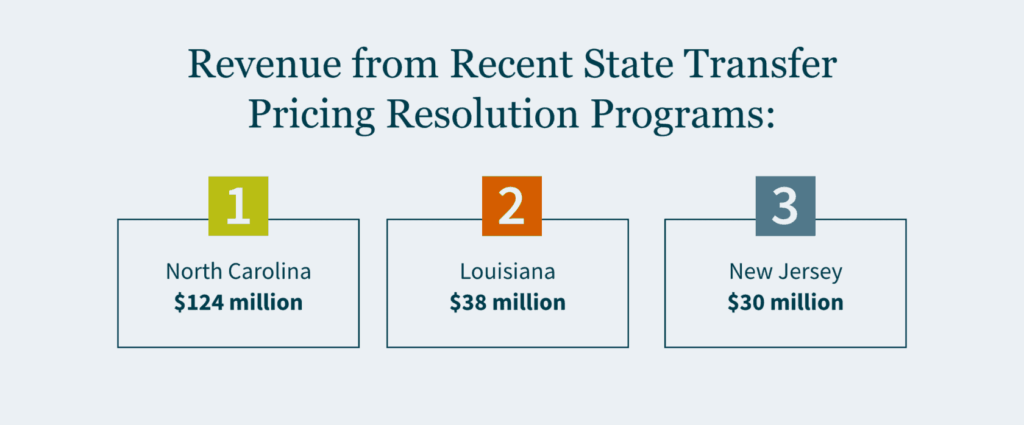

6. Don’t Overlook State and Local Taxes (SALT)

Beyond federal taxes, SALT significantly impact overall tax liability. When selling art online (whether physical or digital), be mindful of sales tax requirements, which are determined by local laws. Whether revenue is from “tangible” versus “intangible” products (physical objects versus services, ideas, software, etc.) can dictate where taxation occurs — affecting if your income is subject to sales tax or not.

Tip: Stay informed about varying tax rates, and be cautious of sales and use tax implications tied to transmitting creative art across state lines.

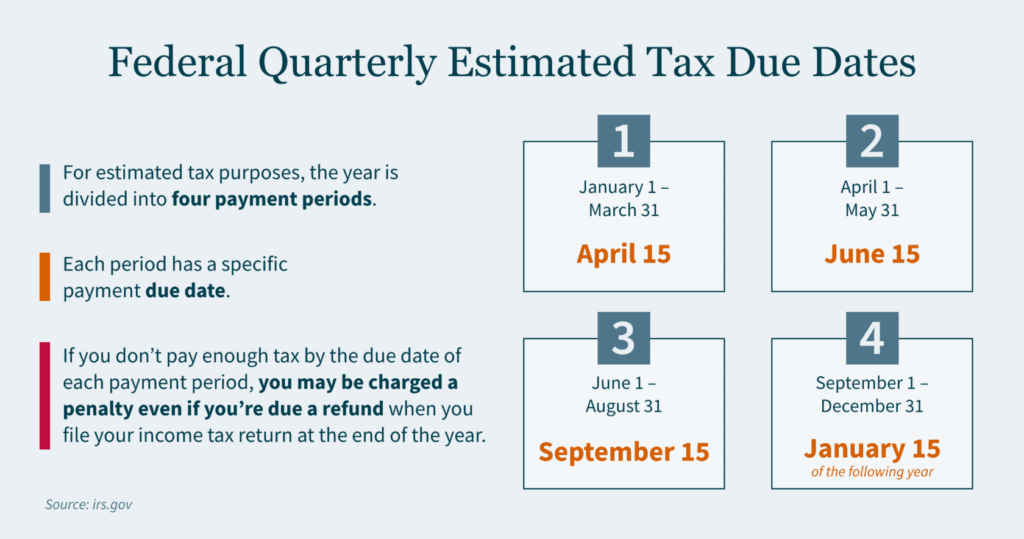

7. Plan for Estimated Taxes

As an independent contractor with variable income streams, you should plan for estimated taxes to avoid financial surprises. These quarterly payments encompass income taxes on your profits plus the self-employment tax (covering Social Security and Medicare). For those earning up to $160,200 in net income, the self-employment tax rate currently stands at 15.3%. The silver lining is that you can deduct half of this self-employment tax when filing your income taxes.

Tip: Set aside a portion of your income for estimated tax payments, ensuring proactive financial planning throughout the year.

8. Report Global Income and Claim Foreign Tax Credits

United States (U.S.) citizens or residents earning abroad must report all worldwide income to the Internal Revenue Service (IRS). If you’re earning income in or from foreign countries, it’s crucial to understand foreign tax credits, filing requirements, and deductibility in various jurisdictions. Every tax jurisdiction may have a different method to tax your creation; and different tax implications may arise based on where brands and intellectual property are created and protected.

Tip: Work with a tax professional to evaluate the potential benefits of foreign tax credits for non-U.S. income.

9. Learn Your Options for Transferring Wealth

Digital assets such as domain names, electronically stored photos, and videos to email and social media accounts all have value. When transferring these as gifts or bequests, there may be tax implications that can be circumvented if the transfer is appropriately structured or organized.

Tip: Consider trusts and estate planning for more tax-efficient wealth transfer.

10. Adapt a Business Owner Mindset

As an artist, embracing a business owner’s perspective is essential for long-term success. Understanding basic financial statements like balance sheets and profit and loss (P&L) statements allows you to gauge profitability, identify your most valuable revenue sources, and streamline your efforts. Elevating your financial literacy empowers you to make more informed decisions — which can lead to greater freedom and flexibility in your artistic career.

Quick Tip: Learn to read a balance sheet and create a basic P&L statement for a clearer financial picture.

Integrate Financial Management into Your Creative Journey

Effective financial planning is like a great work of art — every brushstroke matters. By taking these steps today you can better position yourself to continue pursuing your creative passion tomorrow.

Need a hand with taxes and accounting for your creative venture? Our Entertainment, Sports, and Media practice works with a diverse range of artists — from musicians to photographers to online creators — and our International Tax and State and Local Tax teams can provide guidance to help you address areas like sales tax or foreign tax credits. Reach out to MGO today.