Key Takeaways:

- Tech companies have historically faced complex state and local tax challenges, particularly regarding nexus and sales tax.

- Understanding product and service classification, customer types, transaction documents, and research and development activities is crucial to navigating tax challenges.

- Regular nexus reviews and proactive tax planning can help companies determine compliance, mitigate risks, and identify savings opportunities.

~

For technology companies, state and local tax (SALT) — particularly issues related to nexus and sales tax — can be a minefield. Here is what you need to know to stay compliant and avoid costly mistakes.

Understanding Nexus and Protected Activities

Nexus determines whether your company has a taxable presence in a state. For today’s tech businesses with customers spanning across the U.S., nexus can be triggered more easily than you might think.

- For sales tax purposes, in addition to physical presence, most states have statutes that establish a “bright line test” based on sales revenue and/or transactions. Generally, the rule is $100,000 or more in sales and/or more than 200 transactions occurring in a state. This is referred to as “economic nexus.”

- For state/local income tax purposes, in addition to physical presence, some jurisdictions also have a “bright line test” based on the presence of certain factors including property, payroll, or sales in a state. This test is referred to as “the factor presence test.”

Additionally, for net income tax purposes, there is a federal law that protects certain activities performed by taxpayers selling tangible personal property. Public Law 86-272 (PL 86-272) shields most sales solicitation activities — which would normally be subject to income tax — from a state’s jurisdiction. However, assisting with installations, calibrations, or training are among activities typically not protected (even though these tasks may support the sales process). This common selling practice in the tech industry often creates income tax nexus without companies realizing it.

PL 86-272 does not apply to service providers. Thus, to the extent the revenue generated by a tech company is for services (as defined by each state) and the company solely solicits sales in the state, the activity will nonetheless create income tax nexus in that state.

For franchise tax, gross receipts tax and other state/local taxes, nexus thresholds may be far lower than the ones discussed. In addition, the PL 86-272 protections do not apply.

The application of nexus rules by tax type to the tech industry is extremely complex and requires a review by a state tax law professional.

Navigating Sales Tax Complexities

In addition to nexus, sales tax rules can vary significantly from one jurisdiction to another, making compliance challenging for tech companies. Two main factors drive this complexity:

1. Product and Service Classification and Documentation

Different states may classify your product/service in different ways, affecting its taxability. This is especially true in the tech industry where states are continuously examining the definition of software as a service (SaaS). For example, one state might conclude your product/service is software while another state may classify it as data processing. State auditors will review your revenue streams, documentation, etc., to make the determination. This conclusion matters as some states tax data processing while others may not.

The classification also matters in the application of sourcing rules by state. For example, sourcing software revenue may differ state by state. It may be sourced based on where the software or server is located in one state and where the user is located in another state. The complexity arises in applying two (2) sets of rules on the revenue generated from the same transaction.

2. Customer Type

The taxability of your product/service can also depend on the type of customer you sell to. Nonprofit organizations, healthcare facilities, government entities, and wholesalers may be exempt from sales tax in certain jurisdictions. Keeping accurate exemption certificates is essential when selling to a mix of taxable and exempt customers to avoid over collecting or under collecting taxes.

Exploring Tax Credits and Incentives

In addition to understanding your nexus and sales tax obligations, your company may also benefit from exploring tax credits and incentives available at the state and local level such as:

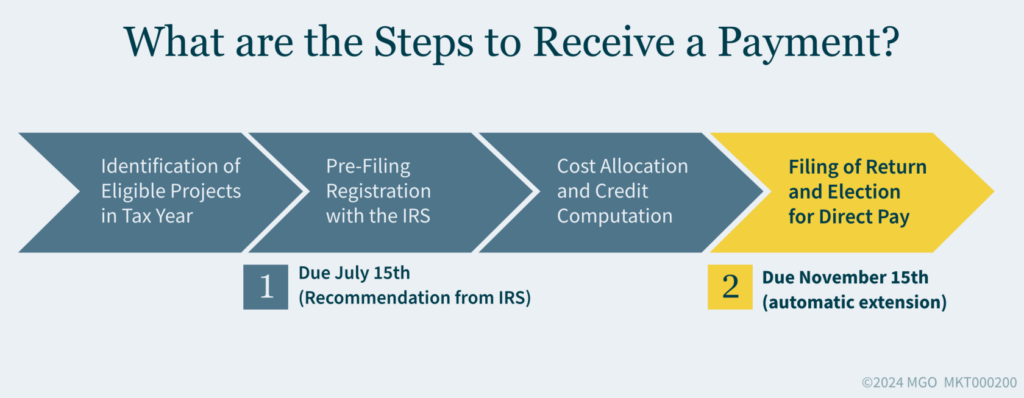

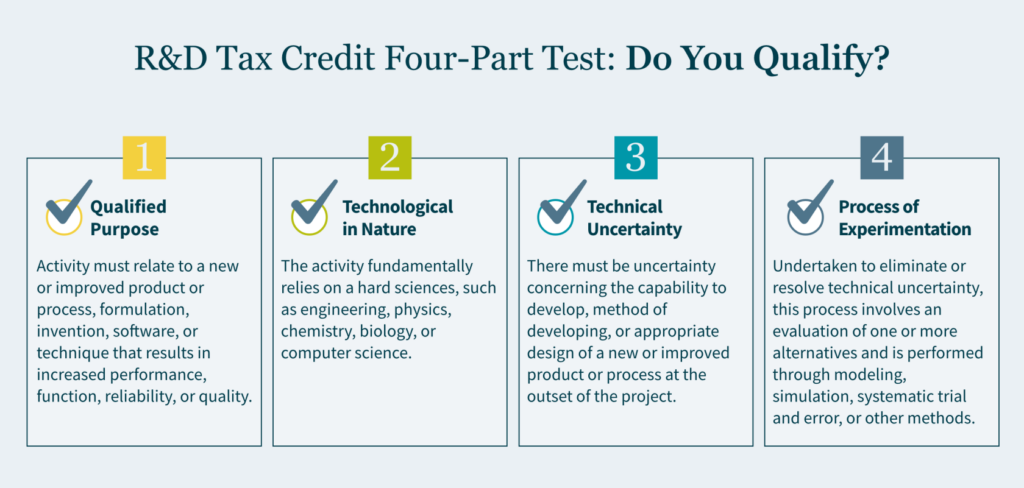

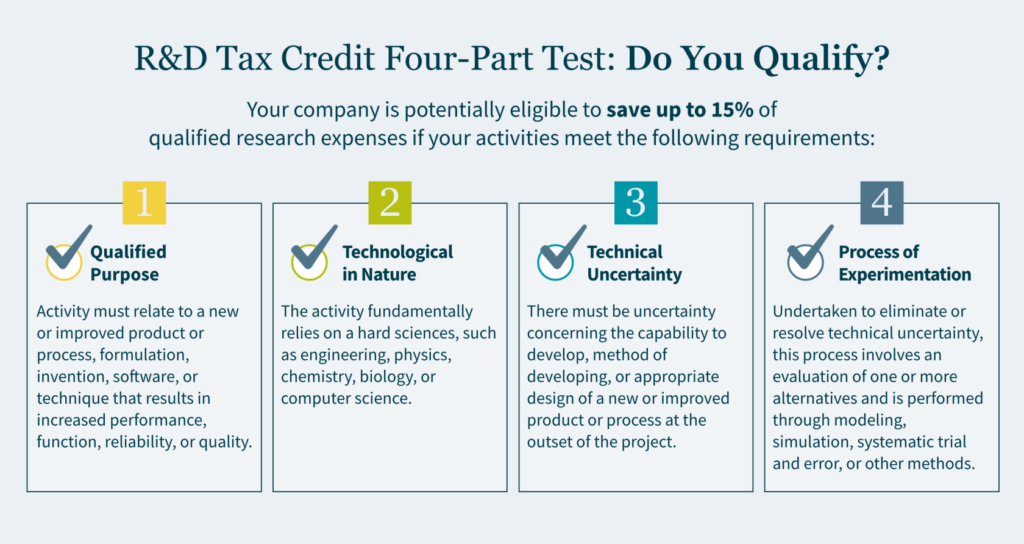

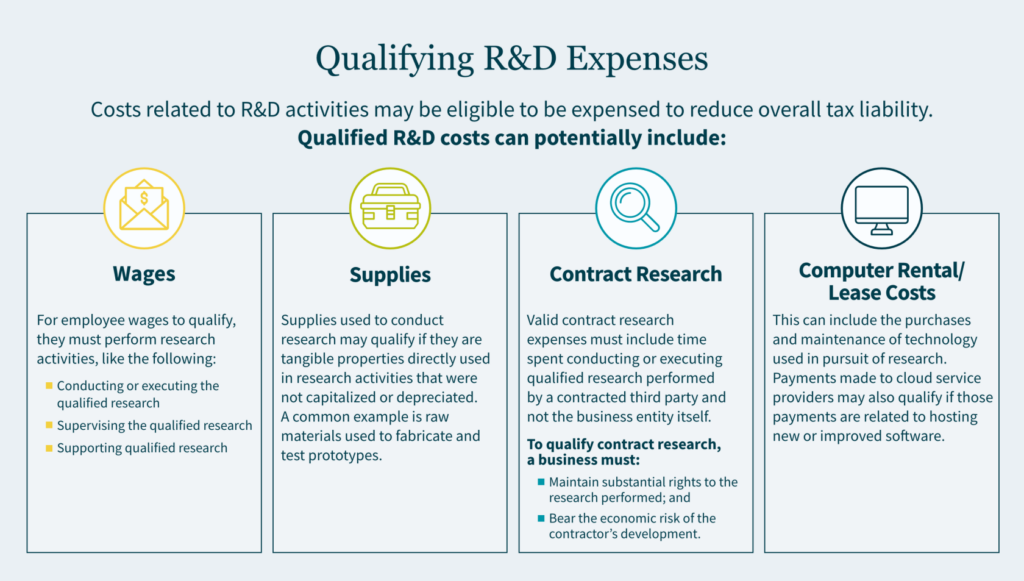

R&D Tax Credits

Tech companies frequently engage in research and development (R&D), which can qualify for substantial tax benefits. Similar to federal R&D tax credits, many states offer R&D credits that can help reduce your overall tax burden.

Environmental Incentives

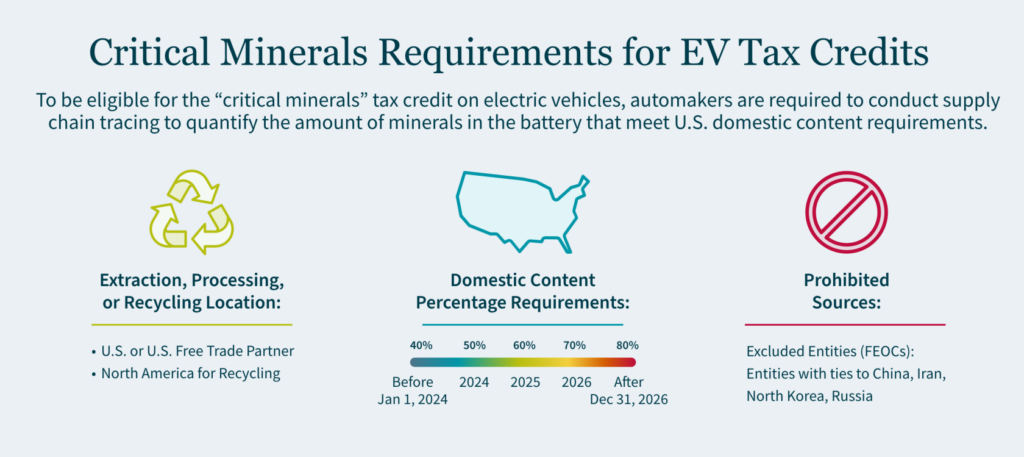

As your company expands, you may invest in new office space or facilities, incorporating environmentally friendly technologies. Some states offer environmental tax credits that can help you reduce costs while contributing to sustainability initiatives.

4 Key Strategies for Staying SALT Compliant

Keeping up with state and local tax laws can be overwhelming — especially when they are constantly changing. Here are strategies to help you stay compliant:

1. Understand Your Obligations

Staying compliant starts with understanding how your products and services are classified for both income and sales tax purposes. Each state may treat your offerings differently and understanding whether your product and/or service is taxable, and at what rate, is critical. Additionally, you need to assess your support and sales activities to determine whether they are protected activities, such as those covered by PL86-272, or if they create taxable presence (nexus).

2. Simplify with Software

Sales tax software can help streamline your compliance process. Many tech companies operating in multiple states use this tool to add sales tax automatically to customer invoices. The software calculates the tax rate for each location based on state, local, and district level rules. It can also help with tracking transactions and automating sales tax filings, reducing errors, and saving time.

3. Document Your Decisions

Meticulous documentation is key to maintaining compliance, especially if your company is subject to an audit. Keep records of decisions on tax classifications, nexus determinations, and exemptions. This documentation will be invaluable during an audit — helping you prove that your company acted in good faith and followed the appropriate processes.

4. Conduct Regular Reviews

As your business grows, so do your tax obligations. It is important to periodically review your nexus footprint — especially when expanding into new states or hiring remote employees. A nexus review assesses your corporate and selling activities by state to determine if your company has tax nexus and therefore potential tax exposure and filing obligations. Regular nexus reviews will help you collect and remit sales taxes and pay income and gross receipts taxes in all necessary jurisdictions and avoid penalties for non-compliance.

Taking a Proactive Approach to SALT

As your tech company expands into new markets, staying ahead of state and local tax (SALT) obligations becomes increasingly important. Regular nexus reviews and proactive tax planning not only helps you avoid costly mistakes but also positions your company for sustainable growth.

How MGO Can Help

With extensive experience working with technology companies and a dedicated SALT team, we can help you effectively navigate the complexities of state and local taxes. Through our nexus review process, we analyze your multistate activities — including sales, payroll, and property presence — to develop a tailored SALT compliance plan and resolve outstanding liabilities resulting from unpaid taxes in various jurisdictions.

In addition, our Tax Credits and Incentives team can help you determine if you qualify for any state and local tax credits to offset your tax burden.

Reach out to our team today to gain clarity on your SALT obligations and protect your business.