Executive Summary

- The Internal Revenue Service (IRS) instituted a moratorium on the processing of new Employee Retention Tax Credit (ERTC) claims due to an influx of fraudulent and exaggerated claims — primarily stemming from unscrupulous ERTC mills.

- As of July 31, 2023, the IRS Criminal Investigation division had initiated 252 investigations involving more than $2.8 billion in potentially fraudulent ERTC claims. Fifteen investigations have resulted in federal charges, with six of those resulting in convictions with an average sentence of 21 months.

- Taxpayers who are not certain of their eligibility should consult with a trusted tax professional for a second review and may want to avail themselves of the IRS’s new settlement and/or withdrawal programs.

~

The IRS recently took a drastic step to impede a wave of ineligible ERTC claims by halting the processing of new refund requests through at least December 31, 2023.

Ineligible ERTC claims have plagued the IRS since Congress enacted the credit in 2020. In fact, the IRS opened its 2023 “Dirty Dozen” list with warnings about common ERTC scams that taxpayers should be wary of. This prominently placed notice — as well as subsequent announcements from the IRS — alerted taxpayers to unscrupulous actors who have been advising employers to claim credits in excess of what they could legitimately qualify for while charging those employers hefty upfront fees or fees contingent on ERTC refunds.

In the wake of a flurry of IRS investigations that identified more than $2.8 billion potentially fraudulent claims, the halt on processing ERTC claims will allow the IRS to further focus their efforts on investigating and ultimately prosecuting fraudulent claims. In the following we’ll detail the impact of the IRS moratorium and provide guidance if you suspect you’ve been exposed to inaccurate or fraudulent ERTC claims.

Background on the ERTC

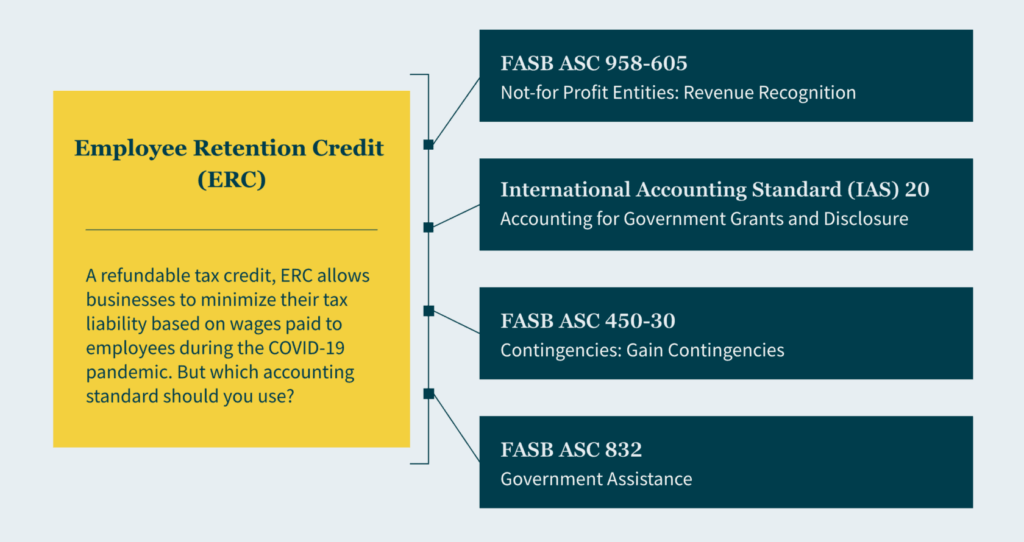

First established in 2020 by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the employee retention tax credit was critical — along with Paycheck Protection Program (PPP) — in giving businesses that struggled to navigate the pandemic’s challenges much needed resources to pay employees while the businesses were shut down or facing declining sales.

For most taxpayers, the ERTC was claimed on quarterly payroll tax returns encompassing the period March 13, 2020, through September 30, 2021 (i.e., first quarter of 2020 through the third quarter of 2021). For a small subset of businesses classified as “recovery startup businesses” (as defined below), the ERTC could also be claimed for the fourth quarter of 2021.

Despite the halt in processing by the IRS, eligible taxpayers are still able to claim the credit by filing amended quarterly payroll tax returns. Amended payroll tax returns for 2020 quarters are able to be processed by the IRS as long as they are filed on or before April 15, 2024, while amended payroll tax returns for 2021 quarters are able to be processed as long as they are filed on or before April 15, 2025.

The credit is calculated based on the “qualified wages” of employees. The maximum amount of payroll tax credit that an employer can claim per employee is $26,000.

Qualification Tests

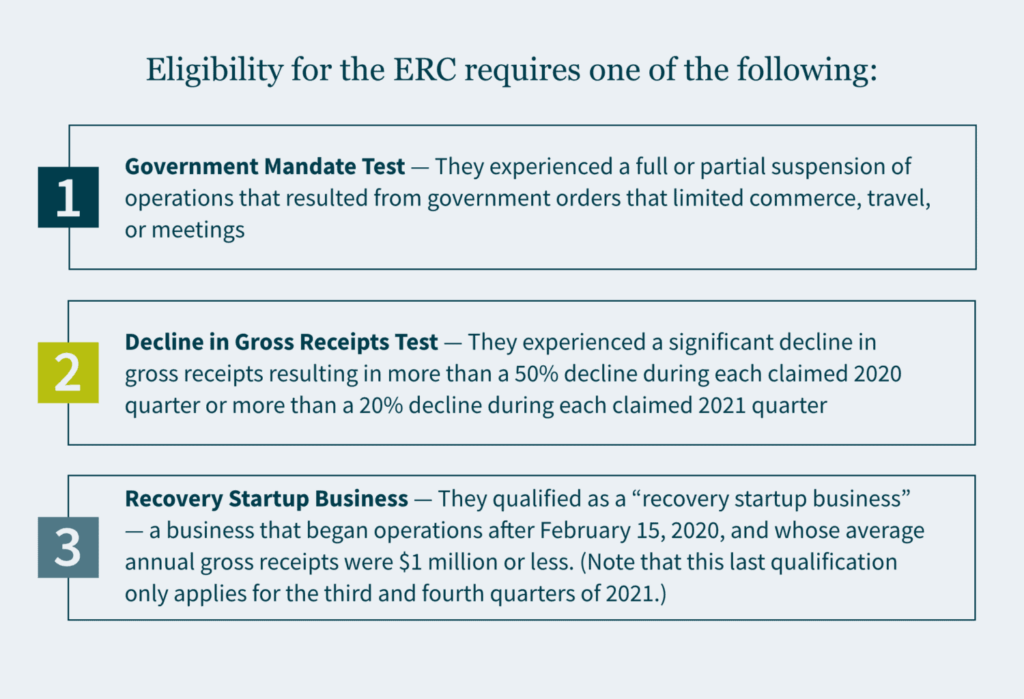

To be eligible for the ERTC, businesses must generally satisfy one of the following criteria for each of the quarters for which they are claiming the credit:

- Government Mandate Test — They experienced a full or partial suspension of operations that resulted from government orders that limited commerce, travel, or meetings.

- Decline in Gross Receipts Test — They experienced a significant decline in gross receipts resulting in more than a 50% decline during each claimed 2020 quarter or more than a 20% decline during each claimed 2021 quarter.

- Recovery Startup Business — They qualified as a “recovery startup business” — a business that began operations after February 15, 2020, and whose average annual gross receipts were $1 million or less. (Note that this last qualification only applies for the third and fourth quarters of 2021.)

The IRS Processing Moratorium

On September 14, 2023, the IRS announced that it would halt the processing of new ERTC claims through at least December 31, 2023. The IRS also stated that it plans to subject its queue of more than 600,000 existing ERTC claims to stricter compliance reviews, increasing the standard processing goal for those claims from 90 days to 180 days — with a potential for a much longer processing time for claims that require further review or audit.

This processing moratorium comes on the heels of a significant influx of claims – many of which the IRS believes are ineligible. The IRS stated that it has received more than 3.6 million ERTC claims over the life of the ERTC program, with about 15% of those claims being received in the 90-day period preceding the processing freeze. This amounts to roughly 50,000 claims still being received a week. To put this in perspective: the IRS has paid out about triple the amount that Congress had originally estimated for the program.

Additionally, as of July 31, 2023, the IRS Criminal Investigation division had initiated 252 investigations involving more than $2.8 billion in potentially fraudulent ERTC claims. Fifteen of the 252 investigations had resulted in federal charges, with six of those resulting in convictions. Four of the six convictions had reached the sentencing phase with an average sentence being 21 months.

The IRS intends on utilizing the moratorium to add more safeguards to the processing of ERTC claims, to protect businesses by decreasing the momentum of the pop-up ERTC mill industry, and to provide several solutions for taxpayers who submitted invalid claims. Those solutions include:

- A claim withdrawal program will be rolled out in Fall 2023 allowing businesses to withdraw ERTC claims that have not been processed or paid, even if those claims are under audit or awaiting audit.

- A claim settlement program rolling out in Fall 2023 that will allow businesses to repay ERTC claims, while also avoiding penalties and future compliance actions. (Note that fraudulent claims may still be subject to criminal referral.)

How to Respond to IRS Scrutiny of ERTC Claims

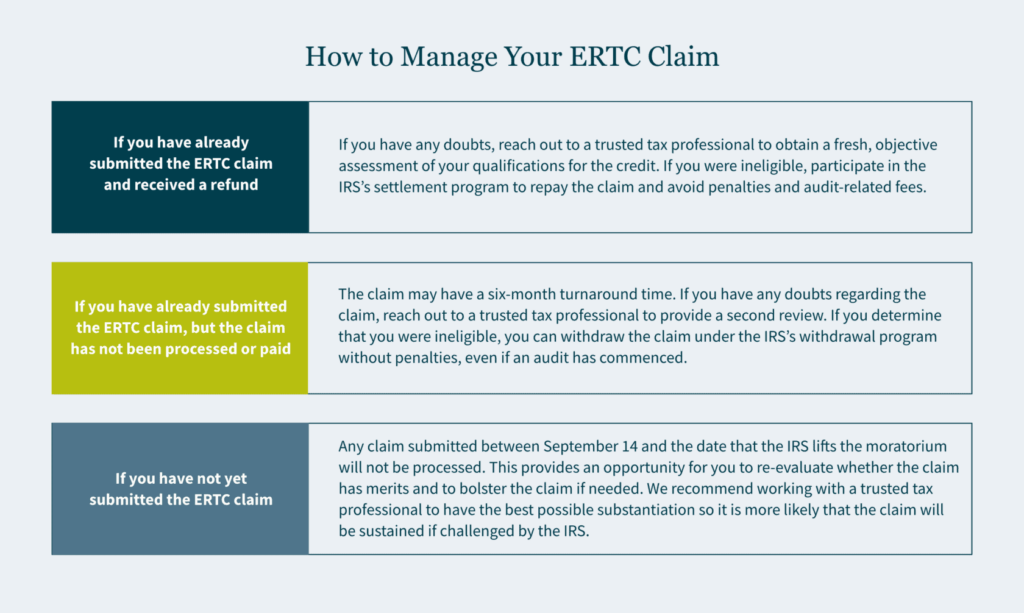

Given the expected extra scrutiny that businesses can expect to face on their claims, businesses should review ERTC claims that they have made and/or intend to make where there are any doubts regarding the eligibility of those claims:

- If you have already submitted the ERTC claim and received a refund: If you have any doubts regarding your eligibility, we recommend reaching out to a trusted tax professional to obtain a fresh, objective assessment of your qualifications for the credit. If you determine that you were ineligible, you can participate in the IRS’s settlement program so that you can repay the claim, avoiding both penalties and audit-related fees.

- If you have already submitted the ERTC claim, but the claim has not been processed or paid: The claim will take longer to process than during the summer — increasing from a three-month turnaround time to a likely six-month turnaround time. If you have any doubts regarding the claim during this period, we recommend reaching out to a trusted tax professional to have a second review of the claim. If you determine that you were ineligible, you can withdraw the claim under the IRS’s withdrawal program without penalties, even if an audit has commenced.

- If you have not yet submitted the ERTC claim: Any claim submitted between September 14 and the date that the IRS lifts the moratorium – currently after December 31, 2023 – will not be processed. This should provide an opportunity for you to re-evaluate whether the claim has merits and to bolster the claim if needed. We recommend working with a trusted tax professional to have the best possible substantiation for your claim so that it is more likely that the claim will be sustained if challenged by the IRS.

How MGO Can Help

MGO’s ERTC Second Look program is geared towards the types of objective, trustworthy reviews that would benefit you during this time of heightened ERTC claim scrutiny. Our experienced Credits & Incentives team can identify audit red flags, areas that need more substantiation, miscalculations, and incomplete filings. In addition, our Tax Controversy team — in tandem with our Credits & Incentives team — can defend you if any of your ERTC claims are challenged by the IRS, with the ability to represent you during audit, appeals, and tax court. Contact us to learn more.