Key Takeaways:

- Navigate the crucial “now what?” phase after pre-filing by focusing on cost allocation, credit computation, and timely return filing by November 15.

- Tackle complexities like multiple credits, thorough documentation, and tight timelines to maximize your clean energy tax benefits.

- Leverage professional guidance to optimize your credits and potentially secure substantial refunds for reinvestment in your community.

~

You’ve taken the first step towards benefiting from clean energy tax credits by completing your pre-filing registration. But what comes next? For state or local government entities, navigating the world of energy tax credits can be complex. Let’s break down the crucial next steps to help you maximize your benefits and meet the necessary deadlines.

Understanding the Timeline

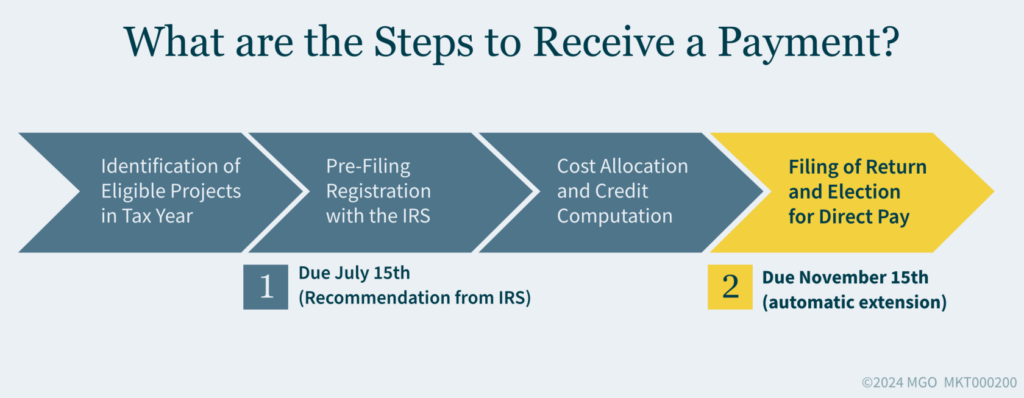

After pre-filing registration, you’re now in the “now what?” phase. This critical period involves two main steps:

- Cost allocation and credit computation, and

- Filing of the return (due November 15).

It’s essential to maintain momentum during this phase to receive the full benefits of the tax credit.

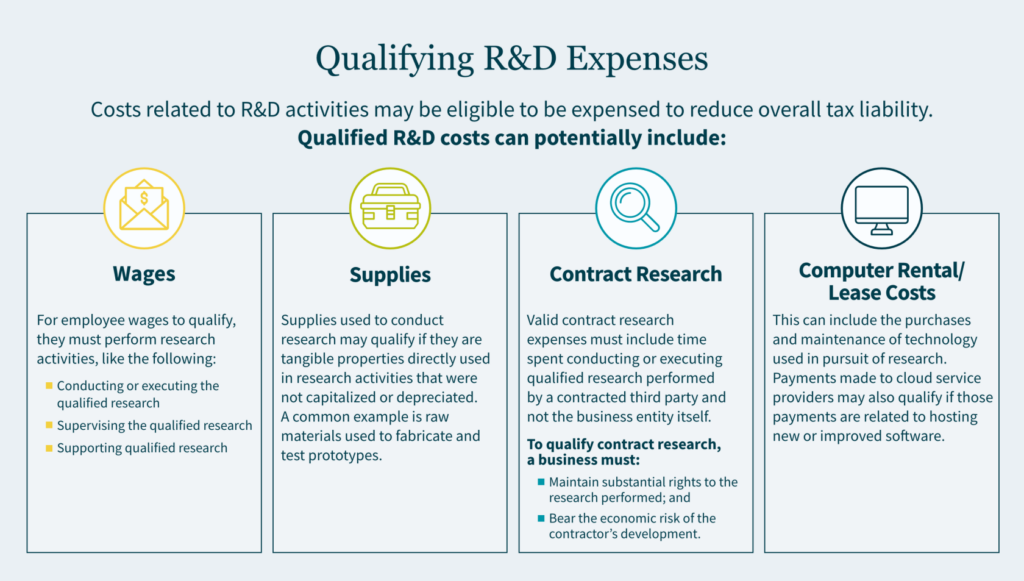

Cost Allocation and Credit Computation: Key Considerations

As you prepare to file your return, keep these important factors in mind:

Multiple Credits and Projects

If your entity is filing for more than one credit or managing multiple projects, the process becomes more intricate. Each credit may require separate forms and documentation, and careful management is needed to avoid errors that could delay your refund.

Documentation and Support

Given that this is a relatively new process for many governmental entities, thorough documentation is essential. From initial project costs to ongoing expenses, every financial detail must be meticulously recorded. Proper documentation not only supports your credit claims but also protects your entity in the event of an audit.

Timeline Considerations

The timeline for filing is tight. After prefiling registration, you have a few months to complete cost allocation, credit computation, and the final tax return. Missing the November 15 deadline could result in forfeiting your refund for the year. Working with knowledgeable tax professionals can help you streamline this process and meet all necessary deadlines.

How Professional Guidance Can Help Your Government

Given the complexities involved, your government may benefit from tax credits and incentives professionals to help you navigate the intricacies of:

- Proper assessment of eligible expenses

- Gathering and organizing necessary documentation

- Verifying compliance with all IRS requirements

- Maximizing your potential benefits

Filing the Return: The Final Step

Once your cost allocations and credit computations are complete, you’ll move on to filing your tax return. For 2023 tax filings, this return is due by November 15, 2024. Meeting this deadline is crucial to secure your refund.

A few key notes on filing your return:

- Your filing must include the registration number(s) provided after your pre-filing registration review.

- This is where you will make the formal election for elective pay (also referred to as “direct pay”).

- Complete and accurate filing will help you receive the full value of your eligible credits.

What If You Missed the Pre-Filing Registration?

If you haven’t completed your pre-filing registration yet, it’s crucial to act quickly. While the IRS recommended a July 15 deadline, it’s not a hard cutoff. However, delays from a late pre-filing could impact your ability to meet the November 15 filing deadline. Contact a professional as soon as possible to avoid missing out on potential opportunities.

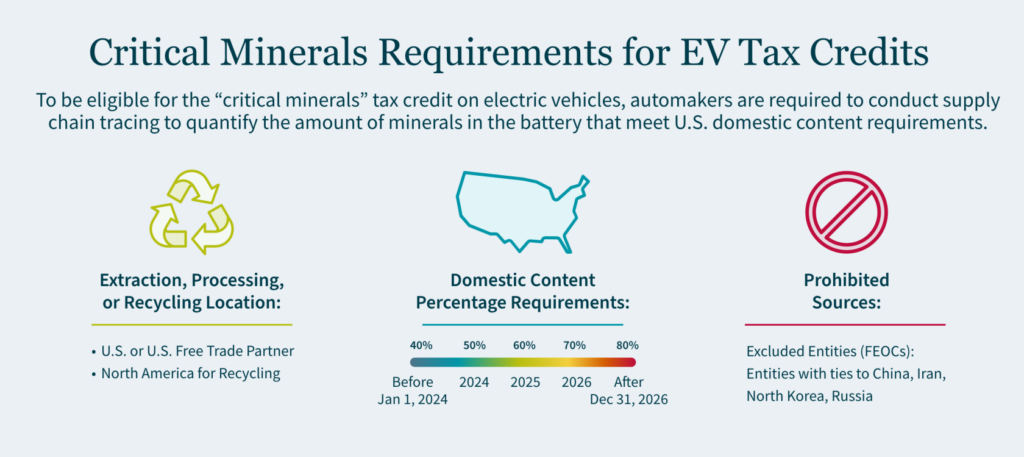

Elective Pay: A Quick Refresher

Elective pay allows governmental entities to benefit from certain clean energy tax credits. The amount of the credit is treated as a payment of tax, and any overpayment results in a refund. This means you can receive the full value of your investment tax credit even if you don’t owe other federal income taxes.

For example, a Northern California city recently computed over $6 million in credits for a $28 million clean energy project. This city stands to receive a substantial refund, which can be reinvested in further sustainable initiatives or other community needs.

Unlock the Full Potential of Your Energy Tax Credits

By staying informed and proactive, you can navigate this process successfully and maximize the benefits of clean energy investments for your community. As you move forward, remember that you don’t have to go it alone — engaging with a tax credits and incentives professional can help you optimize your credits and create a smooth process from start to finish.

How MGO Can Help

Need assistance with your cost allocation and credit computation to meet the filing deadline, or just want to learn more about what energy incentives could be applicable for your entity? Visit our Renewable Energy Investments and Credits page or reach out to our Tax Credits and Incentives team today.