his article is part of an ongoing series, “Navigating the Complexities of Setting Up a Business in the USA“. View all the articles in the series here.

Key Takeaways:

- Implementing effective transfer pricing strategies is essential for regulatory compliance and optimizing your tax position in the U.S.

- Transfer pricing helps intercompany transactions align with the arm’s length principle, preventing double taxation and mitigating tax risks.

- Meticulous documentation and regularly updated policies are key to maintaining compliance with transfer pricing regulations.

~

As a multinational enterprise setting up operations in the United States, it is imperative for you to understand the complexities of transfer pricing and intercompany transactions. Effective transfer pricing strategies will help you meet regulatory compliance and improve your tax position.

Fundamentals of Transfer Pricing

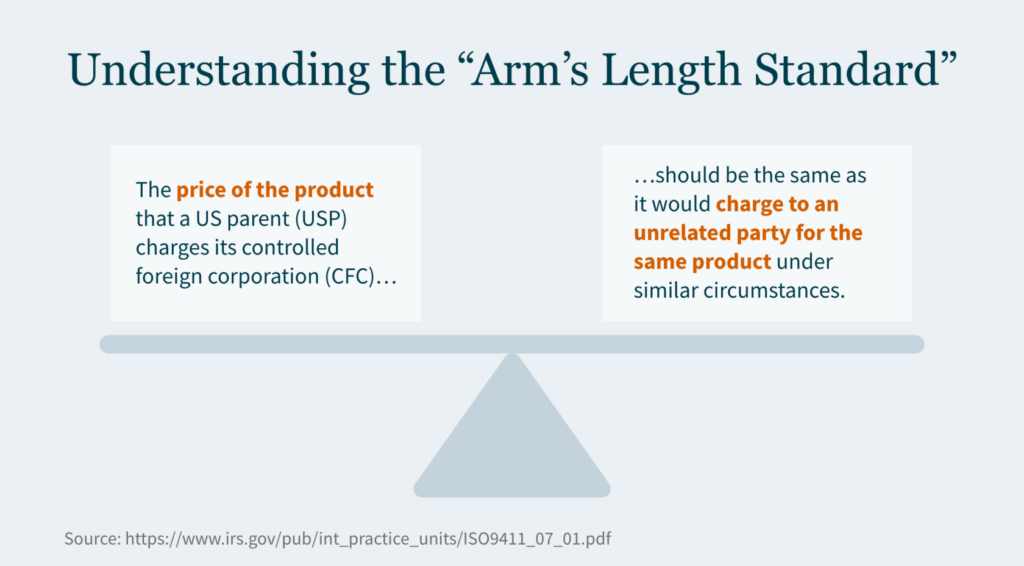

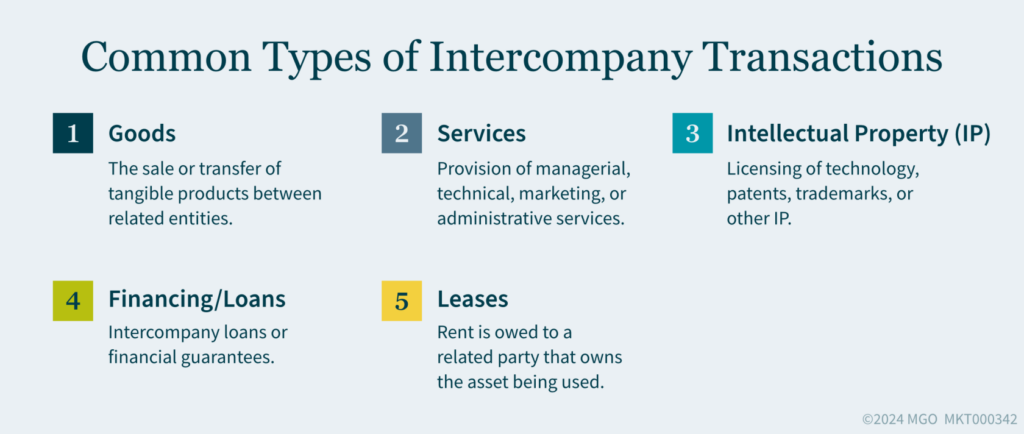

Transfer pricing involves setting prices between related entities for transactions — such as the purchase or sale of goods, provision of services, performance of manufacturing activities, cost allocation, or use of intellectual property. This practice of “negotiating” prices between related entities ensures transactions are conducted at “arm’s length”, meaning the prices are consistent with those charged between independent parties. Proper transfer pricing can help you avoid double taxation, mitigate tax risks, and follow U.S. laws.

It is important to note that “related entities” for these purposes involve the concepts of both common ownership and common control. Many taxpayers who fail to understand these concepts also fail to properly address transfer pricing rules and regulations for various transactions.

Regulatory Requirements

IRS Guidelines on Transfer Pricing

The Internal Revenue Service (IRS) provides detailed guidelines on transfer pricing to promote fair pricing practices. These guidelines require businesses to apply the arm’s length principle and provide adequate documentation to justify pricing methods.

Documentation and Compliance

Compliance with U.S. transfer pricing regulations involves meticulous documentation. Companies must prepare and keep detailed records of intercompany transactions — including the rationale for pricing decisions, application of the best method, and evidence that prices meet arm’s length standards. Non-compliance can lead to substantial penalties and adjustments imposed by the IRS.

Setting Up Transfer Pricing Policies

Establishing effective transfer pricing policies requires a thorough understanding of the business model, industry standards, and regulatory requirements. Your company should develop policies that align with the arm’s length principle and keep consistency across all intercompany transactions. Additionally, you should continuously check and update these policies to adapt to any changes in business operations and tax regulations.

For further insights into developing robust transfer pricing strategies, explore our case study on global transfer pricing for a semiconductor leader.

Real-World Transfer Pricing Strategies

Examining real-world examples can offer valuable insights into effective transfer pricing strategies.

Example 1: Goods Transfer

A multinational company based in the United Kingdom sets up a U.S. subsidiary to handle distribution. To follow transfer pricing regulations, the company conducts a thorough analysis to decide proper prices for goods transferred to the U.S. entity, verifying the profitability of the U.S. entity is appropriate.

Example 2: Service Provision

A Japanese company provides technical support services to its U.S. subsidiary. By documenting the cost-plus method, where a markup is added to the costs incurred in providing the services, the company shows compliance with the arm’s length principle.

Example 3: Intellectual Property Licensing

A German firm licenses its proprietary software to a U.S. branch. The firm conducts a detailed analysis to decide the right royalty rate, confirming the transaction meets IRS guidelines and minimizes tax liabilities.

Optimizing Your Transfer Pricing Approach

For multinational businesses moving into the U.S. market, it is vital to understand and implement effective transfer pricing strategies to assist with regulatory compliance, improve tax positions, and support seamless intercompany transactions.

Even if your business is familiar with Organization for Economic Co-operation and Development (OECD) transfer pricing guidelines or currently operates in a country that mirrors them, you need to know the subtleties that may occur should the IRS review your related-party transactions. The IRS will generally abide by U.S. transfer pricing principles without consideration of OECD guidelines. Understanding the differences may help you avoid headaches and create a consistent approach throughout your organization worldwide.

If your business is navigating the complexities of transfer pricing, professional advice and tailored strategies are recommended. For detailed guidance and personalized support, reach out to our International Tax team today.

Setting up a business in the U.S. requires thorough planning and an understanding of various regulatory and operational challenges. This series will delve into specific aspects of this process, providing detailed guidance and practical tips. Our next article will discuss operational strategies for a successful expansion.