Executive Summary:

- Cyber threats are increasingly elevating data and infrastructure risks for state and local governments. Proactive security standards and assessments can strengthen governmental defenses.

- Cyber Maturity Assessments (CMAs) evaluate preparedness to safeguard against, detect, isolate, and respond to system threats holistically across staff, procedures, and tools.

- Conducting a CMA can provide governments strategic advantages, such as: gauging risk management capabilities, fostering a security culture, mapping regulatory requirements, adapting to the evolving threat landscape, and informing cybersecurity strategies.

~

Cyber threats grow more sophisticated every day, increasing risks to sensitive data and critical services at the state and local level. With public-sector cyberattacks on the rise, today’s governments need to reinforce their cyber defenses to protect government operations and maintain constituent trust.

In the realm of cybersecurity, staying ahead of the curve is not just advisable; it’s imperative. In 2016, the Department of Defense (DoD) introduced a final rule amending the Defense Federal Acquisition Regulation Supplement (DFARS). This rule mandated new cybersecurity safeguards and cyber incident reporting for controlled unclassified information (CUI).

Transitioning from DFARS, the DoD has now developed the Cybersecurity Maturity Model Certification (CMMC), a framework designed to enhance the cybersecurity of government contractors. While state and local governments are not beholden to the CMMC, your team can still benefit from embracing CMMC standards and proactively developing comprehensive security programs.

5 Benefits of a Cyber Maturity Assessment for Your State or Local Government

To check your government against CMMC standards, a powerful tool you can employ is a Cyber Maturity Assessment (CMA) — which examines your organization’s overall preparedness to safeguard against, recognize, isolate, and react to cyber threats that could compromise sensitive data and systems. Analyzing more than just adherence to regulations, a CMA is a holistic analysis of people, processes, and tools that assesses the entity’s broader cyber risk exposure and defenses.

Here are five ways a CMA can be a trusted ally in fortifying your cybersecurity defenses:

1. Risk Management

The CMA framework addresses the crucial question: Is your organization equipped to navigate evolving risks effectively? With the assistance of CMA, state and local governments can gain insights into the maturity of their current processes and mechanisms. This empowers them to make informed decisions on risk mitigation strategies, ensuring a robust defense against emerging cyber threats.

2. Strengthening Security Culture

Promoting a culture of security and privacy by design is paramount in today’s digital landscape. CMA serves as a catalyst in fostering this mindset within organizations. By assessing the maturity of security practices, it enables state and local governments to identify areas for improvement, laying the foundation for a resilient security culture.

3. Understanding of Multiple Regulatory Requirements

Navigating the complex web of regulatory requirements is a challenge for any government entity. CMA provides a comprehensive understanding of an organization’s capabilities to meet controls-based regulatory requirements. This not only ensures compliance but also establishes a framework for efficient regulatory adherence, minimizing vulnerabilities.

4. Proactiveness in an Ever-Evolving Cybersecurity Landscape

As cyber threats continue to grow in scale and sophistication, organizations must be proactive in adapting to the evolving landscape. CMA equips state and local governments with the foresight needed to stay ahead of cybercriminals. By identifying potential threats and vulnerabilities, organizations can implement strategies to drive growth and transformation while safeguarding their digital assets.

5. Determining Considerations for a Cybersecurity Strategy

Crafting an effective cybersecurity strategy requires a deep understanding of an organization’s capabilities and potential areas for improvement. CMA assists in identifying key considerations for a cybersecurity strategy, ensuring that state and local governments can rapidly adapt to the dynamic cybersecurity landscape.

Employing a Methodical Approach to CMA that Delivers Actionable Insights

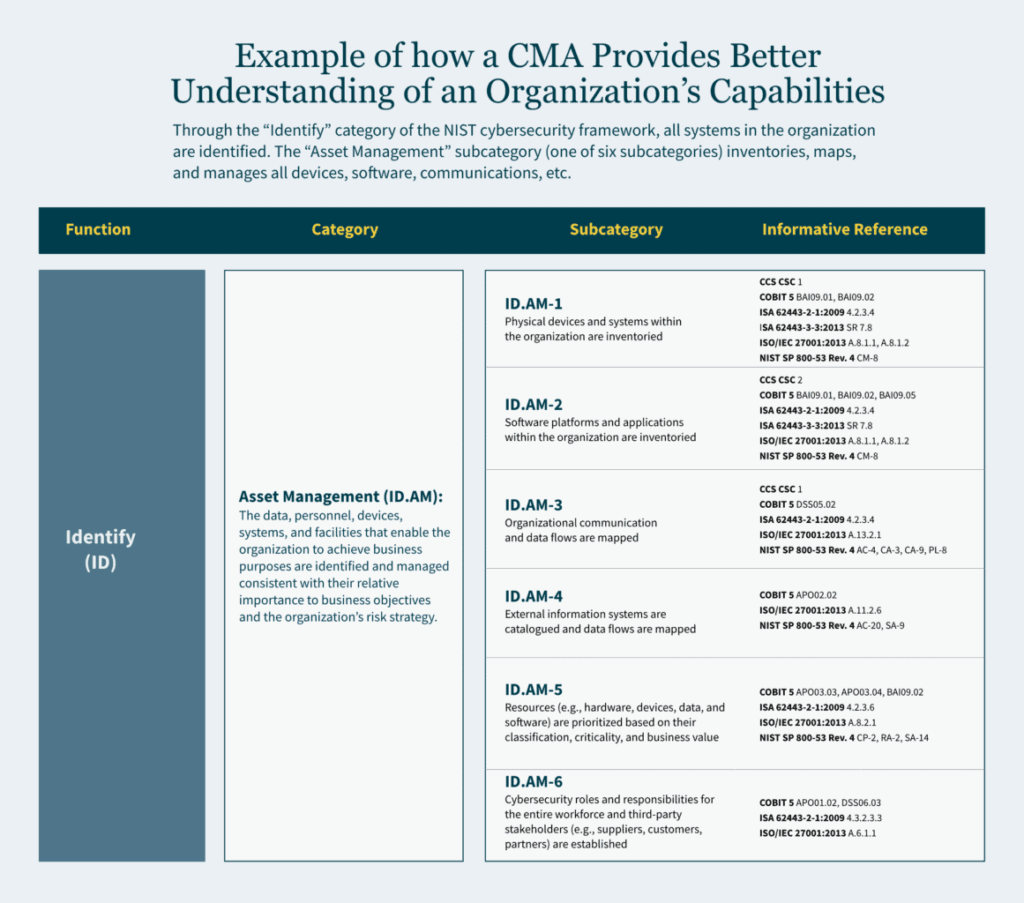

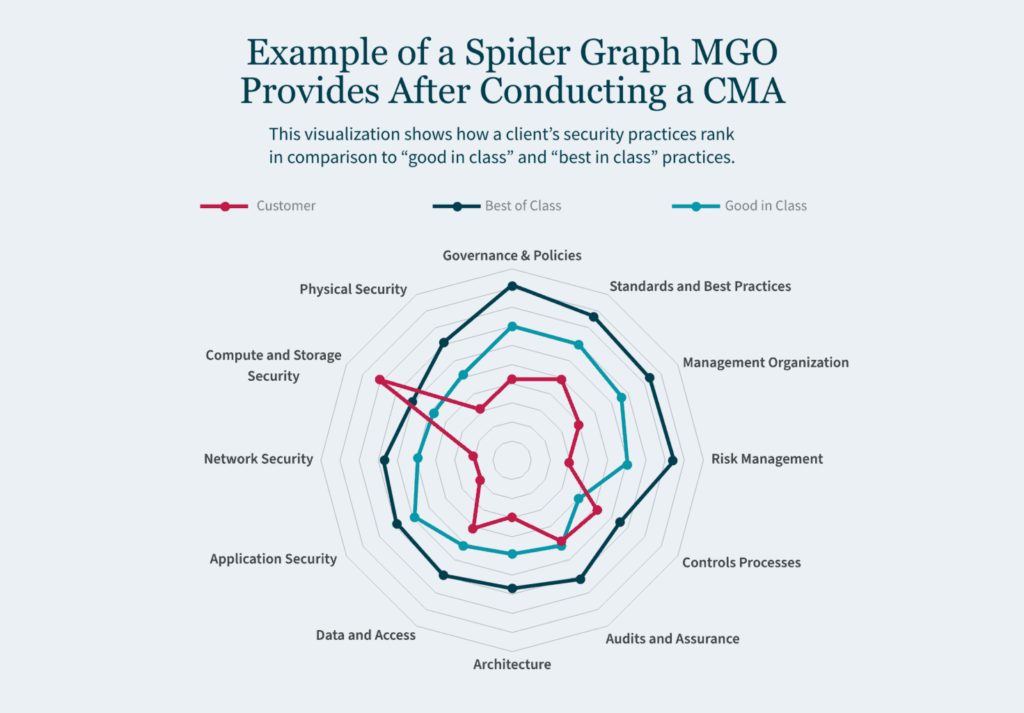

Conducting a productive CMA that yields meaningful insights requires experience with security frameworks and familiarity with the latest threat trends impacting state and local governments. At MGO, our Technology and Cybersecurity Advisory (TCA) team approaches each CMA engagement through a consistent methodology focused on mapping security practices to leading industry standards, evaluating core capability areas, and developing practical recommendations tailored to the organization.

Key elements of MGO’s CMA methodology include:

- Utilization of NIST Cybersecurity Framework (CSF), ISO 27001 or CIS Controls as a Baseline – The TCA team will help you identify current gaps in the security of information assets and determine potential opportunities for improvement relative to your organization’s size and stage in the lifecycle.

- Focus on Key Cybersecurity Capabilities – Emphasizing key cybersecurity capabilities including governance, detection, prevention, response and legal compliance, the TCA team will assist in aligning and mapping these capabilities against industry standards.

- Recommend Prioritized Areas of a Management Action Plan – The TCA team will assist you in identifying key areas of improvement and provide a risk-ranking to help prioritize moving forward.

- Maintaining Continuous Improvement – Instituting a recurring cycle of assessment and improvement is crucial, as cybersecurity maturity is a dynamic process that must adapt to evolving threats and business needs.

How We Can Help You Achieve Your Cybersecurity Goals

Our highly skilled team delivers in-depth cybersecurity and business knowledge that translates to outside-the-box thinking and practical recommendations. We will work with your team to conduct deep-dive walkthroughs and technical testing to help you manage potential cybers