Key Takeaways:

- Many businesses may miss out on significant savings by not fully using state and local tax (SALT) credits and incentives. But there are thousands available across state and local jurisdictions.

- SALT programs offer valuable credits for job creation, capital investment, and research and development (R&D) — but companies often struggle with awareness, eligibility, and administrative challenges in utilizing these programs.

- Third-party advisors can help businesses identify and maximize SALT savings while maintaining compliance. Properly leveraging SALT credits can provide a strong return on investment.

~

State and local tax (SALT) credits and incentives programs continue to be underutilized by taxpayers. Despite the substantial value they can add for businesses, BDO’s 2024 CFO Outlook Survey found that just 34% of CFOs plan to optimize costs by claiming tax credits in the next 12 months. This suggests that many companies could be leaving significant savings on the table.

There are myriad reasons why businesses do not take full advantage of SALT credits and incentives, even though those programs can be instrumental in unlocking cost savings for business activities such as upgrading existing facilities, relocating, building new facilities, and research and development (R&D).

There are thousands of credits and incentives available across state and local jurisdictions. Some companies lack awareness of the full range of credits and incentives available to them, while others may be aware of the programs but unsure of how to take advantage of them. The administrative burden of fully implementing awards once obtained can also be a barrier.

The benefits of tax credits and incentives can be a strong return on investment for companies able to take advantage of them, but many businesses lack the internal resources or expertise to navigate these opportunities effectively. This is where engaging with a third-party advisor may be a strategic value-adding measure.

Tax Credits and Incentives Refresher

Statutory tax credits can reduce a company’s overall tax liability — or in some cases provide a cash benefit for refundable or transferable credits — and may be available retroactively if applications are supported with appropriate documentation. Examples include statutory income/franchise tax credits and unique sales tax exemptions.

Tax incentives are generally broader than tax statutory credits and can come in the form of discretionary cash grants, negotiated abatements, unique exemptions and exclusions, and preferential tax rates. In many cases, they can offer above-the-line savings, making them appealing even to businesses operating at a tax loss. Examples include payroll tax rebates or property tax abatements.

Common SALT Credits and Incentives

The thousands of SALT credits and incentives available in the U.S. can vary widely, but some of their themes are consistent across jurisdictions. Below are a few of the most common SALT programs that are relevant to a large range of businesses.

Job Creation

Many jurisdictions offer credit and incentive programs to promote job creation. The most effective and typical incentive is a rebate of a portion or all of future payroll/withholding taxes for new jobs created for an expansion project. This type of incentive is highly lucrative because it is generally in place for at least 10 years. Negotiated incentives to reward job creation can generally be found in most states, but the Southeast continues to offer some of the best incentives.

Capital Investment

Capital investment incentive programs are designed to boost local economic development by supporting projects such as constructing new facilities, acquiring production equipment, or upgrading existing facilities. For example, an energy company that commits to a large-scale project to purchase a new piece of equipment may be eligible for income tax credits to offset a percentage of its investment costs. Other common opportunities include real and personal property tax abatements for new or improved facilities and investing in new equipment.

Utilities

As businesses across industries look to reduce their environmental impact, they might want to consider projects that may be eligible for credits and incentives, such as upgrading utility infrastructure, implementing energy-efficient systems, and enhancing water conservation. Across the nation, several jurisdictions offer utility tax credits, energy efficiency grants, renewable energy tax incentives, and utility rate reductions. These initiatives are often not limited to specific industries and can even be available to large nonprofit organizations such as hospitals, which may be eligible for a utility rate reduction without having to make any new investments.

Research and Development

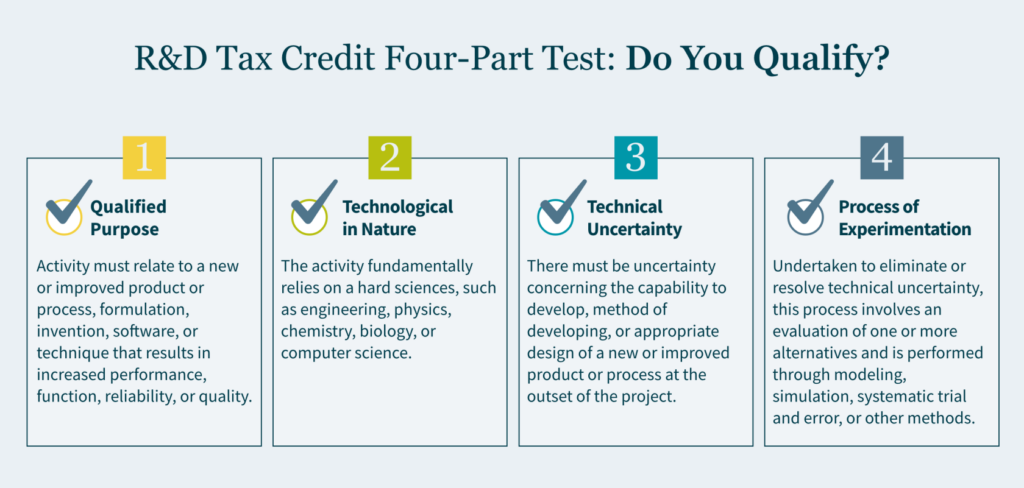

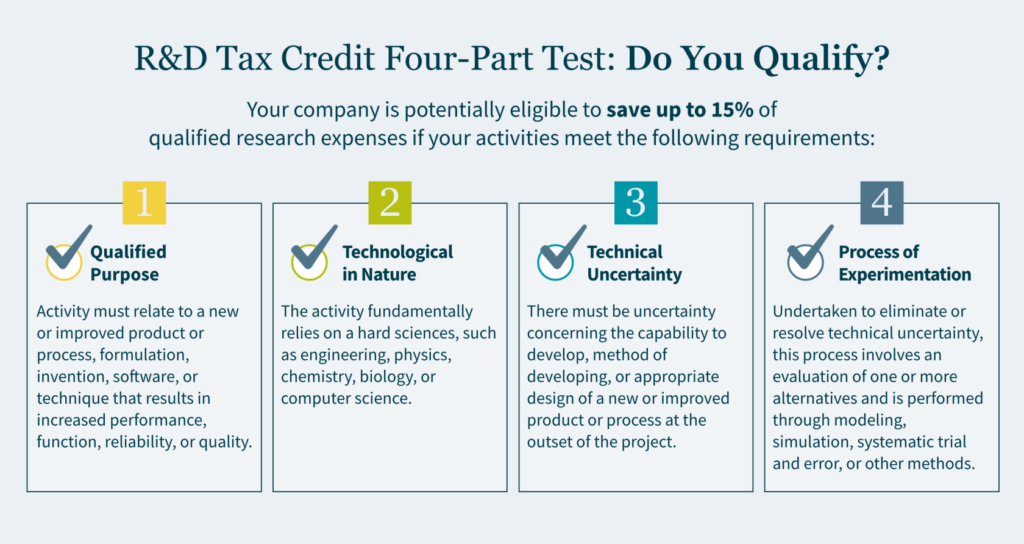

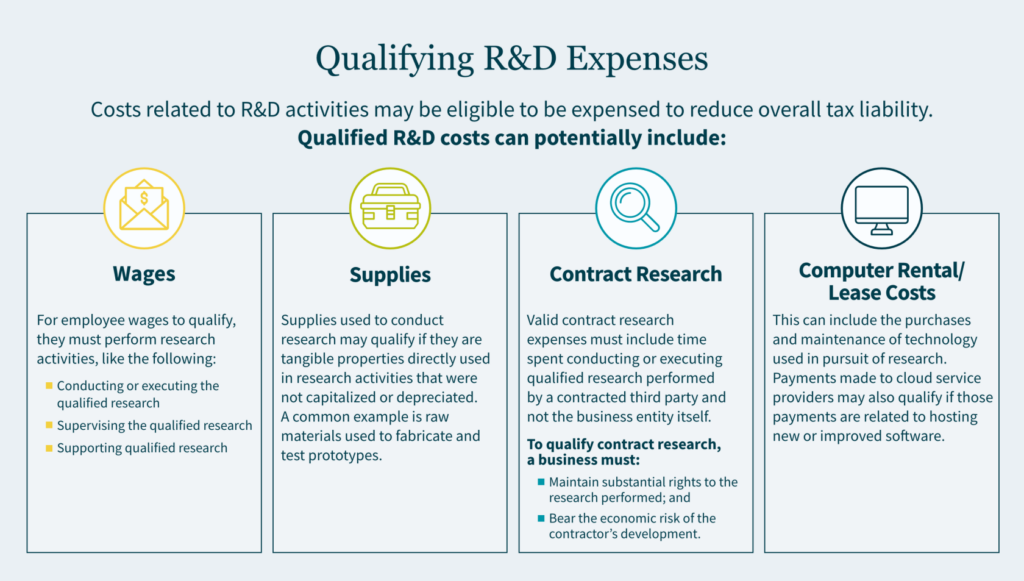

States and jurisdictions across the country are vying to attract innovation by offering a variety of R&D credits to businesses in all industries. These programs can offset the cost of developing new products and processes, testing new or improved products and processes, enhancing existing products and processes, and creating prototypes. For example, an auto manufacturer seeking to develop longer-lasting batteries for electric vehicles may be eligible for credits or incentives to support researching or prototyping a new battery.

Benefits of Working with an Advisor

Lack of awareness of or a failure to understand eligibility are two of the most common reasons businesses miss out on available SALT credits and incentives programs. Many companies do not have in-house expertise to uncover these savings opportunities, but third-party advisors have the skills, relationships, and experience necessary to conduct the planning and analysis needed to determine which credits and incentives businesses should pursue.

- Advisors can help tax leaders review their companies’ profiles and business strategies to uncover any past, current, or future opportunities. For example, a review of prior income tax returns could result in identifying retroactive refund opportunities.

- Advisors can also review the programs offered by the various jurisdictions where the company operates, which, depending on the company’s size and scope, could represent savings opportunities in dozens of locations.

- Advisors can take a comprehensive approach to reviewing all available opportunities or can tailor credit reviews to the most pertinent and strategic business needs.

- They can also help leaders stay abreast of new credits in the locations where they operate and identify incentives and explore eligibility as they expand operations.

- Further, advisors are critical in helping businesses collect the extensive documentation required to qualify for, take advantage of, and report their use of credits and incentives programs. This compliance work can be challenging for a company’s in-house tax team to navigate, so outsourcing it can provide valuable time savings. It can also help ensure companies are taking full advantage of their awards.

How MGO Can Help

As a third-party advisor, we uncover credits and incentives applicable to your business profile and strategy, particularly in areas where you plan to operate or expand. Staying at the forefront of new incentives and programs, our team helps you benefit from the latest opportunities — matching your needs to available programs at the federal, state, and local levels. We work with both statutory and non-statutory programs, collaborating closely with relevant authorities.

SALT credits and incentives are a critical component of tax planning and should be explored to determine how they can support your overall business strategy or create opportunities for retroactive or above-the-line savings. To learn more, reach out to our team today.

Written by Tim Schram. Copyright © 2024 BDO USA, P.C. All rights reserved. www.bdo.com