This article is part of an ongoing series, “Navigating the Complexities of Setting Up a Business in the USA”.

Key Takeaways:

- Expand into the U.S. market to access a large and diverse customer base.

- Navigate the multi-layered U.S. tax system and adapt to cultural differences.

- Choose the right business entity and plan for compliance with U.S. regulations.

~

Expanding your business into the United States can significantly increase your market share and open the door to new opportunities. However, the process involves navigating a complex landscape of regulations, tax considerations, and operational challenges. This series provides an overview to help you understand how to successfully set up your business in the U.S.

Why Expand to the U.S.?

Expanding into the U.S. market allows you to:

- Access a large and diverse customer base.

- Leverage the economic scale of the U.S. market.

- Explore opportunities for growth and innovation that may not be available in other countries.

- Have access to what may be a significant amount of capital (whether this may be equity or debt or other arrangements).

Moving into the U.S. market can help you drive more sales and reach new types of customers. You may also launch new products here that might not succeed in your home market.

5 Key Considerations for Foreign Businesses

When setting up a business in the U.S., you must navigate a range of unique challenges — including:

1. Multi-Layered Tax System

In many countries, businesses deal with a single national tax system where their provinces or states mimic or have congruent rules with federal rules. In contrast, the U.S. has a multi-layered tax system involving federal, state, and local taxes that at many times are not congruent.

When you start a business in the United States you are dealing with 50 states (and the District of Columbia), multiple localities, and certain territories. Each state has its own set of rules and regulations applicable to income taxes, which can be quite different from a single national system (and often at odds with the federal rules).

In addition, state and local jurisdictions impose taxes unique to the state and local level — including sales tax, property tax, and gross receipt tax. Finally, not all states honor the provisions of U.S. tax treaties with foreign countries.

2. Cultural and Business Practice Differences

Understanding and adapting to cultural and business practice differences is crucial. For instance, business practices that are common in Europe or Asia might not be as effective in the U.S. Additionally, legal agreements and formalities that might be less stringent abroad are often necessary in the U.S. to protect business interests.

3. Legal Structure and Entity Choice

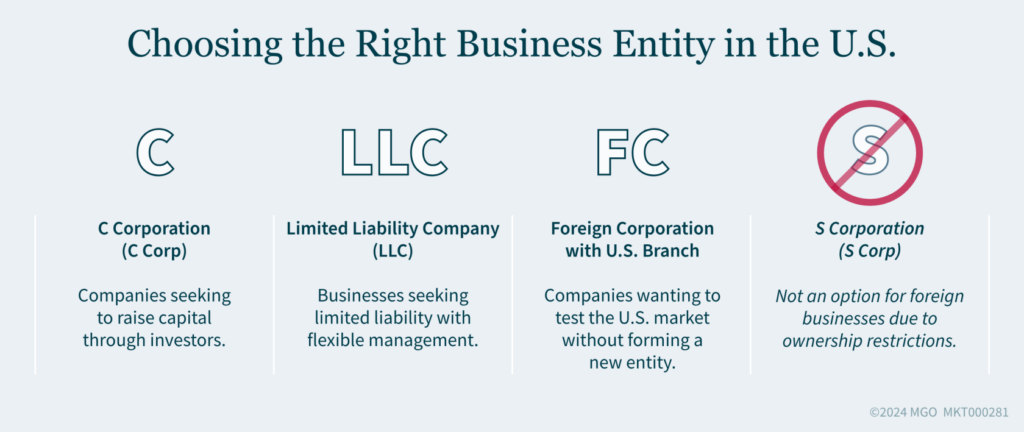

Choosing the right business entity is vital as it affects tax obligations, legal liability, and operational flexibility. Options include C corporations (or C corps), limited liability companies (LLCs), foreign corporations with or without U.S. branches, partnerships or joint ventures, or franchising or direct importing. An S corporation (S corp) is not an option for foreign businesses due to ownership restrictions.

Each structure has its own set of advantages and legal implications, which should be carefully considered.

4. Regulatory Compliance

The Corporate Transparency Act is one newly created obligation for all businesses operating in the U.S. Failure to comply can result in significant penalties. It is important to understand the reporting requirements and file all necessary documentation on time.

In addition, you should consult a lawyer to ensure the entity form is respected — including prompt organizational filings with the Secretary of State and obtaining necessary business licenses.

These are just a few of the myriad of regulations your business must navigate. That’s why it’s critical to hire the right professionals to build your team, as missing any of these requirements may place your business in peril.

5. Operational Challenges

Operational planning is essential for a successful U.S. expansion. Key operational considerations include:

- Employee benefits and regulations: U.S. regulations on health insurance, retirement plans, and other employee benefits can be significantly different from those in other countries. For example, in Europe, many employee benefits are government-run, while in the U.S., they are often the responsibility of the employer.

- Logistics and supply chain management: Choosing the right location for operations includes considerations such as proximity to logistics centers and understanding regional operational costs.

- Insurance and banking: Obtaining necessary insurance coverage and opening bank accounts can be challenging for foreign businesses. Some U.S. banks may not provide accounts to foreign-owned companies, and those that do might have stringent requirements. Certain banks may refuse to conduct business with certain entities in industries such as cannabis and cryptocurrency, to name a couple.

Establishing a U.S. Presence for Your Business

Setting up a business in the U.S. requires thorough planning and an understanding of various regulatory and operational challenges. From navigating the multi-layered tax system to selecting the right business entity and following U.S. regulations, each step is crucial for a successful expansion. By addressing these key considerations and seeking professional guidance, you can effectively establish your presence in the U.S. market.

For more detailed insights and personalized help, connect with our International Tax team and start your journey towards successful U.S. market entry today.

Setting up a business in the U.S., requires thorough planning and an understanding of various regulatory and operational challenges. This series will delve into various aspects of this process, providing guidance and practical tips. Our next article will discuss navi