Key Takeaways:

- Comprehensive fund administration services can support investment funds and auxiliary entities like management companies and general partners.

- Combining advanced technology with personalized human oversight helps provide accurate financial reporting and compliance.

- The right partner offers services beyond fund administration — including tax compliance, audit support, and operational assistance — all under one roof.

~

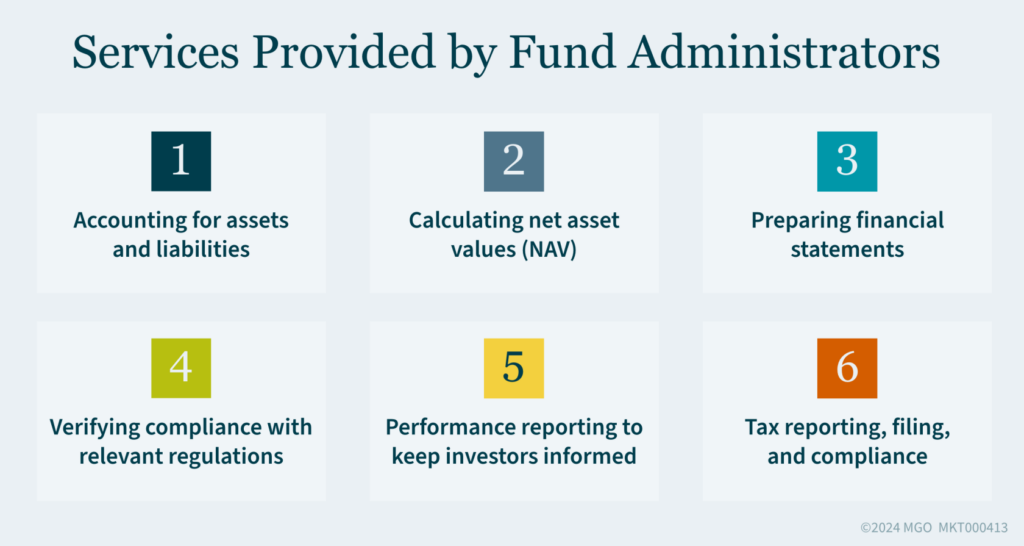

Navigating the world of fund administration today can be complex. You need a sophisticated and reliable support system — especially with the rigorous regulatory requirements investment funds face. Fortunately, by partnering with the right provider, you can access comprehensive fund administration services tailored to meet the needs of investment managers, private equity firms, family offices handling venture capital funds, and those managing special purpose vehicles (SPVs).

Here is a look at the benefits of combining fund administration with integrated tax compliance and audit support services so you can focus on growing your investment fund with confidence.

How a Full-Service Approach to Fund Administration Benefits You

A modern approach to fund administration goes beyond traditional, standalone services. A comprehensive approach supports the core fund as well as management companies and general partner entities — areas where conventional fund administrators often fall short.

Whether you need assistance with cash management, payroll, or other operational tasks, the right service provider can offer a full range of services under one roof. This integration streamlines operations, eliminates the need for multiple vendors, and facilitates a consistent, high-quality service experience.

Merging Technology with Human Insight

Fund administration is more than having software for net asset value (NAV) calculations. Many large firm administrators rely heavily on technology and artificial intelligence to handle these tasks. While this tech-first approach can offer efficiency, it often results in a disconnect between the financial reports generated by software and the actual economic realities of the fund.

Incorrect data (such as unexplained accruals or NAV calculations that do not reflect actual financial activity) reverberates down the line, leading to inefficiencies and unnecessary rework during the audit process. The right fund administration service provider brings a human touch to the process by reviewing financials before they reach you and your investors, catching discrepancies or potential errors that software alone might overlook. Your advisors should also regularly meet with your fund managers to review financial details and verify accuracy rather than simply relying on software outputs.

Specialized Services for Funds, Management Companies, and General Partners

Another common pain point in fund administration is a lack of support for auxiliary entities like management companies and general partner entities. Traditional fund administrators often focus solely on the fund — leaving investment managers to juggle separate vendors for operational needs like payroll, cash management, and audit support.

Your service provider should be able to fill this gap by offering a full suite of services for the fund and its auxiliary entities. Whether you need services for the entire group or just the management company while the general partner entity supports fund operations, finding tailored solutions to fit your needs is possible.

Sample Case Study

An investment fund, a company based in London with one domestic and two offshore funds, switched administrators three times because they struggled to find a provider to competently handle both the fund administration and operational needs of the management company.

Once they finally found comprehensive fund administrative support, their advisor stepped in as an outsourced CFO — streamlining financial operations and providing audit support (including drafting financial statements and communicating with auditors). The team remained a constant presence, guiding the company through key transitions.

Seamless Tax and Audit Support

Beyond fund administration, tax compliance and audit support are essential for reducing operational disruptions.

The right service provider can act as a liaison between your fund and external audit teams — drafting financial statements, communicating with auditors, and preparing allocation schedules. This audit support minimizes the disruption that typically occurs during audit fieldwork to create a smooth audit process for the fund and auxiliary entities.

In addition to audit support, a full-service provider can prepare tax filings — including K-1s for investors, pushing them out sooner and more efficiently than most fund administrators. With a tax consulting arm that specializes in complex transactions, your provider can also offer valuable tax advice on fund operations, acquisitions, and other critical financial activities for investment managers.

Tailored Services for SPVs

SPVs are mini-funds that, while less complex than traditional funds, still require specialized knowledge and experience.

If you are happy with your existing fund administrator but need a cost-effective solution for an SPV, a fund administration service provider can handle these smaller entities — providing just the right level of service to supplement your needs.

Building Lasting Relationships

Investment fund administration can feel like a revolving door. However, building long-term, stable relationships can foster deeper understanding and continuity, ultimately benefiting fund operations and growth.

Once you have worked with a consistent team for many years, you will usually experience better-aligned services that evolve to meet your needs over time.

How MGO Can Help

At MGO, we provide comprehensive fund administration services that go beyond the traditional scope. Combining technology with a human touch and deep experience and insight, we offer integrated support across your funds, management companies, and general partner entities.

Our dedicated team can help you maintain accuracy, verify compliance, and gain greater peace of mind. If you are looking for a fund administrator that offers a full spectrum of services, reach out to MGO’s Private Equity and Venture Capital team today to learn how we can support your investment fund needs.