- Outsourced CFO services provide part-time or as-needed financial guidance, making it an ideal solution for businesses that don’t require a full-time executive.

- An Outsourced CFO provides services tailored to meet your needs, bringing a wealth of experience and proficiency from different industries.

- By quickly integrating into your business, an outsourced CFO eliminates the need for a lengthy executive search and onboarding process.

~

A chief financial officer (CFO) is an essential role in growing companies. They lead the company’s financial function, partner with the CEO to maximize value creation, help shape investment and financing decisions, and communicate with key stakeholders.

However, not all businesses — especially startups and those in the middle market — have the resources to appoint a full-time CFO.

Fortunately, outsourced CFO services provide a flexible, cost-effective, and results-driven alternative for businesses seeking top-tier financial strategic oversight without the permanent overhead of a full-time executive.

What Is an Outsourced CFO?

An outsourced CFO can bring a wealth of diverse knowledge to your business. They function much like a traditional CFO but on a flexible, often part-time basis.

Outsourcing this role is particularly valuable to small businesses, startups, or mid-sized enterprises that do not require — or cannot afford — a full-time CFO.

The services offered by an outsourced CFO depend on your needs but might include:

- Strategic financial planning and analysis

- Financial forecasting and budgeting

- Cash flow management

- Presenting financial data to boards of directors, investors, lenders, and other decision-makers

- Evaluating the company’s strengths and weaknesses, and offering suggestions for improvement

- Helping assess the viability and potential return on investment (ROI) of new products or markets

- Analyzing pricing and cost structures to improve profit margins

- Assisting with raising capital or securing financing

- Helping a company navigate a financial restructuring

You can tap an outsourced CFO to provide routine financial advice and oversight or to lead specific projects. They adapt to your business’s precise needs.

Why Hire an Outsourced CFO?

Hiring an outsourced CFO brings a range of benefits. Here are some of the benefits you can expect to gain:

Cost efficiency and flexibility

Hiring a full-time CFO is expensive. According to Salary.com, the salary for a CFO in the U.S. is between $334,103 and $565,829, depending on education, experience, and credentials. That figure doesn’t include bonuses or benefits.

If you have a startup or small- to medium-sized enterprise operating with a limited budget, that level of investment is usually not feasible or even necessary.

An outsourced CFO enables you to get the financial experience, knowledge, and leadership you need, when you need it. This piecemeal approach helps manage costs and provides the flexibility to scale up or down based on your requirements.

Access to strategic advice

Outsourced CFOs bring a broad spectrum of experience and knowledge gained from working across various industries and business models.

A CFO who has only worked in manufacturing might have a tough time adapting to the unique opportunities and challenges a company faces in the real estate, technology, or hospitality industry. On the other hand, an outsourced CFO may have worked with companies across multiple industries. This diverse perspective makes them well-equipped to handle challenges and offer insights that internal resources may lack.

Additionally, if an outsourced CFO encounters a specific issue, they can tap into a wider network of professionals in their firm — from tax professionals to industry-specialized practitioners. This offers a more robust and informed service than you get from an in-house financial executive.

Seamless integration and strategic development

Integrating an outsourced CFO into your business is usually swift, so you can bypass the lengthy recruitment and onboarding process of hiring a full-time CFO.

Your outsourced CFO provides immediate access to financial ability, which is crucial if you face urgent strategic decisions or complex financial challenges.

In fact, we have worked with many companies who initially engaged us on an interim basis while they searched for a full-time CFO. Often, they find the arrangement so beneficial it becomes a long-term strategy.

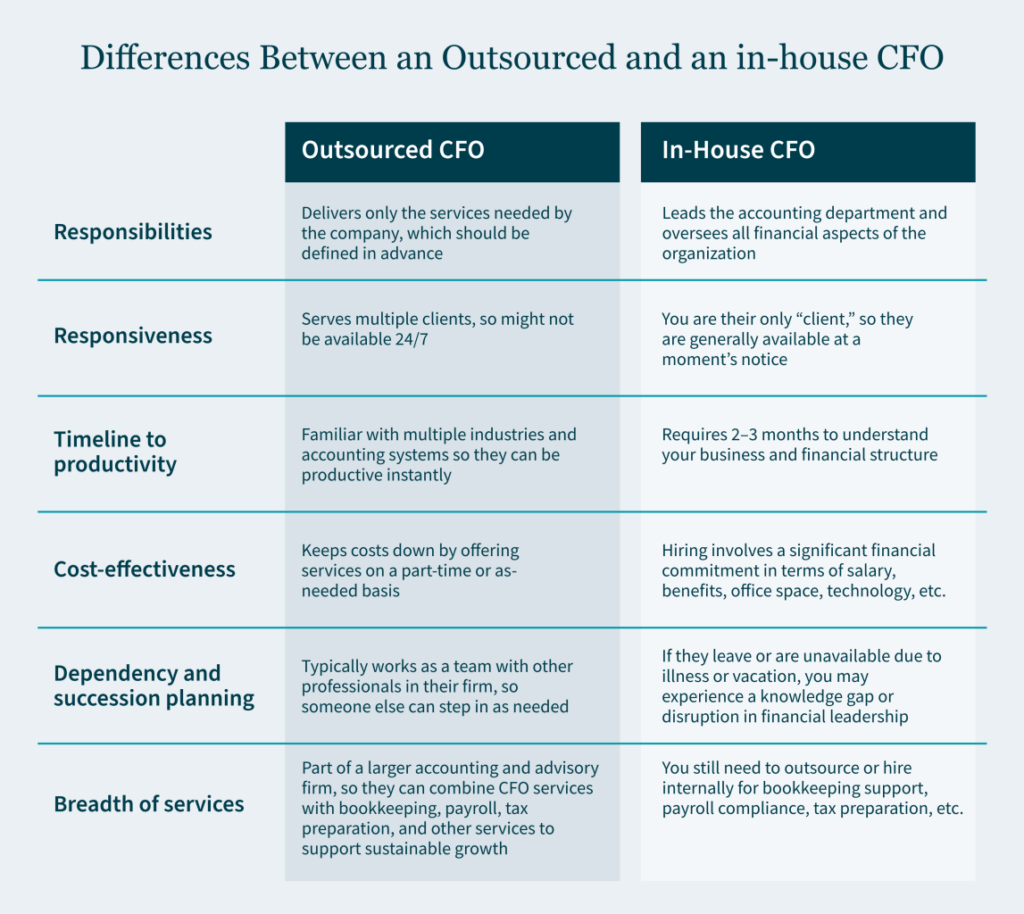

Comparing Outsourced Versus In-House CFOs

An outsourced CFO can be a strategic partner to help you shape financial strategy, develop your internal teams, and streamline operations. However, they may not be the right solution in every situation.

Here is a look at the difference between an outsourced and an in-house CFO so you can decide which category of financial executive you need:

Many of our clients develop strong, ongoing relationships with their outsourced CFO and find they provide a level of service that closely mirrors that of an in-house CFO.

Experience the Outsourced CFO Advantage

An outsourced CFO offers a strategic advantage that is both cost-effective and rich in knowledge. Opting to outsource this critical role enables you to focus more on your core strategic areas while ensuring your accounting and finance functions receive the oversight and attention they deserve.

How We Can Help

To learn more about how our outsourced CFO services can benefit your organization, contact MGO today. We are happy to discuss how we can provide a tailored approach that aligns closely with your financial goals and operational needs.