Executive Summary:

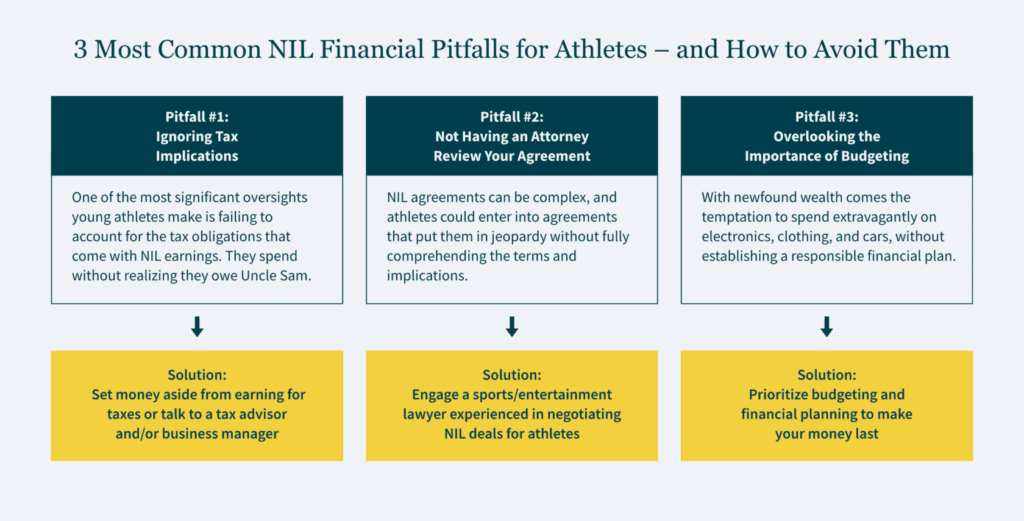

- Name, image, and likeness (NIL) deals offer athletes exciting opportunities, but also potential pitfalls if not approached strategically.

- Athletes should educate themselves on taxes, carefully review contracts, and budget with long-term security in mind.

- With guidance on financial obligations, agreements, and smart money management, athletes can maximize NIL benefits while safeguarding their futures.

~

You are a talented young athlete with a growing public profile. You’ve just been offered a Name, Image, and Likeness (NIL) deal, an opportunity that can put some extra money in your pocket or even, in some cases, make a more profound impact on your financial life. It’s an exhilarating time, but it’s also crucial to approach this new chapter with the right knowledge and mindset.

New Division I NIL Disclosure and Assistance Rules

The Division I Board of Directors recently made some notable updates to its NIL rules, which went into effect on August 1, 2024. Key changes include:

- Increased NIL assistance: Schools are now permitted to assist student-athletes in identifying NIL opportunities and facilitating deals with third parties, provided the athlete discloses their NIL arrangements. While schools can help, student-athletes maintain full control over the terms of their agreements.

- Expanded disclosure requirements: To receive NIL-related support from their school, student-athletes must disclose any NIL agreement valued at $600 or more within 30 days of signing the contract. This applies to both current and prospective student-athletes.

- New NIL reporting platform: The NCAA has launched NIL Assist, a mobile-friendly platform that streamlines NIL disclosure, provides educational resources, and allows student-athletes to review service providers.

- Post-eligibility insurance: The NCAA has also introduced post-eligibility insurance for all divisions, covering injuries sustained during participation in college athletics for up to two years after graduation. This includes up to $25,000 for mental health services.

These changes are designed to provide student-athletes with increased NIL-related support and flexibility while maintaining fairness and clarity in the ever-evolving NIL landscape.

Three Essential Financial “Plays” Every NIL Athlete Needs to Know

Whether you’re a college or high-school athlete, or the trusted advisor to a young athlete, here are three critical actions you should take to avoid common financial pitfalls associated with NIL deals.

1. Recognize Your Tax Obligation

One of the first hurdles you’ll encounter in the world of NIL deals is taxes. It’s essential to understand that the money you earn from these deals is subject to taxation. Many young athletes overlook this, often because they’ve never had to deal with taxes before.

To avoid potential financial trouble down the road, consider these steps:

- Educate Yourself: Young athletes receiving payments from NIL deals are responsible for paying taxes on that income just like professional athletes. Take the time to learn about taxes, especially how they apply to your earnings. Understanding the basics of taxation will empower you to make informed decisions.

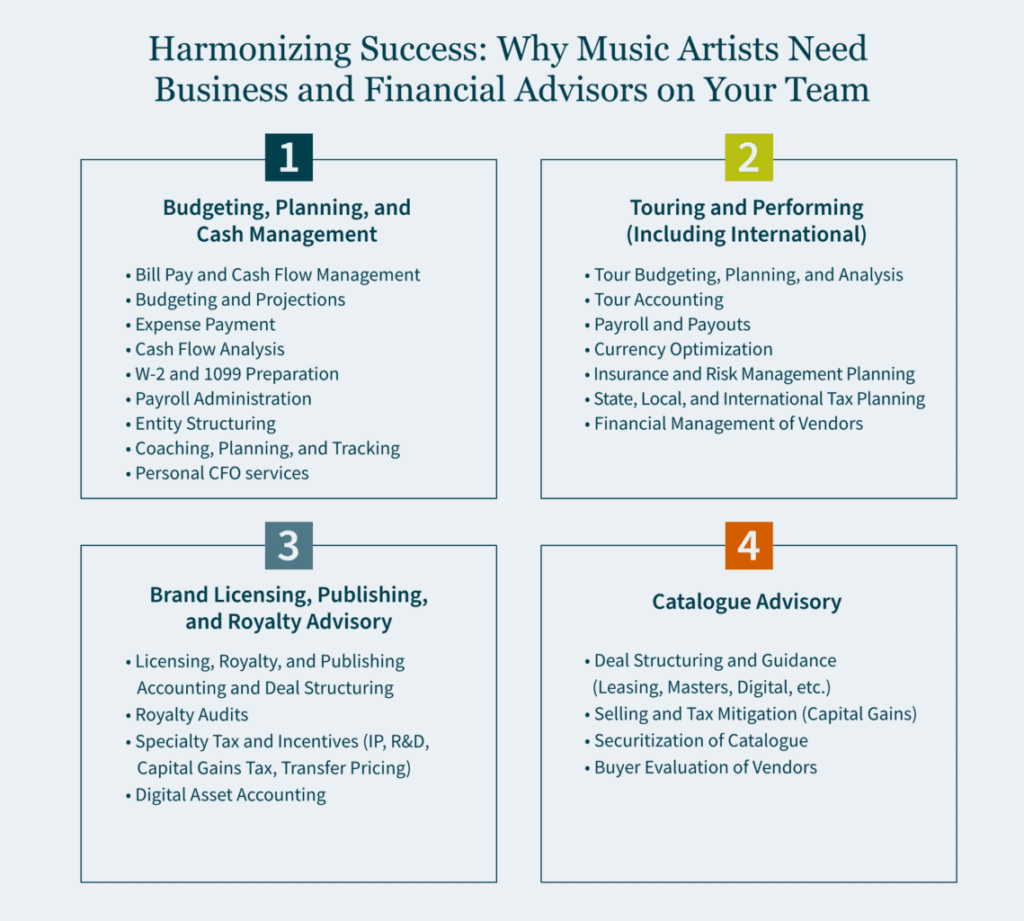

- Consult a Tax Professional: Before signing any NIL agreement, consult with an experienced accountant, tax advisor, or business manager. They can help you calculate your tax obligations, identify potential deductions, and develop a tax strategy tailored to your situation. Along with ensuring any federal, state, and local taxes you owe are paid on time (avoiding penalties), a tax professional can also help you navigate more complex situations – such as earning income across multiple states.

- Practice Smart Spending: Resist the urge to splurge on electronics, clothes, or cars as soon as the money starts rolling in. Create a budget that considers your future tax payments, living expenses, and financial goals. Staying disciplined with your spending is key to long-term financial success.

2. Execute Agreements Cautiously

Navigating NIL deals can be tricky. There are various state laws and school policies to consider, along with a number of legal “gotchas” to avoid. Here’s how you can safeguard your interests:

- Seek Legal Advice: Before signing any NIL agreement, engage a lawyer with experience negotiating NIL and brand endorsements for athletes. An attorney with expertise in sports contracts can help you navigate the important terms in an NIL deal, such as money, exclusivity, length of the agreement, how the brand can use your name, image, and likeness, and an athlete’s delivery requirements. An experienced attorney will help you spot potential pitfalls and ensure the agreement aligns with your long-term goals.

- Beware of “Standard” or Simplistic Agreements: When someone refers to a contract as “standard” or provides an overly simplified agreement, that should throw up a red flag. All it takes is the slightest language in your agreement to give a company unfettered rights to use your name, likeness and image in ways you never intended.

- Follow Regulations: An experienced advisor will help you navigate specific laws and policies set by your state, school, and the NCAA regarding NIL deals. For example, you cannot share photos or videos in your team uniform with logos from other brands without first getting permission from your school or the brands.

3. Budget Wisely for the Long Term

While newfound wealth can be exhilarating, it’s crucial to manage your finances wisely:

- Prioritize Needs Over Wants: When it comes to spending, prioritize essential needs over extravagant wants. Understand this financial windfall may be a one-time occurrence, so focus on building a secure future rather than indulging in immediate gratification.

- Future-Proof Your Earnings: Instead of assuming this is a continuous stream of income, treat each deal as if it were your last. Create a budget that accounts for potential future earnings and uncertainties, ensuring you’re prepared for any scenario.

- Explore Tax Mitigation Strategies: Consider tax mitigation strategies, such as retirement planning and deferral opportunities, to minimize your tax burden. Consulting a financial advisor can help you explore these options.

Make the Most of Your NIL Opportunities

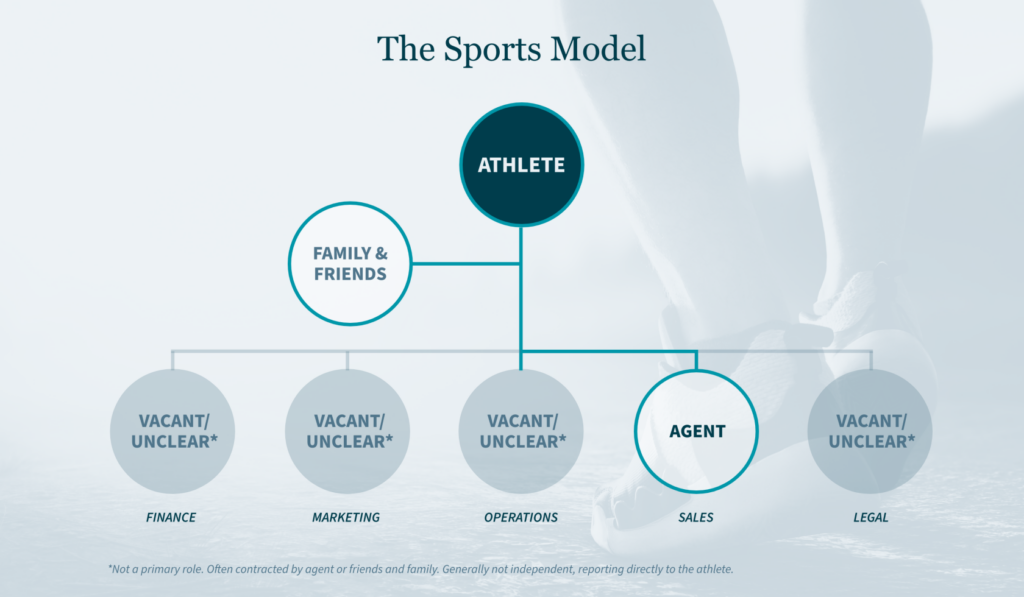

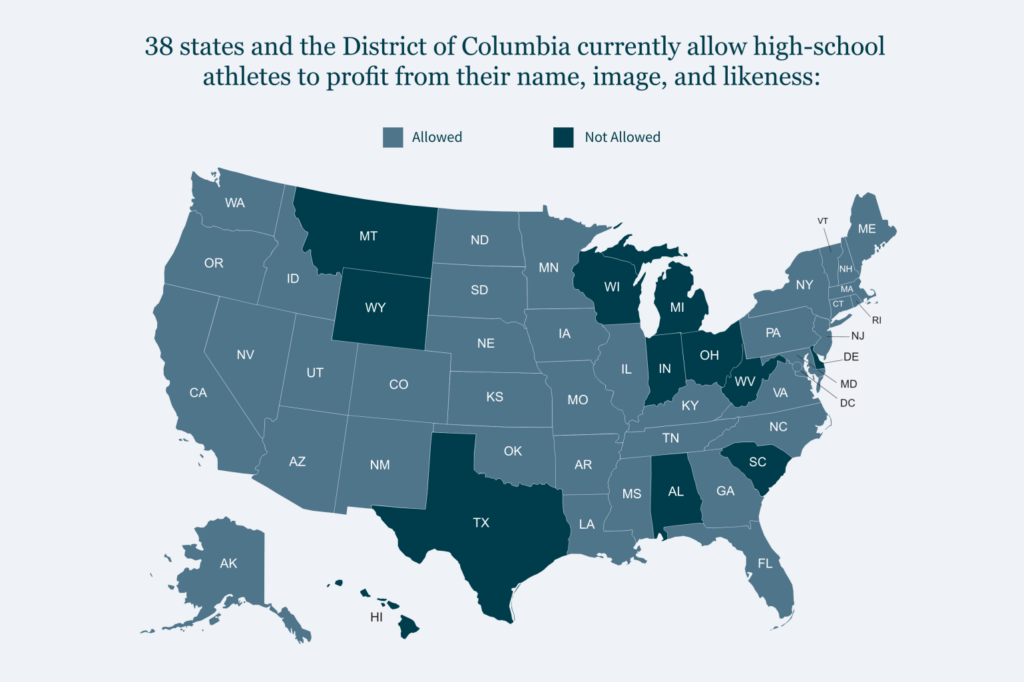

The legalization of NIL in college and high school sports represents an exciting shift for young athletes. It can offer game-changing money, enabling you to take care of your financial needs, along with building your brand for future growth. But with great success also comes great responsibility. Even professional athletes who’ve reached the highest pinnacles of their respective sports can end up without the financial resources they need if they don’t plan ahead.

The good news is by recognizing the potential pitfalls and seeking professional guidance early in your NIL journey, you can better position yourself for long-term financial success. Remember, it’s not just about profiting from your name, image, and likeness today, but also securing your financial future for tomorrow.

How We Can Help:

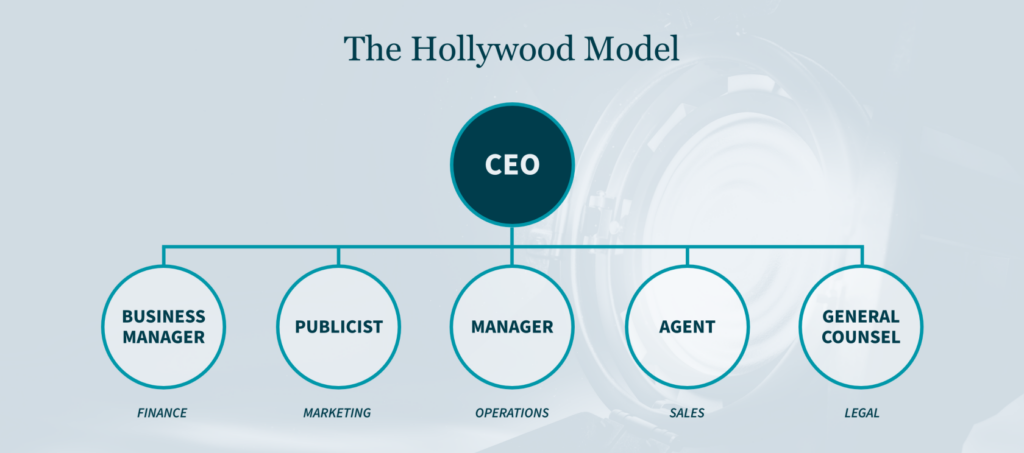

Our Entertainment, Sports, and Media practice understands the unique challenges athletes face at all stages of their financial journey. Whether you need assistance with tax planning, contract negotiations, or financial strategy, we’re here to guide you toward a successful future in the world of sports and NIL.

This article was co-authored by Leron E. Rogers, Partner at Fox Rothschild LLP.