Key takeaways:

- Utilizing IC-DISCs is a savvy strategy for U.S. wineries aiming to expand internationally, offering significant tax benefits, and supporting cash flow management.

- Successful international expansion requires understanding and navigating local regulations and choosing the appropriate business structure or appropriate method of entering a foreign market that will sustain company growth and provide necessary flexibility.

- Advanced technologies and innovative practices can help wineries enhance production efficiency, market analysis, and intellectual property management.

~

You have invested time, energy, and meticulous care into crafting your wine. As a result, you have steadily increased your brand recognition and revenue. With a solid domestic footprint in place, you start the process of building your international presence.

That’s when you run into some new challenges: Cost. Compliance. Taxes. Understanding the complexities of structuring your business and strategic tax planning are crucial as your winery expands its reach to a larger global and more diverse audience.

To get the most from your winery’s international expansion, here are four key strategies to keep in mind:

1. Decreasing Your Tax Burden on International Sales

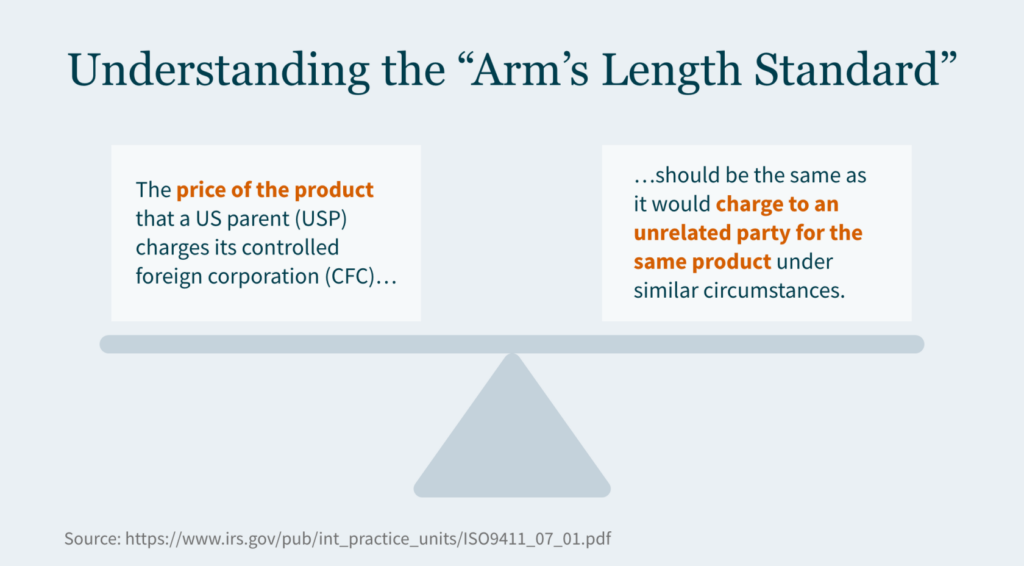

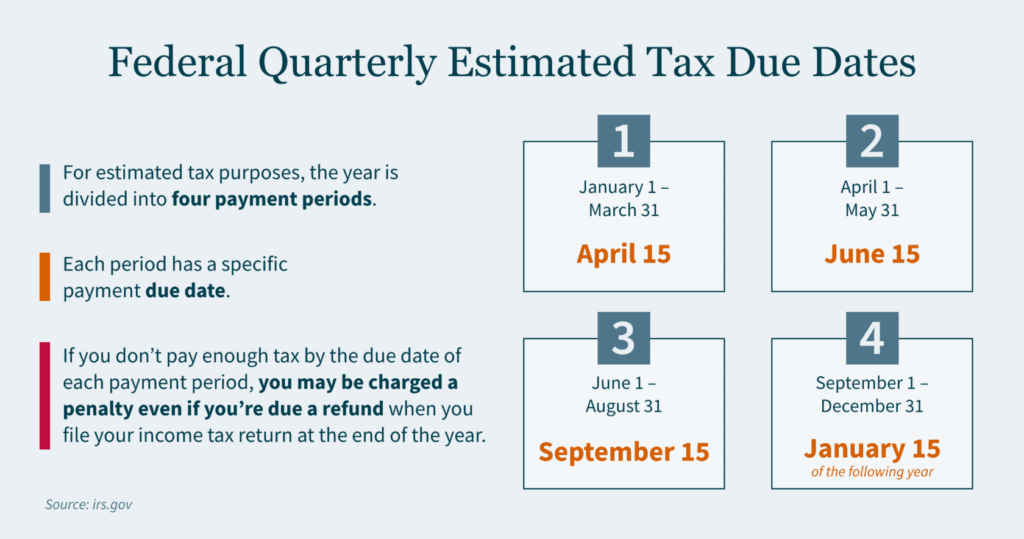

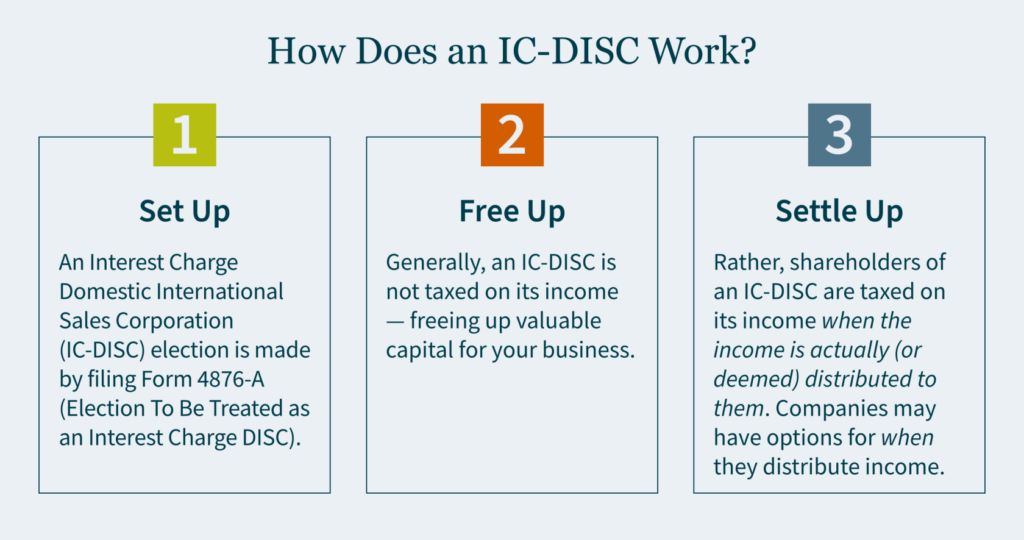

One of the primary considerations for wineries expanding internationally is the strategic formation of an IC-DISC (Interest Charge Domestic International Sales Corporation). This tax vehicle can significantly benefit U.S. exporters by reducing tax burdens on export income. By establishing an IC-DISC, your winery can enjoy deferred tax payments and lower rates on dividend distributions, which are vital for managing cash flow and reinvesting in growth.

Wineries with substantial international sales should consider an IC-DISC strategy. While the setup involves initial costs and compliance, the long-term tax savings make it an attractive option. Careful planning and advice from tax professionals with specific knowledge of the wine industry can help you maximize the benefits.

2. Navigating International Compliance and Business Structuring

Expanding into international markets requires more than just tax planning — it demands a comprehensive understanding of the local compliance and business environments. Your winery must adhere to various regulations, from local business laws to specific wine industry standards, which can differ significantly by country.

Choosing the appropriate business structure or method of entering a foreign market is pivotal. Whether establishing a direct presence through subsidiaries or leveraging partnerships, your winery must assess its operational scale and strategic goals. For smaller wineries, direct export might be feasible. Larger operations might benefit from a more established local presence, which can facilitate deeper market penetration and brand recognition.

3. Leveraging Technology and Innovation

Incorporating technology and innovation has become an increasingly important competitive advantage in the wine industry. From production techniques to supply chain management, technology can streamline your operations and enhance quality control across borders.

Advancements such as artificial intelligence (AI) offer new ways to analyze market trends and consumer preferences, enabling wineries to adapt strategies dynamically. For instance, AI is transforming the way sommeliers select and pair wines. Additionally, AI-powered systems can examine the chemical and sensory attributes of wines, recommending ideal conditions and components to achieve a specific flavor profile. This leads to time savings, minimizes waste, and provides winemakers the flexibility to explore novel mixtures and styles.

The use of AI and Generative AI (GAI) in wine inventory, selection, and pairings is growing increasingly popular. Companies that consider how to capture these business processes — and do so tax efficiently — may reap the rewards of increased profitability.

4. Building a Responsive and Agile Business Model

For wineries operating internationally, quickly adapting to new opportunities and challenges is critical. This includes being responsive to market demands, regulatory changes, and competitive pressures. Developing an agile business model allows for rapid adaptation and decision-making, enabling you to take advantage of emerging trends and mitigate potential risks.

Tax and accounting firms can assist wineries in building responsive models that quickly adapt to market demands and regulatory changes. In addition, helping wineries know when and how to upscale from one operating model to another is often critical. Strategic advisory services can help your winery anticipate shifts in the international landscape and adjust your strategy effectively, reducing risks and capitalizing on new opportunities.

Taking Your Winery to the World Stage

For wineries looking to expand internationally, a strategic approach to tax planning, compliance, and business structuring is essential. By leveraging tax strategies like IC-DISCs, ensuring compliance with local regulations, adopting innovative technologies, and developing an agile business model, you can enhance your competitiveness and position your wine for growth in the global marketplace.

How MGO Can Help

MGO can provide your winery with guidance on setting up an IC-DISC. Our tax professionals are well-versed in the complexities of international tax law, helping you enhance tax savings and manage compliance risks. Our team can also advise you on optimal business structures, market entry strategies like importing or licensing, and adherence to international standards.

With our global reach and local knowledge, MGO equips your winery with the insights needed to establish and maintain a compliant international presence. Reach out to our team today to learn more.