Key Takeaways:

- The Treasury and IRS released new proposed regulations affecting how dual consolidated losses (DCLs) are calculated and their interaction with the Pillar Two global tax regime.

- A new set of rules for disregarded payment losses (DPLs) has been introduced — these apply to disregarded payments deductible in foreign countries, but not included in U.S. taxable income.

- The proposed regulations expand the definition of a separate unit and address how foreign tax rules (under Pillar Two) may trigger foreign use restrictions on DCLs.

~

The Department of the Treasury and the IRS on August 6 released proposed regulations on the dual consolidated loss (DCL) rules and their interaction with the Pillar Two global taxing regime. The proposed regulations also make several changes to how DCLs are calculated and introduce a new disregarded payment loss rule.

DCL Rules

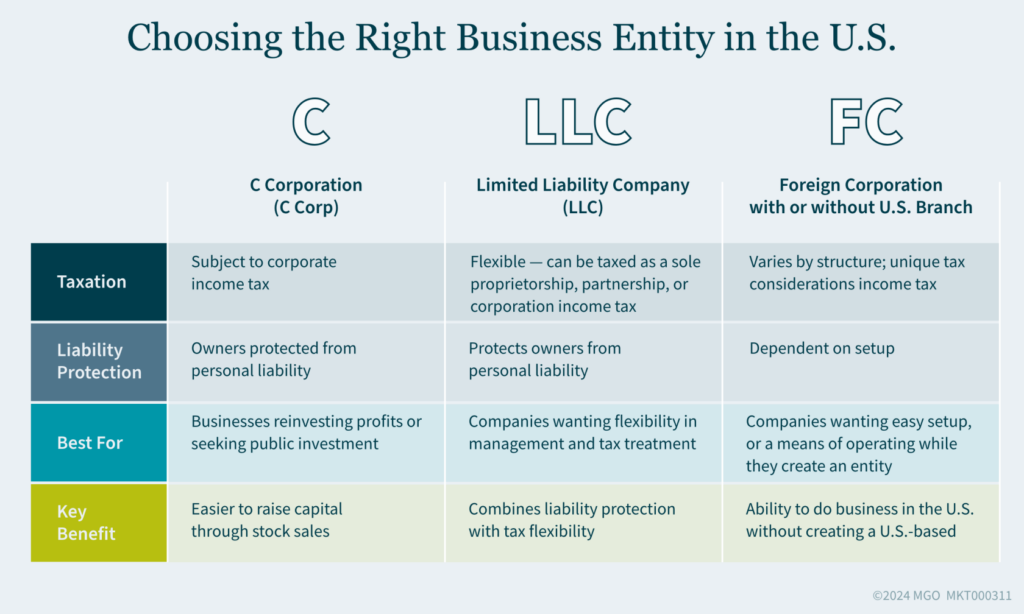

The DCL rules apply to ordinary losses of a dual resident corporation (DRC) or a separate unit. A DRC is either (1) a domestic corporation that is subject to an income tax of a foreign country on its worldwide income or taxed as a resident under the law of that country; or (2) a foreign insurance company that elects to be taxed as a domestic corporation under Internal Revenue Code Section 953(d) and is a member of an affiliated group, even if not subject to tax in the foreign country. A separate unit for purposes of the DCL rules is a foreign branch or hybrid entity that is owned by a domestic corporation. S corporations are not subject to the DCL rules, and domestic corporations will be treated as indirectly owning a separate unit that is owned by a partnership or grantor trust.

Under Section 1503(d), a DCL of a DRC or separate unit generally cannot be used to offset U.S. taxable income of a domestic affiliate (no “domestic use”). This means that the DCL may be used only for U.S. federal income tax purposes against the income of the DRC or separate unit that incurred the DCL.

Some exceptions apply to the domestic use prohibition; for example, a U.S. taxpayer may file a domestic use election and agreement (DUE) certifying that there has not been and will not be any foreign use of the DCL. Foreign use is defined making a portion of the DCL available under a foreign country’s income tax laws to reduce the income of another entity (one that is classified as a foreign corporation for U.S. income tax purposes).

DCLs and Interaction with Pillar Two

The proposed regulations address the coordination between foreign use under the DCL rules and Pillar Two, including expanding the definition of a separate unit to include certain hybrid entities subject to an income inclusion regime (IIR) and foreign branches subject to a qualified domestic minimum top-up tax (QDMTT) or an IIR. More specifically, the proposed rules provide that an income tax for purposes of the DCL rules may include a tax that is a minimum tax computed based on financial accounting principles, such as an IIR or QDMTT. Subject to an exception under the duplicate loss arrangement rules when a double deduction is denied, foreign use could occur if a deduction or loss included in a DCL were used to calculate net GloBE income for an IIR or QDMTT or, alternatively, used to qualify for the transitional CbCR safe harbor. The result of a foreign use would be that no DUE would be permitted to be made to allow for the DCL to be used in the U.S. The proposed rules provide no guidance on the undertaxed profit rules (UTPR).

The proposed regulations also address the concept of “mirror legislation.” The mirror legislation rule under the current DCL rules essentially provides that if the foreign country has its own DCL-type rule that “mirrors” the U.S. rule and that foreign country’s DCL-type rule applies to the loss at issue, then for purposes of the U.S. DCL rules, a foreign use of the DCL will be deemed to occur. The proposed regulations clarify that foreign law, including the GloBE rules, that deny deductions due to the duplicate loss arrangement rules, does not constitute mirror legislation as long as the taxpayer is allowed a choice between domestic or foreign use.

To address legacy DCLs, the proposed regulations provide a transition rule that, subject to an anti-abuse rule, extends the relief given in Notice 2023-80 by treating DCLs incurred in tax years beginning before August 6, 2024, as legacy DCLs and allowing the DCL rules to apply without regard to Pillar Two taxes.

Inclusions Due to Stock Ownership

Under the current DCL rules, U.S. inclusions arising from a separate unit’s ownership in a foreign corporation (such as Subpart F or GILTI) are treated as income and attributable to that separate unit for purposes of determining the income or DCL of that separate unit. This rule also applies to other types of income, such as dividends (including section 1248) and gains from the sale of stock. Under the DCL proposed regulations, with limited exceptions, these types of income (as well as any deductions or losses, such as section 245A dividends received deductions (DRD), attributable to these income items) would be excluded for purposes of calculating a DRC’s or separate unit’s income or DCL.

New Disregarded Payment Loss Rules

The proposed regulations introduce a new set of disregarded payment loss (DPL) rules, which operate independently of the DCL rules. To address certain deduction/non-inclusion outcomes, the DPL rules would apply to some disregarded payments (interest, royalties, and structured payments) that are deductible in a foreign country but are not included in U.S. taxable income because the payments are disregarded.

The DPL rules would require a consenting domestic owner of a disregarded payment entity to include in U.S. taxable income the amount of the DPL of the disregarded payment entity, subject to certain calculation requirements, if one of the following triggering events occur within 60 months: (1) a foreign use of the disregarded payment loss; or (2) failure to comply with certification requirements during the 60-month certification period. A disregarded payment entity is generally a disregarded entity, DRC, or foreign branch.

Since no express statutory authority exists for the new DPL rules, under the proposed regulations, Treasury would implement the DPL rules in coordination with the entity classification election rules under Treas. Reg. §301.7701-3(c), which means that when a specified eligible entity either elects to be disregarded for U.S. tax purposes or defaults to a disregarded entity under the general rules of Treas. Reg. §301.7701-3(b), the domestic owner would be deemed to consent to the new DPL rules. A specified eligible entity is an eligible entity (whether foreign or domestic) that is a foreign tax resident or is owned by a domestic corporation that has a foreign branch. This deemed consent rule would also apply in a situation where a domestic corporation directly or indirectly acquires an interest in a preexisting disregarded entity, as well as a domestic corporation that owns an interest in a disregarded entity by reason of a conversion from a partnership.

The DPL consent rules would apply to new entity classification elections filed on or after the date the proposed DCL rules are finalized and existing entities starting 12 months after the date the proposed regulations are finalized, which would allow taxpayers to restructure their operations before the DPL rules enter into effect.

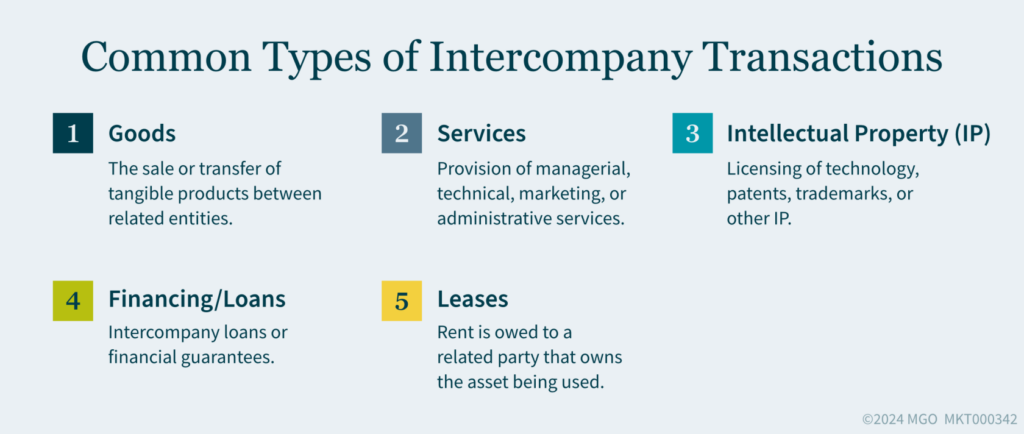

Intercompany Transactions

The Section 1502 consolidated return regulations provide rules for taking into account certain items of income, gain, deduction, and loss of members from intercompany transactions, essentially treating consolidated group members as separate entities for some purposes and single entities for other purposes. The purpose of the regulations is to provide rules to clearly reflect the taxable income (and tax liability) of the group as a whole by preventing intercompany transactions from creating, accelerating, avoiding, or deferring consolidated taxable income (or consolidated tax liability).

The proposed regulations modify the existing regulations and generally shift application of the regulations to separate-entity treatment. More specifically, if a member of a consolidated group is a DRC or a U.S. member that owns a separate unit, the proposed regulations state that despite Section 1503(d) requiring certain treatment of the member’s tax items, the counterparty consolidated group member’s income or gain on the intercompany transaction will not be deferred. For example, if one member has intercompany loan interest expense that the DCL rules prevent from being deducted, the counterparty member’s interest income would still be included in income.

Additionally, under the proposed regulations, the Section 1503(d) member has special status in applying the DCL rules, which means that if a Section 1503(d) member’s intercompany (or corresponding) loss would otherwise be taken into account in the current year, and if the DCL rules apply to limit the use of that loss (preventing it from being currently deductible), the intercompany transaction regulations would not redetermine that loss as not being subject to the limitation under Section 1503(d). A Section 1503(d) member is an affiliated DRC or an affiliated domestic owner acting through a separate unit.

Books and Records

Under Treas. Reg. Section 1.1503(d)-5, a separate unit’s income or DCL calculation is based generally on items reflected on the separate unit’s books and records as adjusted to conform to U.S. federal income tax principles. As a result, certain transactions, such as transactions between the separate unit and its U.S. owner, are disregarded for purposes of calculating a separate unit’s income or DCL. The proposed regulations clarify that items that are not (and will not be) on the books and records of the separate unit are not included in the separate unit’s income or DCL calculation. This clarification was provided, according to the Treasury, to address positions taxpayers have taken that allocate income on the books and records of the U.S. owner to the separate unit, although those items are not on the books and records of the separate unit.

Applicability

The proposed regulations would generally apply to tax years ending on or after August 6, 2024, except for the intercompany transaction regulations, which would apply to tax years for which the original U.S. income tax return is due without extensions after the date the final DCL regulations are published in the Federal Register. This means that if the final regulations are published by April 15, 2025, they would apply to calendar year 2024. Deemed consent under the DPL rules would apply to tax years ending on or after August 6, 2025.

Once the proposed regulations are finalized, taxpayers can choose to apply them retroactively to open tax years, subject to some consistency requirements.

Insights

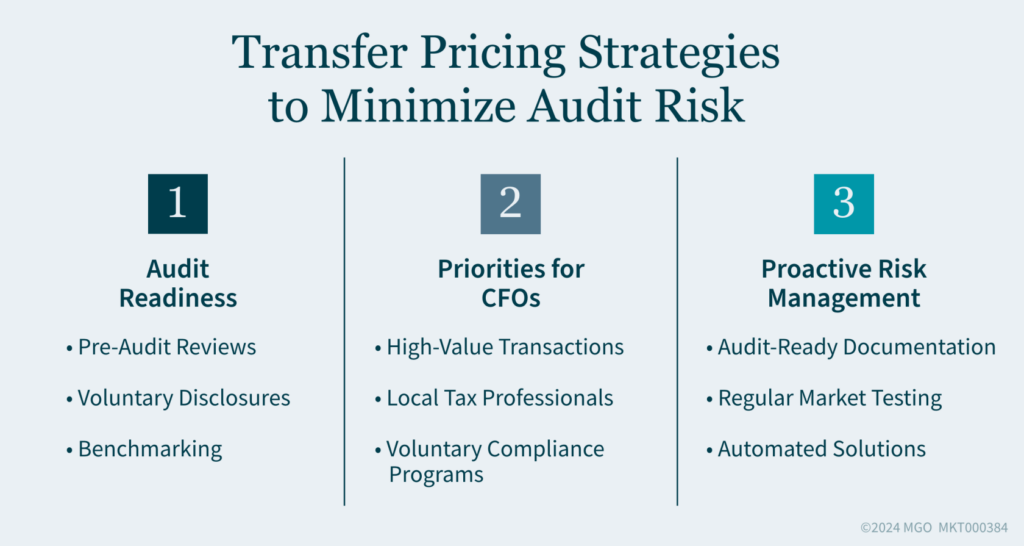

The DCL proposed regulations are lengthy and complex and include significant changes that taxpayers should consider now, since many of the changes will apply retroactively to calendar year 2024 once the proposed regulations are finalized.

Taxpayers affected by the proposed regulations should consider the impact these rules may have on their DRCs or separate units, especially since the transitional Pillar Two relief is expected to end soon for many calendar-year and fiscal-year taxpayers.

Taxpayers may need to make adjustments to their DCL calculations going forward to take into account the new rules regarding removing items from the DCL calculation that are not on the separate unit’s books and records and U.S. inclusions, among others. The removal of these items could have a significant effect by unintentionally creating a DCL or increasing the amount of any existing DCL, among other possible upshots.

How MGO Can Help

If the Treasury and the IRS finalize these proposed regulations and you have a multinational company, you may lose the ability to take a U.S. deduction for losses incurred by foreign hybrid entities and foreign branches. If you are affected by the interaction of Pillar Two and the new proposed DCL rules, MGO’s team of experienced international tax advisors can discuss the potential of restructuring to minimize any negative tax consequences. We can also mockup OECD Pillar Two modeling and assist with planning for the overall minimization of your worldwide taxation with income or direct taxes. Our compliance services can help you with your foreign compliance calendars too. Trust us as we dive into the details and limit your global tax rate and overall exposure.

Written by Michael Masciangelo and Tiffany Ippolito. Copyright © 2024 BDO USA, P.C. All rights reserved. www.bdo.com