This article is part of an ongoing series, “Navigating the Complexities of Setting Up a Business in the USA”. View all the articles in the series here.

Key Takeaways:

- Plan for U.S. employee benefits — they differ greatly from other countries and require employer management.

- Choose the right U.S. location to improve coordination, tax benefits, and operational efficiency.

- Secure proper insurance and banking solutions to avoid common challenges faced by foreign businesses in the U.S.

~

Expanding into the United States is a strategic move that offers your business significant opportunities for growth — particularly as the U.S. continues to attract substantial foreign direct investment (FDI). Recent data highlights the U.S. as a leading destination for global businesses, but companies entering the U.S. market still face a host of operational challenges. Careful planning and a thorough understanding of the regulatory and logistical landscape are crucial for a smooth transition.

This article delves into the operational considerations your business must address when expanding into the U.S. — focusing on employee benefits, coordination, supply chain management, insurance, and banking.

Importance of Operational Planning

Effective operational planning is the cornerstone of a successful expansion into the U.S. market, especially as FDI continues to drive economic growth in the region. This planning involves not only understanding the regulatory environment but also anticipating challenges related to employee management, supply chains, insurance, and financial operations. Inadequate planning can result in significant delays, increased costs, and potential legal issues — which can be particularly detrimental in a competitive market increasingly influenced by global investment.

Employee Benefits and Regulations

When expanding to the U.S., your company must navigate a complex landscape of employee benefits and regulations — which differ from those in your home country. In many sectors that are seeing increased FDI, such as manufacturing and technology, understanding and managing these benefits is critical to attracting and retaining top talent in the competitive U.S. job market.

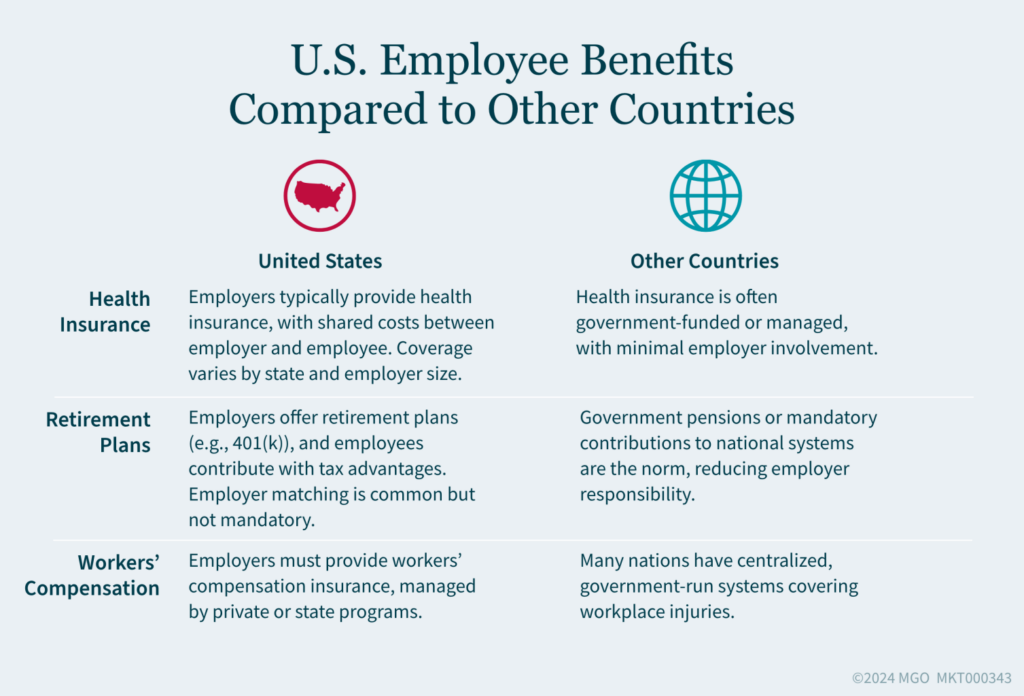

- Differences in Employee Benefits Between the U.S. and Other Countries: In many countries, such as those in the European Union, employee benefits like health insurance and retirement plans are often managed or mandated by the government. However, in the U.S., these benefits are typically the responsibility of the employer. This shift can be surprising for foreign companies, requiring a thorough understanding of U.S. labor laws and regulations.

- Health Insurance, Retirement Plans, and Other Benefits: U.S. employers are generally expected to provide health insurance as a standard benefit — with medical, dental, and vision benefits often requiring contracts with separate insurance carriers. Employers must typically cover 50% of insurance costs (though minimum coverage varies by state). Many companies also offer retirement plans such as 401(k)s. Navigating the selection and administration of these benefits can be challenging, particularly for small- or medium-sized enterprises. You may need to consult with benefits professionals to stay compliant with U.S. regulations and remain competitive in the job market.

Logistics and Supply Chain Management

Managing U.S. operations efficiently requires careful consideration of location, coordination, and infrastructure needs. Strategic decisions about operational setup can have a notable impact on your overall business success.

- Choosing the Right Location for Operations: The U.S. is a vast country with significant regional differences in cost, labor availability, and infrastructure. Selecting the right location for your operations can affect everything from shipping costs to employee satisfaction. For instance, companies focused on manufacturing might prefer regions with lower labor costs and favorable tax treatments; those in distribution might prioritize proximity to major logistics hubs.

- Shipping and Inventory Management: Efficient shipping and inventory management are essential to support product flow and meet customer expectations. Foreign companies in the U.S. often rely on third-party providers to manage these aspects — especially if they lack a physical presence. However, this can create tax obligations in multiple states, as having inventory in a state may trigger state and local tax filing requirements.

- Obtaining the Necessary Insurance Coverage: Foreign companies often discover their existing insurance policies do not cover their U.S. operations. It’s crucial to secure the appropriate insurance coverage — either through global policies that extend to the U.S. or by obtaining new policies tailored to U.S. risks. Your coverage needs may include general liability, property, product liability, workers’ compensation, and employment practices liability depending on the nature of the business.

- Challenges in Opening Bank Accounts: Opening a bank account in the U.S. can be a complex process for foreign-owned businesses. Some banks may be hesitant to provide accounts or offer credit facilities to companies without a U.S. presence or substantial collateral. This can limit access to credit and other financial services, making it essential to plan financial operations carefully.

Setting Your Business Up for U.S. Success

Expanding into the U.S. market requires careful consideration of various operational factors — from employee benefits and logistics to insurance and banking. As the U.S. continues to attract substantial foreign direct investment, it is critical to understand and address these challenges to be competitive and position your business for successful growth. By planning accordingly, you can capitalize on the opportunities presented by this dynamic market.

Ready to launch your U.S. expansion? Reach out to our team today to learn how we can help support your operational planning efforts.

Setting up a business in the U.S. requires thorough planning and an understanding of various regulatory and operational challenges. In this series, we will delve into specific aspects of this process, providing guidance and practical tips. Our next articles will explore the complexities of navigating states and local taxes.