Executive summary

- President Biden has signed the Inflation Reduction Act of 2022 into law.

- This large package contains many new tax credits to incentivize taxpayers to “go green” with energy from renewable resources while simultaneously receiving financial relief.

- It also extends or adds to currently existing credits for additional tax-saving opportunities.

On August 16, President Joe Biden signed the Inflation Reduction Act (IRA) of 2022 into law. Within the large tax reform package are numerous “green” tax credits focused on providing financial relief to taxpayers while incentivizing them to make sustainable choices and combat climate change.

These new credits are aimed at motivating taxpayers to use energy from renewable sources, prioritizing options like wind and solar. The IRA also introduces new credits and strengthens or extends existing credits that provide tax relief for purchasing new and used clean-energy vehicles and installing energy efficient heating and cooling systems. Additionally, companies that cut their methane emissions can access certain credits, while those that do not could face penalties.

The rules and regulations around claiming these green credits can be complicated. In this article, our Tax Credits and Incentives team breaks down how individuals and organizations can capitalize on these tax saving opportunities.

Swap gas guzzlers for an electric vehicle

Taxpayers that purchase a new or used “clean car” can qualify for this consumer tax credit. Vehicles considered clean are those that use a battery partly or fully manufactured in North America and built with materials extracted or processed in one of the countries currently in a free-trade agreement with the U.S.

Your income is a factor in how much you can reap in tax credits. If a taxpayer makes less than $150,000 annually (or has a combined family income below $300,000), the taxpayer can get up to $7,500 for new electric vehicles that qualify. Note the money would be applied at the point of sale, so the taxpayer’s monthly payments would be lowered (as opposed to reducing the tax bill months down the line).

Previously, the federal tax credit for electric vehicles did not include cars from manufacturers that already sold at least 200,000 models (GM, Toyota, and Tesla were excluded). This bill unravels that; instead, there is now a price threshold per vehicle. To qualify for the credit, bigger vehicles like SUVs, pickup trucks, and vans would have to cost less than $80,000 to qualify for the credits. Smaller vehicles are capped at $55,000. So, if you have your eye on a super sporty electric vehicle, you may be out of luck.

Taxpayers can also get $4,000 off a used electric vehicle if it is sold by a dealer for $25,000 or less — but only if they individually make up to $75,000 annually or $150,000 jointly. The addition of credits for used electric vehicle purchases is a win for the industry, and advocates of the bill are hopeful that this incentive will encourage an increase in electric vehicle adoption.

Modifying your home to be more energy efficient

To incentivize taxpayers to make their homes more energy efficient, the bill’s $4.28 billion High-Efficiency Electric Home Rebate Program provides rebates for low- and moderate-income households when they replace fossil-fuel boilers, furnaces, water heaters, and stoves with more efficient electric devices powered by renewable energy.

Some taxpayers will need to upgrade their electrical panels before they are able to install the new appliances. They can take advantage of up to $4,000 to do so. Furthermore, if they are interested in making their home generally more energy efficient, they can capitalize on a rebate of up to $1,600 given to seal and insulate their house, as well as up to $2,500 to improve their home’s wiring.

In terms of appliances, taxpayers can get up to $8,000 to install heat pumps that both heat and cool their home, plus as much as $1,750 for a heat-pump water heater. To offset the cost of a heat-pump dryer or electric stove, taxpayers can claim up to $840. It is estimated by making these changes, they can save significantly on their future energy bills.

There are several parameters for these rebates. First, the program runs through September 30, 2031 — so you do have time to implement these changes to your home. The maximum amount taxpayers can collect is $14,000, and to qualify, their household income cannot exceed $150% of the median income in the area they live. For those who do not qualify, there is a tax credit of up to $2,000 available to install heat pumps, plus up to $1,200 annually to install new windows, doors, or an induction stove.

Save when installing solar panels

Lastly, taxpayers can collect a 30% tax credit for installing residential solar panels through December 31, 2034. The credit decreases to 26% if you wait until after December 31, 2032. Taxpayers can also install solar battery systems to qualify for the tax credit.

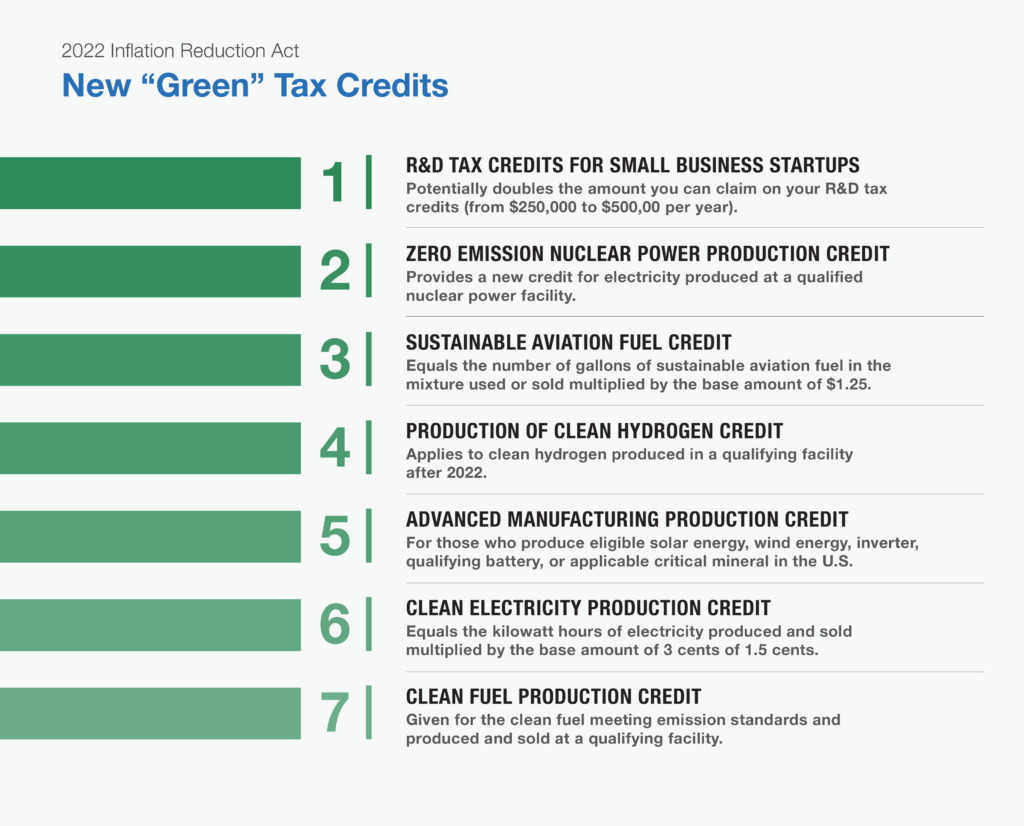

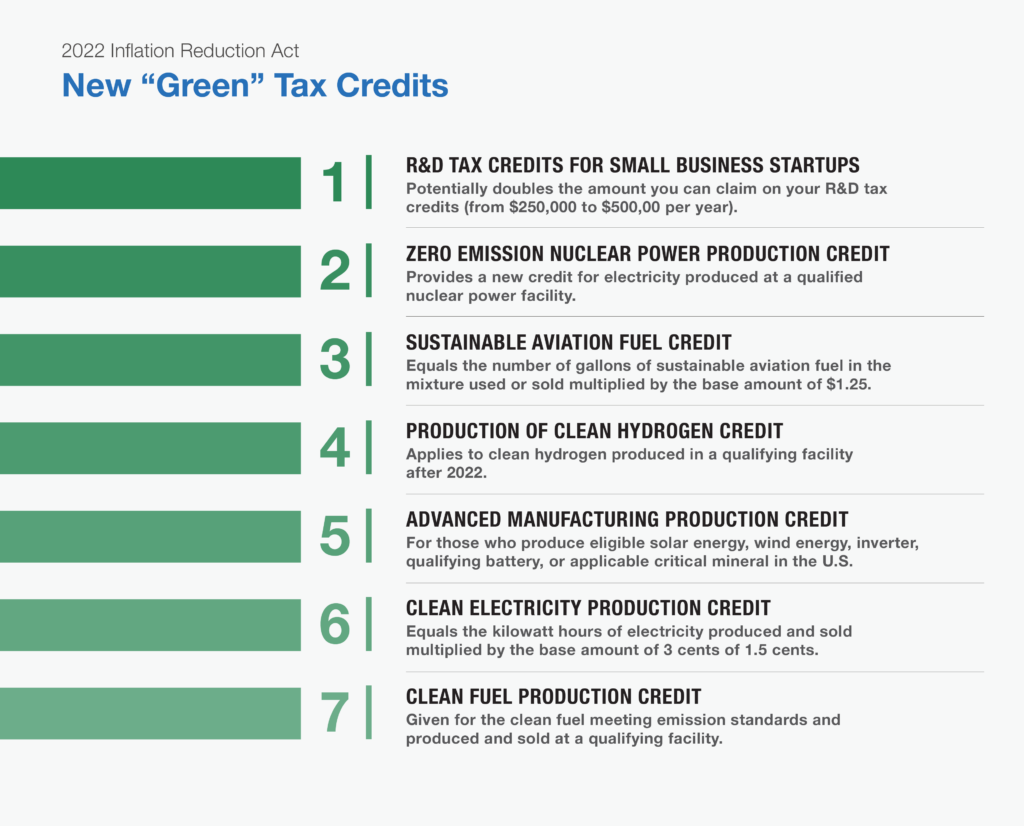

New “green” tax credits

There are other ways taxpayers can take advantage of going green. Here are some of the new tax credits to capitalize on.

Doubling of R&D Tax Credits for Small Business Startups — Would potentially allow recipients to double the amount they can claim on any R&D tax credits (from $250,000 to $500,000 per year against payroll taxes).

Zero Emission Nuclear Power Production Credit — Provides a new business credit for electricity produced by a taxpayer at a qualified nuclear power facility before the date of enactment.

Sustainable Aviation Fuel Credit – Creates a new business credit for each gallon of sustainable aviation fuel sold or used as part of a qualified fuel mixture. The credit equals the number of gallons of sustainable aviation fuel in the mixture multiplied by the base amount of $1.25. There are increases available if the taxpayer meets certain greenhouse gas emissions reductions, and it applies to fuel sold or used in 2023 and 2024.

Production of Clean Hydrogen Credit — Given to producers of clean hydrogen during the ten-year period beginning on the date a qualifying facility is originally placed in service. It applies to clean hydrogen produced after 2022.

Advanced Manufacturing Production Credit — Provides a new production credit for each eligible solar energy component, wind energy component, eligible inverter, qualifying battery component, and applicable critical mineral produced by a taxpayer in the U.S. (or in U.S. possession and sold to an unrelated person). It applies to components and minerals produced and sold after 2022.

Clean Electricity Production Credit — New business credit for clean electricity facilities placed in service after 2024 (where the greenhouse gas emissions rate is not greater than zero). The credit amount equals the kilowatt hours of electricity produced and sold multiplied by the base amount of 3 cents or 1.5 cents. The credit will phase out one year after the later of 2032 or the year when annual greenhouse gas emissions from U.S. production are equal to less than 25% of the 2022 emissions rate (whichever comes first).

Clean Electricity Investment Credit — New investment credit for clean electricity property investments in energy storage technology and qualified facilities placed in service after 2024 where the greenhouse gas emissions rate is not greater than zero. It phases out after the later of 2032 or when the annual greenhouse gas emissions from U.S. electricity production are equal to or less than 25% of the 2022 emission rate (whichever comes first).

Clean Fuel Production Credit — Creates a business credit for the clean fuel a taxpayer produces at a qualifying facility and sells for qualifying purposes. The fuel must meet certain emissions standards.

Extension and modification of “green” tax credits

Several tax credits already in existence were extended and modified in the Inflation Reduction Act. They include:

Renewable Electricity Production Tax Credit (PTC) — Extends the beginning of construction deadline for certain renewable electricity production facilities through the end of 2024, as well as reduces the base amount of credit with the potential to qualify for five times that amount. It applies to facilities placed in service after 2021, and increases the credit amounts for domestic content, energy communities, and hydropower.

Energy Investment Tax (ITC) — Extends the beginning of construction deadline for some types of energy property, including qualified fuel cell property, for one year through the end of 2024. It extends the beginning of construction deadline for geothermal equipment through the end of 2034 and permits the credit for new types of energy property like energy storage technology, microgrid controller property, and qualified biogas.

Carbon Oxide Sequestration Credit — Extends and enhances carbon oxide sequestration credits for qualified industrial facilities and direct air capture facilities IF construction begins before 2033. It also lowers the minimum carbon capture requirement, and generally applies to those facilities and equipment placed in service post-2022.

Tax Credits for Biodiesel, Renewable Diesel, and Alternative Fuels — Extends these tax credits through 2024 and apply to fuel sold or used after 2021.

Second Generation Biofuel Credit — Extends tax credits to second generation biofuel through 2024 and applies to second generation biofuel production after 2021.

Nonbusiness Energy Property Credit — Extends this credit through 2023, as well as changes the credit rate to 30% for both qualified energy efficiency improvements and residential energy property expenditures. It replaces the $500 lifetime limit with a $1200 annual limit, modifies the limits for specific types of property, and modifies standards for qualified energy efficiency improvements on property placed in service after 2022.

Residential Energy Efficient Property Credit — Extends the residential energy-efficient property credit through 2034 and replaces the credit for biomass fuel property expenditures with a new credit for battery storage technology expenditures on those made after 2022.

New Energy Efficient Home Credit — Extends the business credit for contractors who manufacture or construct energy efficient homes through 2032. It applies to dwellings acquired by the contractor after 2022.

Alternative Fuel Vehicle Refueling Property Credit — Extends the tax credit through 2032 and increases the credit limit to $100,000 per item of depreciable refueling property and $1,000 per item of non-depreciable refueling property.

Advanced Energy Project Credit — Extends the competitively awarded investment tax credit for clean energy and energy efficiency manufacturing projects. It provides as much as $10 billion of new credit allocations effective in early 2023.

Increase in Energy Credit for Solar and Wind Facilities — In order to qualify, one must have a maximum net output of less than five megawatts and must be in a low-income community, on American Indian land, or part of a low-income residential building project (or low-income economic benefit project), effective in early 2023.

Reinstatement of Superfund Hazardous Substance Financing Rate — Reinstates a financing rate on crude oil and imported petroleum products at a rate of 16.4 cents per gallon through 2032.

Our perspective on the Inflation Reduction Act’s tax credits

Looking ahead, it is imperative that you are ready to capitalize on these tax credits. Getting into the weeds with some of the qualifications, however, could prove challenging, and working with a professional services firm could make all the difference in ensuring you take advantage of the credits you qualify for.

At MGO, our dedicated Tax Credits and Incentives team brings more than 30 years of experience in helping you structure your expenses in a way that will help you acquire appropriate documentation, assist in calculating and claiming credits, and maximize the amount you can receive. Our full-service firm, led by experienced CPAs and attorneys, provides a holistic approach to examining your organization and determining how you can best reach your goals.

About the author

Michael Silvio is a partner at MGO. He has more than 25 years of experience in public accounting and tax and has served a variety of public and private businesses in the manufacturing, distribution, pharmaceutical, and biotechnology sectors.