For the second time in 2022, the Internal Revenue Service (IRS) has announced an interest rate increase of 1% for both overpayments and underpayments for the calendar quarter beginning on July 1, 2022. Under the Internal Revenue Code, the IRS sets a new interest rate every quarter, but due to the low prevailing market rates, prior to Q2 of 2022, the agency had not updated the rate since Q3 of 2020. Whether you are filing as a corporation or an individual taxpayer, this interest rate hike could have critical consequences for those who have unpaid tax balances with the IRS.

How is interest calculated on unpaid taxes?

Interest accrues on any unpaid tax from the due date of the return until the date of payment in full. The interest rate is determined quarterly. Interest compounds daily and is charged on the sum of all outstanding taxes and penalties.

Understanding overpayment and underpayment rates

The overpayment rate is the sum of the federal short-term rate plus 3 percentage points. For corporations, it is the federal short-term rate plus 2 percentage points. For the portion of a corporate overpayment of tax exceeding $10,000, it is the federal short-term rate plus 0.5%.

The underpayment rate is the sum of the federal short-term rate plus 3 percentage points, except underpayments for large corporations is the sum of the federal short-term rate plus 5 percentage points.

Starting July 1, the new increased rates will be:

- 5% for overpayments (4% for corporations),

- 2.5% for the portion of corporate overpayment exceeding $10,000,

- 5% for underpayments, and

- 7% for large corporate underpayments.

What are the most common penalties?

Failure to Pay Penalty: If a return is filed but the tax owed was not paid on time, a late payment penalty will be imposed at .5% of the unpaid taxes for each month, or the part of the month the taxes remained unpaid. The penalty will not exceed 25% of the unpaid tax amount. Full monthly charges are applied even if taxes are paid in full before the end of the month.

Failure to File Penalty: Based on how late the tax return is filed and the amount of unpaid tax as of the original payment due date, this penalty is 5% of the unpaid taxes for each month, or the part of the month that a tax return is late. The penalty will not exceed 25% of the unpaid tax amount.

Combined Failure to Pay and Failure to File Penalty: If both penalties are applied in the same month, the Failure to File Penalty will be reduced by the amount of the Failure to Pay Penalty applied in that month. Based on the current penalty percentages, the late payment penalty would remain at .5%, and the late filing penalty would be reduced to 4.5%.

Substantial Underpayment Penalty: This penalty applies to (1) individuals if the tax liability is understated by 10% of the tax required to be shown on the return or $5,000, whichever is greater or (2) to corporations, if the tax liability is understated by 10% (or, if greater, $10,000) or $10,000,000. The penalty is 20% of the portion of the underpayment of tax that was understated on the return.

Negligence or Disregard of Rules or Regulations Penalty: At 20% of the portion of the underpayment of tax, this occurs due to negligence (lack of a reasonable attempt to follow the tax laws) or a disregard for the tax rules, meaning the taxpayer carelessly, recklessly, or intentionally ignores the tax laws.

Underpayment of Estimated Tax Penalty: This penalty applies to corporations or individuals that do not make enough estimated tax payments or are late in paying them when required. The penalty is based on (1) the amount of the underpayment, (2) the period when the underpayment was due and underpaid, and (3) the interest rate for underpayments published quarterly by the IRS. To avoid it, corporations can make quarterly estimated tax payments if they expect to owe $500 or more in estimated tax when they file their return. Individual taxpayers can avoid it if they owe less than $1,000 in tax after subtracting withholding and refundable credits, or if they paid withholding and estimated tax of the lesser of at least 90% of the tax for the current year or 100% of tax shown on the prior year’s return.

Can a penalty or interest be removed (abated)?

The IRS can remove or reduce some penalties if the taxpayer acted in good faith and can show reasonable cause for the failure to meet their tax obligations. However, by law, the IRS cannot reduce or remove interest unless the penalty is removed or reduced.

Reasonable cause is based on all the facts and circumstances of each situation, and the IRS will consider any reason establishing that a taxpayer used all ordinary business care and prudence to meet their federal tax obligations but were unable to do so. It is important to note that lack of funds is not a reasonable cause for failing to file or pay on time — but it could be considered reasonable cause for the failure-to-pay penalty.

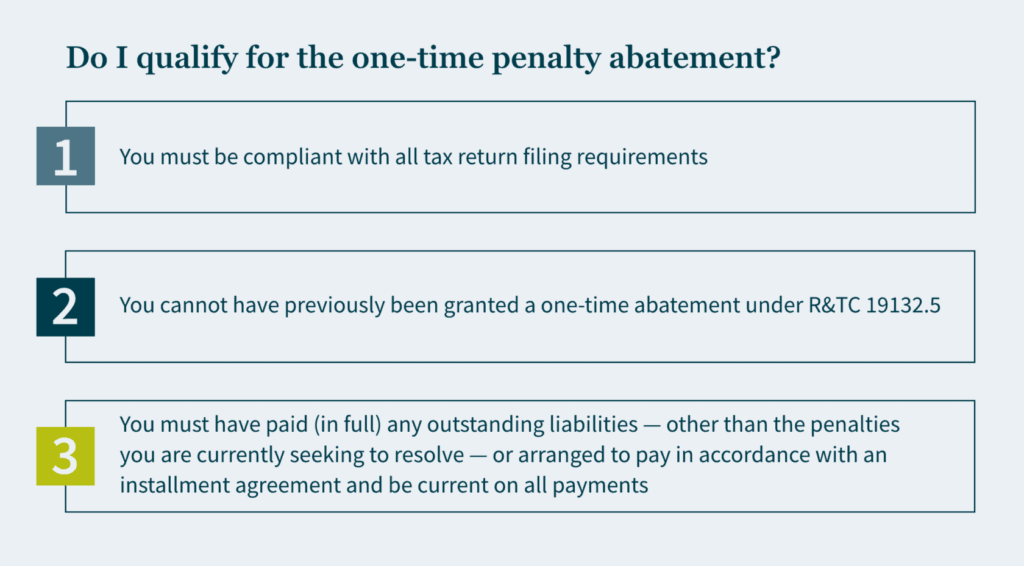

The IRS’s First Time Penalty Abatement Policy (FTA) can provide relief from a penalty if a taxpayer has not incurred penalties previously. To qualify under this policy, the taxpayer (1) did not previously need to file a return or had no penalties for the last 3 years prior to the tax year in which the penalty was received, (2) is current on all required returns or extensions of time to file, and (3) has paid or arranged to pay any tax due.

What options are available if a taxpayer cannot pay the taxes due?

Short Term Payment Plan: This plan is not available for businesses unless it is a sole proprietor or an independent contractor. There is no setup fee, and the balance must be paid within 180 days. A short-term payment plan is available for individuals if less than $100,00 in combined tax, penalties and interest is due. Penalties and interest accrue until the balance is paid in full. T

Long Term Payment Plan (Installment Agreements): An installment agreement is available for individuals if less than $50,000 is owed or for a business if less than $25,000 is due in combined tax, penalties and interest and all required returns are filed. Penalties and interest accrue until the balance is paid in full. The maximum term for most installment plans is 72 months.

If a taxpayer pays less than the full amount due, how is the partial payment applied?

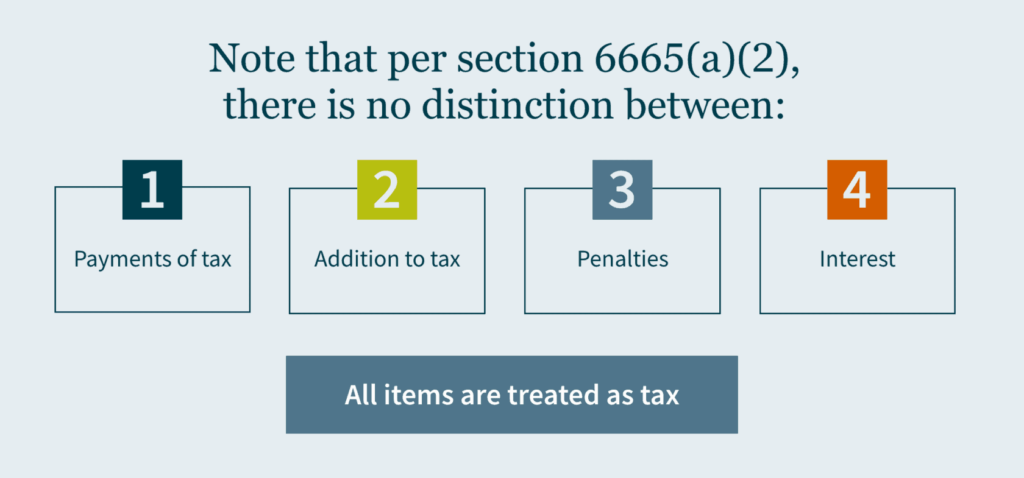

If a taxpayer makes a partial payment accepted by the IRS, and the taxpayer provides specific written directions as to the application of the payment, then the IRS will apply the payment as instructed by the taxpayer. If the taxpayer does not provide instructions with the partial payment, then the partial payment is applied to periods in order of priority that the IRS determines is in its best interest. The payment will be applied to satisfy the liability in successive periods in descending order of priority until the payment is absorbed. If the partial payment applied to a period is less than the liability for the period then the payment will be applied to the tax, then penalty and finally interest, until the amount is exhausted (Rev. Proc. 2002-26).

Example: The taxpayer incurs the following tax deficiency, penalties and interest:

Year 1: Tax: 6,000, Penalty: $1,800, Interest: $1,200

Year 2: Tax: 7,000, Penalty: $ 0, Interest: $ 1,500

The IRS agrees that the taxpayer can satisfy the total liability of $17,500 for a payment of $15,000. There is no agreement as to the allocation of the payment and the taxpayer does not provide any directions for application of the partial payment. The payment is first applied to the Year 1 tax, penalty, and interest (a total of $9,000), leaving $6,000 to be applied to Year 2. The remaining amount is completely absorbed by the tax due for Year 2, which results in the payment of interest in Year 1, but not for Year 2.

However, if the partial payment accepted by the IRS is less than the total of tax and penalties due in both years and there is no agreement regarding the application of the partial payment, then nothing is allocated to the interest in either year. For example: following the amounts listed above, if the partial payment was $12,000 instead, then the entire amount is applied to the tax and penalty in Year 1 (a total of $7,800) and the remaining amount of $4,200 is applied to the Year 2 tax due. None of the partial payment would be applied to the interest in either year.

Final thoughts

Delaying paying (or paying down) any outstanding balances with the IRS will cost you more than in pr