Executive Summary:

- The music industry has changed drastically, with artists now having more control over their careers and revenue streams beyond deals with record labels.

- Artists today need to view themselves as enterprises with diverse income opportunities including live shows, merchandising, licensing deals, streaming royalties, content creation, and catalog sales.

- To fully capitalize on these opportunities, artists must surround themselves with a team of expert advisors to help navigate all the financial, accounting, and business intricacies involved.

~

The journey to success in the music industry is no longer a straight line. While the path to earning substantial revenue previously only had one route — through a major label — those days are gone. The digital age has ushered in a new era, where artists have many direct pathways to their fans and an array of new revenue opportunities.

But with new opportunities comes new challenges. Today’s artists have to figure out how to navigate, manage, and optimize numerous complex revenue streams with little guidance. This is why having a trusted team of advisors is essential to ensure you are getting the most from your artistic output — both in terms of building your fan base and your financial future.

Here’s how working with a top advisor can help you transform from artist to enterprise, adept at building diverse income streams and overcoming any associated financial hurdles.

1. Live Performances: Looking Beyond the Spotlight

Live performances and touring remain pivotal for musicians to generate income. However, the financial success of a tour is not just about what you’re getting paid; it’s also about what you’re spending. That’s why meticulous planning is essential. From production costs to transportation, a trusted advisor ensures every dollar is accounted for before signing any contracts. Artists can also leverage performances for additional revenue through avenues like live streaming, behind-the-scenes access, or even concert films (i.e., Taylor Swift’s Eras Tour film). Advisors can help structure those deals to optimize the highest take-home payout.

2. Merchandising: Capitalizing on Brand Appeal

Merchandising offers a lucrative avenue to capitalize on an artist’s brand and deepen fan connections. Advisors can guide artists through various merchandising paths — from direct sales to brand collaborations to affiliations — to help them determine the best financial option. While direct sales may seem the most appealing on paper (where you might see numbers like “90% profit”), the associated responsibilities, such as sales tax management and warehousing, shipping, and staffing considerations, need careful evaluation. A seasoned advisor helps strike the right balance between profit and practicality.

3. Licensing and Sponsorships: Negotiating the Right Deal

Licensing and sponsorships have become integral to the music industry, with brands using music to sell everything from cars and sneakers to movies and fast food. Advisors play a crucial role in evaluating and negotiating these deals — ensuring you are getting fairly compensated for your name and image, and the opportunity aligns with your brand and goals. The evolving licensing landscape—with artists now able to self-publish and go through Spotify, Apple, and other platforms—has made getting licensing deals done easier. One independent artist we work with got a six-figure deal when a network went to TuneCore looking for music to use in a TV show.

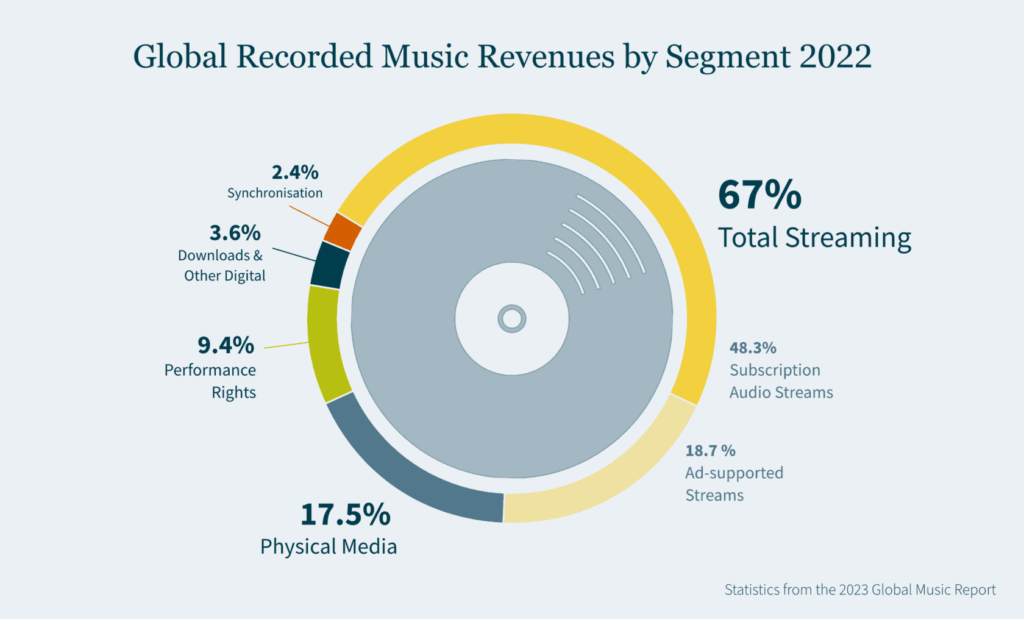

4. Streaming Revenue: Making the Most of Royalties

Music streaming platforms dominate the music consumption landscape today. While streaming royalties may be lower than what an artist receives from radio spins, terrestrial radio cannot touch the real-time data streaming provides (providing demographics of who is listening to your music, where they are listening, etc.). When it comes to managing streaming royalties, it pays to have a trusted advisor to track your royalties across all platforms — analyzing streaming data and royalty statements to ensure proper payment and identifying any discrepancies. Advisors also can strategize royalty planning, including estimated tax payments on royalties to avoid penalties, and help negotiate more favorable distribution deals with streaming platforms, exploring creative arrangements and exclusive partnerships.

5. Creator Content: Creating a Consistent Revenue Driver

In today’s creator economy, valued at over $100 billion, creating content is a powerful revenue stream. Many music artists are augmenting their income to the tune of six-to-nine figures a year by creating content for TikTok, YouTube, podcasts, NFTs, as well as a variety of other media and platforms. Advisors can guide you in navigating the challenges that arise from managing online content revenue — which often trickles, and then floods in, from multiple sources, and can quickly become unwieldy without a system in place to manage it. Proper financial management, including tax planning and budgeting, becomes crucial as content creation becomes a more prominent income source.

6. Catalogue Monetization: Structuring Your Ideal Sale

High-profile artists like Dr. Dre and Justin Bieber have recently sold their catalogue rights for large chunks of change. Catalogue monetization is the one time you are in complete control of your asset; you can carve out whatever deal you want (10-year, 20-year, 50%, 80%, etc.). Advisors guide artists in choosing the right partners, structuring deals, and determining the extent of the catalogue to sell. Your advisor will also help you weigh the tax considerations of collecting royalties versus selling all or some of your catalogue (royalties are taxed at 37%, while catalogue sales are taxed at 20%), and set up your sale in the most tax-efficient manner possible (for example, installment sale vs share sale). This one-time opportunity demands careful deliberation, and having the right team advising on nuances is paramount.

Building the Team Around Your Team

Moving from artist to enterprise means building a team to help you succeed. Your advisors are your team around your team. Much like a corporation brings in consultants, having seasoned business advisors available when you need them will help you make informed decisions to grow your brand and secure your financial future.

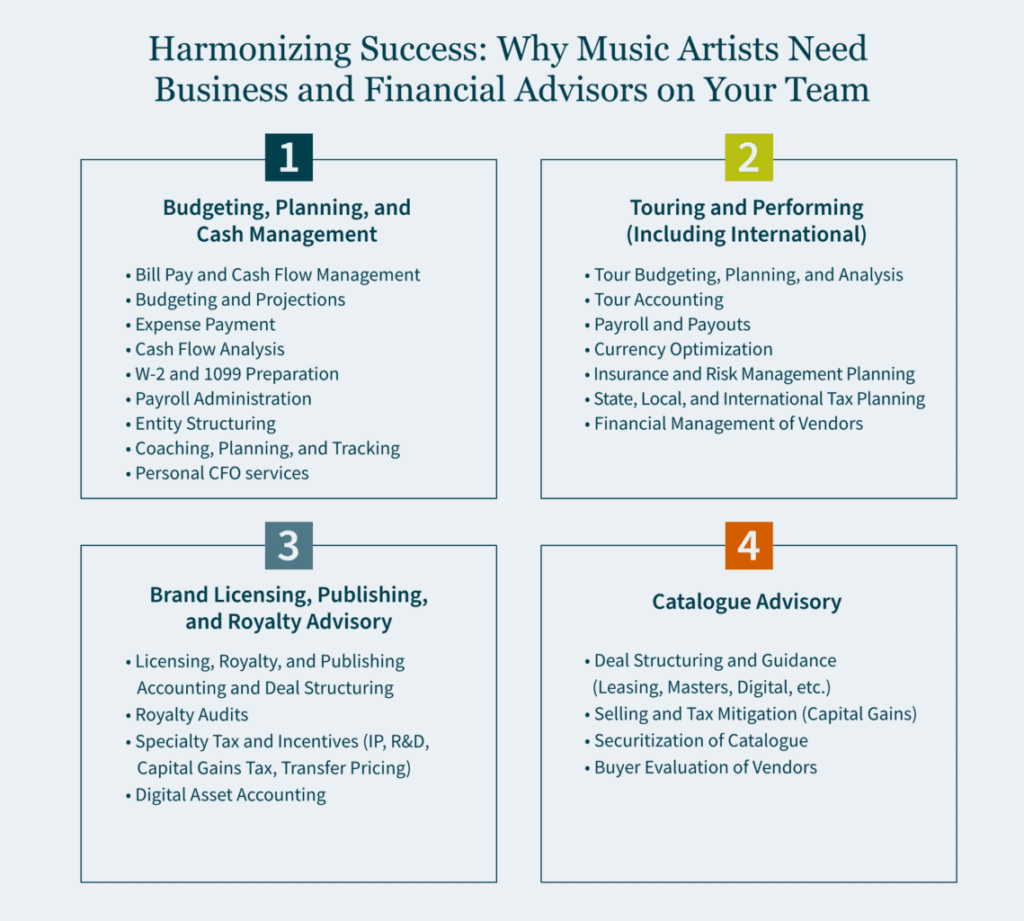

How We Can Help:

Our Entertainment, Sports, and Media (ESM) practice helps music artists at all stages, from rising stars to legends, offering financial, tax, and business management services to help you build your brand and maximize opportunities. Contact our ESM team today to learn how we can help take your music career to the next level.