Executive summary

- A growing organization is a positive, but along with it usually comes increasingly complex financial accounting.

- Outsourcing provides businesses of all sizes with an opportunity to manage an array of issues — from staffing shortages or a lack of specific expertise to disorganized or unsecure financial records.

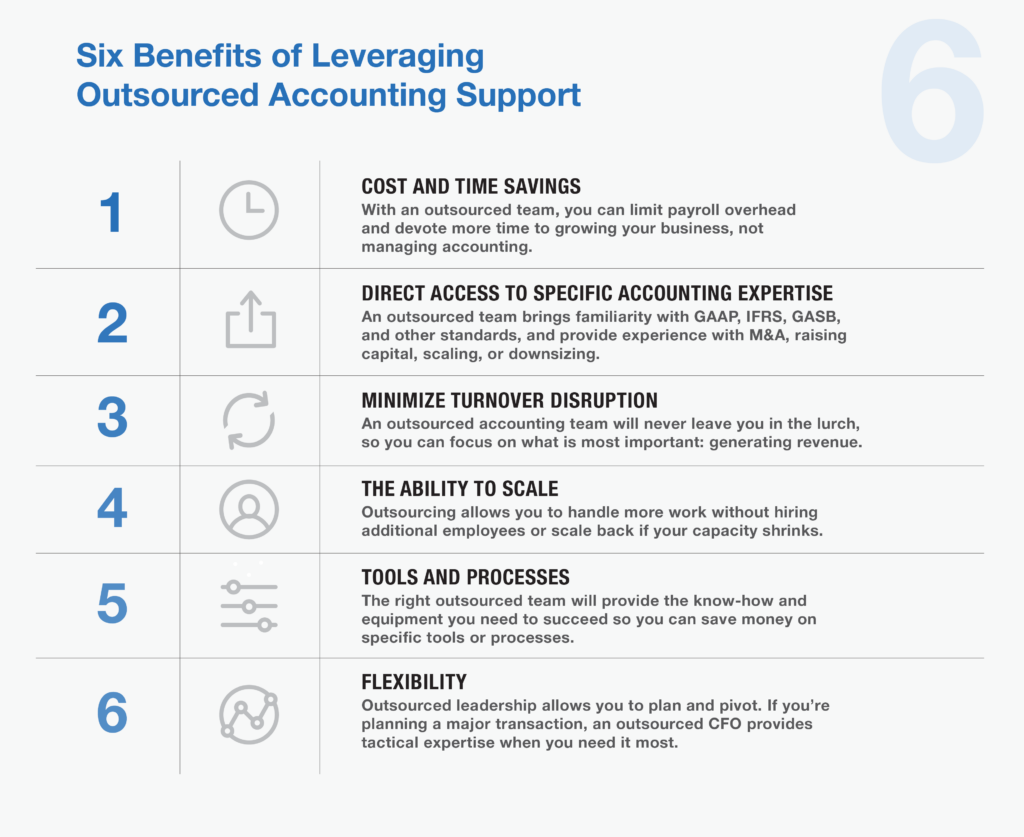

- Benefits of outsourcing include significant cost savings, direct access to specific accounting knowledge, the minimization of turnover, the ability to scale, access to tools and processes, and flexibility.

Many CEOs and business leaders are experiencing challenges in the aftermath of the COVID-19 pandemic, including changing customer trends, aggressive competition, emerging digital technologies, and the new normal of employee expectations for workplace flexibility.

These uncertain economic forces and cultural shifts are putting increased pressure on staffing for organizations of all sizes – especially fast-growing ones. While these difficulties are difficult to overcome, they are also an opportunity to change the “status quo” and level-up back-office performance.

For leaders navigating the uncertain tailwinds of the pandemic and planning to enter a new era of growth, outsourcing represents a powerful opportunity to address any staffing issues or business challenges. It empowers you to access specialized insight on a temporary basis, create value ahead of a major transaction, manage overhead costs, and modernize and revitalize business processes.

A recent study showed that 59% of all businesses utilize outsourced resources and that accounting is the most commonly outsourced function. So, how do you know if outsourcing your accounting function is right for your organization?

In this article we’ll look at five indicators that this strategy might be right for you and detail the key benefits to outsourcing or augmenting your accounting function.

Five signs your business may benefit from outsourced accounting

Here are some questions you should ask yourself to determine if your organization would benefit from outsourced accounting services:

- Is your business growing rapidly?

If you’re experiencing a significant influx of revenue, first off, great work! Your business model is proving out and you’re on the fast-track to success. But what is happening to your expenses, profitability and working capital? Depending on your answer it could mean that your accounting needs are evolving, the risks of a breakdown are higher, and overall, there is simply more at stake. It may be time to confirm that your current in-house team is qualified and staffed appropriately to handle these new responsibilities.

- Are you struggling to keep up with your accounts receivable or payroll?

One way to get a firm answer to whether your team is understaffed is if you’re missing key deadlines or struggling to get timely collection of cash from your accounts receivable. The inability to collect and follow-up on AR is essential to funding current and future growth and is directly connected to meeting your payroll commitments – one of the largest expenses of any business. If anything falls behind, you can find yourself in a difficult position if you do not have the ability to access cash or financing.

- Are your financial records organized and producing usable data?

Your accounting function does more than compliance, it should help guide your organization’s financial hygiene. Organized financials tell a clear story of earnings, spending, and investment, so you can make informed decisions. An over-worked or inexperienced accounting team will be working furiously to keep up with compliance and may not have the capacity, or necessary experience, to provide guidance on your financial scorecard to accrete value to the organization.

- Do your accounting needs fluctuate significantly throughout the year?

If your business experiences big shifts in labor productivity based on the calendar year and your taxes filings are late with significant overages from the tax preparers, or your audits have a significant number of adjustments, that may mean your accounting team lacks capability. Striking the right balance between hiring quality talent and the speed of bringing new hires up to date with company procedures can be a challenge. Outsourcing your team can deliver the resources you need, when you need them, and limit costs during the slower periods.

- Are you concerned about financial security and checks and balances?

If your internal accounting team is one or two individuals, you may be open to hidden risks. An independent team can provide the checks-and-balances that help mitigate the risk of fraud and asset misappropriation.

If you answered yes to any of these questions, you should consider outsourcing part or all of your accounting function. With an outsourced accounting team, you gain immediate access to trained, knowledgeable staff with the knowledge you need in technical accounting. The right outsourced resources can help your business grow faster and run more smoothly — often at a lower price than building an internal accounting department.

Benefits of outsourced accounting services

1.Cost and time savings

Maintaining full-time employees can be costly — and for most organizations, labor costs are some of the highest expenses. By relying on an outsourced team, you can devote your time to growing your business and spend less time managing accounting.

- Direct access to specific accounting expertise

Every company is different, which means every company’s needs are different. By outsourcing, you have access to the service you need when you need it. An outsourced team will bring familiarity with an array of accounting and reporting standards, including GAAP, IFRS, GASB, etc. Plus, they can provide specific experience with M&A transactions, raising capital, scaling, or downsizing operations.

- Minimize turnover disruption

In a smaller organization, each employee is vital to the business’s success. When you lose one, the disruption left in their wake can provide additional challenges. An outsourced accounting team will never leave you in the lurch, so you can focus on what is most important: generating revenue.

- The ability to scale

If your organization has grown quickly, you may experience growing pains when your fortunes suddenly shift. In boom times, you may need to hire more staff to meet demand. But that also means you may find yourself laying off employees in a downturn. Outsourcing allows you to handle more work without hiring additional employees or scale back if your capacity shrinks.

- Tools and processes

No matter what your organization’s size, you should always try to keep your overhead costs minimal. By outsourcing, you can save money on specific tools or processes you might otherwise need to function. The right outsourced team will provide the know-how and equipment you need to succeed.

- Flexibility

By outsourcing certain jobs, you can plan — and pivot, as needed — depending on your organization’s needs. This is especially relevant in the case of needing specialized guidance. If you’re planning a major transaction or other market move, an outsourced CFO can provide tactical expertise when and where you need it.

MGO can help

As your organization grows, your financial accounting needs become increasingly complex. Because your in-house accountants may be limited to handle the basics, outsourcing to professional teams with specialized knowledge and experience can provide precisely the kind of service you require — and give you the time you need to focus on the organization’s other needs.

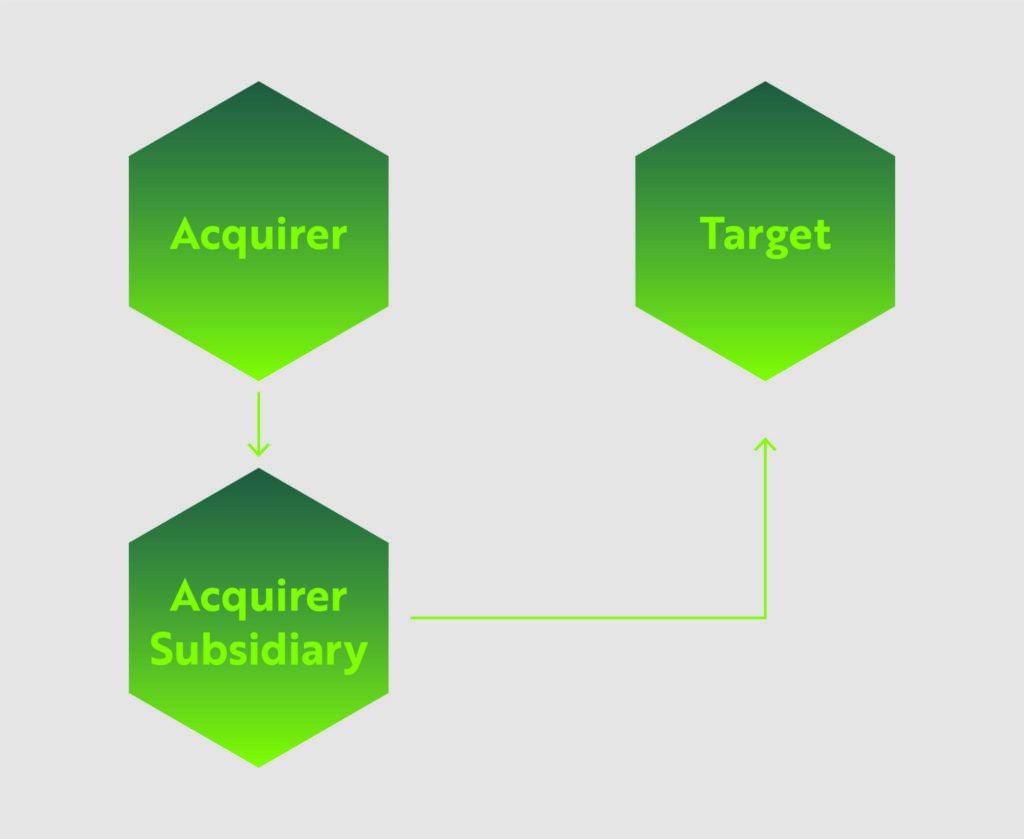

MGO has a robust outsourced accounting team staffed by CPAs with diverse industry background and technical specialties. We’ll provide the right-size solution to your organization’s needs. Areas we support include day-to-day accounting tasks, complex financial systems projects, regulatory compliance demands, and support for M&A deals, raising capital, and other major transactions.

Whether you’re interested in simply augmenting your team with additional financial knowledge, or undertaking a complete accounting transformation, we can help you with the people, processes, and technology you need to move your business forward.

To explore your options and start along the path to organizational change, contact us.