Key Takeaways:

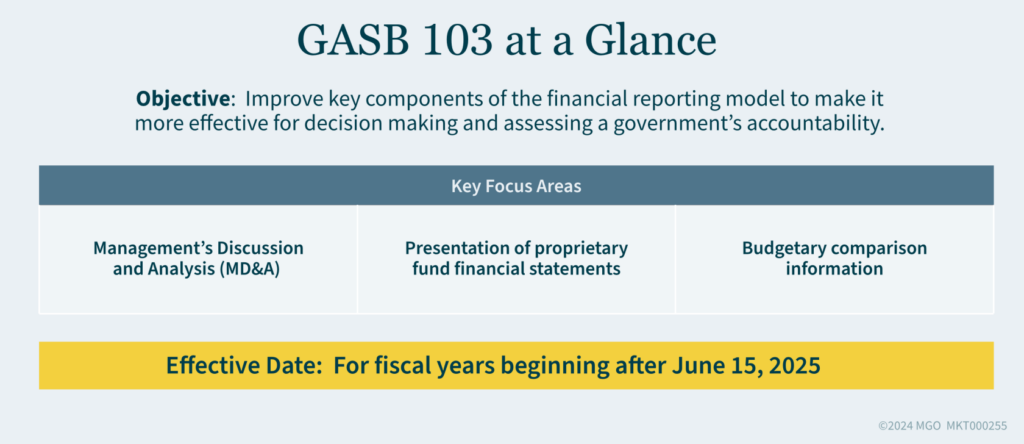

- GASB 103 introduces changes to governmental financial reporting, including updates to three key areas: Management’s Discussion and Analysis, presentation of proprietary fund financial statements, and budgetary comparison information.

- While significant, GASB 103 is less extensive than initially anticipated — with changes scaled back compared to earlier drafts.

- Governments should prepare for GASB 103 implementation by educating their teams, updating processes and templates, and considering the need for additional data collection or external assistance.

~

The Governmental Accounting Standards Board (GASB) has issued Statement No. 103, Financial Reporting Model Improvements (GASB 103), introducing changes to the financial reporting model for state and local governments. This new guidance aims to enhance the clarity and usefulness of financial reports, providing stakeholders with more comprehensive and relevant information.

Here is what GASB 103 means for your government and how you can prepare for these changes.

Understanding the Scope of GASB 103

GASB 103 introduces new or modified guidance in several crucial areas:

- Management’s Discussion and Analysis (MD&A)

- Presentation of proprietary fund financial statements

- Budgetary comparison information

- Unusual or infrequent items

- Information about major component units

- Statistical section

Notably, GASB 103 does not change the basis of accounting or measurement focus for governmental funds financial statements.

Management’s Discussion and Analysis (MD&A)

The MD&A is an essential component of your financial reporting, providing a narrative overview and analysis of your financial activities for the reporting period. GASB 103 aims to make this section more insightful and user-friendly.

Follow these tips to align MD&A with GASB 103 emphasis and requirements:

- Keep your analysis objective and easily readable.

- Base it on currently known facts, decisions, or conditions.

- Present short- and long-term analyses (but don’t duplicate your transmittal letter or the same information within your MD&A).

- Write for users who may not have deep accounting knowledge.

- Compare current year results with the prior year, emphasizing the current year.

- Include three years of comparative data for two-year financial statement presentations.

- Use charts, graphs, and tables to enhance understanding.

- Focus on the primary government, distinguishing it from component units.

Remember, your MD&A should tell a story, not just present numbers. Explain why changes occurred and their significance. Avoid “boilerplate” discussions and focus on what’s most relevant each year.

MD&A Structure

GASB 103 requires that information presented in your MD&A be confined to topics in the following five sections:

- Overview of the Financial Statements

- Financial Summary

- Detailed Analyses

- Significant Capital Asset and Long-Term Financing Activity

- Currently Known Facts, Decisions, or Conditions

Significant capital asset/long-term financing activity should include the following:

- Capital assets include intangible assets under GASB 51 and intangible right-to-use assets under GASB 87 (leases), GASB 94 (PPP), and GASB 96 (SBITA)

- Long-term financing includes debt and obligations from GASB 87 (leases), GASB 94 (PPP), and GASB 96 (SBITA)

Presentation of Proprietary Fund Financial Statements

For proprietary funds, your statement of revenues, expenses, and changes in fund net position must now distinguish between operating and nonoperating revenues and expenses, as well as separately report noncapital subsidies (a type of nonoperating revenue and expense). Here are simplified definitions of how these are categorized:

- Operating revenues and expenses — These are derived from the fund’s principal ongoing operations.

- Nonoperating revenues and expenses — Includes subsidies, contributions to endowments, financing-related revenues and expenses, capital asset disposal, and investment income.

- Subsidies — Resources exchanged between funds or other parties without a corresponding exchange of goods or services that either reduce the receiving fund’s fees/charges or are recoverable through the providing fund’s pricing policies. Subsidies also encompass any other transfers not meeting these specific criteria.

These changes aim to provide a clearer picture of your proprietary funds’ performance and financial position. Don’t underestimate the need to evaluate and separately classify subsidies from capital-related contributions and/or transfers, along with their impact on the statement of cash flows.

Budgetary Comparison Information

GASB 103 is standardizing how you present budgetary information. While budgetary comparison schedules continue to be required for the general fund and each major special revenue fund with a legally adopted annual budget, it must now be presented as required supplementary information (RSI) only (i.e., there is no longer a basic financial statement option). This includes:

- Variance columns — Separate columns for the variances between original and final budget amounts and final budget amounts and actual results.

- Explanation of variances in Notes to RSI — Detailed discussion explaining significant variations between the original and final budget amounts and final budget amounts to actual results. Also of note, the budget analysis will no longer be included in the MD&A.

Unusual or Infrequent Items

GASB 103 retains the definition of unusual or infrequent items from GASB 62 but adds requirements for presenting these items:

- Separate presentation — Present inflows and outflows related to unusual or infrequent items separately as the last presented flows of resources before the net change.

- Disclosure — Disclose in notes the program, function, or activity related to the unusual or infrequent item, and whether it is within management’s control.

Information About Major Component Units

Each major component unit should be presented separately in the statements of net position and activities — unless this reduces the readability of your statements. If readability is affected, you can include combining statements of major component units in your basic financial statements (after fund financial statements).

Statistical Section – Business-Type Activities (BTA)

Due to the changes in the presentation of proprietary fund financial statements discussed above, the statistical section needs an update for BTAs. In the statistical section of separately issued financial reports, governments engaged only in business-type activities or only in business-type and fiduciary activities should present revenues by major source for their business-type activities — distinguishing between operating, noncapital subsidy, and other nonoperating revenues and expenses.

How to Prepare Your Government for GASB 103

The requirements listed above will take effect for fiscal years beginning after June 15, 2025. Now that you know what’s coming, how do you prepare? Here’s a roadmap to help you navigate the transition:

- Educate your team — Help your finance team understand the new requirements. Consider training sessions or workshops on GASB 103.

- Assess your current reporting — Review your existing financial reports against the new standards. Identify areas that will need changes.

- Update your processes — Develop new procedures for collecting and presenting the required information. This might involve changes to your accounting systems or reporting tools.

- Revise your report templates — Create new templates for your financial statements and MD&A that align with GASB 103 requirements.

- Engage stakeholders — Communicate with your governing board, audit committee, and external auditors about the upcoming changes. Their input and understanding will be crucial.

- Plan for data collection — Some new requirements may necessitate collecting data you haven’t tracked before. Start planning for this now.

- Consider external help — If you’re short-staffed or need additional knowledge, consider engaging consultants familiar with GASB 103 to assist with the transition.

How MGO Can Help

Transitioning to the new requirements of GASB 103 can be complex. Our dedicated and experienced State and Local Government team can assist you in navigating these changes, facilitating a smooth transition and compliance with the new standards.

Reach out to our team today to learn how we can support your government in adopting GASB 103 and enhancing your financial reporting processes.