Key Takeaways:

- Effective cost management involves proper inventory costing methods, accurate accounting of tasting room operations, and appropriate financial reporting practices.

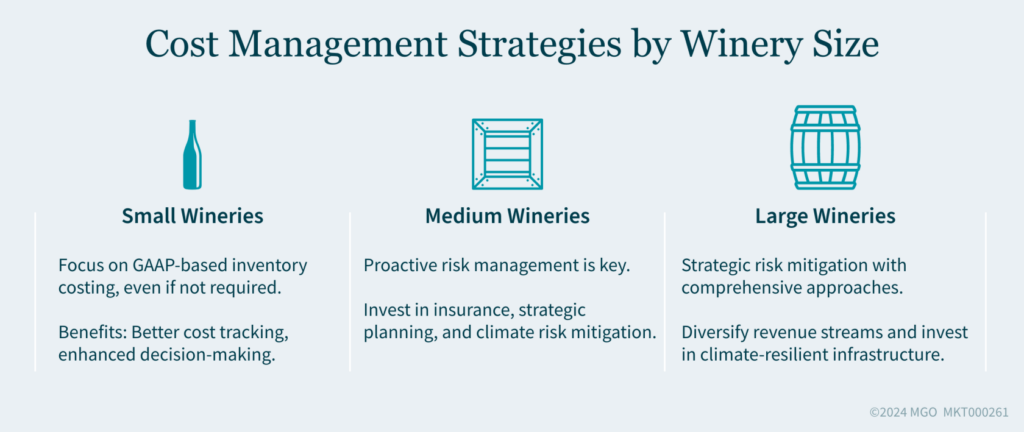

- Wineries of different sizes face unique challenges, from implementing GAAP-based inventory costing for small wineries to comprehensive risk management strategies for large wineries.

- Understanding production costs, distribution expenses, and potential risks helps wineries make informed financial decisions and achieve sustainable growth.

~

As a winery owner, mastering cost management is crucial for profitability. Understanding your expenditures and employing the right strategies can improve your financial health and boost your operational efficiency.

Whether you are a small, medium, or large winery, here are some key factors to keep in mind:

Inventory Costing Methods

For small wineries — which make up 49% of the market — U.S. generally accepted accounting principles (GAAP) inventory costing methods are invaluable. These methods enable you to assign a monetary value to your inventory, providing the exact cost data capture you need to manage production and distribution expenses effectively. If you are a medium-sized (or larger) winery, you can benefit from more comprehensive financial models and robust accounting systems.

Tasting Room Operations

For wineries of all sizes, accurately accounting for tasting room activities is critical. This includes tracking your inventory, managing sample losses, and accounting for both owner and employee samples. Proper financial controls and expense categorization will provide you clear insights into profitability. Understanding these challenges, you should consider comprehensive solutions like inventory costing, financial modeling, and tax preparation to enhance your operational efficiency and profitability.

Audit Versus Review

As your winery grows, the need for independent Certified Public Accountant (CPA) audits or reviews becomes more important. This decision hinges on the level of assurance needed and the specific needs of lenders, investors, or creditors. While audits offer the highest level of assurance and can enhance credibility with stakeholders, they are also more costly. Reviews, on the other hand, are less expensive but provide more limited assurance. Tailored audit and review services can help meet the unique requirements of your winery, supporting accuracy and compliance in financial reporting.

Tax Return Considerations

Proper inventory valuation and tracking of production activities are essential for correct tax preparation. Formal inventory valuation methods — such as those adhering to U.S. GAAP — can aid in exact tax reporting and provide a reliable template for management. This appropriately accounts for all production costs, helping to minimize tax liabilities and avoid potential issues with tax authorities. Specialized tax preparation services tailored to the unique needs of your winery can help you meet compliance requirements and improve financial outcomes.

Small Wineries: Accurate Inventory Accounting

If your winery produces fewer than 1,000 cases annually and lacks extensive accounting resources, you may choose to keep books on a tax basis. However, implementing U.S. GAAP-based inventory costing — even if not needed — can offer valuable insights into your production costs and help you secure debt or equity financing. Accurate cost tracking allows you to make informed decisions about your operational efficiency and financial management, giving you a competitive edge in the crowded market.

Medium Wineries: Proactive Risk Management

For medium-sized wineries, effective risk management is crucial to safeguarding financial stability. Finding potential risks such as climate impacts or market fluctuations requires a proactive approach, including investing in insurance and strategic planning. Although these measures involve upfront costs, they can prevent substantial financial losses overall. Implementing robust risk management practices will help your winery keep consistent production quality and protect your financial health against unforeseen challenges, ultimately supporting sustainable growth and operational resilience.

Large Wineries: Strategic Risk Mitigation

Large wineries, with extensive operations and market reach, face significant risks from climate change and volatile market conditions. Investing in comprehensive risk management strategies, including climate-resilient infrastructure, diversified revenue streams, and market analysis tools, is essential. Upfront costs for insurance and strategic planning are necessary to mitigate these risks. By addressing potential vulnerabilities proactively, your winery can protect its substantial investments, maintain market stability, and set the table for long-term profitability despite external uncertainties. This approach will help you preserve your reputation and sustain growth in a competitive industry.

Distribution and Growth Considerations

For small wineries, distributing wine introduces challenges that require a clear understanding of both production and distribution costs. Increased production often involves significant investments in equipment and facilities, affecting the cost per case until production volumes grow sufficiently. Before entering any distribution channel, it is crucial to understand the full cost of production, develop a solid pricing strategy, and account for the costs involved in various sales channels to support profitability and growth.

Elevate Your Winery’s Profit Potential

Effective cost management is vital for wineries of all sizes to navigate the complexities of the market and achieve sustainable growth. By implementing robust financial practices, correct cost tracking, and comprehensive risk management strategies, your winery can enhance its operational efficiency and profitability.

How MGO Can Help

MGO’s tailored solutions can help you meet these challenges and thrive in this competitive industry. Reach out to our Vineyards and Wineries team today to learn how we can support you.