Alternative Engagement Types: Consulting Services, Agreed-Upon Procedures, and Performance Audits

By Scott P. Johnson, CPA, CGMA

Partner, Macias Gini & O’Connell LLP

State and Local Government Advisory Services

I have spent most of my professional career over the past 35 years serving government agencies and focusing on performance improvement, accountability, and transparency. I recognize the need for continuous monitoring and oversight in the public sector to ensure performance, public accountability, and stewardship of public resources. While participating on a number of professional panels and presentations throughout my career, I have often stated that I embraced the auditor and have welcomed them with open arms into the organizations that I had responsibility over. Why? Because I see auditors as an independent and objective lens, adding value to review and evaluate performance and to make recommendations for improvement. The organizations I have had the pleasure to work for took public accountability very seriously and supported performance improvement as a means to better serve their communities and stakeholders.

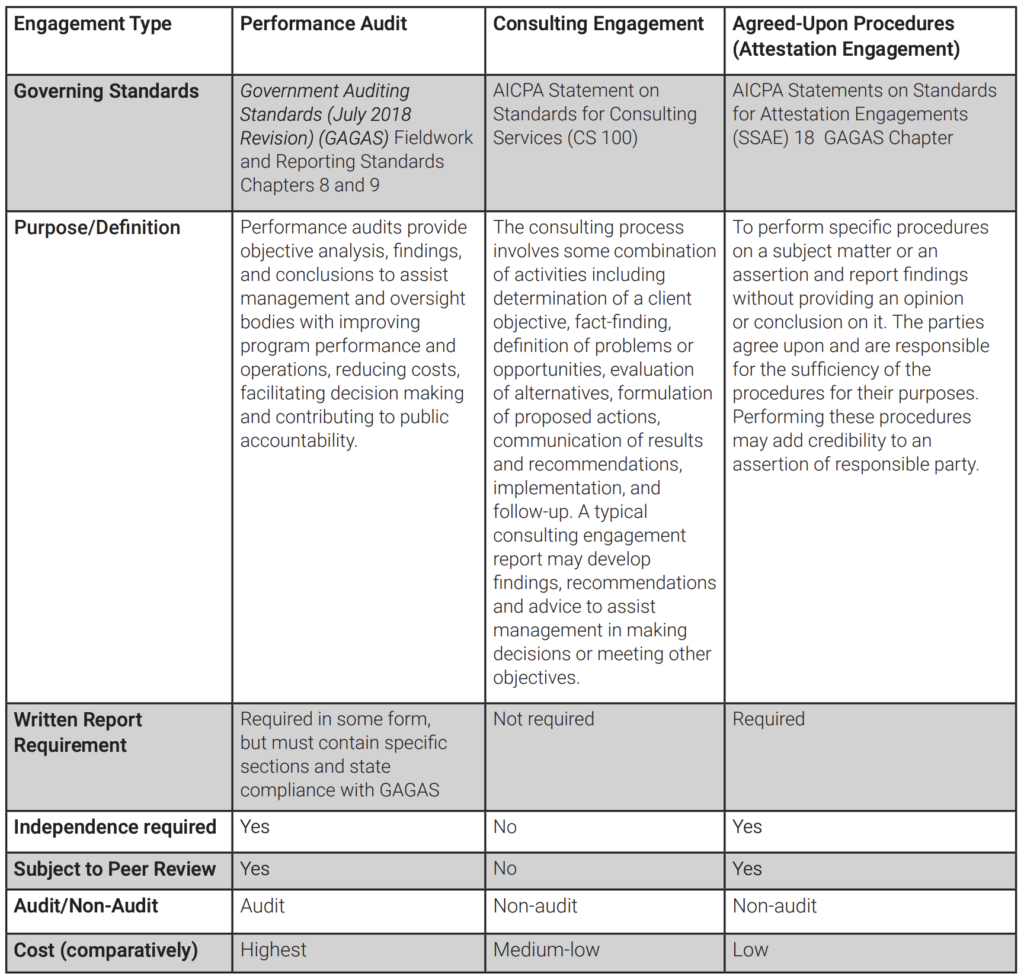

Much like a traditional CPA firm can provide different types of services related to an entity’s financial statements, i.e., audit, review, or compilation, based on need, when government agencies are considering an independent evaluation of performance of their programs or operations, the CPA firm’s advisory or consulting arm can step in and offer a number of engagement types based on the agency’s unique needs: consulting services engagements, attestation engagements (e.g., agreed-upon procedures), and performance audits. It all depends on if, and at what level, assurance is needed. The primary driver of what type of product should be considered is typically based on, for instance, issue complexity, taxpayer concerns or expectations, statute requirements, or increased need for transparency on the efficiency and effectiveness of operations. While the driver of the engagement may differ, time constraints and budget are also determining factors.

This is the first article in a three-part series focusing on performance audits. The primary focus of this article is to discuss the differences of the three aforementioned types of engagements – consulting services, agreed-upon procedures, and performance audits – and to provide guidance when a performance audit might be an option.

It is important to identify the differences between (1) performance audits, (2) consulting services engagements, and (3) agreed-upon procedures attestation engagements. On numerous occasions throughout my government service career and also while serving clients, questions have come up regarding the objectives sought, the scope of the engagement, and the engagement type when considering an evaluation of performance for a particular program or area of operations. Each of these engagements differ in purpose and reporting requirements, as well as potential cost, as shown below in Figure 1.0. These engagements are governed by different standards, formal reports are not always required for each, and independence is not always required (i.e., consulting services).

Performance Audits Defined

Performance audits are defined as engagements that provide objective analysis, findings, and conclusions to assist management and those charged with governance and oversight to, among other things, improve program performance and operations, reduce costs, facilitate decision making by parties with responsibility to oversee or initiate corrective action, and contribute to public accountability. *1

Furthermore, GAGAS states that management and officials of government programs are responsible for providing reliable, useful, and timely information for transparency and accountability of these programs and their operations. Legislators, oversight bodies, those charged with governance, and the public need to know whether (1) management and officials manage government resources and use their authority properly and in compliance with laws and regulations; (2) government programs are achieving their objectives and desired outcomes; and (3) government services are provided effectively, efficiently, economically, ethically, and equitably. *2

Agreed-Upon Procedures (AUP)

Based on my experience, it usually comes down to identifying a few factors that determine the engagement. First, the agency must determine the purpose and scope of the work, specifically what questions they would like to have answered. These questions can be broad or very narrow. For example, in an AUP, management may make an assertion about whether a subject matter is in accordance with, or based on, established criteria that is the responsibility of a third party and hires a CPA to add credibility to that assertion by performing specific procedures to test compliance with the criteria. If an agency needs to know something very specific and wants an independent party to perform specific procedures and tell them what was found, then an AUP is appropriate. However, an AUP report does not provide recommendations, an opinion, or conclusion about whether the subject matter is in accordance with, or based on, the criteria, or state whether the assertion is fairly stated. While the agency may want to use an AUP, some key steps that are taken in consulting engagements and performance auditing, such as planning, are not required in an AUP engagement. Also, risk is not assessed in developing the scope, nor does the auditor use a risk-based approach, which is required in a performance audit. Finally, in an AUP, auditors do not perform sufficient work to be able to develop elements of a finding or provide recommendations.

1 See Paragraph 1.21 of GAGAS.

2 See Paragraph 1.02 of GAGAS.

Consulting Services Engagement vs. Performance Audit

For a consulting services engagement or performance audit, the initial questions are then turned into the objectives of the engagement. If the agency wants an objective review of operations or a program to assist them in making decisions, for example, to assess the management of specific funds, and wants findings and recommendations to improve operations, then the agency should discuss the options of a consulting services engagement or a performance audit. From here, the decisions are truncated. The agency needs to consider whether the report is for an internal audience, such as governing officials, management, or staff, or an external audience, e.g., a regulatory agency or the public. If the communication is intended for internal use, then a consulting services engagement with observations and recommendations may suffice. For these engagements, findings, recommendations, and a conclusion is provided to assist management in decision making. Or, an independent third party, such as a CPA or an internal auditor, may be asked to answer the engagement’s objectives to an external audience, in which case a performance audit may be more appropriate due to the need for an independent, objective report that can withstand scrutiny and is subject to peer review. Sometimes there isn’t a choice; some agencies are bound by the government code or local ordinance to conduct audits under GAGAS.

Performance audits are typically the more costly engagement type of the three, given the amount of work required to conduct an audit and adhere to stringent standards. As we’ll explore in later articles, performance audits conducted under GAGAS provide the highest level of assurance among the three options, based on the level of work required. These audits involve developing the required elements of a finding and the documentary evidence required for planning, fieldwork, and reporting. The amount of work involved is much greater than in consulting services engagements, where observations and recommendations will suffice. Consulting services engagements are not audits and, therefore, offer no assurance. Similarly, in attestation engagements, where only specific procedures are performed, no assurance is provided. *3

Conclusion

Having been on both sides of deciding what engagement to recommend, either for an agency I worked at or to a client, it’s important to discuss the level of work required for each engagement type, the number of hours required to do the work under the appropriate standard within a reasonable time period, and the available budget. Finally, and most importantly, clients should understand that performance audits and consulting services engagements each have their place and serve unique purposes. A performance audit offers independence and objectivity at a step above a consulting services engagement, and might be the best option if a rigorous audit of a program or agency is needed. This is where the consideration of the agency’s need is paramount. There may not always be the budget or time available to conduct a comprehensive performance audit, nor a need for an in-depth evaluation or a legislative requirement to do so. In these instances, a consulting services engagement is a good option, especially when time and budget are factors. A consulting services engagement can provide a sufficient report with recommendations and advice. However, it’s important to make the agency aware of the limitations of non-audit services. In addition, the audience of the final report product and any regulatory requirements should strongly influence the decision-making process.

Forthcoming articles in this series will drill down and focus in more detail on the professional standards associated with performance audits as compared to other types of engagements, “why” an agency would want a performance audit instead of a consulting engagement or an agreed-upon procedures engagement, when a performance audit would be recommended, what key factors should be considered, and what are the expectations of the audience of the report. The third article in this series will focus on the reporting elements of a performance audit and a sample performance audit report.

*3 Attestation engagement standards are covered in GAGAS Chapter 7, and include agreed-upon-procedures, reviews, and examination engagements. Attestation examinations have the highest level of assurance, as an opinion is given; not so for the others. Auditors may use GAGAS in conjunction with other professional standards such as American Institute of Certified Public Accountants (AICPA), International Auditing and Assurance Standards Board (IAASB), or Public Company Accounting Oversight Board (PCAOB) standards. For financial audits and attestation engagements, GAGAS incorporates by reference for AICPA Statements on Auditing Standards and Statements on Standards for Attestation Engagements. In addition, the AICPA promulgates the consulting standards. AICPA standard committees have taken the position that only the U.S. Government Accountability Office (GAO) sets performance audit standards.

CLICK HERE to download article from AICPA >

SOURCES OF INFORMATION AND DOCUMENTATION CONSIDERED

- Government Auditing Standards, issued by the Comptroller General of the United States

– July 2018 Revision (effective for performance audits beginning on or after July 1, 2019; effective for attestation engagements for periods ending on or after June 30, 2020; early implementation is not permitted) - United States General Accounting Office. Best Practices Methodology – A New Approach for Improving Government Operations. May 1995

About the Author

Scott Johnson has 35 years of experience in government administration, with a focus on successfully overseeing internal service operations including; debt management, information technology, human resources, municipal finance, and budget. He has led large and mid-sized operations for California government agencies including the cities of Santa Clara, Milpitas, San Jose, Oakland, and Concord and the County of Santa Clara. Scott is a past president of the California Society of Municipal Finance Officers (CSMFO) and a member of the AICPA Government Performance and Accountability Committee (GPAC). He is currently a partner with Macias Gini & O’Connell LLP (MGO), leading the Advisory Services sector specializing in State and Local Governments, based out of California. He welcomes any questions or comments via email: [email protected].

Greta MacDonald, MPA – Special recognition is given to Ms. MacDonald for her contributions and research for this article. Ms. MacDonald is a Director with MGO in the State and Local Government Advisory Services division. She has over 17 years of experience conducting over 35 performance audits in accordance with GAGAS, which is her specialization area.

Disclaimer: The views expressed in this article are those of the author and do not reflect the official policy or position of the GAO, AICPA, or Macias Gini & O’Connell LLP.