Key Takeaways:

- Professional gaming careers can be lucrative but short-lived, making smart financial management crucial from the start.

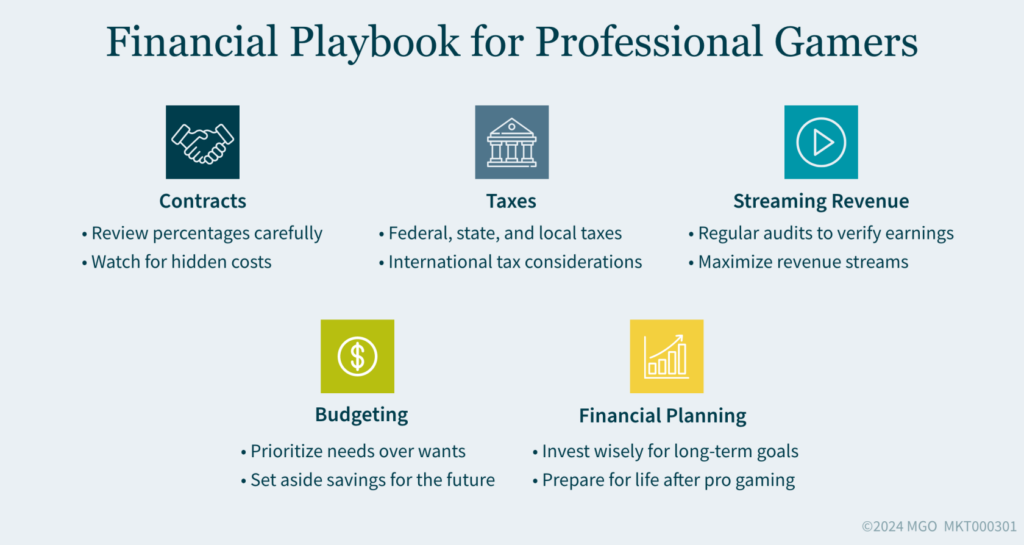

- Mastering the intricacies of contracts, taxes, and revenue streams is essential for pro gamers to maximize earnings and avoid costly pitfalls.

- Building a sustainable financial future in esports demands a strategic balance between capitalizing on current opportunities and planning to achieve long-term goals.

~

The rise of electronic sports (esports) has been nothing short of phenomenal. According to Variety, esports viewership increased a whopping 92% from 2019 to 2023 — with viewers watching more than 2.5 billion hours of esports events last year. Major colleges and universities like Ohio State now offer esports degrees, and brands like Intel, Coca-Cola, and Mastercard are spending millions on esports sponsorships each year.

As a professional gamer, you’re part of this fast-growing industry. But with the thrill of competition and the allure of sponsorships comes the challenge of managing your earnings. Whether you’re streaming on Twitch, competing on the esports circuit, or signing a deal with a major brand, understanding how to manage and maximize your income is crucial.

Making the Right Deal: Stream Play Versus Team Play

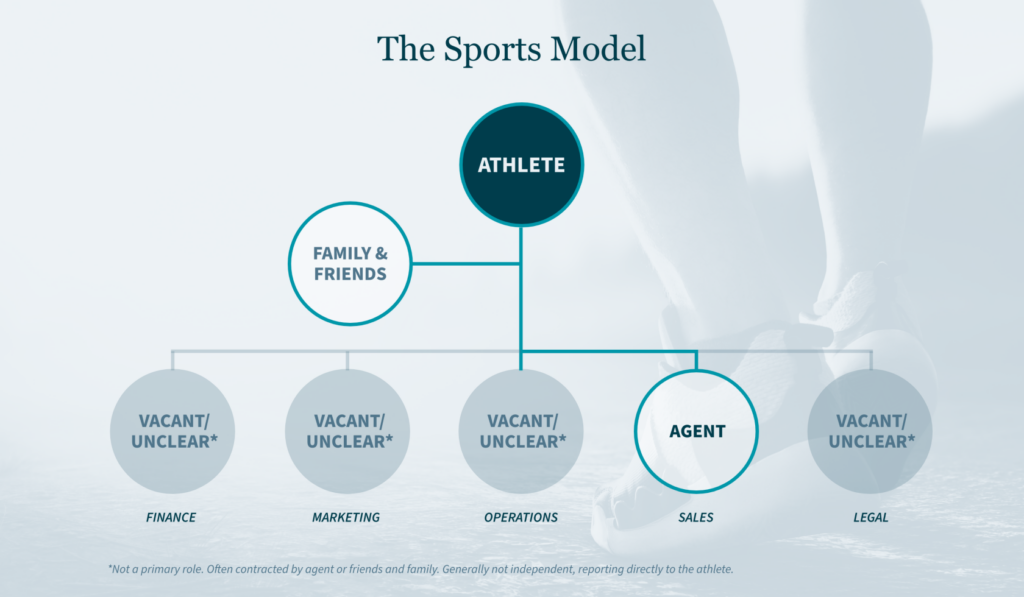

As a pro gamer, you’ll likely face a key decision: Should you focus on building your own brand through streaming or join a team? Both options have their pros and cons, and your choice will impact your earnings significantly.

Streaming: Building Your Own Brand

Streaming offers you the opportunity to build a personal brand and connect directly with your audience. Platforms like Twitch and YouTube allow you to monetize your content through ads, subscriptions, and donations. However, it also means you’re responsible for managing your content, marketing yourself, and properly tracking and reporting your earnings.

An additional challenge with streaming is validating that you’re getting the right percentage from platforms like YouTube. Are you confident that your views and ad revenue are being reported accurately? This is where working with a financial advisor or a business manager can help. They can audit your earnings, verify you’re being paid fairly, and help you optimize your revenue streams.

Joining a Team: Stability with a Salary

Joining an esports team can provide a steady salary and the chance to compete at the highest levels. Teams often handle sponsorships, brand deals, and the logistics of competition, allowing you to focus solely on your gameplay. However, the trade-off is that you may have less control over your brand, and the team may take a cut of your earnings from sponsorships or tournament winnings.

Before signing with a team, it’s critical to have a lawyer review your contract. They can help you understand the terms, such as how much of your earnings the team will take, what happens if you leave the team, and what other obligations you may have. Remember, a contract that seems straightforward can contain clauses that significantly impact your income and career.

Navigating Taxes in Professional Gaming and Esports

As you start earning from your gaming career, taxes are one of the first challenges you’ll face. Your earnings — whether from streaming, sponsorships, or tournament winnings — are all taxable. It’s essential to understand how taxes work in both the country/locality where you live, as well as any jurisdictions where you earn money.

Domestic Taxes: Earning Income Across the U.S.

In the United States, professional gamers are often subject to what’s known as the “jock tax.” Originally designed for athletes, this tax rule applies to individuals who earn income in states where they do not reside. Today, the rule extends beyond athletes to include high-income earners like entertainers and competitive gamers. The tax is typically based on the number of “duty days” you spend in a state for income-generating activities.

For example, if you live in Illinois and come to California for a tournament, California can tax you on that income — even if you’re only there for a few days. Enforcement of the “jock tax” varies by state and locality, and whether you are taxed may depend on how much you earn (the more you make, the more likely you are to be taxed). Because of varying state and local tax rules, you may end up owing taxes in multiple states and localities depending on where you compete and earn income.

Additionally, if you’re selling merchandise or other products as part of your brand, you’ll also need to be aware of sales tax obligations. Depending on where your customers are located, you may be responsible for collecting and remitting sales tax to different states and localities. Each jurisdiction has its own rules, and failing to comply with them could result in penalties or back taxes.

International Taxes: Considerations for Global Gamers

With esports growing globally, you might earn pro-gaming income from multiple countries — each with its own tax rules. For example, if you win a tournament in South Korea or get sponsorship from a European company, you may owe taxes in those countries. You also need to report all foreign income to your home country, adding complexity to your taxes.

Here are some considerations to keep in mind when managing international taxes:

- Double taxation: To avoid paying taxes in two countries on the same income, you can use options like exclusions or foreign tax credits (FTCs). Tax treaties between some countries can also reduce your tax burden. But not all countries have treaties, and claiming these credits can involve complex filings and detailed records. Knowing your options and understanding how to apply them can help you manage your taxes strategically and minimize what you owe across borders.

- Withholding taxes: Various countries impose a withholding obligation on certain types of revenue streams. This means, before you receive your earnings, the country may withhold a portion of your taxes. The rate varies depending on the type of income and local tax laws.

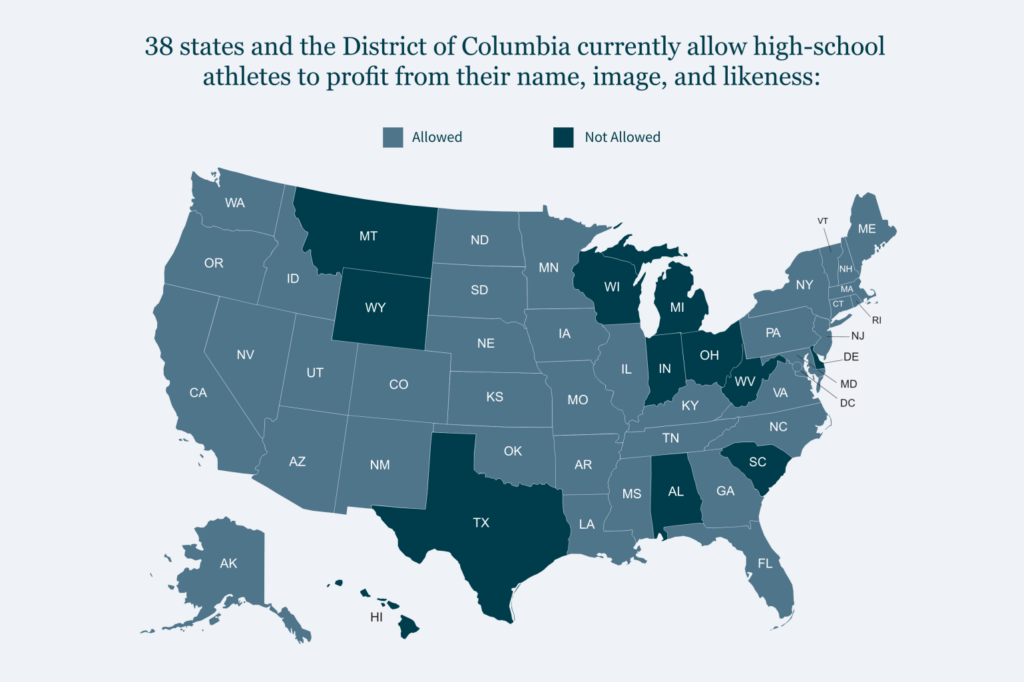

- Intellectual property (IP): Savvy professional gamers are cognizant of IP such as copyrights and trademarks, as well as name image and likeness (NIL). Whether revenue streams like photoshoots, appearances, speaking engagements, and even your social media presence are compensated as “services” or a “right of use” can influence taxation in various countries. Having clear contracts that appropriately define income classes can help you best manage taxation and protect your rights.

Given the complexity of both domestic and international tax laws, it’s wise to consult with a tax team familiar with the esports industry. They can help you navigate multistate and international tax rules, take advantage of deductions and credits, and structure your finances in a way that minimizes your tax burden across multiple jurisdictions.

5 Common Financial Pitfalls Pro Gamers Should Avoid

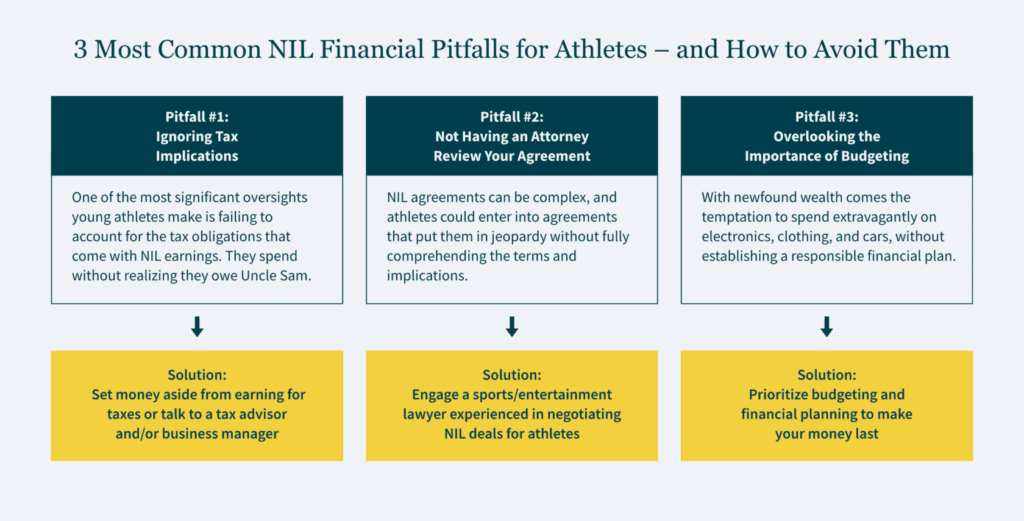

In the fast-paced world of esports and professional gaming, it’s easy to get caught up in the excitement and make decisions that could hurt your financial future. Here are a few pitfalls to watch out for:

1. Don’t Rush into Contracts

It’s tempting to sign the first deal that comes your way, especially when there’s a significant amount of money involved. But taking your time to understand the terms of the contract can save you from potential headaches down the line. Work with legal and financial advisors to review any offers before you sign.

2. Watch Out for Hidden Costs

Some deals come with hidden costs that can eat into your earnings. For example, if a team covers your living expenses but then deducts those costs from your winnings you could end up with much less than you expected. Always ask for a detailed breakdown of any expenses and how they will be handled.

3. Budget for the Long Haul

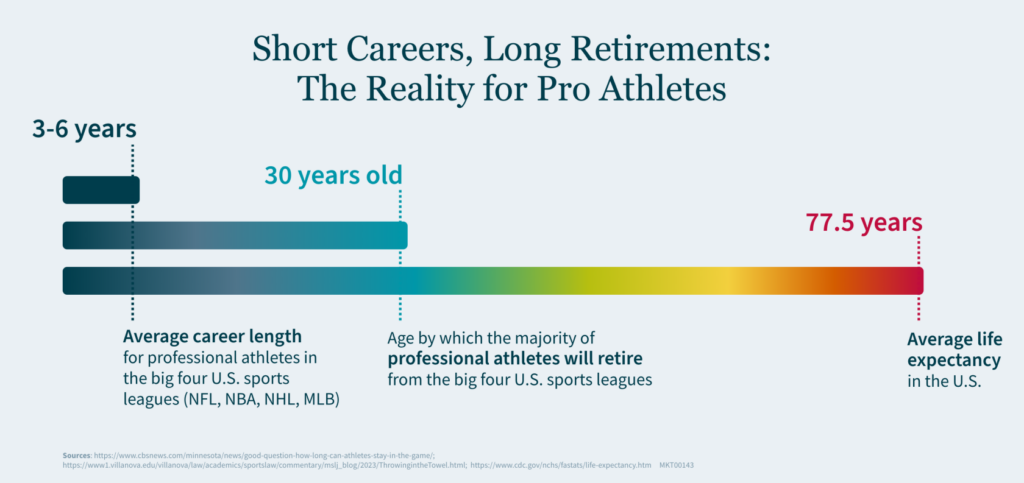

Esports careers can be short — a recent Washington Post headline read “Esports stars have shorter careers than NFL players” — with the peak years often occurring in your early 20s. This makes budgeting and saving for the future even more important.

4. Prioritize Needs Over Wants

When the money starts rolling in, it can be tempting to splurge on the latest gear or a luxury lifestyle. But remember, this income may not last forever. Prioritize saving and investing your money wisely. Work with a financial advisor to create a budget that accounts for your current needs and future goals.

5. Plan for a Sustainable Future

Consider how your current earnings can help you achieve your long-term goals. Whether you want to invest in a new business, save for retirement, or buy a home, planning ahead is key. This is where having a solid financial plan and the right advice can make all the difference.

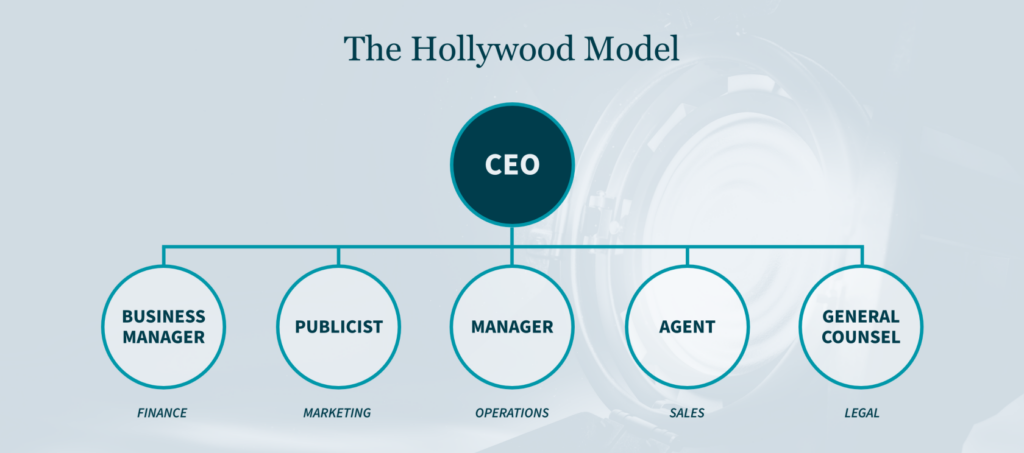

Level Up Your Financial Strategy

Managing your finances as a pro gamer can be overwhelming, especially when you’re focused on winning and building your brand. That’s why having experienced professionals in your corner can make all the difference. Working with a team of advisors — whether it’s a tax professional, lawyer, or financial planner — can give you the peace of mind to focus on your game knowing your finances are in good hands.

How MGO Can Help

We know the unique challenges you face as a professional gamer. From reviewing contracts to navigating international taxes, we’re here to help you maximize your earnings and secure your financial future. Before you sign any deal or make a financial decision, talk to our Entertainment, Sports, and Media team.