Executive summary

- When planning your estate, you must now consider the future of your digital assets.

- Digital assets can include cryptocurrency, nonfungible tokens, intellectual property rights, domain names and websites, and more.

- To make sure your digital assets can be accessed and transferred without incident, proactive planning is key.

- There are risks and challenges associated with each storage and transfer method, so you must choose the best one for you and your beneficiaries.

Estate planning is an ever-evolving process that should be continually revisited as one moves through the various phases of life. There are many facets to consider when it comes to protecting and planning for your assets. Who will get the house and other tangible assets? What about choosing beneficiaries for retirement accounts and life insurance policies?

These are questions surrounding more traditional assets, which certainly play an important role in estate planning, but in today’s technologically advanced age, these are not the only types of assets that should be considered. Digital assets play a larger role in our lives with each passing year, bringing their own unique complications and potential pitfalls to your estate plan.

It can be akin to the Wild West when it comes to the laws governing access to digital assets after one has passed, which can vary in different states or countries, as well as company to company. Read on to learn more about the proactive planning they require to be confident your estate will be administered smoothly.

What are digital assets?

Digital assets are anything created and stored digitally (i.e., on a cell phone, a server, computer, or other electronic device) that has or provides value. This can be sentimental value, as well as the more direct financial value. They can include data, videos, images, written content, and more — and, like tangible assets, they have ownership rights.

Some of the more common examples when it comes to estate planning are:

- Cryptocurrency, such as bitcoin

- Nonfungible tokens (NFTs)

- Intellectual property rights

- Domain names and websites

Accessing your digital assets

Issues can arise with digital assets if they aren’t given proper consideration in your estate plan. Without adequate planning, the executor of one’s estate may have issues locating and accessing the assets, meaning they could go untouched, never reaching the intended beneficiary or providing value to anyone.

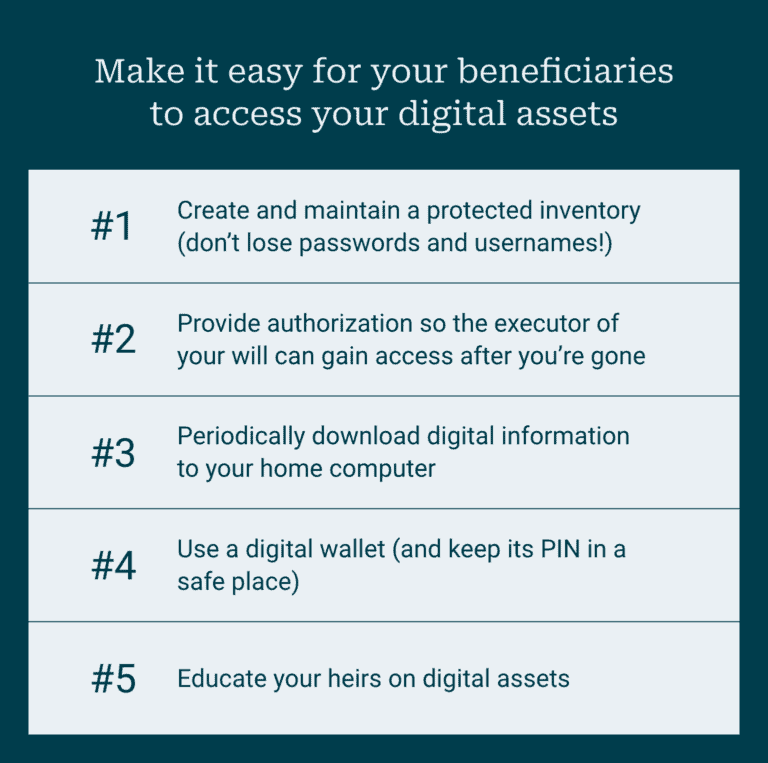

Typically, digital assets are password-protected. To ensure the fiduciary will have access after one passes, it is important to create and maintain a secure inventory of your digital assets and online accounts with their respective login information (such as passwords and usernames). If access requires a biometric reading, such as face or iris recognition or fingerprint scanning, be sure you communicate this to the service provider or administrator, so authority is not challenged, risking permanent loss of access.

However, due to federal privacy laws such as the Computer Fraud and Abuse Act and the Stored Communications Act, as well as online user agreements, it can be difficult to gain access to online accounts from service providers. To mitigate this, as part of one’s estate plan, it is advisable to prepare a statement to permit these companies to disclose the account information to whoever is executing the will and handling the estate proceedings. Unfortunately, some companies don’t always comply with intended authorization, depending on the terms and conditions of their agreement.

To best avoid control and access issues, periodically download digital information to a home computer so, with the assistance of online afterlife companies, the information can be easily restored.

Digital storage of digital assets

There is also an option to store certain digital assets in a way that is not reliant on the internet: using a digital wallet. This is also referred to as “cold storage” or a “cold wallet,” and they are not accessible via the internet. Thus, they are what most consider to be the safer approach to storing digital assets because they can’t be easily hacked or broken into. In fact, in some cases, it’s impossible to do so.

This type of storage, however, does come with its own set of risks. Because it is accessed by a password and private key (which is like a secret PIN used to confirm transactions and prove ownership of a blockchain address), if those are lost or destroyed, it could mean losing the assets forever. There is no “forgot password” option or customer service department to call for help. We advise storing the password and key in a way that is also not accessible through the internet (i.e., on a phone or computer). Storing the access information at home could also prove risky due to the chance of a break-in, house fire, or natural disaster. Securing them in a safe deposit box or making multiple copies to store in various places are recommended approaches.

Transferring your digital assets

Physically transferring digital assets to heirs can also be challenging. It is important that clear instructions are left detailing the intent for the content and ensure heirs have access to the assets as needed.

For example, if digital assets are stored on a computer, those may be transferred with the computer without proper planning. If the same person isn’t to inherit the computer and the digital assets housed there, this needs to be specified.

When working with cryptocurrency, it can be especially challenging to transfer to heirs because most exchanges do not allow a beneficiary to be named directly within the account — transferring ownership must be done via a will or legal document. Be sure to leave account information and/or private keys with a trusted source — or, as noted above, secure it in a safe place (and tell someone where it is). It is challenging enough when a family loses a loved one; difficulties in executing their estate plan will further the burden.

Another measure that can be taken to ensure estate executors and heirs know how to work with digital assets is for all parties to have familiarity with the transfer process. This can be more complicated than a basic bank transaction — each recipient will need his or her own personal digital address for each type of digital currency. Some range in excess of 100 characters and can be confusing or overwhelming to maneuver and work with.

We advise some training or practice while the original owner of the assets is still living to help alleviate these concerns. When needing to transfer larger asset values, we suggest first initiating a transfer of a very small portion of the total asset value to ensure the process is working as intended, then proceeding to repeat the process with the remainder. If a mistake is made and asset value is sent to the wrong digital address, it may be lost permanently.

MGO’s perspective on digital assets and estate planning

A proper estate plan should ensure your assets — all of them — fall into good hands after one passes. Without proper planning in this new and ever-changing arena of digital assets, the value of these assets may be lost. Maintaining an inventory of assets, accounts, and their associated passwords; backing up data; and meeting with a professional who can assist with these steps goes a long way towards ensuring your digital assets are not lost into the digital abyss.

MGO’s Private Client Services team is equipped to help you with this unique form of family wealth management. Contact us to learn more about how you can ensure your digital assets endure the test of time.