Key Takeaways:

- Employers should promptly respond to IRS notices regarding ERC claims to avoid disallowance and potential legal action.

- Accurate documentation is essential, particularly regarding qualifying government orders and the eligibility period for ERC claims.

- Understanding IRS-identified risks, such as overstating claims and calculation errors, is crucial to avoid costly compliance issues.

~

UPDATE (AUGUST 2024):

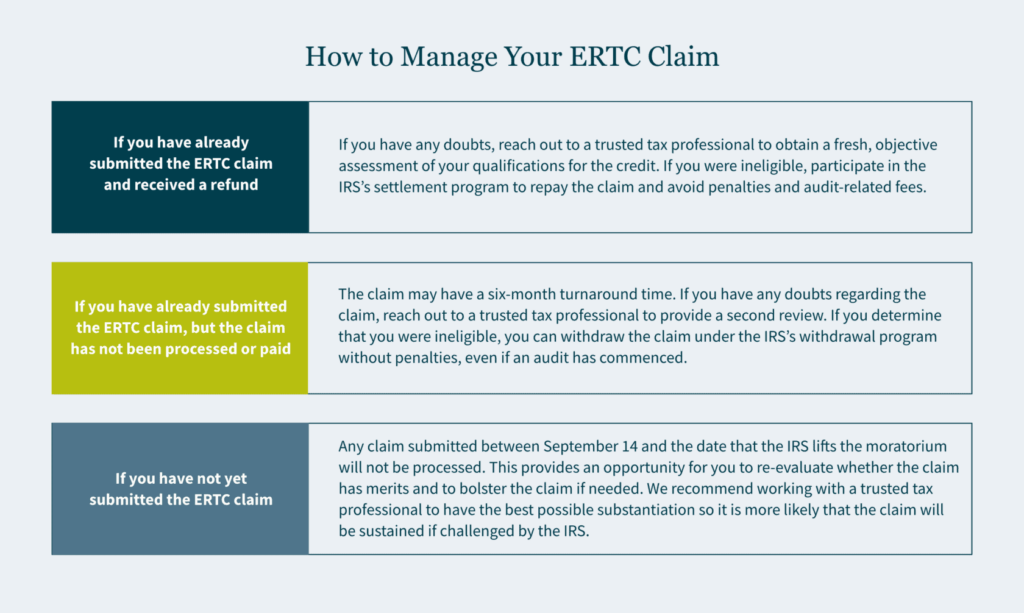

The IRS is advancing its processing of Employee Retention Credit (ERC) claims while extending the moratorium on new claims to January 31, 2024. The IRS will now start processing claims filed between September 14, 2023, and January 31, 2024. This shift allows the IRS to expedite payments for legitimate claims and crack down on improper filings. What this means is that taxpayers who filed ERC claims after the prior moratorium date of September 14, 2023, and have been waiting for them to be processed, should now see progress on these claims in the coming months. This is a very positive development for taxpayers who have submitted pending claims.

Recently, 28,000 disallowance letters were sent, potentially saving $5 billion in erroneous payouts. The agency’s actions reflect a careful balance between protecting taxpayers and ensuring eligible businesses receive due funds. The IRS also recently reported that it has identified 50,000 valid ERC claims and is quickly processing them and sending refunds in the weeks ahead.

For those taxpayers who have received denial letters or believe their claims were wrongly rejected, there are several paths to address these issues. Consulting with a tax controversy advisor is advisable to determine the best course of action, including the possibility of appealing the decision. In some cases, taxpayers may consider pursuing legal action through tax court, U.S. District Court, or the Court of Federal Claims, either as an alternative to an appeal or following an unsuccessful one. Engaging an attorney early in the process is recommended to explore all available options.

To combat a wave of frivolous Employee Retention Credit (ERC) claims, the IRS has sharply increased compliance action through audits and criminal investigations, with more activity planned in the future. In this heightened enforcement-focused environment, employers are advised to act swiftly when responding to IRS notices regarding ERC claims.

Immediate Action Required for Employers Receiving IRS Audit Notifications

Employers must be aware that failing to respond to IRS notices within the time frame specified can lead the IRS to disallow the entire ERC claim and issue a notice of disallowance. Once the IRS formally disallows a refund claim, the taxpayer may be permitted to first file a protest with the IRS Office of Appeals or, in some cases, the taxpayer may decide to file a lawsuit in federal court to litigate the issue. Both scenarios subject employers to the necessary defense of an often burdensome and costly refund claim controversy, further delaying the much-needed ERC relief promised by Congress.

The successful defense of any ERC examination will depend greatly on an understanding of the risks and eligibility criteria to avoid the costly repercussions of noncompliance, including the potential for general examination. In Notice IR-2024-39, the IRS highlighted warnings signs that ERC claims may be incorrect, urging businesses to revisit their eligibility.

Key Examination Risks Identified by the IRS

- Claiming Too Many Quarters: It is unusual for employers to qualify for the ERC in all available quarters. A meticulous review of eligibility for each quarter is advised to avoid overstating claims.

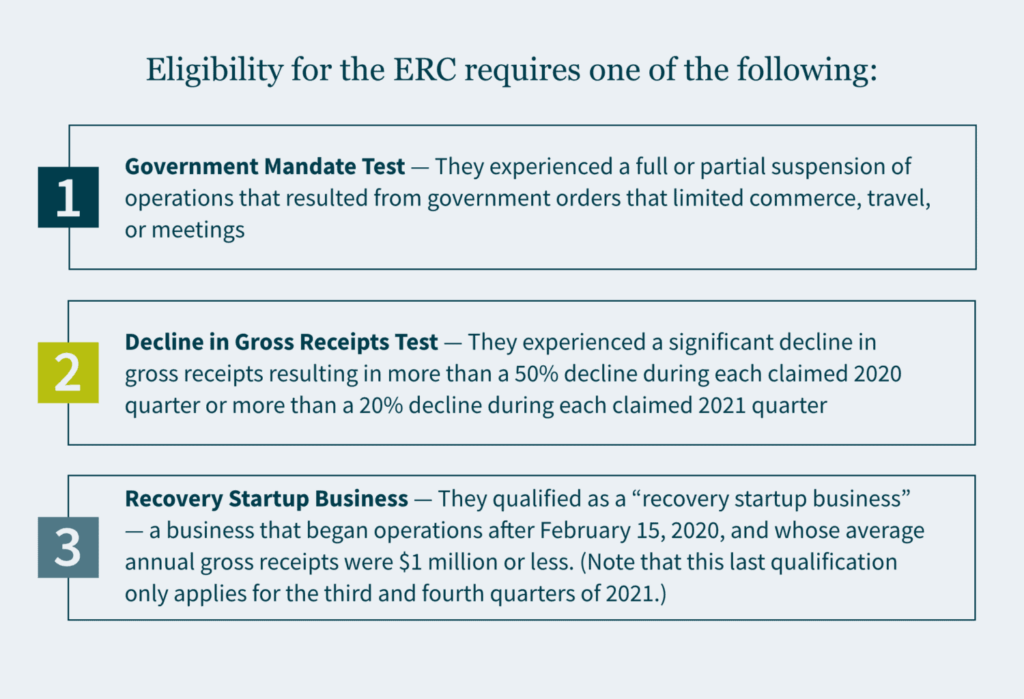

- Non-Qualifying Government Orders: The IRS has clarified that not all government orders related to COVID-19 qualify for the ERC. Orders must have directly affected the employer’s operations, and mere guidance or recommendations do not suffice. Businesses must be able to document and substantiate the impact of qualifying government orders.

- Employee Counts and Calculation Errors: Thanks to changes in the law throughout 2020 and 2021, employers must now be vigilant in their calculations, adhering to the dollar limits and credit amounts for qualified wages.

- Supply Chain Disruptions: Qualifying for the ERC based solely on supply chain issues is rare. Employers must demonstrate that their supplier was affected by a qualifying government order.

- Overstating the Eligibility Period: Claiming the ERC for an entire calendar quarter is possible only if the business was impacted for the full duration of the quarter. Employers are entitled to claim ERC only for wages paid during the actual suspension period and must maintain accurate payroll records.

Navigating Refund Claim Controversies Amid Increased IRS Action

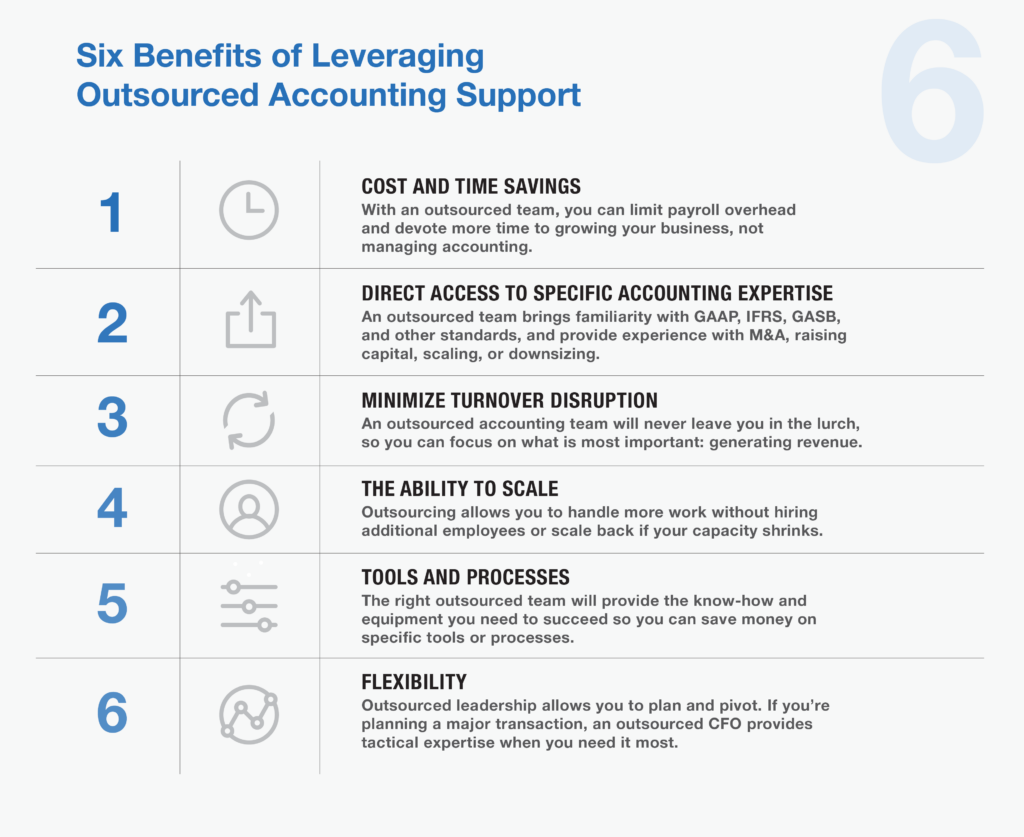

Employers should seek guidance from trusted tax professionals to maintain compliance and effectively manage the challenges of the IRS’s ongoing enforcement actions.

How MGO Can Help

MGO can assist you in navigating IRS audits and ERC claims — helping you meet compliance standards, provide accurate documentation, and address tax controversies. For detailed assistance, visit our Tax Advocacy and Resolution services.