Key Takeaways:

- Professional athletes need to assemble teams of qualified advisors to properly manage their complex financial affairs, just as successful CEOs build executive teams to run their companies.

- The business manager or CFO plays the crucial role of quarterbacking the athlete’s daily financial operations — providing advice, serving as a gatekeeper, and coordinating the overall strategy with other advisors.

- Carefully vetting and selecting a highly qualified, ethical business manager is essential, as many professional athletes have fallen victim to mismanaged finances.

~

As an athlete entering the draft, you are no longer just a player. You are now a professional, paid to play the game you love at the highest level. But along with the title “professional athlete” comes the weight of greater financial responsibility.

The financial profile of a professional athlete more closely resembles a mid-sized, private company than a typical household. While the economics can be exceptional, an alarming number of players lack the support structure necessary to navigate the depth and complexity of their financial requirements.

A professional athlete is the CEO of the brand that bears your name. To ensure the long-term value of that brand, you need to embrace this role and re-imagine your future beyond the playing field.

How to Assemble a Team to Support Your Athletic Career

Six-time NBA champion Michael Jordan once said, “Talent wins games, but teamwork and intelligence win championships.” This is just as true in the business world as it is in the world of professional sports. That’s why the world’s top CEOs make team-building their top priority. The way they approach that process serves as a valuable roadmap for both CEOs and athletes alike.

The Corporate Model

Most businesses share a common structural framework. While details may vary across different industries and global regions, the core elements of the Corporate Model (below) remain consistent. This framework identifies the primary business functions and areas of expertise critical to an organization’s success.

The Corporate Model has been successfully adapted to a wide variety of business categories, evolving as necessary to the unique needs of each organization’s operating environment.

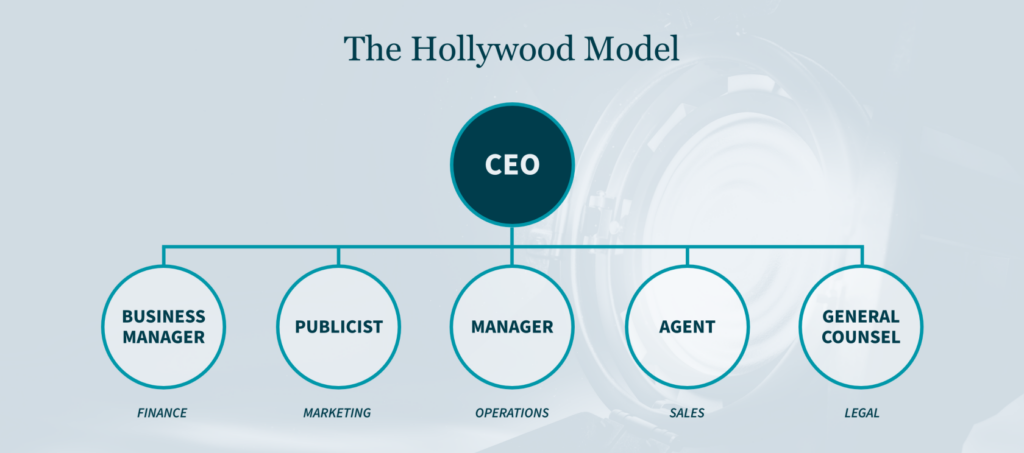

The Hollywood Model

The film and television industry shares many traits with professional sports. The quality of the product is determined largely by the quality of talent in the spotlight — driving significant demand and high salaries for the best actors, directors, writers, etc.

Over the years, Hollywood leaders recognized that many of the same principles of growth and financial governance in the corporate world apply to talent in film and television. This led to the evolution of what we call the Hollywood Model (shown below).

This model identifies the importance of each individual role in the Corporate Model, albeit by different names. For example, the Chief Financial Officer (CFO) becomes the Business Manager, taking the lead on the client’s financial affairs.

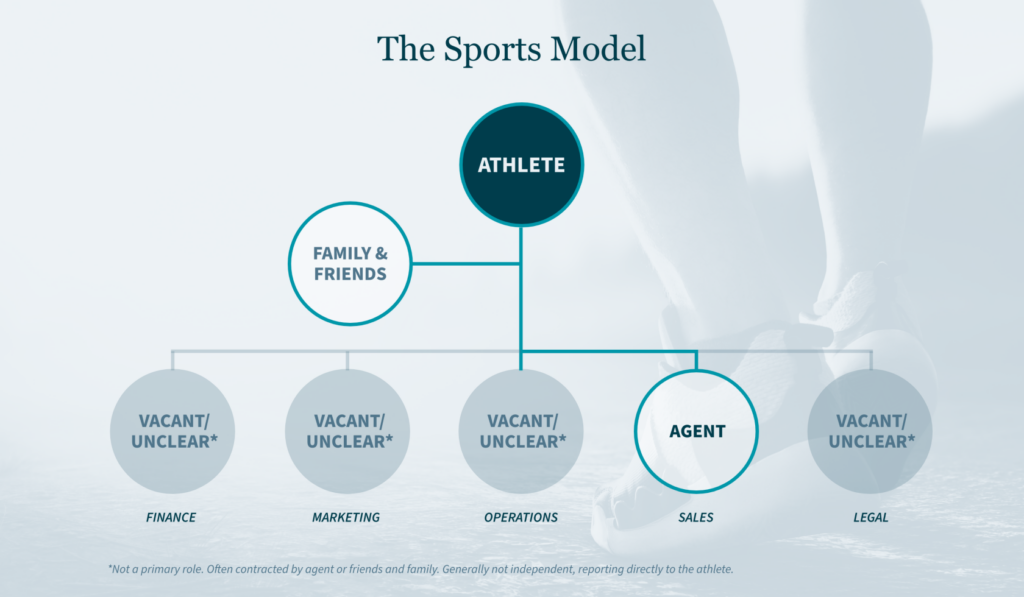

The Sports Model

Over the past several decades, the financial lives of professional athletes have become increasingly complex. Salaries, endorsements, appearances, and other sources of income have grown significantly, and so have demands for athletes’ time and attention. However, the average player’s support system has failed to evolve at the same pace. The model below shows how the support team of a typical athlete compares to Corporate Model.

While professional athletes understand the importance of experience, expertise, and teamwork, they often lack a clearly defined model for building their teams off the field. The majority of highly publicized financial failures in professional sports stem from athletes who were either (a) missing key role players on their teams, or (b) trusting important roles to inexperienced or sometimes even unscrupulous acquaintances.

The MGO Model

At MGO, we have been fortunate to work with some of the most successful executives and entrepreneurs in the world — as well as many of the biggest names in sports and entertainment. As a result, we have come to know the traits and practices that drive success across industries.

The MGO Sports Model identifies and defines the roles critical to success — and aligns the work of leading advisors under a common vision. While each role is important, we encourage you to begin with the person who will serve as the quarterback of your daily financial life: your CFO/Business Manager.

Roles and Responsibilities of Your Business Manager

While each member of your team plays a vital role, the CFO/Business Manager is the person with the most tangible daily impact on your financial life.

Here are four ways your CFO/Business Manager contributes to your team:

- Quarterback – Your business manager leads your financial operation, responsible for hands-on, real-time execution of the financial plan. This includes establishing budgets, paying bills, and monitoring the expenditures of anyone with access to your accounts or credit cards.

- Advisor – Business managers serve as on-call financial advisors, working closely with you on your most important financial decisions — including family estates and trusts, marketing and name, image, likeness (NIL) deals, tax planning (including international tax), major purchases, potential investments, and charitable contributions.

- Gatekeeper – High-profile athletes can be targets of investment scams and unwarranted requests for financial support. When these propositions come from friends, family, and former acquaintances, your business manager can serve an important gatekeeper function. By establishing a recognized first point of contact for all financial requests, most questionable requests can be filtered out before they reach you.

- Strategist – Your business manager works closely with your entire roundtable of advisors, ensuring that everyone is aligned and working together to implement a common strategy.

Selecting a Trusted Business Manager

Despite the critical role played by CFOs/Business Managers in the financial lives of their clients, most states require no credentials to use the title. As a result, there are people with little or no accounting experience using that title today.

Many of the highly publicized financial challenges in sports and entertainment have stemmed from unqualified and/or unethical advisors serving in the role of business manager for high-profile clients. That’s why we suggest doing your own due diligence before hiring the quarterback of your financial team.

Things to consider when selecting a CFO/Business Manager:

- Is the business manager a licensed CPA (certified public accountant)?

- Is the business manager’s firm a licensed CPA firm?

- What systems and certifications do they have in place to safeguard your money and data privacy?

- What services will the CFO/Business Manager provide? For example…

- Financial Planning

- Bill Pay and Cash Management

- Tracking Income/Receivables

- Negotiating/Overseeing Major Purchases

- Overseeing Insurance/Risk Management

- Tax Consulting/Preparation

- What types of reports will you receive? (ask to see samples)

- How is bill pay managed? How are payment authorizations handled?

- Do they have a dedicated staff? Do they have experience with similar clients?

Need Help Navigating the Complexities of Your Financial Journey?

MGO’s dedicated Entertainment, Sports, and Media team understands the unique challenges athletes face and provides tailored solutions that align with your goals. Reach out to us today to learn how we can help you achieve financial success beyond the field.