Welcome to the Cannabis M&A Field Guide from MGO. In this series, our practice leaders and service providers provide guidance for navigating M&A deals in this new phase of the quickly expanding industries of cannabis, hemp, and related products and services. Reporting from the front-lines, our team members are structuring deals, implementing best practices, and magnifying synergies to protect investments and accrete value during post-deal integration. Our guidance on market realities takes into consideration sound accounting principles and financial responsibility to help operators and investors navigate the M&A process, facilitate successful transactions, and maximize value.

In the cannabis and hemp industries, capturing the true value of real estate holdings in an M&A deal can be both elusive and central to the overall success of the transaction. Difficult-to-acquire licenses and permits are essential for operating, which often drives up the “ticket price” of property, ignoring operational and market realities that suppress value in the long run. On the flip side, real estate holdings are sometimes considered “throw-ins” during a large M&A deal. These properties can hold risks and exposures, or, in many cases, are under-utilized and present an opportunity to uncover hidden value.

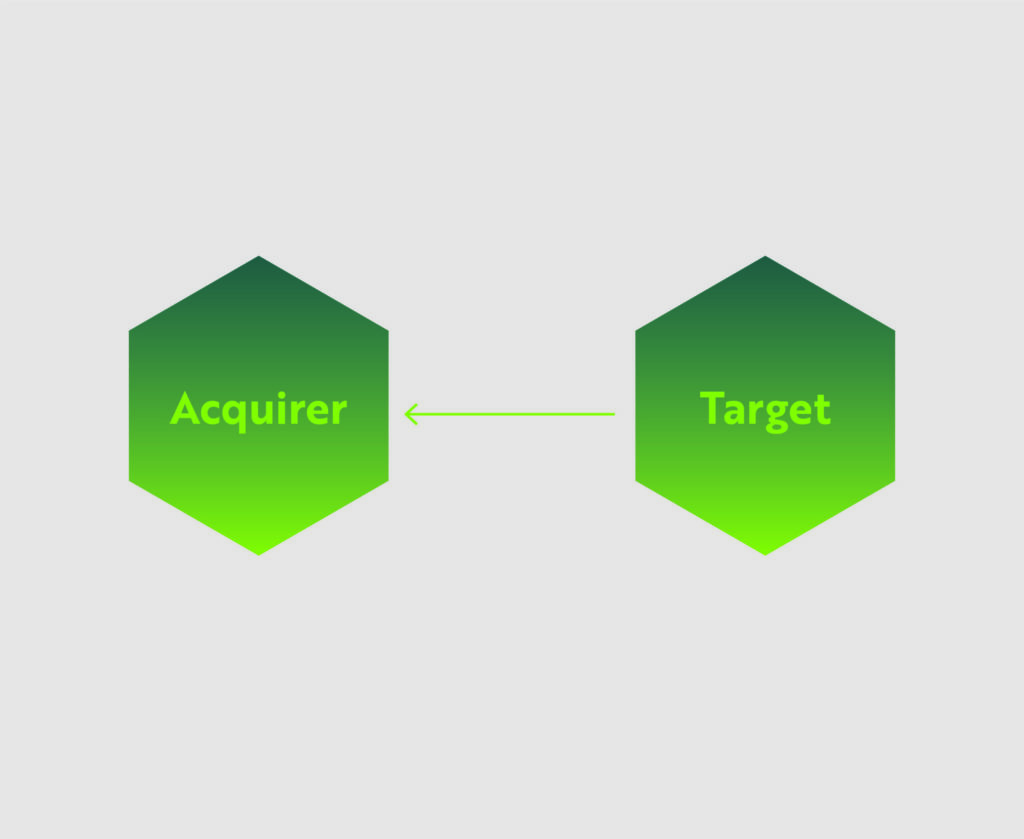

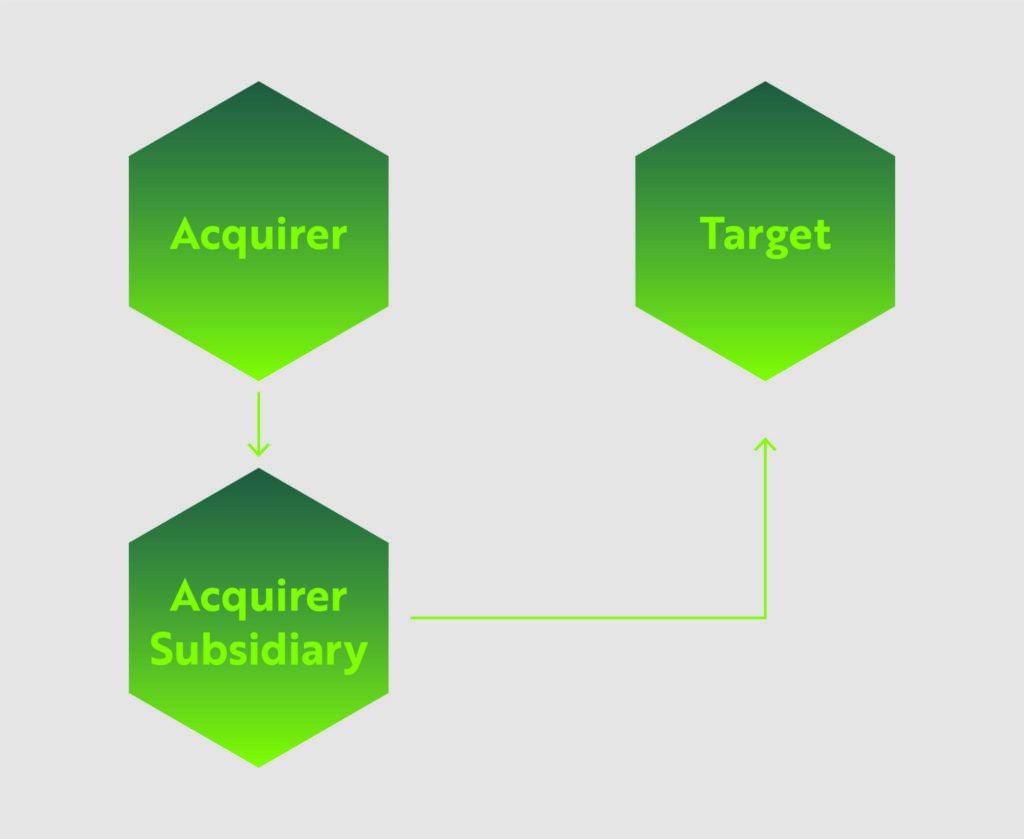

Both Acquirers and Target companies must take specific steps toward understanding the varied layers of risk and opportunity presented by real estate holdings. In the following, we will address some common scenarios and provide guidance on the best way to ensure fair value throughout an M&A deal.

Real estate as a starting point for enterprise value

Leaders of cannabis and hemp enterprises must understand that real estate should be a focus of the M&A process from the very beginning. All too often, c-suite executives are well-acquainted with detailed financial analyses for other parts of the business, but have a limited or out-of-date idea of their enterprise’s square footage, details of lease agreements, or comparable values in shifting real estate markets. Oftentimes it takes a major business event, like an M&A deal, to spur leadership to reexamine and understand real estate holdings and strategy. Regrettably, and all too often, principals come to that realization post-closing and realize they may have left money on the table.

In an M&A deal, the party that takes a proactive approach to real estate considerations gains an upper-hand in negotiations and calculating value. Real estate holdings can provide immediate opportunities for liquidity, cost-reduction, or revenue generation. At the same time, detailed due diligence can reveal redundant properties, costly debt obligations, unbreakable leases, and other red flags that would undermine value post-closing.

For both sides of the M&A transaction, real estate strategy and valuation should be a core consideration of the overall goals and value drivers of the deal. A direct path to this mindset is to place real estate holdings on the same level of importance as other assets that drive value – human capital, technology, intellectual property, etc. Ensuring that real estate strategy aligns with business goals and objectives will save considerable headaches and potential liabilities in the later stages of negotiating and closing the deal.

Qualify and confirm all real estate data

One of the harmful side-effects of a laissez-faire attitude toward real estate in M&A is that the entire deal can be structured around data that is simply inaccurate or incomplete. This inconsistency is not necessarily the result of an overt deception, but too often it is simply an oversight. Valuations can also be based upon pride and ego, without supporting market data.

Let’s visit a very common M&A scenario: The Target company has real estate data on file from when they purchased or leased the property (which may have been years ago), and that data says headquarters is 20,000 sq. ft. of office space. Perhaps they invested heavily into improvements like custom interiors that did nothing to add value to the real estate. The Target includes that number in the valuation process and the Acquirer assumes it is accurate. Following the deal, the Acquirer moves in and, in the worst case, realizes there is actually only 15,000 sq. ft. of useable space. Or it is equally common that the Acquirer learns the space is actually 25,000 sq. ft. Either way, value has been misrepresented or underreported. M&A deals involve a multitude of figures and calculations, and sometimes things are simply missed. But those small things can have a major impact on value and performance in the long run.

The only solution to this problem is to dedicate resources to qualifying and quantifying data related to real estate holdings. When preparing to sell, Target companies should review all assumptions – square footage, usage percentage, useful life, etc. – and conduct field measurements and physical condition assessments (“PCA’s”). This will help your team understand the value of your holdings and set realistic expectations, and perhaps just as importantly, it saves you from the embarrassment of providing inaccurate numbers exposed during Acquirer’s due diligence—and getting re-traded on price and terms. That reputation will ripple through the marketplace.

From the Acquirer’s side, the details of real estate holdings should come under the same level of scrutiny as financials, control environment, etc. Your due diligence team should commission its own field measurements and PCA, and also seek out market comparables to confirm appraisals. It is simply unsafe and unwise to assume the accuracy of any of these details. Performing your own assessments could reveal a solid basis to re-negotiate the M&A, and will help shape post-merger integration planning.

Tax analysis will reveal risks and opportunities

The maze of tax regimes and regulatory requirements cannabis and hemp operators navigate naturally creates opportunities to maximize efficiencies. This is particularly the case when it comes to enterprise restructuring to navigate the tax burden of 280E.

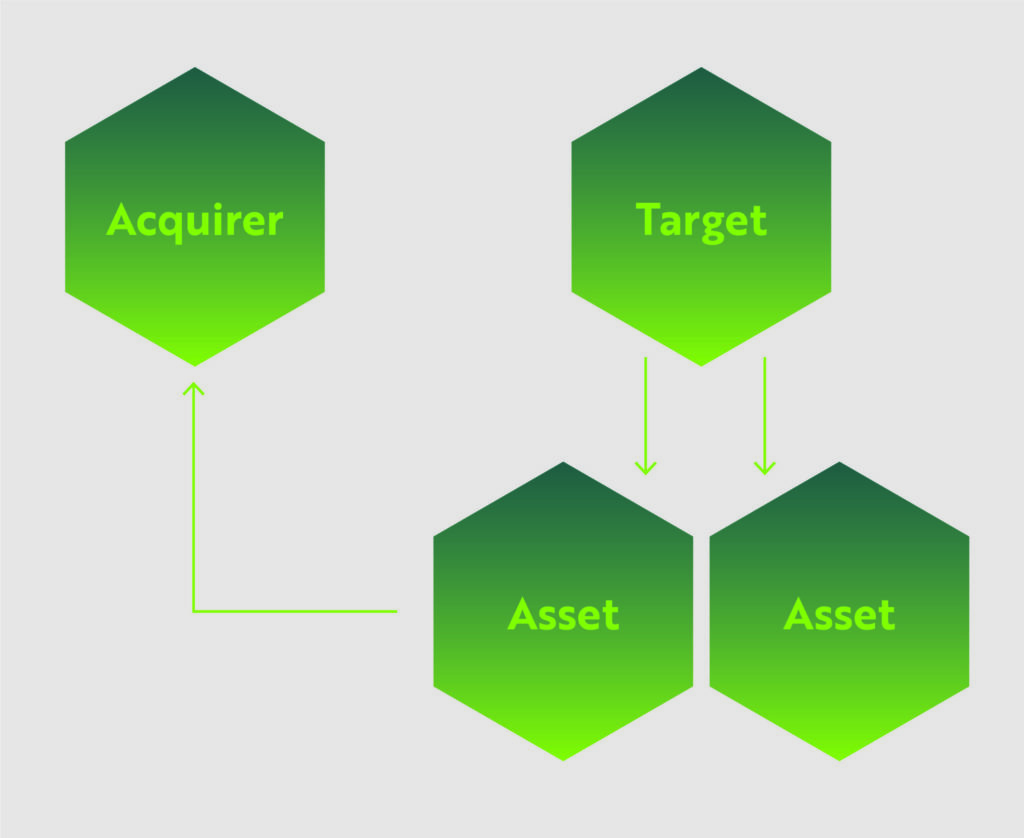

For example, it may be possible to establish a real estate holding company that is a distinct entity from any “plant-touching” operations. By restructuring the real estate holdings and contributing those assets to this new entity it may be possible to take advantage of additional tax benefits not afforded to the group if owned directly by the “plant-touching” entity. This all assumes a fair market rent is charged between the entities.

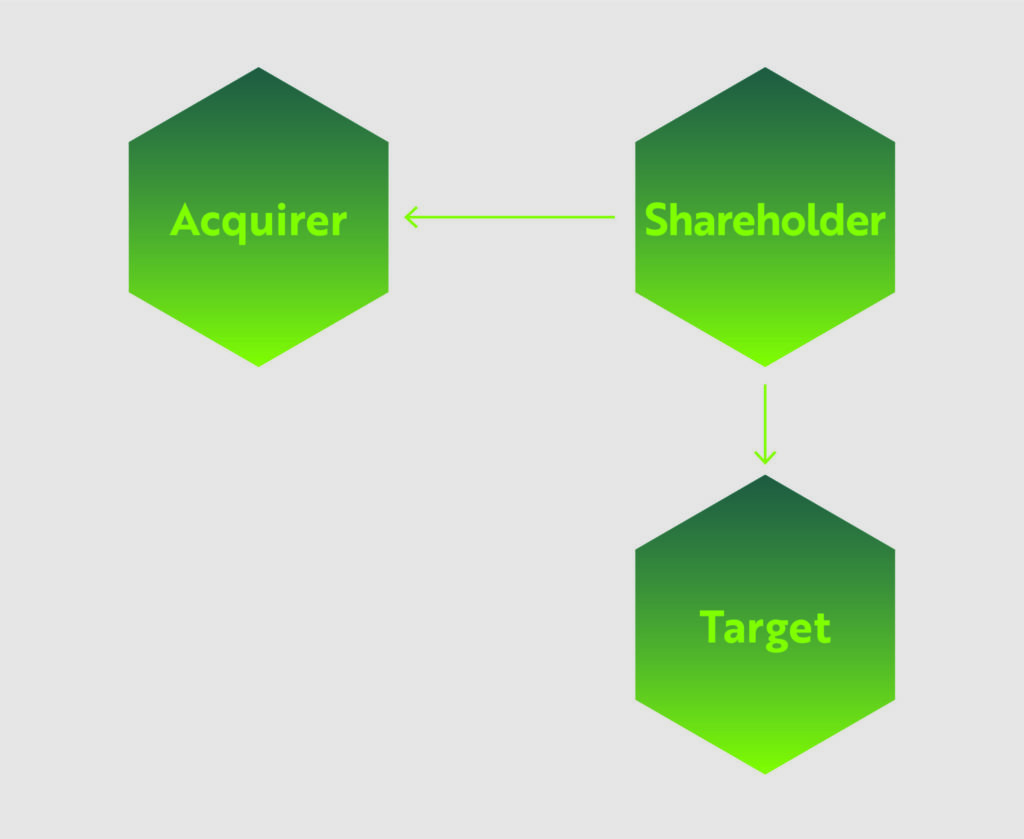

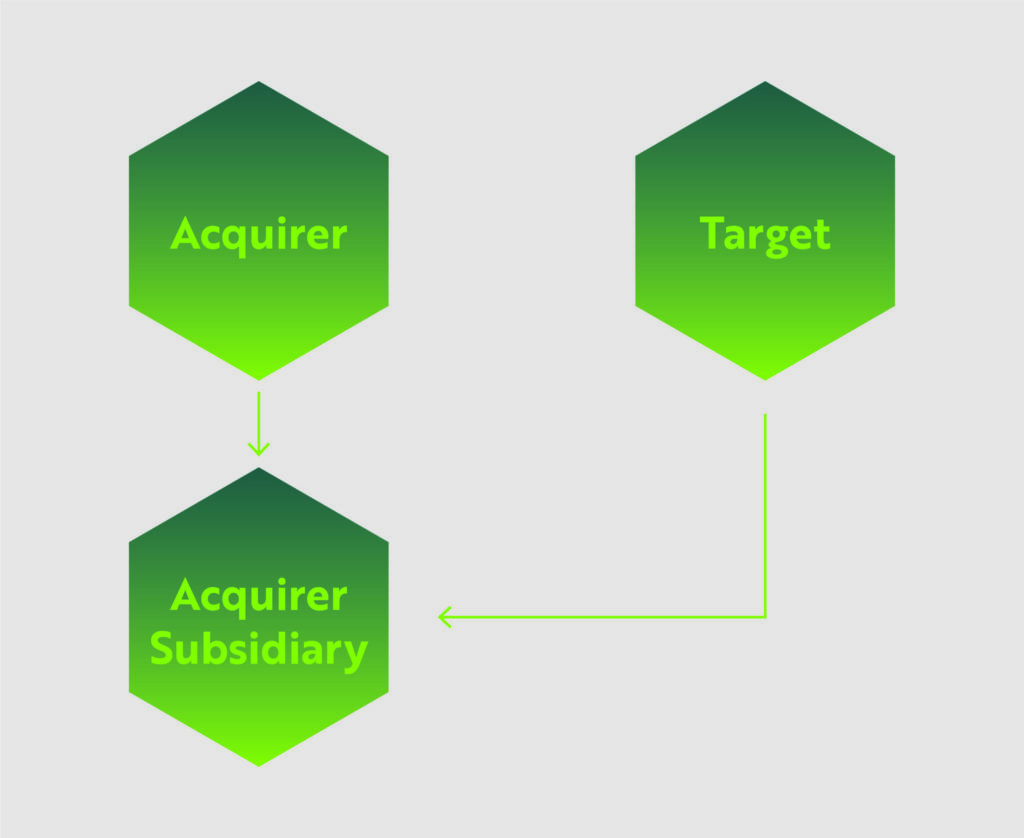

Recently, operators have looked to sale/leaseback transactions to help with cash flow needs and thus these types of transactions have gained prominence for cannabis and hemp operators. It is important that these transactions be carefully reviewed prior to execution to ensure they can maintain their tax status as a true sale and subsequent lease, instead of being considered a deferred financing transaction. If a Target company has a sale/leaseback deal established but under audit the facts and circumstances do not hold up, this could open up major tax liabilities for the Acquirer.

When entering into an M&A transaction, it is important that the Acquirer look at the historical and future aspects of the Target’s assets, including the real estate, to maximize efficiencies of these potentially separate operations. It is also equally important to review pre-established agreements/transactions to ensure the appropriate tax classification has been made and that the appropriate facts and circumstances that gave rise to the agreements/transactions have been documented and followed to limit any potential negative exposure in the future.

Contract small print could make or break a deal

An area of particular focus during due diligence should be a review, and close read, of the Target company’s existing property leases and other contracts. There are any number of clauses and agreements that seem harmless and inconsequential on the surface, but can have disastrous effects in difficult situations. In many cases the lease/contract of a property is more important than the details of the property itself. For example, if the non-negotiable rent on a retail location is too high (and scheduled to go higher), there may be no way to ever turn a profit.

The financial distress resulting from the COVID-19 pandemic has brought these issues to the forefront in the real estate industry. Rent payment and occupancy issues are shifting the fundamental economics of many property deals and contracts. If, for example, you are acquiring a commercial location that is under-utilized because of market demand or governmental mandate, you must confirm whether sub-leases or assignments are allowed at below the contract price. If not, you could be stuck with a costly, underperforming asset amid quickly shifting commercial real estate demand.

In many leases and contracts there are Tenant Improvement Allowance conditions that require the landlord to fund certain property improvement projects. If utilizing these terms is part of the Acquirer’s plans, you may need to have frank and open conversations with landlords about whether the funds for these projects are still available, and if those contract obligations will be met. Details like these are often penned during times of financial comfort without consequences to the non-performing party, but a landlord struggling with cash flow may not have the capability to meet contract standards.

These are just a few examples from a multitude of potential real estate contract issues that can emerge. It is recommended to not only examine these contracts very closely, but have dedicated real estate industry experts perform independent assessments that account for broader social, economic, and market realities. That independent analysis will help your executive team formulate a real estate strategy that better aligns with core business objectives.

Dig deep to uncover real value

There are countless scenarios where issues related to real estate make or break an otherwise solid M&A transaction, whether before or after closing the deal. The only path forward is to treat real estate holdings with the same care and attention paid to the other asset classes driving the deal. The cannabis and hemp industries have recently endured micro-boom-and-bust cycles that have left many assets under-performing. As Target companies offload these assets, and Acquirers seek out good deals, both parties must undertake focused efforts to establish the fair value of complex real estate assets and obligations.

Catch up on previous articles in this series and see what’s coming next…