Key Takeaways:

- Navigate the unique financial challenges of the entertainment industry with a solid strategy tailored to your diverse income streams and career goals.

- Master budgeting and maintain open communication with your business manager to create stability and prevent potential issues before they occur.

- Prepare for financial unpredictability and leverage your brand strategically to maximize long-term success.

~

In the entertainment industry, where the spotlight often shines brightly but unpredictably, managing your finances can feel like walking a tightrope. Whether you’re an actor, producer, director, or writer, the nature of your income is unique — often fluctuating with the ebb and flow of projects, endorsements, and creative ventures.

As you navigate this complex landscape, having a solid financial strategy becomes crucial. Here are top tips to help you maximize your earnings, plan for the future, and maintain financial stability:

1. Understand Your Income Streams

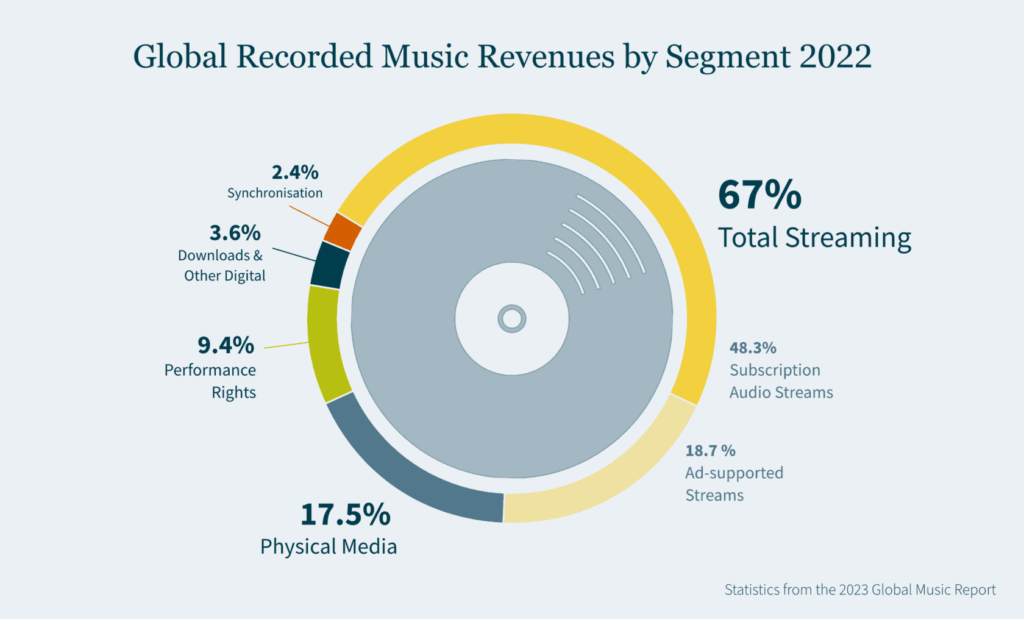

In today’s entertainment industry, your income is likely coming from multiple sources — acting gigs, endorsement deals, social media partnerships, and more. It’s essential to have a clear understanding of where your money is coming from and how it’s being managed.

Different income streams often involve different representatives, each focused on a specific aspect of your career. You might have an agent handling your film and TV roles, another for endorsements, and yet another for book deals or modeling contracts. This diversification offers incredible opportunities but also requires careful management. The first step in securing your financial future is knowing exactly who is managing each income stream and how those funds are being handled.

When you understand your income sources, you can better plan and project your financial future. This foresight is especially critical in an industry where income is not always consistent.

2. Master the Art of Budgeting

Unlike a traditional job where you receive a steady paycheck, your earnings can be unpredictable, often arriving in large sums at irregular intervals. This means budgeting is not just important — it’s essential for your financial well-being.

When a major payday comes in, it’s easy to feel flush with cash. But remember, that money often needs to last until your next project. A key part of effective budgeting is stretching your income to cover your expenses over an extended period so you can live comfortably between jobs. This might involve setting aside a portion for savings, investing in long-term financial goals, or simply making sure you have enough to cover day-to-day expenses without stress.

Effective budgeting also means being realistic about your spending. It’s tempting to see a million-dollar deal as a windfall, but after commissions, taxes, and other expenses, that sum shrinks significantly. Understanding the difference between gross and net income is vital, and a good business manager will help you navigate these waters so you can avoid overspending based on inflated expectations.

3. Prioritize Open Communication

Financial management in the entertainment industry isn’t just about numbers; it’s about trust and communication. You’re not just hiring a business manager, you’re bringing on a team that should be in lockstep with you — understanding your goals, lifestyle, and the unique challenges of your career.

Open communication with your business manager through regular check-ins, updates, and transparent reporting will keep you on the same page so vital information doesn’t slip through the cracks. This is especially important when your financial situation changes — whether you’ve taken on a new project, invested in a new venture, or simply have questions about your spending.

A proactive approach to communication also means that your business manager should be alert to any potential financial issues before they become problems. For instance, if your spending starts to increase unexpectedly, it’s essential to address it immediately, adjusting your budget or planning for additional income sources to maintain financial balance.

4. Plan for the Unpredictable

In the entertainment industry, no two careers are alike, and neither are the financial challenges you’ll face. Whether it’s an unexpected tax bill, a dip in income, or a sudden opportunity that requires quick financial maneuvering, you need to be prepared for anything.

Your business manager should help you anticipate these challenges, providing guidance on everything from tax planning to estate management. Annual financial reviews are a great way to stay on top of your financial health, allowing you to adjust your plans as your career evolves.

For A-list talent with significant wealth, this planning might also include customized reporting and detailed management of a diverse portfolio — from real estate to investments in startups or other ventures. The goal is to keep you informed and confident in your financial decisions, no matter how complex your financial landscape may be.

5. Leverage Your Brand

Today’s entertainment landscape offers more opportunities than ever for you to build and leverage your brand. From creating your own content to partnering with brands, the potential for income is vast. However, with these opportunities comes the need for strategic management.

Whether you’re considering launching a product line, investing in a startup, or simply increasing your social media presence, your business manager should help you evaluate these opportunities so they align with your long-term financial goals.

There is also a lot of equity to be found in authenticity today. Invest in and promote what you’re passionate about. This authenticity not only resonates with your audience but also increases the value of your brand.

Creating Financial Stability in the Entertainment Industry

Your career is unique. So are your financial needs. With the right guidance and a clear plan, you can navigate the complexities of the entertainment industry and focus on what you do best — creating and performing — knowing your financial future is secure.

How MGO Can Help

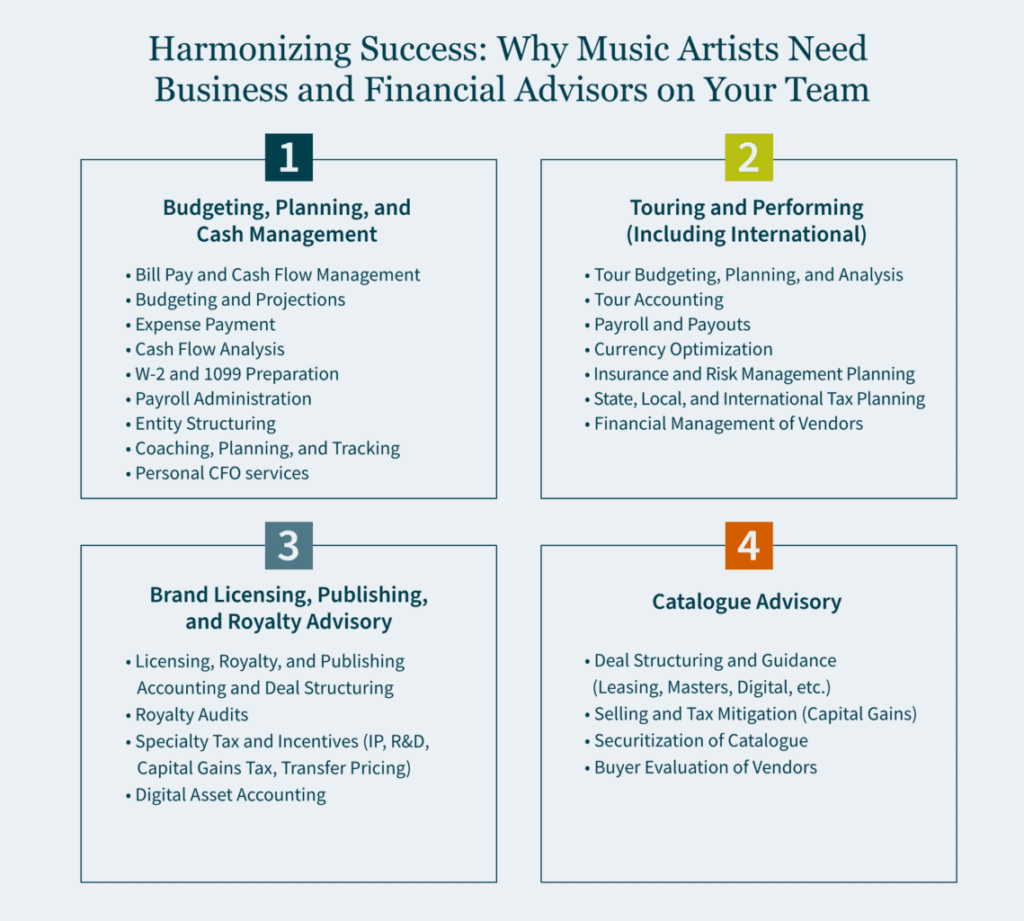

Our dedicated Entertainment, Sports, and Media team provides customized business management services to leading and up-and-coming talent in the entertainment industry. We work closely with you to stretch your earnings, plan for the future, and manage your diverse revenue streams.

Reach out to our team today to find out how our personalized approach can help align your financial goals with your lifestyle so you can focus on your craft.