Key Takeaways:

- A business manager helps you stay focused on your creative career by handling the financial and logistical complexities that come with success in entertainment.

- From budgeting and tax strategy to international compliance, risk management, and investment vetting, business managers protect your earnings and help you plan for both boom years and dry spells.

- Whether you’re just starting out or managing major deals, a business manager is key to building long-term financial stability and turning fame into lasting wealth.

—

Success in the entertainment industry can be thrilling — and fast. One day you’re auditioning and hustling, and the next you’re signing your first major deal. But with that success comes complexity. Contracts. Cash flow. Taxes. Big purchases. Bigger risks.

That’s where a business manager becomes indispensable.

If you’re a working entertainer — whether as an actor, director, writer, producer, or content creator — you need someone watching your financial back so you can focus on what you do best. A business manager isn’t just a luxury for the elite; it’s a critical support system that helps turn career momentum into long-term financial security.

8 Reasons Business Managers Are Essential for Entertainers

Once the wheels on your career start rolling, here’s why you want a business manager in your corner:

1. Handle the Business So You Can Stay Creative

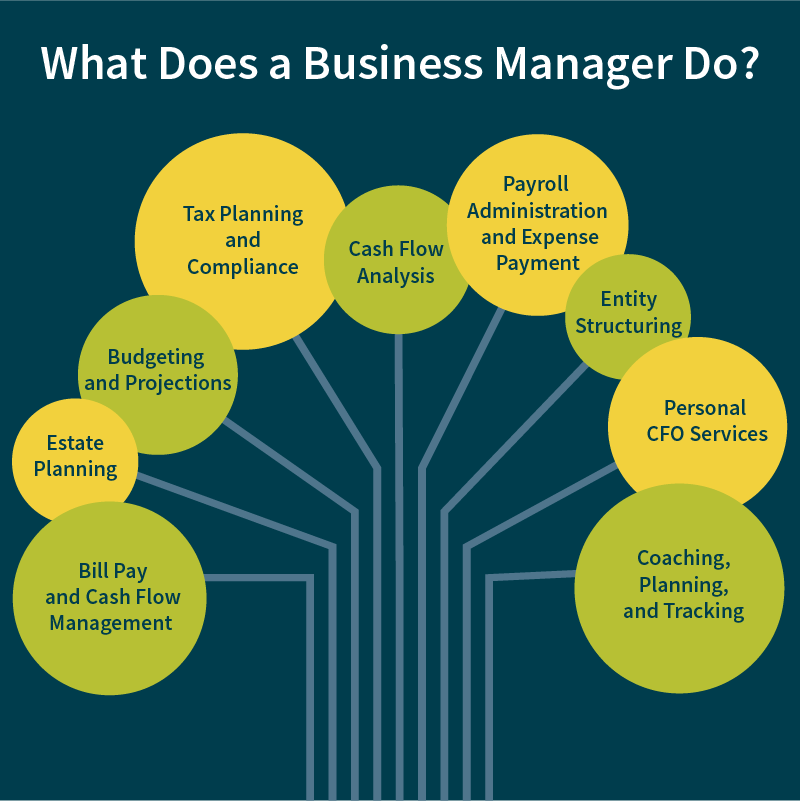

Entertainers are visionaries. But managing day-to-day expenses, long-term financial goals, and tax obligations requires a different skill set — and a lot of time. Business managers act as your financial quarterback, helping you handle:

- Bill payments and banking

- Budgeting and cash flow planning

- Major purchases like homes and cars

- Tax strategy, compliance, and filings — domestically and internationally

- Collaborating with your advisory team on investment opportunities and due diligence

- Team coordination with attorneys, agents, and financial advisors

- Estate planning

While you focus on your craft, a business manager helps maintain the structure behind the scenes — aligning your lifestyle and spending habits with your income and goals.

2. Get a Head Start, Not a Headache

The best time to bring on a business manager isn’t when you’ve made it big. It’s before that.

Many entertainers see an influx of income early in their careers — sometimes unpredictably and in large amounts. Without someone helping build a solid financial plan from the start, it’s easy to overspend or mismanage resources.

Even earning a couple hundred thousand dollars or working in a different state or country can create tax complexities or prompt decisions — like forming a business entity — that require guidance. Having a manager early on helps build good financial habits and prepare for income fluctuations, which are common in this industry.

3. Understand What You’re Really Earning

You might sign a million-dollar deal — but that doesn’t mean you take home a million dollars. After agent commissions, legal fees, business management, taxes, and other deductions, the actual net income could be closer to 35 to 40 cents on the dollar.

That’s a surprise most entertainers don’t see coming.

A business manager helps break down what your deals really mean for your bottom line. They plan for taxes, track spending, and project income and cash flow over time to keep you financially stable — especially in the off-seasons when work slows or stops altogether.

4. Plan for Peaks and Valleys

Every career has its highs and lows, but in entertainment, those extremes can be particularly wide. A steady year might be followed by months with no income at all. Think writer’s strikes. Production shutdowns. Or just a natural lull between projects.

A business manager builds financial plans to help weather those dry spells — so you’re not scrambling when the checks stop. That might include:

- Setting aside emergency funds

- Balancing liquid versus long-term investments

- Evaluating major purchases relative to available cash

- Forecasting income needs for 3–5 years

Rather than letting a peak year prompt a rash decision — like buying a multi-million-dollar house — a business manager helps align your lifestyle with your financial reality.

5. Protect Against Costly Missteps

When your name is in the credits (or trending on social media), investment pitches will follow. Some may come from friends. Others may seem like can’t-miss opportunities. But not all that glitters is gold.

One of the most common mistakes entertainers make is jumping into investments without proper vetting. Business managers step in to help with due diligence — researching deals, reviewing contracts, and bringing in attorneys or financial advisors when necessary. Their job is to help protect your wealth from risky decisions and align your investments with your long-term goals.

They can also help make sure you have contracts in place for domestic staff and other personal service providers — protecting your privacy, minimizing liability, and helping you avoid costly disputes down the road.

6. Build the Right Team — and Lead It

Think of a business manager as your in-house CFO. But unlike a solo act, they don’t work in isolation. They coordinate with everyone on your team — agents, attorneys, financial planners, insurance brokers — to make sure all aspects of your financial life are connected.

A good business manager doesn’t just generate reports and process numbers — they act as a strategic advisor with your best interests at heart. That includes regular communication, personalized advice, and a clear understanding of your financial picture.

When evaluating a potential business manager, ask:

- How often will we communicate?

- What kind of reports or updates will I receive?

- How will you help me make financial decisions?

- Can you work with the other professionals on my team?

The right manager should not only be qualified — but committed to helping you succeed beyond the next paycheck.

7. Look Out for Your Best Interests

The best business managers aren’t just number crunchers — they’re protectors. That means spotting red flags before they become problems, like making sure your employees are logging a lunchtime break if they work more than five hours.

It also means stepping up during emergencies — whether that’s getting you a last-minute hotel extension during the California wildfire evacuation or being the first to coordinate with your insurance broker to fast-track your claim.

Your business manager is often the first person you call when something goes wrong — and the one quietly making sure it doesn’t.

8. Set the Foundation for Long-Term Success

At the end of the day, fame and fortune don’t guarantee financial security. But with the right guidance, they can become the foundation for lasting wealth and freedom.

A business manager helps you:

- Navigate complex income structures and tax issues

- Build a spending and savings plan that reflects your reality

- Avoid costly financial traps

- Assemble a trustworthy advisory team

- Plan for the future — even when the future is uncertain

Whether you’re landing your first breakout role or headlining your fifth series, a business manager helps translate your creative wins into a secure, stable, and fulfilling financial future.

In a world where so much is unpredictable, that’s a role every entertainer needs.

How MGO Can Help

As a full-service CPA and consulting firm with a dedicated Entertainment, Sports, and Media practice, we bring a level of depth that goes beyond the typical business management firm. That means when you’re launching a production company or heading overseas for a tour, you get access to a national network of tax, audit, and consulting professionals.

Need help navigating California’s tax structure? Our state and local tax team is on it. Filming in Europe? Our international tax professionals can help you plan proactively. That kind of integrated support is what makes MGO different, and it’s why so many entertainers choose us to meet their long-term financial needs.

Reach out to our team today to find out how we can help you protect, grow, and oversee your money — wherever your career takes you.