Key Takeaways:

- Tariffs increase material costs and uncertainty, challenging how your U.S. apparel brand manages production and pricing strategies.

- Supply chain volatility from shifting trade policy forces your business to rethink sourcing, inventory, and cash flow management.

- Without clear, consistent tariff rules, it’s harder for apparel companies to invest in long-term domestic manufacturing solutions.

—

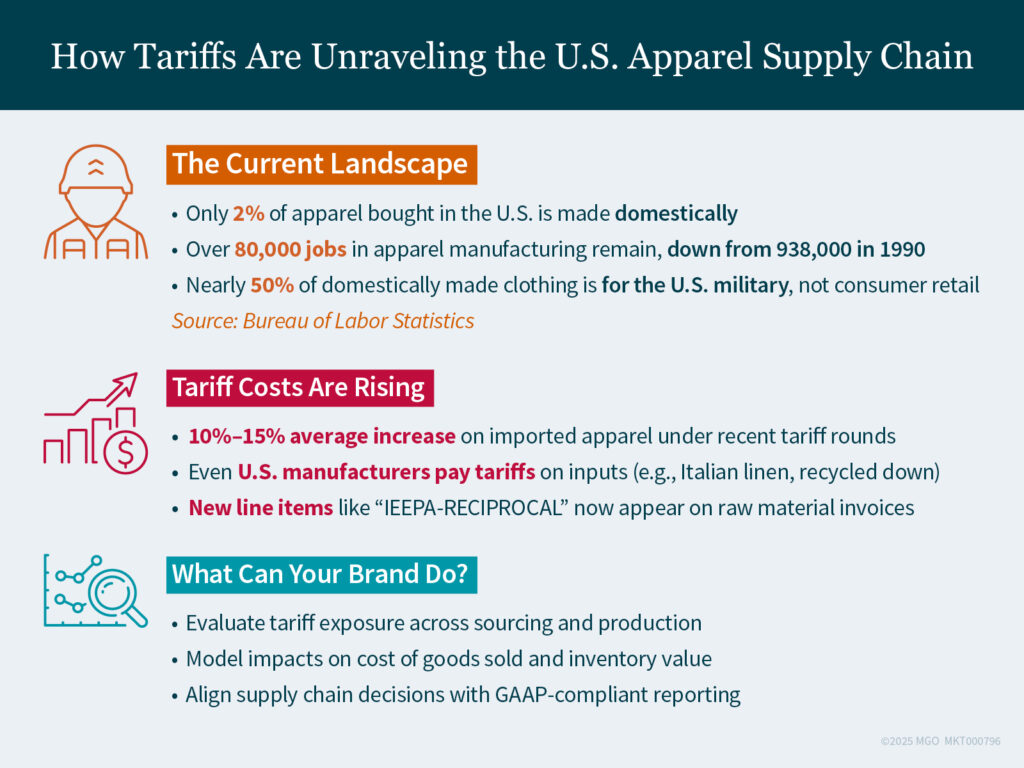

If you run a U.S.-based apparel company, you’ve likely heard that tariffs were meant to level the playing field. But for many in the industry, they’ve done the opposite — raising costs, sowing uncertainty, and complicating domestic production. With fabric and components sourced globally and labor-intensive processes still rooted overseas, your business is caught in policy limbo.

Background: The Tariff Trap

Recent rounds of tariffs — particularly under the International Emergency Economic Powers Act (IEEPA) — were intended to push manufacturing back to U.S. soil. But apparel isn’t like steel or semiconductors. Most American-made garments rely on imported fabrics and specialized inputs from Europe and Asia. Now, U.S. companies that cut and sew domestically are hit with fees not only on finished goods but also on raw materials — from Italian linen to recycled goose down from Switzerland.

Your business doesn’t benefit when both your competitors and your suppliers are penalized.

Rising Costs, Limited Gains

Tariffs might raise the price of foreign goods, but for domestic producers that increase rarely offsets the broader challenges:

- The average U.S. clothing item already costs significantly more due to fair labor wages, healthcare, and compliance standards.

- Most local manufacturers serve niche, high-end markets where even slight price hikes reduce demand.

- Investment in automation or workforce expansion becomes risky amid tariff instability.

As one industry leader told The New York Times, “If we know these tariffs are locked in … we can deal with it. But right now, it might change tomorrow.”

Uncertainty Freezes Innovation

Your apparel company needs clarity to make long-term decisions — on hiring, machinery, and sourcing. Yet, recent reversals and pauses in policy have undermined confidence. Business leaders across the sector are holding back on growth initiatives, delaying plans to move production domestically, and watching consumer demand fall as inflation creeps into discretionary spending categories.

Alternative Solutions: Beyond Tariffs

There are more effective strategies to support U.S. apparel than blunt-force tariffs:

- Federal procurement mandates: Extending Buy American rules beyond military contracts could offer your company stable demand.

- Wage subsidies: Redirecting tariff revenue to offset domestic labor costs, as some entrepreneurs suggest, would truly support reshoring efforts.

- Transparent trade policy: Your supply chain planning hinges on consistent, long-term policy, not reactive measures driven by political cycles.

Regulatory Pressure Meets Strategic Insight

With trade policy increasingly shaped by executive authority — like the IEEPA — your business must assess both direct financial impact and indirect regulatory exposure. For apparel manufacturers subject to audit requirements or preparing for financing, aligning your operations with Public Company Accounting Oversight Board (PCAOB) and Financial Accounting Standards Board (FASB) standards is non-negotiable.

MGO works with brands like yours to incorporate shifting cost structures from tariffs in financial statements, inventory valuation, and pricing models — helping you keep your firm aligned with generally accepted accounting principles (GAAP) and investor-ready.

Preparing for What’s Next

Whether you’re producing premium fashion in Houston or high-volume basics in Los Angeles, your apparel business faces complex financial and regulatory pressures. MGO offers audit clarity, tax efficiency, and consulting support tailored to today’s global apparel supply chain.

From understanding tariff impacts on GAAP reporting to improving sourcing strategies amid global disruption, we help apparel brands move forward with confidence.

Learn more at mgocpa.com/apparel