Key Takeaways:

- Businesses must now capitalize Research & Experimental (R&E) expenditures and amortize them over 5 or 15 years, significantly impacting cash flow and project viability for innovation-driven enterprises.

- The gradual phase-out of bonus depreciation rates necessitates a reevaluation of capital expenditure strategies and their tax implications.

- Mergers, acquisitions, and international transactions can come with complex tax consequences. Proactively engage with your accountant to navigate compliance, optimize tax positions, and leverage strategic planning opportunities.

—

You turn to your tax advisor to learn how the latest tax law changes will impact your organization. But does your advisor reach out proactively to discuss how upcoming changes might impact your business and its tax liabilities?

As we progress through 2024, several significant tax developments may impact how you make business decisions and manage your tax obligations. Is your accountant aware of these changes and, more importantly, actively discussing the implications and opportunities with you?

1. Research and Experimental Expenditures

Internal Revenue Code (IRC) Section 174 was one of the most radical components of the Tax Cuts and Jobs Act (TCJA) of 2017 and continues to create questions for corporate tax departments today. It requires your company to capitalize and amortize Research and Experimental (R&E) expenditures over five years (15 years for the research performed outside of the U.S.) instead of deducting them in the year incurred.

Losing the ability to deduct R&E expenditures can significantly increase your taxable income, impacting cash flow and project viability.

Your accountant should guide you through the implications of this change, helping you maintain records linking expenses to qualified research activities and maximizing your R&D tax credits.

2. Accelerated/Bonus Depreciation Phaseouts

Another significant change from the TCJA that might catch you off guard is the phaseout of accelerated and bonus depreciation.

As a reminder, the bonus depreciation rate was 100% in 2022 but dropped to 80% in 2023. It will continue to drop by 20% each year until bonus depreciation is unavailable in 2027 (assuming Congress doesn’t enact new tax law changes).

This gradual reduction impacts your ability to deduct the cost of capital expenditures, affecting your tax liability and financial planning strategies.

Despite the phaseout, there are still planning opportunities for companies to consider. For example, you might accelerate planned equipment purchases before year-end, use a cost segregation study to accurately categorize building components into asset classes with shorter recovery periods, and continue to take advantage of Section 179 expensing rules.

Your accountant should proactively discuss these changes with you to help you make informed decisions about capital investments.

3. Foreign Sales – FDII Deduction

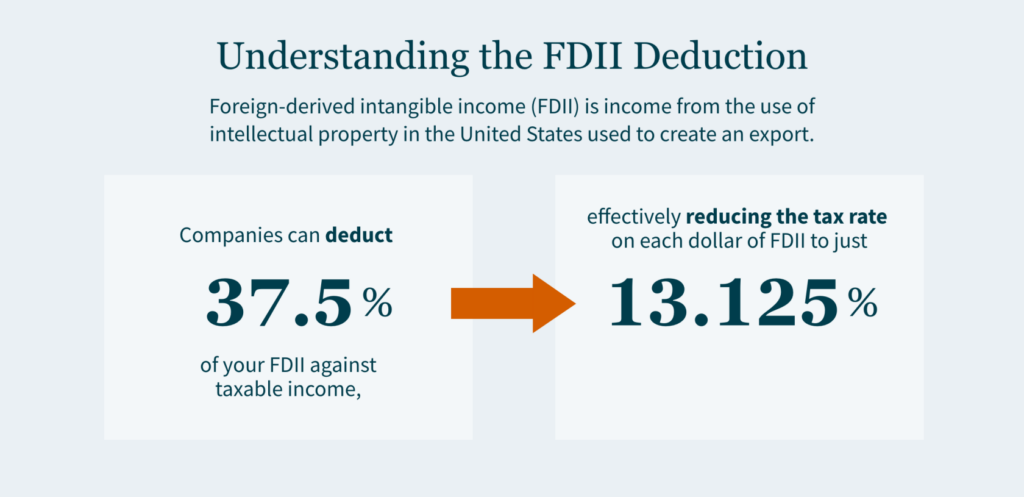

The Foreign-Derived Intangible Income (FDII) deduction represents a significant tax-saving opportunity if your company has foreign sales.

FDII is income from the use of intellectual property — legally protected, non-physical assets in the United States used to create an export.

You can deduct 37.5% of your FDII against taxable income, effectively reducing the tax rate on each dollar of FDII to just 13.125%. However, the FDII deduction will be reduced after 2025, at which point the effective tax rate will rise to 16.4% under current law.

Your accountant should actively inquire about foreign sales activities and advise on the potential benefits of the FDII deduction, so you do not overlook valuable tax savings.

4. M&A and Cross-Border Transactions

Mergers and acquisitions (M&A) and cross-border transactions present a complex array of tax considerations.

Cross-border transactions can include any transaction outside of the U.S., including receiving interest or royalties from a foreign entity or making sales in a foreign country (whether to an unrelated third party or a related entity). These transactions can come with transfer pricing considerations, foreign tax consequences, and reporting requirements in foreign jurisdictions.

In the mergers and acquisitions space, your accounting firm can help with various issues, including buy- or sell-side due diligence, risk mitigation, structuring the transaction as a stock sale or an asset sale, analyzing transaction costs, and determining whether you can deduct or capitalize those costs.

Whether you’re contemplating a transaction or have recently completed one, your tax advisor can provide support in navigating the tax implications, ensuring compliance, and optimizing your tax position through strategic planning and structuring.

Unlock the Power of Proactive Advice

The tax landscape in 2024 includes significant changes and opportunities. From how businesses account for R&E expenditures to the strategic implications of FDII deductions, and the potential tax benefits, these developments require careful consideration and strategic planning.

To navigate these changes effectively, engage with a team of advisors who are aware of these developments and prepared to discuss their implications for your business. Reach out to an MGO advisor today.