Executive Summary:

- Environmental, social, and governance (ESG) information helps investors, regulators, and the public-at-large understand and interpret a government entity’s risk profile and its ability to drive positive impact.

- To present this information publicly, government entities are developing robust “Climate Action Plans,” which are reviewed and refreshed on a periodic basis.

- As disclosing ESG-related information to the public becomes more common, government entities are also expanding ESG-related disclosures within annual financial reports.

—

Coined in a 2004 United Nations report, the term “environmental, social, and governance” (and its accompanying acronym “ESG”) is less than 20 years old. Yet, you would be hard-pressed to find a boardroom today where ESG is not top of mind. It is not just businesses either — ESG is also an increasingly important topic of discussion within government organizations.

State and local governments use ESG-related information as a mechanism to measure and track priorities, footprints, and targets. As governments have matured their ESG reporting and presented information more consistently with year-to-year comparability, investors*, regulators, and the public-at-large have sought out this reporting to help them understand risk and the government entity’s ability to drive positive impact.

*Note: The term “investors” refers to those who are exploring and/or holding investments in government-issued securities (e.g., hedge funds, institutions, individuals, etc.).

The Increasing Importance of “Climate Action Plans”

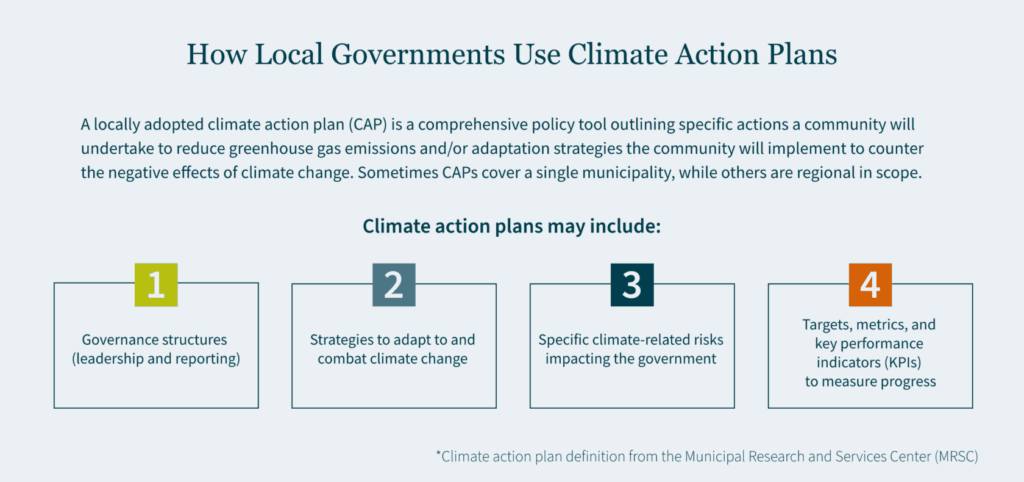

To present ESG-related information to the public, many government entities develop and communicate robust “Climate Action Plans”. These plans highlight a myriad of information, including (but not limited to):

- Governance structures (e.g., communication and reporting lines from environmental leadership into the mayor’s office)

- Strategies to adapt to and combat climate change

- Specific climate-related risks, which impact the government entity

- Targets, metrics, and key performance indicators (KPIs) used to measure progress

As Climate Action Plans continue to evolve, governments are commanding and allocating more financial resources to activate these plans. With the increased focus on climate-related initiatives presented in Climate Action Plans, we are seeing an expansion of ESG-related information disclosed within “Annual Comprehensive Financial Reports” across the country — a sign that financial disclosures are maturing to meet growing interests from investors, regulators, and the public-at-large.

A Growing Push from Investors and Regulators

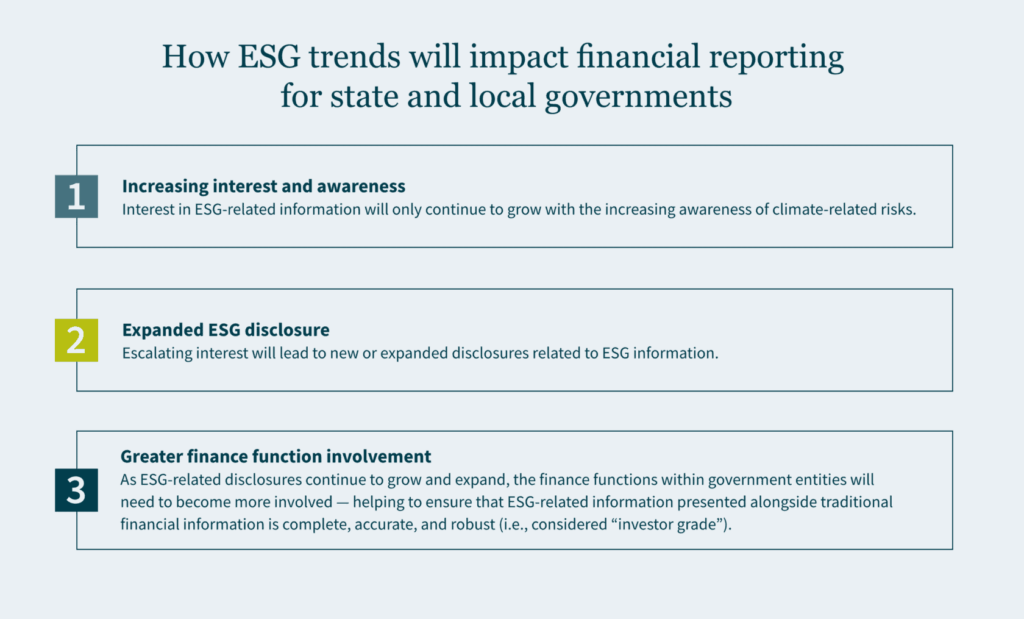

The focus on non-financial risks (including, but not limited to, ESG-related risks) by investors and regulators continues to intensify. When we take a step back to analyze the trend, a few things become clear:

- Interest in ESG-related information will only continue to grow with the increasing awareness of climate-related risks.

- Escalating interest will lead to new or expanded disclosures related to ESG information.

- As ESG-related disclosures continue to grow and expand, the finance functions within government entities will need to become more involved — helping to ensure that ESG-related information presented alongside traditional financial information is complete, accurate, and robust (i.e., considered “investor grade”).

To dive deeper into that last point, where would a finance function start? The short answer is by increasing the integration and collaboration between a government entity’s environmental leaders and the finance functions. The longer answer is that government entities need to develop holistic approaches to collecting and reporting robust ESG-related information to meet the expectations of investors, regulators, and the public-at-large.

The bottom line: As the issuance of and investment in municipal securities continues to grow, the quality of ESG-related information disclosed to the public will need to be enhanced to meet the demands of investors.

Transparency in Budgets and Financial Reporting

With an increase in ESG-related disclosures in annual financial reports by government entities, recent interpretive guidance from the Governmental Accounting Standards Board (GASB) indicates that government entities can expect further scrutiny and regulation as these types of disclosures become more commonplace.

Essentially, it is important for your government to have a robust, well-communicated ESG “story” within a Climate Action Plan — but you also must provide investor-grade transparency within audited financial statements. Government entities are already beginning to meet this challenge. Two examples of local governments with a growing presence of ESG-related information in their Annual Comprehensive Financial Reports are the City and County of San Francisco and the City of Fremont.

The City and County of San Francisco transparently discloses both environmental and social initiatives, capturing details related to its Environmental Protection Fund, as well as specific details related to revenues received from state, federal, and other sources for the preservation of the environment.

The City of Fremont — which is much smaller in terms of population (~230,000) and financial resources (roughly $1.5 billion in total primary government assets from “government activities”) — depicts ESG-related information throughout its annual report, including but not limited to qualitative information in the “management discussion and analysis” section, as well as quantitative information related to “community development and environmental services.”

The Path Forward: Enhancing Your ESG Reporting

With ESG-related information becoming more integrated into investor decision-making, your government needs to focus on enhancing its Climate Action Plans and developing “investor grade” disclosures related to ESG risks and opportunities for inclusion within your traditional financial reporting. These initiatives will require additional financial resources and human capital to create and maintain — and further collaboration between environmental, social, and financial leaders will be needed to drive the change.

How MGO Can Help

Incorporating ESG disclosures into financial reporting can pose challenges to states and local governments unfamiliar with ESG reporting standards. With experience providing ESG solutions, our State and Local Government Practice will work with your team to meet requirements and make information “investor-ready,” while also ensuring accountability and transparency.