This article was co-authored by Todd Collins, Vice President of HMK Insurance, an Alera Group Company

Key Takeaways:

- Breweries, distilleries, and vineyards face significant economic, financial, and regulatory challenges that impact profitability.

- Strategic decisions around insurance and taxes can help companies manage costs and take advantage of tax incentives.

- Coordinating guidance from tax and insurance advisors specializing in the craft beverage industry can optimize financial and risk management strategies.

~

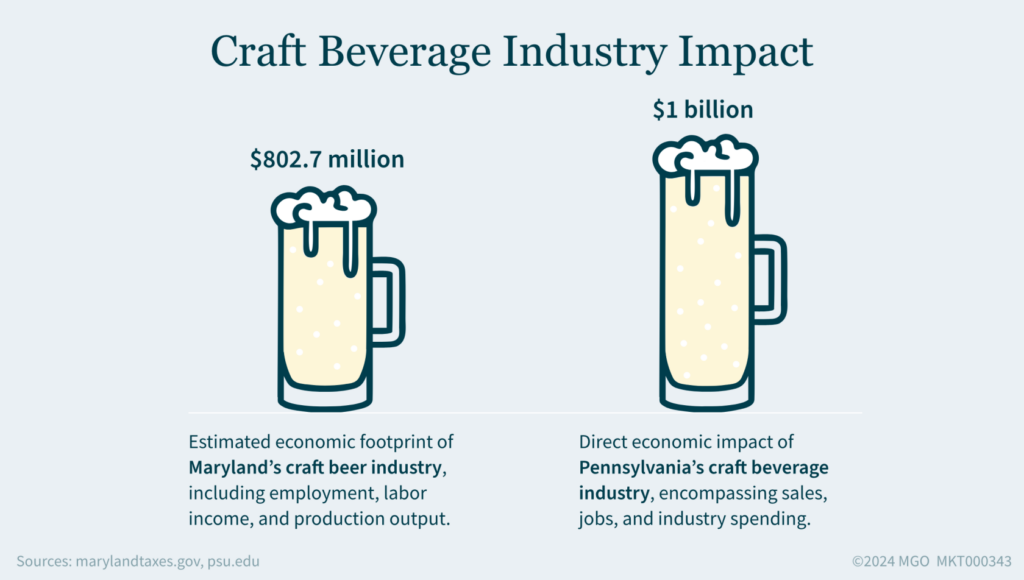

Maryland and Pennsylvania have a thriving craft beverage industry, made up of hundreds of breweries, distilleries, and vineyards. As a business in this dynamic region, you have incredible opportunities. However, you also operate in a tightly regulated space where high insurance premiums and taxes on production, distribution, and retail operations often squeeze profit margins.

Integrated insurance and tax planning can help reduce these pressures, providing protection and potential tax savings.

Tax Hurdles for Craft Beverage Companies

Across the U.S., the alcohol industry must deal with a complex web of federal, state, and local tax laws covering income, excise, and sales taxes, as well as licensing fees. These taxes and fees add up as producers are taxed at multiple stages of production and sales.

The market’s saturation has only intensified competition. With both rising production costs and taxes, small- and medium-sized producers must find innovative ways to stay profitable. Leveraging tax benefits and taking strategic steps to lower insurance costs can help offset some of these financial pressures.

Integrating Insurance Strategy with Tax Strategy

Insurance premiums can substantially burden small businesses, particularly for alcohol producers whose operations are often capital-intensive. Property insurance rates have risen steadily in recent years, while climate change has increased the risk of fires, floods, and other severe weather events. Breweries, distilleries, and vineyards may require higher coverage limits for bank financing or contractual obligations, so finding cost-saving opportunities becomes paramount.

Fortunately, your company has several options for integrating insurance and tax strategies. They include:

- Tax-deductible premiums: Your insurance premiums are tax-deductible, providing a direct reduction in taxable income.

- Business interruption insurance: Proceeds from business interruption insurance — which provides critical cash flow during unexpected shutdowns — are considered taxable income. However, companies can usually offset that income with ongoing business expenses to neutralize the tax impact.

- Property insurance savings: Breweries, distilleries, and vineyards invest heavily in equipment and physical infrastructure, making property insurance essential. Your business can lower property insurance premiums by opting for higher deductibles. Although a higher deductible won’t result in dollar-for-dollar savings, it can ease the financial burden of premiums.

- Avoiding over-insurance: Carefully selecting liability and property coverage limits can prevent over-insurance, especially for smaller operations that may not need the highest levels of protection.

- Navigating crop insurance: Crop insurance is scarce and often inaccessible for small vineyards growing their own grapes or breweries cultivating hops. However, your business can deduct casualty losses in the year they incur. When affordable coverage isn’t available, it’s worth discussing the potential risks of self-insurance versus the value of buying coverage with an insurance advisor.

- Exploring captive insurance: For larger producers spending upwards of $150,000 annually on premiums, captive insurance arrangements are becoming increasingly popular. Captives offer the ability to self-insure through a dedicated subsidiary, potentially leading to lower long-term insurance costs. However, captives are not feasible for smaller producers, given the scale required to justify their setup and operational costs.

Your company can reduce costs and maintain cash flow by strategically aligning insurance and tax planning.

Work with Trusted Advisors to Align Insurance and Tax Strategies

Given the complex interplay between insurance and taxes, breweries, distilleries, and vineyards need experienced guidance. MGO, a leading tax advisory firm, and Alera Group, an independent insurance agency offering commercial insurance, employee benefits, and personal insurance solutions, can provide invaluable insights for alcohol producers looking to optimize their financial and risk management tactics. Together, we help clients identify and manage potential risks and benefit from tax-efficient planning.

In today’s challenging economic environment, you need to look beyond traditional strategies to remain competitive. Integrating tax and insurance planning can provide cost savings, protect cash flow, and offer advantages to support your overall financial stability.

For more detailed insights and personalized help, reach out to MGO’s Vineyards and Wineries team to learn how MGO and Alera Group can support you.