Key Takeaways:

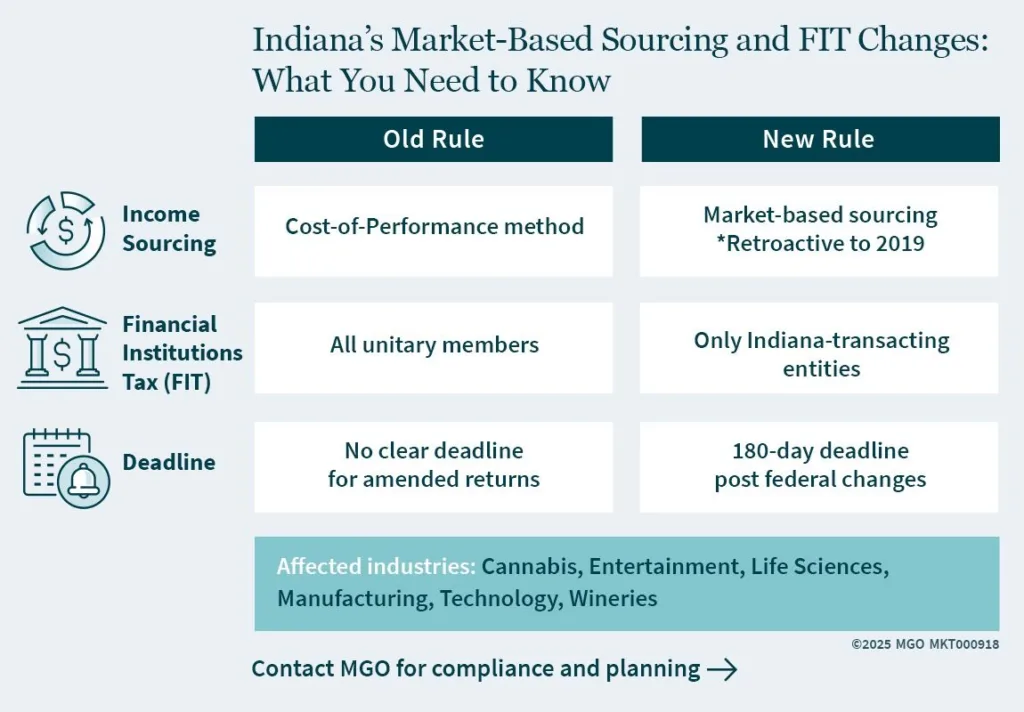

- Indiana now uses market-based sourcing for services and intangibles, retroactive to 2019—and companies should review apportionment for prior years.

- Financial institutions must file combined FIT returns that include only entities transacting business in Indiana, and unitary group filings should be reassessed.

- Amended Indiana returns are required within 180 days of any federal changes, and missing this deadline may leave your returns open to audit risk.

—

If you do business in Indiana — or with customers in Indiana — there’s a big tax update you should know about. The state has officially moved to market-based sourcing for service and intangible income. That means instead of focusing on where you perform the service, Indiana now cares about where your customers receive the benefit. And here’s the kicker: it applies retroactively all the way back to tax years starting January 1, 2019.

This change, now locked in under 45 IAC 3.1-1-55.5, lays out a tiered framework that walks through where to source revenue — starting with the benefit location, then moving to the customer’s billing address, and if needed, using a reasonable approximation.

The rule casts a wide net, covering everything from service revenue and intangible licenses to digital goods and even tax credit assignments. But it does carve out a few exceptions—like insurance premiums, GILTI (Section 951A), and repatriated dividends (Section 965). Read more here and here.

While Indiana leans heavily on the Multistate Tax Commission’s model, there are state-specific twists, especially in areas like construction, publishing, and transportation. So, if you’re operating across state lines, you’ll want to make sure your compliance strategy accounts for those differences.

Financial Institutions Tax: Clarity on Combined Reporting and NOL Treatment

In tandem with sourcing updates, the Indiana Department of Revenue has revised Information Bulletin #200 to clarify how the Financial Institutions Tax (FIT) should be applied. These updates strive to reduce confusion around combined reporting and net operating losses (NOLs).

If your entity is a part of a unitary group, it must file a combined FIT return, but only for members actively transacting business in Indiana. For more information, you can consult the bulletin, as it also outlines how adjustments can be made if the standard calculation doesn’t fairly reflect Indiana-source income.

It’s important for you to note that for NOLs, Indiana has reaffirmed conformity with federal treatment: no Indiana NOL exists without a federal NOL, even if one could arise from Indiana-only modifications. Your NOLs may be carried forward for 15 years, with no carryback allowed. The bulletin also addresses scenarios involving the discharge of indebtedness.

Another important update: your amended Indiana returns are required within 180 days of a federal return change (audit, amended return, etc). If you fail to comply, you leave your return open to state audit indefinitely.

What This Means for You, the Taxpayer

Indiana’s adoption of market-based sourcing, especially with retroactive effect, could significantly impact your multistate businesses with service or intangible income. If your company previously applied cost-of-performance methods, you should evaluate whether prior filings require adjustments.

Financial institutions should confirm that only Indiana-transacting entities are included in FIT combined returns and revisit how NOLs are calculated and carried forward under the revised guidance.

With the new 180-day amended return rule, you’ll want your tax department to review its federal change reporting processes to avoid inadvertently triggering an open audit window.

Your Next Steps

These changes go back to 2019, so they could affect both your compliance obligations and potential refund opportunities. You should evaluate your business’s prior filings, update sourcing methodologies, and consider participating in Indiana’s newly approved tax amnesty program (HB 1001), which may offer you limited relief for pre-2023 exposures. Program details are forthcoming.

For companies generating service revenue, licensing IP, or filing under Indiana’s FIT rules, these changes are not just procedural for you; they could have real strategic implications. Taking initial action can help you mitigate risk and position your company for better compliance moving forward.

Practical Support for Navigating Indiana’s Tax Rule Changes

Maneuvering Indiana’s new market-based sourcing rules and the revised Financial Institutions Tax framework requires more than just a surface-level understanding. It calls for strategic insight — and tailored execution. MGO’s State and Local Tax (SALT) professionals are here to help you assess the impact these changes can have on your business, identify potential refund opportunities, and realign your compliance strategy.

These regulatory shifts may affect businesses across a range of industries, including manufacturing, technology, cannabis, life sciences, entertainment, and wineries. MGO collaborates with companies in these sectors to evaluate tax positions, assess risks or potential overpayments, and refine state tax strategies that reflect current rules and industry practices. Contact us to learn more about moving forward with clarity, confidence, and compliance.