Executive summary

- There is still uncertainty about how to account for the refundable Employee Retention Credit in your books, because you can’t account for it the same way you can account for the Paycheck Protection Program loan.

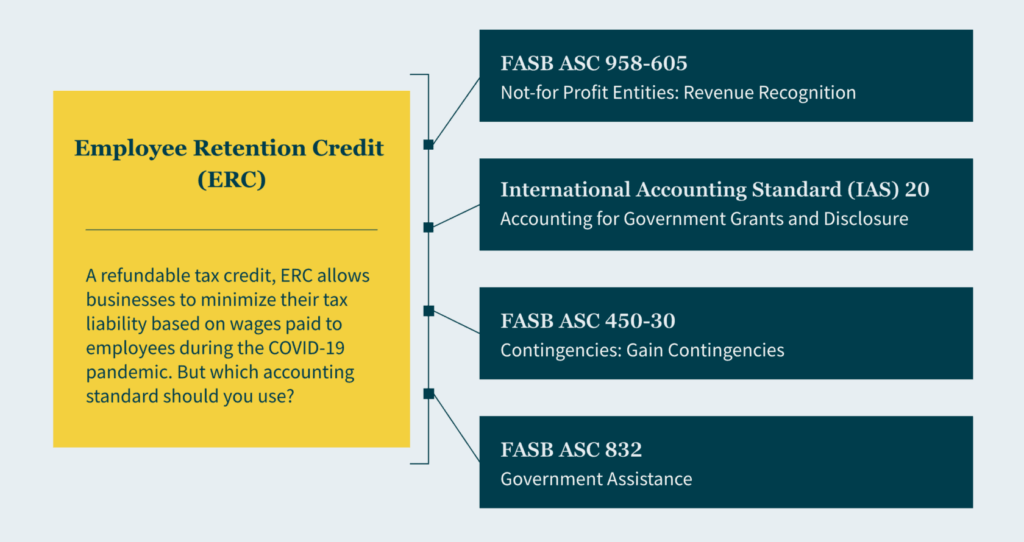

- The standards you can choose from are FASB ASC 958-605, International Accounting Standard (IAS) 20, FASB ASC 450-30, and FASB ASC 832.

- Depending on the standard you choose, you might have to consider the timing of recognition, the presentation of a grant income line, and financial ratios.

The Paycheck Protection Program (PPP) and the Employee Retention Credit (ERC) were powerful economic stimulus programs instituted during the COVID-19 pandemic to provide financial relief to struggling businesses. Both programs were the first initiatives of their kind, and as a result, there remains some uncertainty about what standards apply when accounting for them in your financial statements and records.

If you’re wondering how to distinguish the two, as well as determine the standard you should be utilizing, Angel Naval, a leader in our Client Accounting Solutions practice, breaks it down.

The PPP versus the ERC

Created to aid businesses facing financial challenges through the pandemic, there are several key differences between the PPP and the ERC.

The PPP is a loan and was created for small businesses with less than 500 employees in mind, giving them the funds needed to cover payroll and other eligible expenses. This includes hiring back employees who were laid off and covering applicable overhead. The loans are forgiven if the proper criteria are met (I.e., maintaining payroll and keeping consistent employee numbers).

A subset of the PPP loan, the ERC is a refundable tax credit that allows businesses to reduce their tax liability based on the qualified wages they’ve paid to their employees during the pandemic. It was created for businesses of all sizes to capitalize on in order to avoid layoffs. They can claim up to $5,000 per employee in 2020 and $7,000 per employee per quarter in 2021.

Determining the appropriate accounting standard for ERCs

If you took advantage of the ERC, currently, there is no straightforward way of accounting for it. Put simply, the ERC is a gray area because it’s so new, and there isn’t a straightforward way of accounting for it. Plus, ERCs are payroll credits, not income tax credits — and while FASB has extensive guidance for accounting for income taxes in ASC 740, it doesn’t for payroll taxes. Even the American Institute of Certified Public Accountants (AICPA) has suggested different standards, so it’s up to you to apply your best judgement based on the facts and circumstances of your business. Some things to consider:

- The timing of recognition,

- The financial ratios important to you, and

- Whether you want to present a grant income line.

For income statement presentation, according to AICPA’s December 2022 report, more public entities are crediting the associated expense rather than recognizing the amounts on a separate line item.

For example, you may think you can account for the ERC the same way you can for the PPP, but you can’t. As we differentiated above, the PPP is a loan and the ERC is a payroll credit, therefore the PPP is subject to debt and liability standards and the ERC is not. While the PPP did come first, those companies that have paid payroll taxes but still qualified for the ERC are still able to retroactively claim the credit.

For prospective applications, for-profit entities can adhere to guidance in one of the following.

FASB ASC 958-605

If you’re applying the revenue recognition model under ASC 958-605, ERCs are treated as conditional contributions. In this case, companies must have met the program’s eligibility conditions to record revenue (and no amounts can be recorded until all criteria are evaluated and “substantially” met according to regulations). Given the conditions are met, a refund receivable and income should be recognized in the period the entity determines the conditions have been substantially met. This standard requires that gross revenue be recorded, and it doesn’t permit any netting of revenue against related expenses.

Some barriers to meeting ASC 958-605’s requirements include the eligibility requirements, like meeting the rules for a decline in gross receipts as well as incurring qualifying expenses (i.e., payroll costs). To file for the ERC, you’ll need to decide whether preparing the related ERC form and filing it with the government presents a barrier you’ll need to overcome. Note administrative and other small stipulations do not represent a barrier.

IAS 20

If you’re applying IAS 20, you can’t recognize the ERC until the “reasonable assurance” threshold is met in correlation with ERC’s conditions and receiving the credit. In this case, “reasonable assurance” translates to “probable” under GAAP standards and is easier to satisfy than “substantially met” in Subtopic 958-605. Once you’ve provided reasonable assurance that conditions will be met, the earnings impact of the government grants is recorded over the periods in which you recognize as expenses the related costs that the grants are intended to cover. So, you’ll need to estimate the amount of the credit you expect to keep.

IAS 20 allows you to record and present either the gross amount as other income or net the credit against other related payroll expenses. For every quarter that a company meets the recognition criteria, it records a receivable and either other income or net expense.

FASB ASC 450-30

If you’re interested in applying FASB ASC 450-30, please note amounts related to the ERC wouldn’t be recognized under this model until all uncertainties regarding the disposition of the credit are resolved — and there’s less detail on the disclosure, measurement, and recognition requirements as compared to the other standard models. For this reason, the AICPA doesn’t believe this model to be a preferred accounting policy for the ERC.

FASB ASC 832

If you’re applying this model, you must disclose several specifics about transactions with a government within its scope. These entail the nature of the transactions, which includes a description of the transactions as well as the form in which it has been received, whether it’s cash or other assets. You must also detail the accounting policies you used to account for the transactions. Any line items on the balance sheet and income statement that are affected by the transactions must be accounted for too — plus, the amounts applicable to each financial statement line item in the current reporting period.

How MGO can help

While there are clear accounting standards for the PPP, there is still some uncertainty surrounding the ERC. Depending on the standard you choose, you may have to consider the timing of recognition, financial ratios, and whether to present a grant income line. Therefore, businesses need to apply their best judgment based on the facts and circumstances of their business when accounting for ERCs. Our Client Accounting Solutions team has extensive experience helping clients navigate complex tax regulations post-pandemic. Contact us to learn more about which standard you should be using for federal relief programs.

About the author

Angel Naval oversees our West Coast Financial Advisory Services practice and provides value-added guidance for your corporate finance, financial planning, and business process needs.