Key Takeaways:

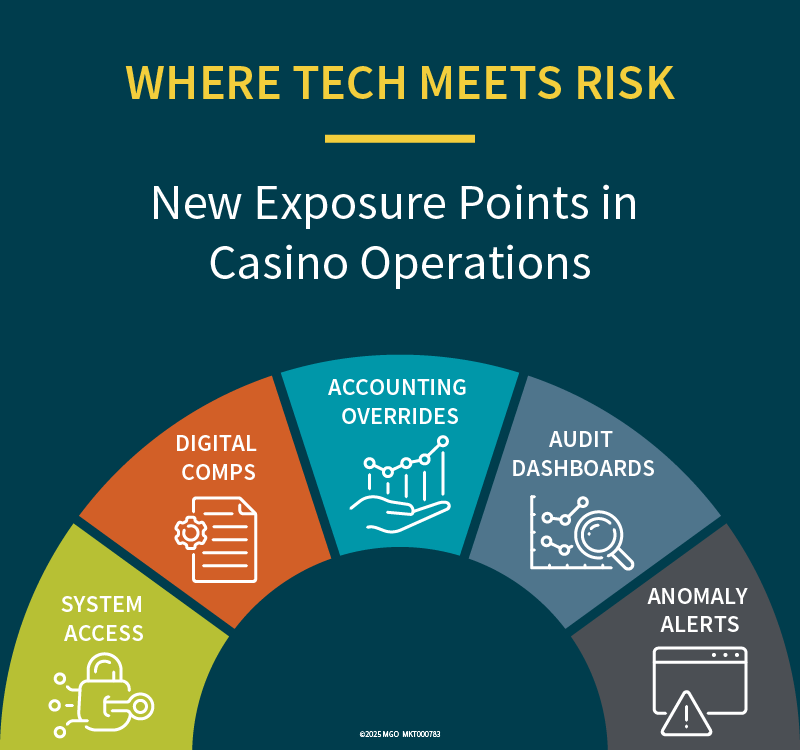

- New digital tools improve casino operations but introduce new fraud exposure points.

- Cross-functional coordination is critical to detect overrides, unauthorized access, and system anomalies.

- Updating fraud prevention strategies to reflect evolving technology improves visibility and oversight.

—

As your casino or Tribal gaming operation invests in digital transformation — from mobile payments to cloud-based financial systems — you’re unlocking new efficiencies. But you’re also exposing your organization to new types of risk. Fraud today looks different than it did even five years ago, and traditional controls aren’t always equipped to catch red flags embedded in digital workflows.

More than ever, your casino leadership must rethink fraud detection in terms of system access, data integrity, and cross-platform monitoring.

When Convenience Outpaces Control

The adoption of integrated rewards systems, digital comp tracking, and automated accounting platforms has brought greater efficiency to casino operations. But as convenience increases, so do the opportunities for fraud and internal misuse — especially if controls aren’t updated alongside the technology.

In some cases, unrestricted journal entry access can allow users with elevated permissions to override approval processes without oversight. In others, digitally approved promotional expenses may be manipulated through incorrect coding or bypassed policies, making fraudulent transactions harder to detect in real time.

These risks tend to surface when technology adoption outpaces internal control updates. Without exception reporting or regular review, irregular transactions — such as off-hour entries or high-dollar adjustments — can slip through unnoticed, potentially changing both financial reporting and organizational reputation.

Why System-Based Controls Need Cross-Team Support

Preventing fraud in digital environments requires a coordinated effort between finance, audit, and IT — not just stronger passwords or patch management.

When your internal audit, finance, and IT teams coordinate regularly, you can reduce silos and spot digital anomalies faster. This includes mapping user roles, restricting elevated access, reconciling data across systems, and reviewing logs for overrides — all activities that help close gaps created by modern, interconnected platforms.

This kind of shared responsibility is critical in Tribal casino operations where oversight is often split between departments or governing bodies.

Adapting Your Internal Audit Program

Firms experienced in gaming advisory — like those specializing in internal audit and IT risk integration — play a vital role in helping Tribal operations scale fraud controls alongside technology adoption. This often includes:

- Performing IT-focused fraud risk assessments

- Designing exception reporting dashboards

- Finding high-risk transactions through digital ledger analysis

Casino operators receive help from outside perspectives that understand the intersection of financial systems, emerging risks, and the regulatory nuances unique to Tribal enterprises.

Real-World Scenario: Data-Driven Comp Abuse

In one Tribal casino, a digital comp tracking system was introduced to streamline promotional offerings. Over time, an employee issued an unusually high volume of comps without proper approval, and the system lacked real-time alerts to flag the activity.

It wasn’t until audit staff reviewed system log data and conducted a frequency analysis of comp values that the pattern was found. Audit teams compared issuance trends over time, finding outliers tied to a single user account. The irregularities stood out against typical issuance behavior, prompting the team to implement new alert thresholds and tighten user access controls.

Preparing for the Future

Digital tools offer tremendous operational advantages — but only if they’re matched with adaptive fraud prevention strategies. The most effective casino operations regularly review system permissions, update audit procedures, and involve external specialists to assess risk holistically.

Firms like MGO, with experience in both internal audit and gaming operations, can provide valuable perspective by showing you gaps in digital controls, designing analytics-based testing procedures, and aligning your technology stack with evolving compliance requirements. This collaborative approach can help your casino not only stay ahead of fraud risks — but also strengthen financial resilience in a tech-driven environment.

Explore MGO’s casino risk advisory services → mgocpa.com/solution-industry/tribal-nations-and-gaming