Key Takeaways:

- A slower SEC rulemaking process may reduce regulatory pressure, giving asset managers more time to adapt compliance strategies and implement reforms.

- Shifting SEC priorities could lead to revised or withdrawn regulations, offering asset managers a chance to reassess risk and reallocate compliance resources.

- A more supportive stance on digital assets may open the door for investment firms to expand offerings and attract clients exploring cryptocurrency exposure.

—

A Regulatory Reset in Progress

With a new SEC chairman at the helm, your investment firm may soon feel the impact of a more measured and business-friendly regulatory approach. Paul Atkins’ confirmation signals a likely shift away from rapid-fire rulemaking and toward methodical, consultative oversight — a welcome reprieve for asset managers overwhelmed by previous years’ aggressive timelines and expanding mandates.

While there’s still uncertainty about how far these changes will go, your firm can prepare to capitalize on a potentially reduced compliance burden, extended implementation windows, and emerging opportunities in areas like digital assets.

What’s Changing at the SEC?

The appointment of Chairman Atkins follows former Acting Chair Mark Uyeda’s philosophy: “Slow is smooth and smooth is fast.” This shift in mindset means your organization may benefit from longer regulatory timelines, fewer surprises, and increased opportunities to provide input before new rules are finalized.

Key Implications:

- Deliberate Rulemaking: Asset managers may no longer need to scramble to meet short compliance deadlines. The SEC appears poised to review and potentially withdraw or revise several proposed rules, including those on ESG disclosures, outsourcing, and custody of client assets.

- Extended Timelines for Final Rules: Rules adopted but not yet in effect — such as the updated Form N-PORT — could see delayed implementation. This gives your firm more time to develop thoughtful compliance strategies and engage in dialogue with regulators.

- Regulatory Clean-Up: An executive order mandates the SEC to eliminate “anti-competitive” regulations. This could simplify your compliance burden, reduce red tape, and make way for innovation — especially for firms looking to explore emerging sectors.

Digital Assets: A Strategic Advantage

Chairman Atkins is also signaling a more favorable stance on digital assets. If your firm has been hesitant to move into cryptocurrency and blockchain investments, now may be the time to re-evaluate.

Under the prior administration, SEC enforcement actions created a chilling effect on digital innovation. In contrast, Atkins — with advisory experience in crypto — is expected to introduce clearer, more constructive frameworks. His focus on “rational and principled” regulation could position digital assets as a viable component of your offerings, giving early movers a strategic edge.

Don’t Scale Back Just Yet

Despite this seemingly softer tone, your compliance strategy shouldn’t be scaled down prematurely. Regulatory priorities are still evolving, and the risks of misjudging the new agenda remain high.

Stay informed and keep your compliance systems strong while observing how the SEC’s actions unfold. By maintaining readiness and flexibility, your organization can adapt strategically and avoid costly missteps.

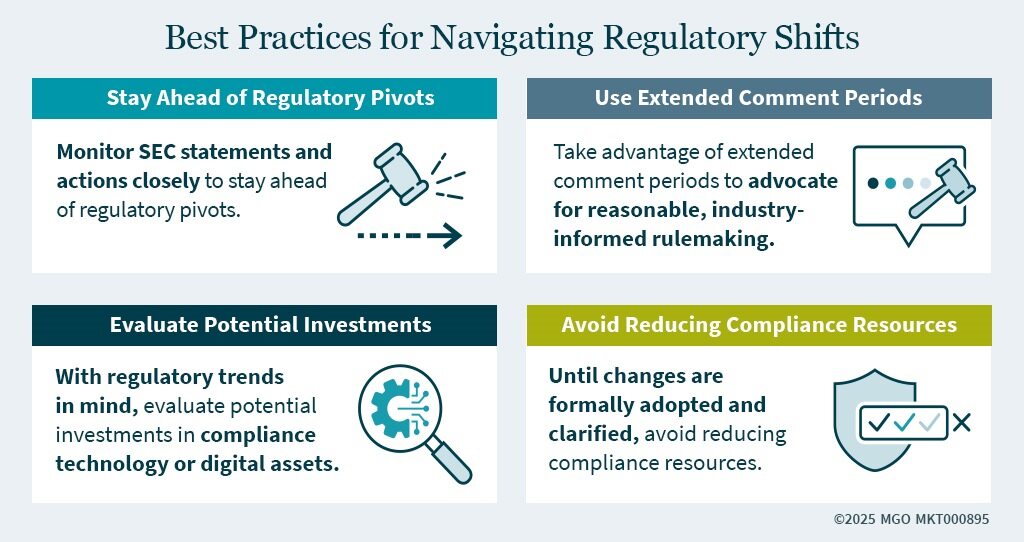

Your Best Practices for Navigating Regulatory Shifts

- Monitor SEC statements and actions closely to stay ahead of regulatory pivots.

- Use extended comment periods to advocate for reasonable, industry-informed rulemaking.

- Evaluate potential investments in compliance technology or digital assets with regulatory trends in mind.

- Avoid reducing compliance resources until changes are formally adopted and clarified.

How MGO Can Help

Navigating regulatory uncertainty requires both agility and insight, and that’s where MGO comes in. Our team stays on top of every SEC development, helping investment firms interpret shifts in policy, plan for evolving compliance demands, and seize emerging opportunities, from ESG to digital assets. Whether you need support rethinking your compliance strategy, evaluating new technologies, or engaging regulators during comment periods, MGO can give you the clarity and experience you need to stay ahead, regardless of the headlines.