Key Takeaways:

- R&D tax credits incentivize innovation by reducing tax liability and providing cash flow for companies to reinvest in research.

- Current legislation proposes delaying R&D cost amortization, advocating immediate expensing through 2025 to boost U.S. innovation.

- To maximize R&D tax benefits, companies must strategically align projects with eligibility criteria, maintain documentation, choose the optimal claim path, and tailor strategies to industry-specific nuances.

—

In the competitive global market, staying at the forefront of innovation is not just a goal but a necessity for businesses of all sizes. Noting this, the U.S. government established a pivotal incentive to reward and encourage investments in research and development (R&D). R&D tax credits serve as a cornerstone for companies pushing the boundaries of innovation and technological progress.

Empowering Innovation Through Tax Incentives

The beauty of R&D tax credits lies in their dual benefit structure. Not only do they reduce tax liability for your business, but they also enhance cash flow — allowing reinvestment back into your company’s innovation pipeline. This reinvestment is vital for continuous improvement and long-term success, particularly for startups dreaming big and established companies refining processes and products. R&D tax credits are not just a tax strategy; they are a fundamental part of your growth narrative.

Whether you are a fledgling tech startup aiming for the next big breakthrough or a seasoned manufacturer improving existing processes, R&D tax credits offer widespread applicability. They represent a commitment to supporting the growth and innovation journey of businesses across various sectors, from AI and green energy to biotech and manufacturing.

Legislative Efforts Amidst Challenges

The Tax Cuts and Jobs Act (TCJA) introduced in 2017 made significant changes to R&D tax incentives, shifting from immediate expensing of R&D costs to a more burdensome five-year amortization. However, in a move to rejuvenate the innovation landscape, the Tax Relief for American Families and Workers Act of 2024 has been proposed to delay this amortization, championing immediate expensing through 2025. This legislative initiative underscores the economic imperative for the U.S. to maintain its global leadership in innovation and technology.

While there is bipartisan support for the importance of R&D incentives, with key proposals awaiting Senate action, the legislative landscape is not without its challenges. The proposed Fiscal 2025 Budget by President Biden earmarks substantial investments in innovative sectors to complement the tax incentives. However, the legislative progress faces hurdles with ongoing debates over government funding, potentially delaying critical policy adjustments necessary for the R&D tax incentives to realize their full potential.

Strategizing to Maximize Your R&D Benefits

For your business to capitalize on these incentives, you must align with the stringent four-part test that stipulates qualifying R&D activities must be:

- Technological in nature

- Aimed at permitted purposes

- Directed towards the elimination of uncertainty

- Entail a process of experimentation

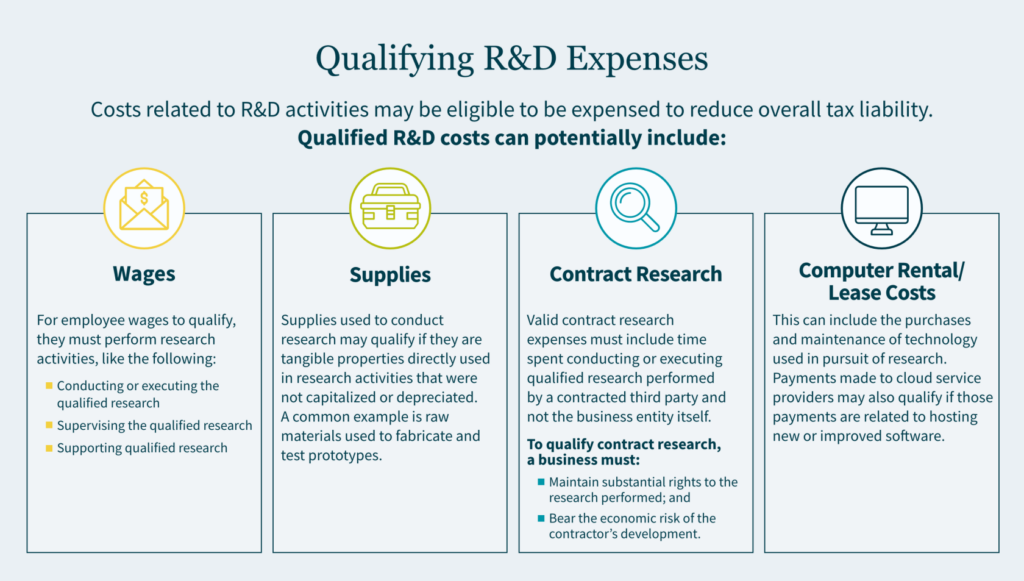

Maintaining rigorous documentation is essential, linking projects directly to these eligibility criteria. Choosing the right claim path — against income or payroll tax — can also determine the extent and immediacy of the benefit. Furthermore, industry-specific insights can guide your company on how to tailor your R&D strategies — acknowledging that some activities may qualify more readily based on your industry’s nature.

How We Can Help

MGO’s Tax Credits and Incentives team can help you turn tax expenses into positive cash flow. Reach out to our team today to find out how you can leverage R&D tax credits to grow your business.