This article is part of a series, “Navigating the Complexities of Setting Up a Business in the USA”. View all the articles in the series here.

Key Takeaways:

- Assess different business structures to find the best fit for your U.S. operations and strategic goals.

- Understand how each entity type affects your tax obligations and benefits.

- Look for legal and tax advice to navigate complex regulations and improve your business setup.

~

Choosing the right business structure is a critical step in setting up your U.S. operations. The structure you select will affect your tax obligations, legal liability, and potential to raise capital. Additionally, the entity you choose may impact your day-to-day business operations and long-term strategic goals.

Importance of Selecting the Appropriate Business Entity

Selecting the right business entity affects everything from how profits are taxed to the level of personal liability for owners. It also dictates the regulatory requirements you must follow — which can vary significantly depending on the chosen structure.

Types of Business Entities

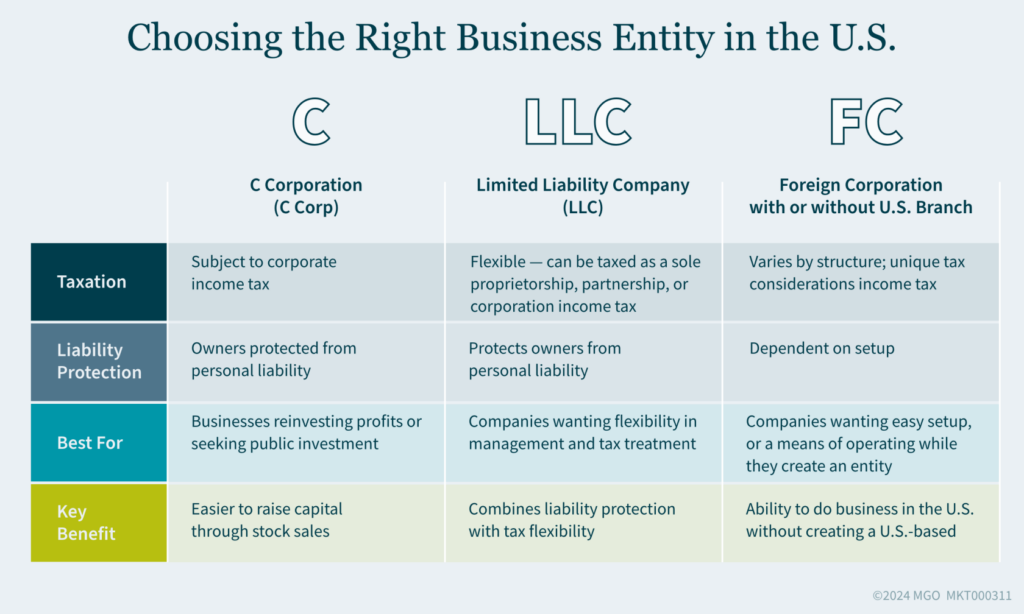

The main types of business entities available in the U.S. include:

- C corporation (C corp) — A standard corporation subject to corporate income tax. This structure is beneficial for businesses that plan to reinvest profits into the company or seek public investment.

- Limited liability company (LLC) — A flexible entity that can be taxed as a sole proprietorship, partnership, or corporation. It offers liability protection while providing tax flexibility.

- Foreign corporation with or without a U.S. branch — This setup allows a foreign company to do business in the U.S. without forming a separate legal entity. However, it comes with its own set of tax and legal considerations. It is crucial to consider both sides of the equation when deciding the entity structure, as cross-border operations can be complex and require careful planning.

Keys Factors to Consider When Selecting an Entity.

When choosing a business structure, consider the following:

- Tax implications — Different structures have varying tax rates and filing requirements

- Legal considerations — The level of liability protection varies by entity type. C corps and LLCs generally offer more protection against personal liability than sole proprietorships or partnerships

- Operational needs — Consider how the chosen structure will affect your business operations. For instance, C corps can raise capital more easily through stock sales, while LLCs offer greater flexibility in management and profit distribution. Additionally, forming a U.S. entity may simplify transactions with other U.S. businesses versus operating as a foreign corporation with a U.S. branch.

Making the Right Entity Decision for Your U.S. Expansion

Selecting the right business entity is crucial for the success of your U.S. operations. To determine what the right entity is for you, it is important to evaluate all factors — including tax implications, legal protections, and operational needs. Consulting with legal and tax professionals can help you make an informed decision that aligns with your business goals.

Need help choosing the right business structure for your U.S. expansion? Reach out to our International Tax team today to get professional guidance tailored to your specific needs.

Setting up a business in the U.S. requires thorough planning and an understanding of various regulatory and operational challenges. This series will delve into specific aspects of this process, providing detailed guidance and practical tips. Our next article will discuss navigating the U.S. tax system, a crucial consideration for any foreign business looking to enter the U.S. market.