Key Takeaways:

- Many professional athletes go on to achieve even greater financial success in their lives after sports through proactive financial planning and capitalizing on post-career opportunities.

- Having the right financial advisory team is crucial for transitioning athletes to make smart money decisions across areas like investments, business ventures, taxes, estate planning, and risk management.

- With proper guidance, athletes can turn their playing careers into lifelong financial stability and growth through entrepreneurship, investments, and other lucrative second careers.

—

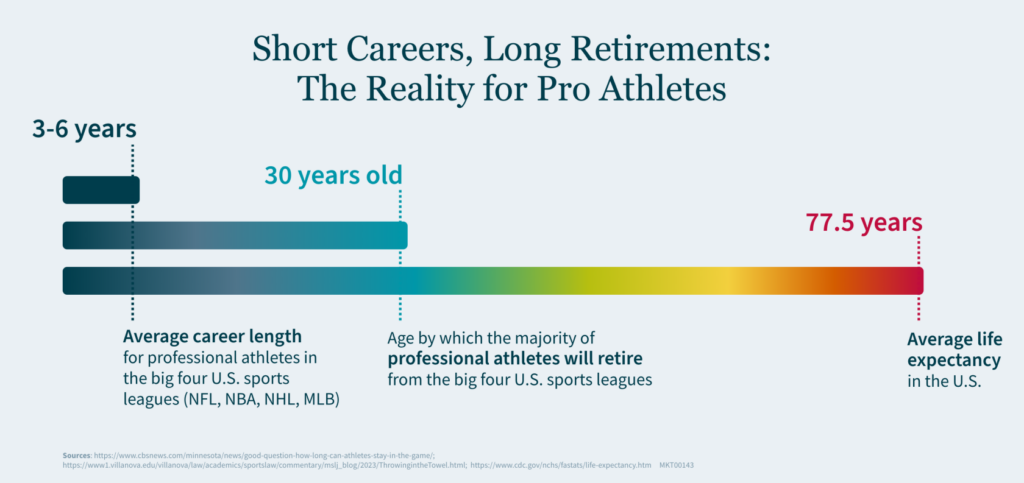

As a professional athlete, you’ve spent years honing your skills, building your career, and making a name for yourself. But what happens when the final whistle blows and your playing days are behind you?

The good news is many athletes move on to highly successful and lucrative ventures after their time in sports — some even making more money than they did during their athletic careers. With the right financial support and strategic planning, you can be one of them.

From Athlete to Entrepreneur: Maximizing Post-Career Opportunities

The transition to life after sports can be incredibly rewarding, opening doors to new and exciting opportunities. Many professional athletes have not only avoided the financial pitfalls often associated with post-career life but have also thrived financially.

Here are a few notable examples of athletes who’ve achieved significant financial success with their second careers:

Kenny Smith

Kenny “The Jet” Smith played 10 years in the National Basketball Association (NBA), winning back-to-back championships with the Houston Rockets in 1994 and 1995. While Smith made just under $12 million over his playing years, as an analyst on the Inside the NBA alongside Ernie Johnson, Charles Barkley, and Shaquille O’Neal, Smith reportedly takes home $16 million per year.

Maria Sharapova

While Sharapova earned over $300 million during a career where she became just the tenth woman to win all four major championships, she retired at the young age of 32 in 2020. Since that time, she has established herself as an investor and entrepreneur — working with health and wellness brands like Therabody and Tonal — while also serving on the board of directors for luxury fashion house Moncler Group.

Derek Jeter

Jeter played 20 seasons at shortstop for the New York Yankees, winning 5 World Series titles before retiring in 2014. After earning over $265 million in MLB salary, Jeter went on to found Jeter Publishing with Simon & Schuster and the media company The Players’ Tribune in 2014, which publishes first-person stories from athletes. From 2017, he became part-owner and CEO of the Miami Marlins.

David Beckham

Playing 21 seasons of professional soccer for teams like Manchester United, Real Madrid, the LA Galaxy, Beckham racked up league titles and millions in contract dollars. Retiring in 2013, he transitioned into a successful business career — starting the management company DB Ventures and collaborating with brands like HUGO BOSS. In 2018, Beckham brought Major League Soccer to Miami as co-owner of Inter Miami CF.

These examples demonstrate the wealth creation potential that exists long after an athletic career ends. Of course, it’s not just about what you do after your playing days are over; it’s also about what you do with your money.

The Role of Financial Advisors in Your Post-Career Success

The right financial advisors can help you navigate the complex financial landscape, assisting you to make smart decisions that will benefit you in the long term. Here are some key areas where advisors can support you:

Investment Planning

Post-career, it’s essential to make your money work for you. Financial advisors can help you develop a diversified investment portfolio tailored to your risk tolerance and long-term goals. This could include stocks, bonds, real estate, and business ventures.

Business Ventures

Many athletes transition into entrepreneurship. Advisors can provide invaluable support in evaluating business opportunities, developing business plans, and managing your ventures. Whether you’re interested in starting a restaurant, a retail chain, or a tech startup, having the right guidance can make all the difference.

Tax Planning

High earnings often come with complex tax obligations. A financial advisor can help you navigate these complexities, enabling you to take advantage of tax-saving opportunities and stay compliant with regulations.

Estate Planning

Protecting your wealth for future generations is crucial. Advisors can assist you in creating an estate plan that distributes your assets according to your wishes, minimizing tax liabilities and providing for your loved ones.

Retirement Planning

Even if you’re transitioning into a second career, planning for retirement is essential. Advisors can help you set up retirement accounts, plan for long-term care, and establish a steady income stream throughout your retirement years.

Risk Management

Life is unpredictable, and managing risk is a crucial part of any financial plan. Advisors can help you select the right insurance policies and develop strategies to protect your assets against unforeseen events.

Taking the Next Step in Your Post-Playing Journey

Transitioning from a professional athlete to a successful entrepreneur, broadcaster, coach, or executive is not just a dream; it’s a reality for many who have walked in your shoes. With strategic planning and the right financial support, you can turn your athletic success into lifelong financial stability and growth.

Remember, the game doesn’t end when you leave the field; it simply evolves. Embrace the opportunities ahead and put the right team in place to guide you through every step of your post-career journey.

How We Can Help

Our dedicated Entertainment, Sports, and Media team has extensive experience guiding professional athletes through all phases of their career journeys. We offer comprehensive financial services tailored to help you achieve continued success. Reach out to our team today to discuss how we can support your post-career goals.