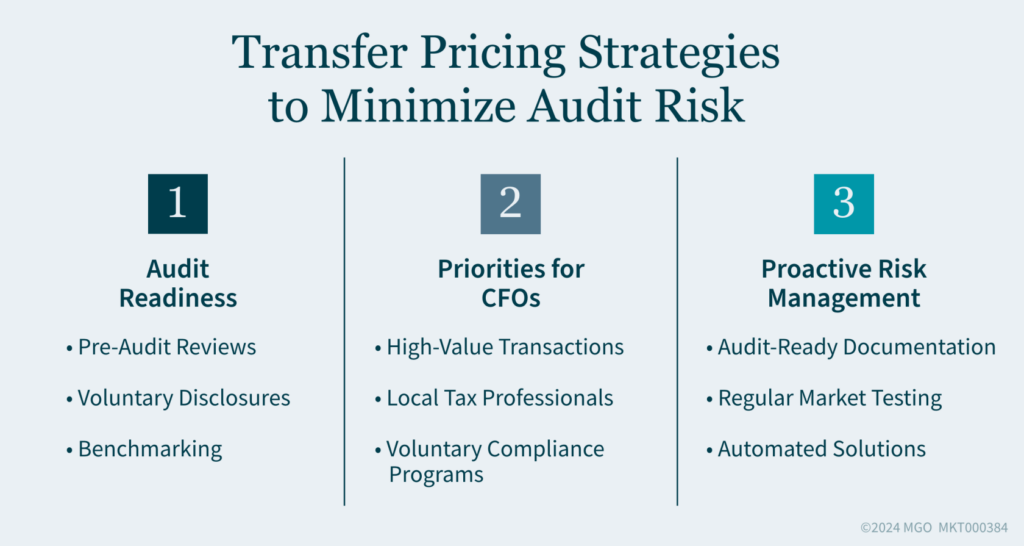

Key Takeaways:

- Transfer pricing is an increasing area of focus for tax authorities, requiring CFOs to adopt more strategic audit preparation.

- Proactive measures like pre-audit reviews, voluntary disclosures, and benchmarking are crucial for companies to defend transfer pricing policies and minimize risks.

- Prioritizing high-value transactions, collaborating with tax professionals, and leveraging technology are essential to stay ahead of evolving transfer pricing regulations and potential audits.

—

In today’s global tax environment, transfer pricing has become a critical focus for tax authorities. With multinational companies operating across multiple jurisdictions, tax authorities are intensifying their efforts to scrutinize transfer pricing practices and confirm that profits are appropriately distributed and taxed in their jurisdictions. This growing focus requires chief financial officers (CFOs) and tax executives to shift from compliance alone to comprehensive audit preparation and strategic risk management.

From Compliance to Audit Readiness

While transfer pricing compliance has always been important, the increasing focus on audit enforcement is changing the landscape. It is no longer enough to simply have policies in place; your company needs to be prepared to defend them under rigorous examination. This shift highlights the importance of proactively managing transfer pricing risk and preparing for potential audits.

Risk management and audit preparation efforts include:

- Pre-audit reviews — Conducting periodic pre-audit reviews is essential. These reviews offer an opportunity to examine your transfer pricing documentation and policies to confirm the pricing of all intercompany transactions is supported by clear agreements. It is important the documentation reflects an arm’s length standard and is presented in a way that would stand up to an audit. Showing gaps, inconsistencies, or potential weaknesses early on allows your company to address them before tax authorities intervene.

- Voluntary disclosures — In cases where pre-audit reviews reveal potential issues, voluntary disclosures can be a valuable tool. If discrepancies are found, making voluntary disclosures to tax authorities can sometimes lead to more favorable outcomes as it shows good faith and a proactive approach to compliance. It also demonstrates your company has a level of sophistication in overall global financial hygiene. This strategy can help you avoid more severe penalties that may arise from issues discovered during an Internal Revenue Service (IRS) or foreign jurisdiction audit.

- Benchmarking — Benchmarking and testing are also key components of audit preparedness. Your company should consistently review its transfer pricing policies and test them against current market conditions. This is particularly important when there are economic shifts or significant changes in business operations — such as the introduction of new products, services, or intangible assets. By regularly benchmarking intercompany pricing, your company can support alignment with the arm’s length principle and minimize risk during an audit.

The Role of CFOs in Managing Transfer Pricing Risk

For CFOs, transfer pricing audits are a significant financial risk. These audits can result in tax adjustments and penalties. They can also lead to reputational damage if issues are not handled properly and with sufficient expeditiousness. CFOs together with their tax advisors play a significant role in mitigating this risk by taking a strategic approach to audit readiness and documentation.

Key areas of focus for CFOs include:

- High-value transactions — A top priority for CFOs should be focusing on high-value transactions. Not all intercompany transactions carry the same level of risk, and those involving intangible assets, intellectual property, or complex financial arrangements tend to receive the most scrutiny from tax authorities. It is important to thoroughly document and benchmark these transactions to avoid potential challenges during an audit.

- Tax professionals — Another critical element of risk management is collaborating with tax professionals. Transfer pricing rules can vary significantly across jurisdictions, and tax advisors are well-versed in the specific requirements and regulations in various countries. Working closely with these advisors enables your company to adapt its transfer pricing policies to standards and minimize exposure to risk.

- Voluntary compliance programs — In some cases, companies may receive help by entering voluntary compliance programs — such as advance pricing agreements (APAs). These agreements allow your company to gain certainty over transfer pricing arrangements by agreeing to terms with tax authorities in advance. For high-risk transactions or operations in high-risk jurisdictions, APAs can provide a level of protection from future audits and disputes.

Proactive Risk Management in Transfer Pricing

The global tax landscape continues to evolve as regulatory authorities refine their approaches to transfer pricing audits and enforcement. For mid-market companies with limited resources, it is particularly important to strike the right balance between compliance and cost-efficiency. This requires a proactive approach to transfer pricing risk management that combines audit readiness with strategic planning.

Steps for proactive risk management include:

- Audit-ready documentation — The first step in proactive risk management is building audit-ready documentation. This includes keeping detailed records of all intercompany transactions, agreements, and financial data that support the arm’s length nature of pricing decisions. Regularly reviewing and updating this documentation helps your company stay prepared for potential audits.

- Regular market testing — Beyond documentation, CFOs should incorporate benchmarking and market testing into risk management strategies. By continuously checking how your pricing compares to the market, your company can stay aligned with the arm’s length principle and minimize exposure to tax adjustments. Regular testing can also help you find potential discrepancies before they become audit issues.

- Automated solutions — Finally, using technology to enhance efficiency and accuracy in transfer pricing documentation and analysis is essential. Automated solutions and data analytics offer the ability to quickly find risks, prioritize compliance efforts, and streamline the process of audit preparation.

Keeping Your Company Ahead of the Transfer Pricing Curve

In an era of increased scrutiny and regulatory pressure, transfer pricing compliance is a priority for multinational companies. For CFOs and tax executives, the challenge lies not just in keeping compliant but in preparing for audits and managing the associated risks. Proactive risk management, strategic audit readiness, and a careful focus on high-value transactions are critical components in navigating this complex landscape.

By focusing on audit preparedness, keeping documentation up-to-date, and collaborating with local tax professionals, you can position your company to minimize tax adjustments, penalties, and disputes. As transfer pricing rules continue to evolve, staying ahead of the curve with a forward-thinking strategy is essential for supporting compliance and reducing financial risks.

How MGO Can Help

Our International Tax team is here to help you navigate the new transfer pricing landscape. We can assist you in both broad and focused areas, providing guidance to meet your specific transfer pricing needs. Our services include:

- IRS Pre CheckUP — We help you identify and rectify potential weaknesses in transfer pricing and international tax documentation and practices before facing an actual IRS audit.

- Review of:

- Cross-border agreements for U.S. tax updates

- Benchmark data sets

- Transfer pricing documentation

- U.S. tax returns to confirm consistency with transfer pricing documentation and policies, as well as withholding practices

Protect your company from costly adjustments and penalties — reach out to our team today.