Executive Summary:

- Many state and local governments today are short on resources, limiting their ability to effectively manage a growing amount of complex debt, leases, and subscriptions.

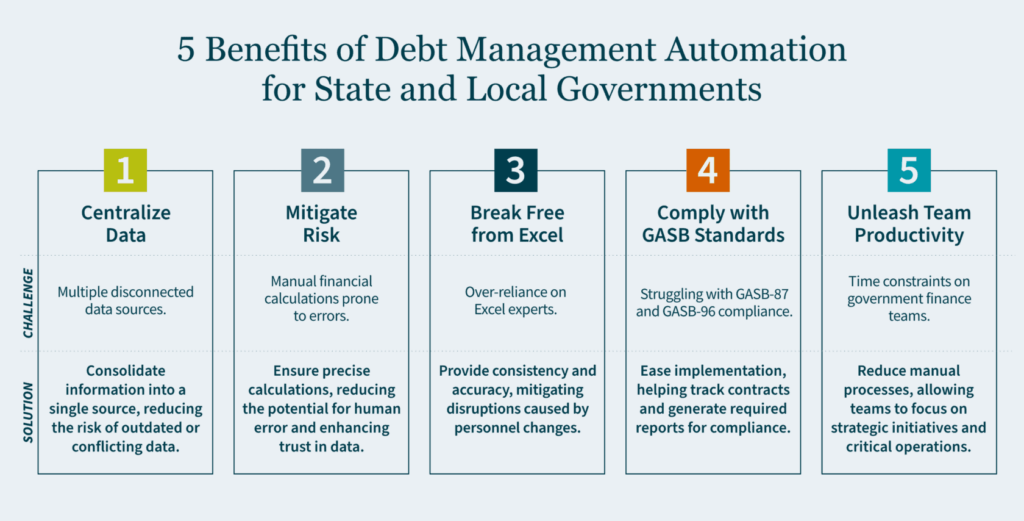

- Technology solutions like debt management software can help by centralizing data, automating complex tasks, and mitigating risk of errors.

- Automated systems save significant time preparing financial statements and disclosures compared to manual processes, enabling teams to focus on strategic initiatives.

~

Government finance teams have never faced more obligations with fewer resources. As key personnel retire or leave for other opportunities, organizations risk losing institutional knowledge around managing critical finance functions like debt service and reporting. At the same time, new accounting standards around items like leases and subscriptions have added layers of complexity to already overstretched personnel.

If your state or local government finance team is still tracking your accounting and disclosures manually or relying on trustees to notify you about debt service payments, technology solutions may provide a way to ease key pain points and help you better manage your debt.

The Quicksand of Spreadsheets and Shortage of Government Talent

Many finance teams currently rely on elaborate Excel spreadsheets to track balances, payments, and disclosures related to municipal bonds, notes, loans, and other debt obligations. This reliance introduces a high degree of risk, as a departure or error by the one staff member familiar with the spreadsheet structure can lead to miscalculations and missed payments. Excel’s limitations in providing an audit trail and reporting functionality further hinder robust financial management.

Amid growing debt and lease burdens, state and local governments are also suffering acute talent losses as employees seek better compensation or workplace flexibility elsewhere. Governments face a shortage of personnel skilled in specialized areas like defeasance, premium amortization, and derivative valuation — aggravated by constant turnover and migration between organizations. This lack of a stable workforce poses a threat to effective fiscal management, leaving critical positions vacant. Relying on a sole employee or only a few individuals for complex accounting and debt management exposes your organization to the risk of disruption if those key people leave.

Relieving Pain Points by Reducing Reliance on Manual Systems

With manual systems taxing finance teams, increasing the potential for error, and becoming more challenging as demands on human resources grow, many state and local governments have turned to debt management software as a solution. This technology offers a lifeline for state and local governments by automating key elements of the debt lifecycle while improving controls and staff productivity. Municipal debt management software handles complex calculations and disclosures — including amortization schedules, refunding eligibility, premium and discount calculations, gains or losses on refunding calculations, costs of issuance amortization, defeasance tracking, and custom reporting.

Here are five critical ways debt management automation can help improve your efficiency and empower your team:

1. Centralizing Data in One Single Source of Truth

Many government finance teams rely on multiple disconnected data sources — from Excel spreadsheets to paper records in filing cabinets. By eliminating decentralized information and data silos, automated systems provide a consolidated view and a single source of truth, thereby significantly decreasing the likelihood of using outdated or conflicting information.

2. Mitigating Risk through Comprehensive Automation

Manual financial calculations (such as premium/discount amortization) open the door for errors. A few mistakes can lower trust and confidence in the data, raising questions around the accuracy of the reporting. Acting as a safeguard against errors in high-stakes financial transactions, automated systems ensure precise calculations — reducing the potential for human error and the chances of missing a debt service payment or creating material misstatements.

3. Eliminating Reliance on Excel Wizards

The professionals on your team who are “Excel wizards”, creating intricate formulas to simplify accounting tasks, are great… until they leave or retire, and other people have to step into their roles and recreate or unravel their work. Automated systems provide consistency and accuracy, reducing the risk associated with relying on intricate Excel systems and mitigating disruptions due to sudden departures.

4. Facilitating Compliance with GASB-87 and GASB-96

Many finance teams are still struggling to put processes in place to remain compliant with new lease and subscription accounting standards from the Governmental Accounting Standards Board (GASB). Automated cloud-based software significantly eases the implementation workload, helping track contracts, aggregate data, and generate reports required for GASB-87 and GASB-96 compliance.

5. Freeing Your Team to Focus on Productivity

Time is a valuable commodity for any professional. This is particularly true for state and local government finance teams, which are often understaffed and crunched for resources. Automated solutions reduce reliance on manual processes, enabling your finance team to focus more on strategic initiatives rather than routine data entry. With less time drained by debt management, your people can focus more on critical operations.

Moving from Manual to Automated Debt Management

With state and local governments facing expanding responsibilities and diminishing resources, automating critical finance functions like debt management presents a timely opportunity. Establishing more modern systems and streamlining processes allows state and local governments to manage debt and lease data more easily and accurately. By eliminating manual busywork, finance staff can focus their efforts on the important strategic projects and high value-add work that moves governments forward. And governments can make decisions founded on complete and consistent financial data.

How We Can Help Implement a System that Supports Complex Accounting

One option to consider is DebtBook, a leading lease and debt management software for state and local governments that centralizes information and reporting. Public finance teams use DebtBook to create a durable system of record to track all current and historical debt obligations, including all changes over time (reallocation, defeasance, refinancing, etc.). DebtBook helps generate efficiencies across the organization — delivering data consistency and accuracy, while boosting collaboration across internal and external teams.

MGO, in partnership with DebtBook, can assist you with implementation of the system, entering your data, and educating your team on usage and maintenance*. Reach out to us today to learn more about how DebtBook can work for your state or local government.

*Services for audit clients are limited to those that do not impair independence, such as providing advice and validation services to ensure the integrity of the financial information that comes out of the system.