Key Takeaways:

- May apply to more types of leave than previous standard.

- Probability assessment requires analysis and judgment.

- Key changes include specific criteria for recognizing unused and used leave, measurement using current or expected pay rates, and streamlined disclosure requirements.

—

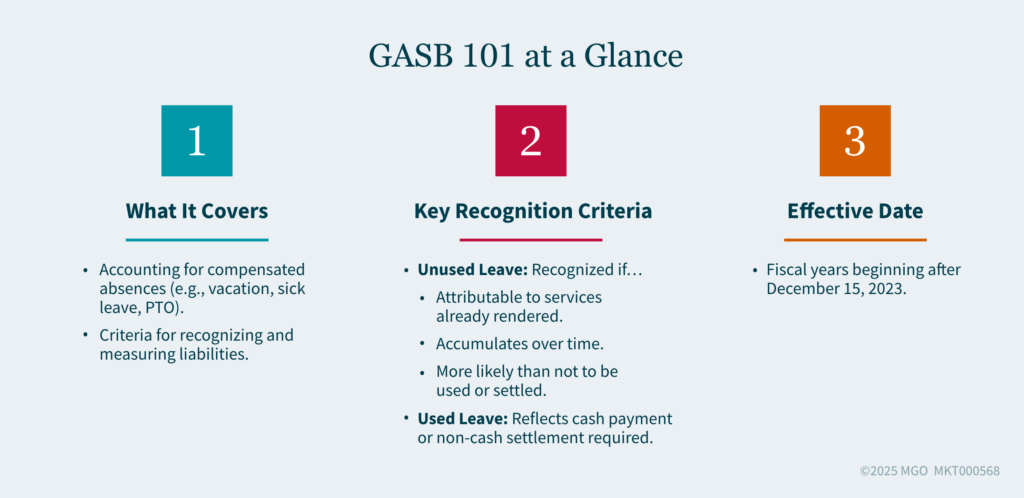

As a state or local government entity, your financial reporting requirements are critical to maintaining transparency and accountability. One area that has seen an update is the treatment of compensated absences under Governmental Accounting Standards Board Statement No. 101, Compensated Absences (GASB 101). Understanding this standard is essential to accurately recognizing and measuring liabilities associated with employee leave benefits.

GASB 101 is effective for fiscal years beginning after December 15, 2023, and all reporting periods thereafter. In addition, the year of transition (implementation) will also need to consider the impact on beginning balances. For comparative financial statements (e.g., two-year presentation), you will need to consider the impact on starting with the earliest year presented.

This article breaks down the key aspects of GASB 101 and what it means for you.

What Are Compensated Absences?

Compensated absences refer to employee leave for which your organization provides monetary or non-monetary compensation. Examples include:

- Vacation leave

- Sick leave

- Paid time off (PTO)

- Holidays

- Parental leave

- Bereavement leave

- Certain sabbatical leaves (those where employees are not required to perform significant duties)

Compensated absences can involve direct payments to employees during their time off, payouts for unused leave upon termination, or non-cash settlements like conversions to defined benefit postemployment benefits.

Recognition: When Do You Record a Liability?

Under GASB 101, you must recognize liabilities for compensated absences in financial statements using the economic resources measurement focus. Specifically, liabilities should be recognized for:

- Unused leave that employees are entitled to and meets specific criteria.

- Used leave that has not yet been paid or settled.

For unused leave, a liability must be recognized if:

- The leave is attributable to services already rendered.

- The leave accumulates over time.

- The leave is more likely than not to be used or otherwise settled through cash or non-cash means.

For used leave, liabilities should reflect the amount of cash payment or non-cash settlement required. The probability assessment of “more likely than not” is defined as the likelihood of more than 50%. The application of the “more likely than not” criterion will require more effort in analyzing historical trends and utilizing judgment to build methods and assumptions into the calculation.

Leave Types Excluded from Recognition

Certain types of leave are excluded from liability recognition:

- Unlimited leave: Leave policies without specific limits do not accumulate and therefore are not recognized until used.

- Sporadic event-based leave: Parental leave, jury duty, and military leave are recognized only when the leave commences.

- Holiday leave: Holidays taken on specific dates are not at the discretion of employees and are recognized only when used.

Measuring Compensated Absence Liabilities

When measuring liabilities, GASB 101 provides clear guidelines:

- Use the employee’s pay rate as of the financial statement date.

- If leave is likely to be paid at a different rate in the future, measure it using that expected rate.

- For leave not attributed to a specific employee, such as pooled leave, use an estimated pay rate representative of the eligible population.

- Include salary-related payments (e.g., employer contributions to Social Security or Medicare) directly and incrementally tied to the leave.

Changes in pay rates that affect the liability should be recognized in the period the change occurs.

Examples of Recognized Liabilities

The following examples illustrate how liabilities for compensated absences are recognized under GASB 101, depending on the type of leave and its terms of use or payment:

- Paid time off (PTO): PTO that accumulates without limits and is paid upon termination is recognized as a liability because it is more likely than not to be used or paid.

- Sick leave: Sick leave that carries over to the next fiscal year but expires at the end of the calendar year is partially recognized based on the amount expected to be used before expiration.

- Compensatory time: Comp time earned for overtime or holiday work that carries over and is paid upon termination is recognized as a liability.

Salary-Related Payments and Compensated Absences

Salary-related payments directly associated with compensated absences include:

- Employer shares of Social Security and Medicare taxes.

- Defined contribution pensions and OPEB expenses directly tied to leave usage.

These payments are recognized as liabilities incrementally, reflecting the portion directly tied to the compensated absences liability.

Relationship to Post-Employment Benefits

Compensated absences often intersect with post-employment benefits. For example, some governments allow unused sick leave to be paid into an account for future healthcare premiums. Such payments are included as liabilities under GASB 101 if they meet the criteria for recognition.

However, the effects of compensated absences on a government’s defined benefit post-employment liabilities are not included in the compensated absences liability itself.

Reporting in Governmental Funds

For governmental funds, liabilities for compensated absences should align with current financial resources measurement principles. Report only the portion of liabilities expected to be liquidated with expendable available financial resources.

Note Disclosures

GASB 101 requires specific disclosures related to compensated absences, including:

- Increases and decreases in liabilities for compensated absences (reported as net amounts if preferred).

- Clear presentation of the amounts recognized as long-term liabilities.

GASB 101 also eliminates certain disclosure requirements from GASB 34, simplifying reporting in this area.

What This Means for Your Government

GASB 101 provides clarity and consistency in accounting for compensated absences, so your financial statements more accurately reflect your organization’s obligations. To comply:

- Review your current leave policies and determine whether they meet the recognition criteria.

- Confirm your financial reporting systems can accommodate the specific measurement and disclosure requirements outlined in GASB 101.

- Train your staff to understand these changes and their impact on your financial statements.

By proactively addressing these requirements, you can improve the transparency and accuracy of your financial reporting — reinforcing trust with your stakeholders and setting a solid foundation for future audits.

How MGO Can Help

Have questions about how GASB 101 applies to your government? Our State and Local Government team can help you navigate GASB 101 requirements and update your liabilities to account for compensated absences. Reach out to our team today to find out how we can support your compliance and reporting needs.