Key Takeaways:

- Potential 2025 tax changes may lower corporate rates and extend key business deductions, affecting planning and cash-flow strategies.

- Trump’s policies may reduce clean energy incentives while maintaining fossil fuel preferences, impacting energy investments.

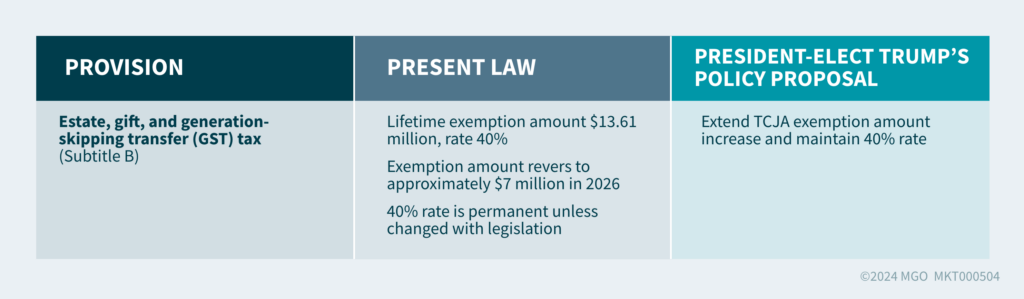

- Estate tax exemption increases from the TCJA could be made permanent, with long-term implications for estate planning.

—

With President-elect Donald Trump winning a second term in the November 5 election, we have a clearer picture of what tax policies will be at the forefront of discussions as we head into 2025 and the scheduled expiration of many Tax Cuts and Jobs Act (TCJA) provisions. While Trump has not released a detailed tax plan, he has commented on several areas of tax law and policy, making it possible to get a good idea of the direction tax policy may take next year.

Republicans also gained control of the Senate and will have a small majority in the chamber in 2025. As of the date of publication of this article, control of the House has yet to be called. Even if Republicans retain control of the House, passing tax legislation may still be challenging. Unless the legislative filibuster is eliminated from Senate rules, any tax law changes will likely still have to be passed through the budget reconciliation process. If the Democrats manage to gain control of the House, passing tax legislation to advance Trump’s policies would become much more difficult and will require much more bipartisan negotiating.

Although it remains to be seen what specific legislative proposals will emerge, businesses and individuals should pay close attention to how Trump’s proposed policy preferences could alter their total tax liabilities.

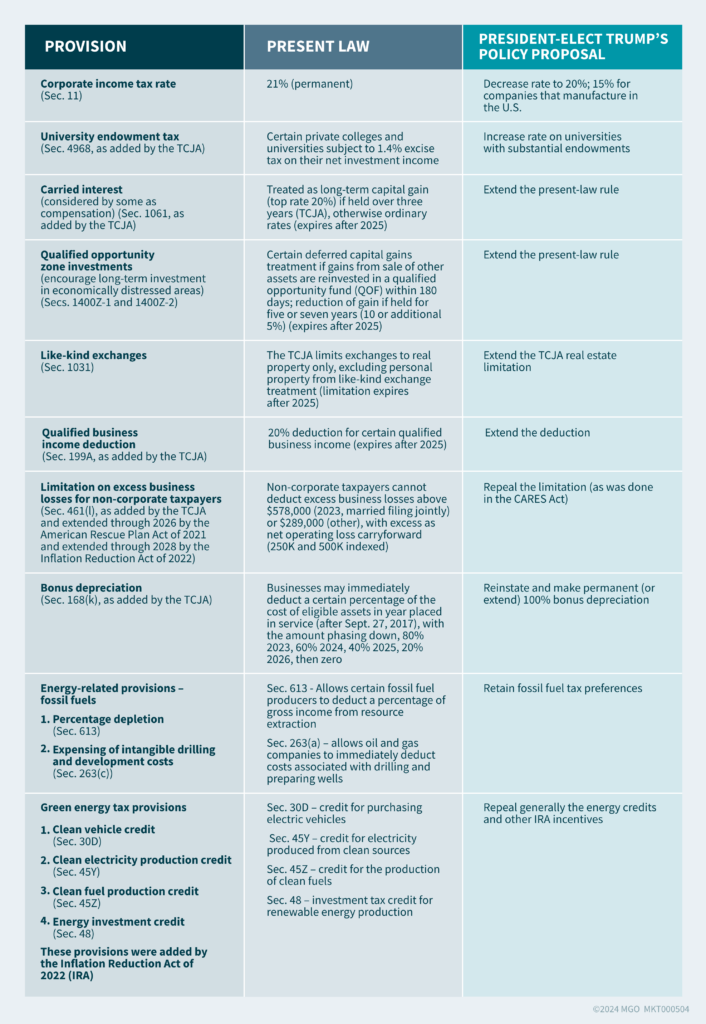

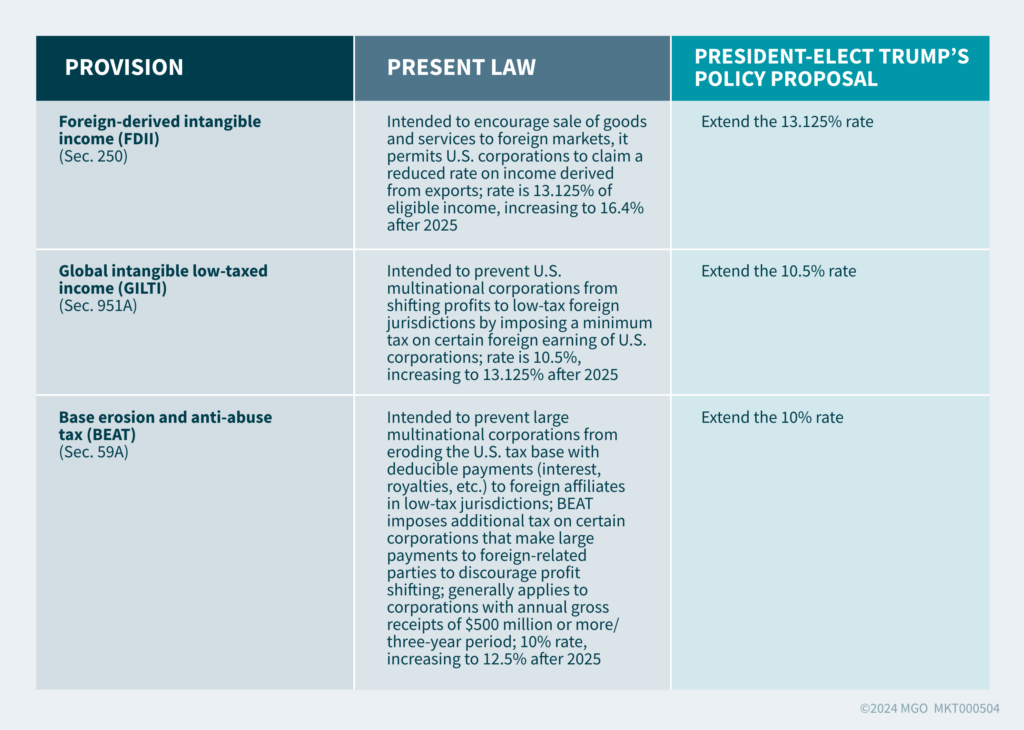

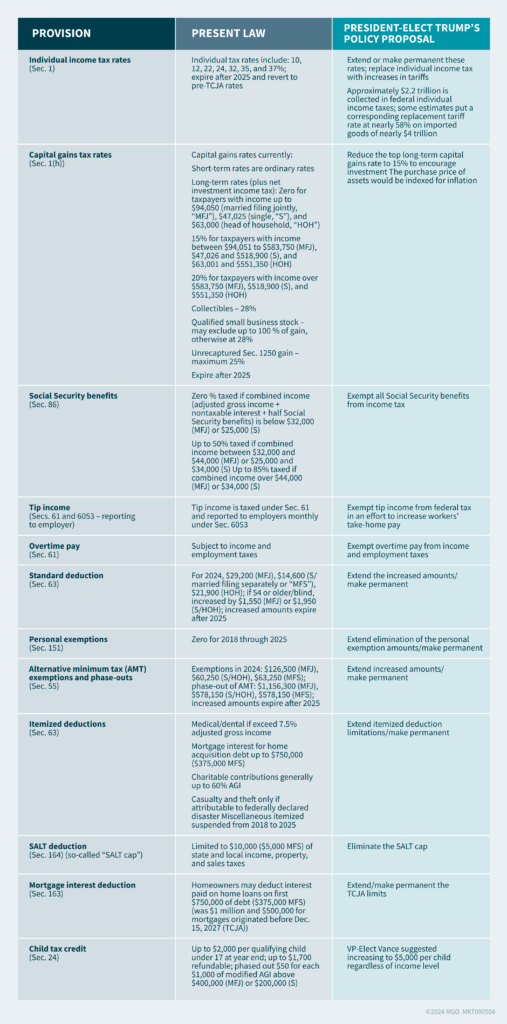

The tables below outline current tax law and policy, as well as expected potential future tax policies under a Trump administration. Four separate tables cover provisions for business tax, international tax, individual tax, and estate, gift, and generation-skipping transfer (GST) tax. All data is based on information released or discussed by Trump as of November 8, 2024.

Business Tax Provisions

International Tax

Individual Tax

Estate, Gift, and GST Tax

How MGO Can Help

MGO delivers comprehensive tax advisory and compliance services to guide you through an increasingly complex and evolving tax landscape. Leveraging deep industry insights and a proactive approach, we assist your business in managing tax liabilities efficiently while uncovering opportunities for growth.

Our team works diligently to provide tailored solutions that address unique challenges, from navigating shifting regulations to optimizing your overall tax strategy. Even in times of regulatory uncertainty, we are committed to helping your organization remain agile and well-positioned for long-term success.

Have questions? Reach out to our tax team today.