Thanks to maturing markets, limited access to capital, and disproportionate tax burdens, many companies in the cannabis industry are facing major challenges in managing their debt and creditors. Without ready access to federal bankruptcy protection, companies with liquidity challenges are looking at their options. But without careful consideration of the tax consequences of these options, companies may be subject to significant tax traps. Here are several factors to consider to avoid these traps and stay solvent:

High Cost of Debt + High Effective Tax Rate = Cash Crunch and Tough Decisions

How did cannabis companies arrive at this decision point? The current cash crunch in the industry has been building for years, precipitated in part by banking regulatory constraints and an abnormally high effective federal tax rate.

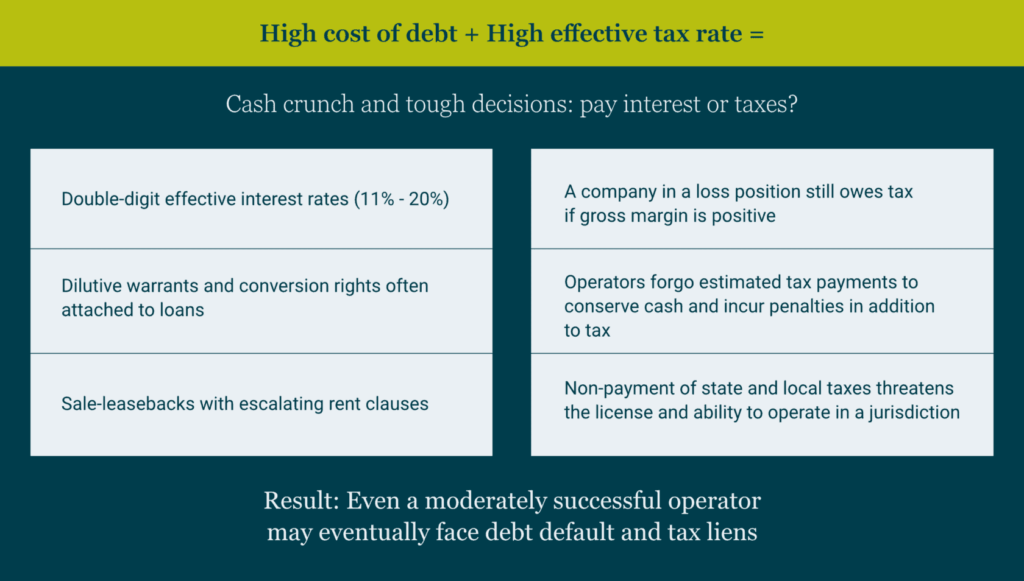

As the below chart illustrates, cannabis companies lack access to traditional banking and market rate loans and have turned to alternative, expensive sources of debt financing bearing effective interest rates as high as 20%. In addition, Internal Revenue Code Section 280E essentially taxes the industry on gross margins, such that even a company that would otherwise be in an overall tax loss position may still owe taxes.

Caught in this double bind, even an operationally successful cannabis company may face a difficult choice: service debt timely at the expense of keeping current with taxes, risking tax liens that threaten the license, or pay taxes when due at the price of defaulting on debt and risking the viability of the business overall.

The Tax Impact of Debt Restructuring

Restructuring debt is one route for cannabis companies in distress to remain operational, but debt modification carries potential tax traps for the unwary — both borrower and lender. Depending on the relative value of the debt exchanged, the borrower can realize cancellation of debt income. The insolvency exception to recognizing and paying current tax on this income may not be available to a cannabis company, as the fair value of its assets — including intangibles — may still exceed its liabilities. A lender may also experience a taxable event on the refinancing, either in the form of interest income, or gain due to the valuation of equity received in the exchange.

In any debt refinancing situation, both the borrower and the lender should anticipate and plan for complex tax calculations involving debt discounts (I.e., original issue discount, or OID) and the fair value of company equity in order to determine correct tax treatment. To avoid any last-minute surprises or deal delays, both the borrower and the lender should model the tax treatment on both sides.

Sales of Distressed Assets and the Tax Impact

Considerations for the borrower:

- Are the assets to be sold in a different tax filing entity as the borrower?

- Will the flow of cash between entities create a taxable event?

Considerations for the lender:

- What is the borrower’s anticipated cash position after paying tax on the sale?

- Can cannabis business assets be sold in the jurisdiction’s regulatory environment? Or is a sale restricted to equity?

Assignment of Income Receipt of Equity

If the borrower and the lender agree on a debt workout based on assignment of income, or equity ownership, both parties should understand the borrower’s existing tax structure and the impact the restructuring will have on both sides.

The borrower should assess whether a “change in control” has occurred for tax purposes, as the use of tax attributes may be limited. If an assignment of income is structured as a fee, consider the tax treatment of the payment and deductibility under 280E.

A lender who becomes an owner or part of management should consider:

- Depending on how the agreement is structured, the assignment of operating income and participation in management may turn the lender, or the lender’s entity, into a “trafficker” subject to 280E.

The lender should also be cognizant of the borrower’s standing with the taxing authorities and whether the operator can afford both paying down tax liabilities and payments under the terms of the workout. The retention of the cannabis or reseller license that the lender is depending on for cash flow is tied to staying current with state and local taxes. An IRS liability that has progressed to the lien stage unbeknownst to the lender could result in a “sudden” drain of cash from a bank account.

“Workouts” With Taxing Authorities

Given the current cash crunch in the industry, companies have been known to delay remittance of sales and excise taxes to state and local governments. Companies should be aware that non-payment of these “trustee” taxes can cause a loss of standing to operate legally and carries personal liability for officers and owners of the company. Taxing authorities may have limited sympathy for a distressed taxpayer who falls behind on these types of taxes and taxpayers should pay down any outstanding balances as soon as possible.

If income taxes are past due, it is important to continue to make payments toward the balance on a regular basis. A taxpayer cannot apply for a formal IRS payment plan until a revenue officer is assigned to the case. Also, a taxpayer must usually pay all outstanding taxes that are not overdue and remain “current” on all future taxes in order to establish and remain on an installment agreement. Federal and state revenue officers are generally willing to work with taxpayers in financial distress who act in good faith throughout the process. Engaging a professional representative who understands tax controversy practice and procedure and how to work with revenue officers can make all the difference between establishing a payment plan and facing a tax lien.

How MGO Can Help

A cannabis company navigating financial distress should engage a tax professional with both industry experience and a high level of tax technical skill to navigate the complex tax impact of a workout or restructuring. MGO’s Cannabis Tax team has both the industry experience and the technical knowledge to assist companies of all sizes during this challenging time.