by Gail Miller

Executive Summary:

- A reverse sales and use tax audit is a proactive measure to help your organization identify and recover overpayments, and devise strategies to reduce future sales and use tax burdens.

- Sales and use tax requirements and exemptions vary from jurisdiction to jurisdiction, but your purchases may qualify for a full- or partial-tax exemption.

- Conducting a reverse audit can positively impact your organization’s bottom line, improve compliance processes, and lead to more informed decision-making.

Sales and use tax rates and regulations change often, and the rules vary widely from state to state. As a result, you may find yourself “over-complying” with sales tax rules and neglecting potential savings when it comes to purchase exemptions.

For example, many states provide agricultural and manufacturing exemptions from sales and use taxes, which you can take advantage of by presenting the appropriate sales tax exemption certificate form to your vendors. And for taxes that have already been paid (and that are still within the statute of limitations), you can submit a claim for refund — through a process that is often referred to as a “reverse audit.”

Good candidates for a sales and use tax audit include any business with multistate operations or large fixed asset investments — including cannabis cultivators, manufacturers, construction companies, or any entity in consumer products, healthcare, research and development, and agriculture.

Let’s explore how our State and Local Tax team can leverage exemptions and perform a reverse audit to improve your bottom line.

Understanding Reverse Sales Tax Audits

Sales tax rates and exemptions vary by state and are frequently impacted by evolving department of revenue interpretations and legislative changes at the state and local levels. This makes compliance challenging, and it’s not uncommon for companies to misapply regulations, remit tax at a higher rate, or miss out on potential full or partial tax exemptions.

During a reverse sales tax audit, members of our State and Local Tax team conduct an in-depth review to identify overpayments of sales and use taxes. This process involves examining your purchase records and tax returns to uncover instances where tax was overpaid or erroneously paid.

Once we determine how much tax was overpaid, we prepare the paperwork to request refunds from the appropriate jurisdictions. Most importantly, we train your team to better understand the sales tax and use laws, rates, and exemptions to prevent costly mistakes in the future.

Key Components of the Audit Process

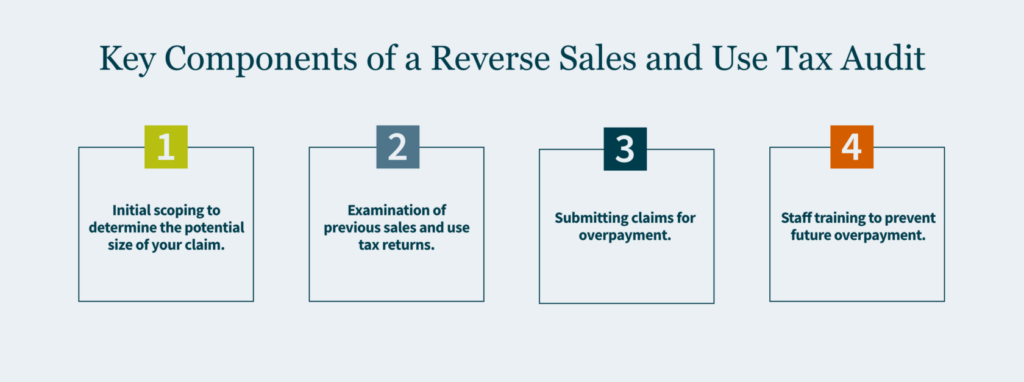

While the term “audit” might have a negative connotation for business owners, a reverse audit isn’t about uncovering wrongdoing but helping your organization locate and uncover potential savings. Although the specific steps for a reverse sales and use tax audit will depend on your business’s unique attributes, the process typically looks something like this:

- Initial scoping to determine the potential size of your claim. We gain an understanding of your business, the jurisdictions you operate in, and your purchasing processes to determine how you were charged tax by vendors and estimate the potential refund we might be able to claim as a result of the reverse audit.

- Examination of previous sales and use tax returns. We review your past returns, invoices, accruals, and other documentation to identify discrepancies and potential overpayments. This involves a line-by-line analysis to confirm tax calculations align with the prevailing tax laws and detect instances where sales tax was paid on non-taxable items or where full- or partial-tax exemptions were overlooked. We also confirm valid exemption certificates are in place and have been correctly applied to qualifying transactions.

- Submitting claims for overpayment. We prepare and submit refund claims to the relevant authorities (keeping in mind the statute of limitations periods, which can vary from state to state). Each state has its own forms and procedures for submitting refund claims. Refunds can also offset audit assessments from state and local governments. This reduces the liability imposed and lowers the amount on which penalties and interest are calculated.

- Train your staff. Finally, we train your team members to identify potential tax-exempt purchases and how to be sure vendors do not charge tax on exempt items. We also provide instruction on proper tax exemption certificate documentation and storage in the event of a future state tax audit. This helps make sure your organization won’t overpay sales and use taxes going forward.

- Recovery of overpayments: The primary benefit is the recovery of funds from overpaid taxes, which can significantly impact your company’s bottom line.

- Compliance improvement: The audit process helps align with current tax laws and regulations, reducing future risks of non-compliance.

- Educational value: A reverse audit helps businesses better understand sales and use tax regulations, leading to more informed decision-making.

Potential Benefits of a Reverse Sales Tax Audit

Key benefits of a reverse audit include:

How MGO Can Help

A reverse sales tax audit is not merely a financial recovery tool but a strategic approach to confirm compliance and optimize tax positions.

To explore how a reverse sales tax audit can benefit your business, contact MGO today. Our team of professionals can discuss your company’s purchases, potential exemptions, and the reverse audit process to determine whether the potential financial opportunities outweigh the time and effort required for the audit.